Yen Slides After BoJ Keeps Key Rate Unchanged

April 25 2024 - 11:23PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Friday after the Bank of Japan left its key

interest rate unchanged and raised its inflation outlook.

The policy board unanimously decided to hold the

uncollateralized overnight call rate to remain around 0 to 0.1

percent.

The board also voted to conduct its bond purchase programme in

line with the decisions made at the March meeting.

The bank today upgraded its inflation outlook for the fiscal

2024 to 2.8 percent from 2.4 percent. Likewise, the projection for

the fiscal 2025 was lifted to 1.9 percent from 1.8 percent.

Inflation is seen at 1.9 percent in the fiscal 2026.

At the same time, the bank lowered its growth projection for the

fiscal 2024 to 0.8 percent from 1.2 percent. The economy is

forecast to expand 1.0 percent in both the fiscal 2025 and 2026.

The forecast for the fiscal 2025 was thus retained from the

previous projection.

Speculation heightened that authorities may intervene in the

market as soon as today, to prop up the currency.

In economic news, data from the Ministry of Internal Affairs and

Communications showed that the consumer prices in the Tokyo region

of Japan were up 1.8 percent on year in April. That was beneath

estimates for an annual gain of 2.6 percent, which would have been

unchanged from the March reading.

The safe-haven yen was trading lower than its major rivals for a

week.

In the Asian trading, the yen fell to a 34-year low of 156.22

against the U.S. Dollar; a 16-year low of 167.53 against the euro;

and a 9-year low of 195.33 against the pound from yesterday's

closing quotes of 156.65, 167.00 and 194.76, respectively. If the

yen extends its downtrend, it is likely to find support around

158.00 against the greenback, 169.00 against the euro and 197.00

against the pound.

The yen slipped to nearly a 2-month low of 171.08 against the

Swiss franc, from yesterday's closing of 170.59. The yen may find

support around the 173.00 region.

Against Australia, the New Zealand and the Canadian dollars, the

yen slid to nearly a 10-year low of 102.17, a 2-month low of 93.15

and a 17-year low of 114.42 from Thursday's closing quotes of

101.44, 95.27 and 113.96, respectively. On the downside, 103.00

against the aussie, 94.00 against the kiwi and 115.00 against the

loonie are seen as the next support levels for the yen.

Looking ahead, the European Central Bank is scheduled to issue

monetary aggregates figures for March, at 4:00 am ET in the

European session.

In the New York session, U.S. PCE price index for March,

personal income and spending data for March, U.S. University of

Michigan's consumer sentiment for April, Canada budget balance

report for April and U.S. Baker Hughes oil rig count data are

slated for release.

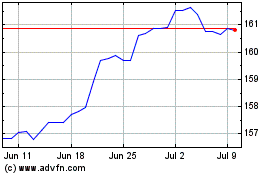

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024