XRP Price Edges Up As Ripple Forms Major Partnership In Japan

April 30 2024 - 3:30AM

NEWSBTC

Ripple has announced a major partnership with Tokyo-based HashKey

DX, a consulting company of the HashKey Group, to deploy XRP Ledger

(XRPL)-powered enterprise solutions in Japan’s burgeoning

blockchain sector. The announcement led to an immediate 1.9%

increase in XRP’s price, although this gain was slightly pared

back; as of the latest data, XRP stands 1.1% higher since the news

broke. The Ripple And HashKey Partnership: Details The

collaboration leverages the substantial success HashKey Group has

seen in mainland China. HashKey‘s blockchain-powered solutions for

supply chain finance have registered over 4,000 companies,

including 23 banks and 4,300 suppliers. The total transaction

volume through these solutions has exceeded $7 billion, with almost

$3 billion in financing transactions. In Japan, these blockchain

solutions will be adapted and deployed through a partnership

involving Ripple and SBI Ripple Asia, a joint venture between SBI

Holdings and Ripple. The XRPL will be the foundational technology

platform. This blockchain specializes in tokenizing and exchanging

both crypto-native and real-world assets. Related Reading: XRP Sees

Over $12 Million Sell-Off: Whale Warning Or Buying Opportunity?

Andy Dan, a representative from HashKey DX, highlighted the

efficiency and suitability of XRPL for their needs, stating, “The

XRPL was the ideal blockchain infrastructure for us to build our

proven supply chain finance solution. With its proven enterprise

track record and unmatched performance metrics, including rapid

settlement speeds, low costs, and scalability, we are confident in

our ability to drive meaningful transformation and introduce

innovative, cutting-edge solutions for businesses in Japan.” Emi

Yoshikawa, Vice President of Strategic Initiatives at Ripple,

echoed this enthusiasm for the partnership: “We are excited to join

forces with HashKey DX and SBI Ripple Asia to introduce XRP

Ledger-powered solutions to Japan. This collaboration exemplifies

our shared commitment to advancing blockchain technology and

delivering tangible value to businesses.” XRP Price Analysis The

initial spike in XRP’s price post-announcement reflects the

market’s optimistic reception of Ripple’s strategic moves. However,

the broader price action context reveals more complexity. Related

Reading: Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And

XRP Among The Undead Over recent weeks, XRP has experienced

volatility, notably breaking down from a symmetrical triangle

pattern on the weekly chart that began forming in September 2021.

This pattern typically indicates a period of consolidation, with

the eventual breakout direction suggesting the prevailing market

force. Currently, the breakdown suggests that sellers have gained

the upper hand, with the triangle now acting as a resistance zone.

XRP faces multiple hurdles ahead as it is currently trading below

several critical exponential moving averages (EMAs) – 20, 50, 100,

and 200-week EMAs, all nested within the former triangle pattern.

This setup presents significant resistance levels that need to be

overcome for bullish momentum to resume. The Relative Strength

Index (RSI), currently at 49, hovers near the neutral 50 mark,

indicating that neither bulls nor bears have definitive control.

This neutral position underlines the market’s current uncertainty,

waiting for a catalyst that could drive the next significant price

movement. Should the bulls regain control and push the price above

the triangle’s resistance, the 0.236 Fibonacci retracement level at

$0.68410 could initiate a shift in sentiment and potentially more

robust gains for XRP. Featured image created with DALL·E, chart

from TradingView.com

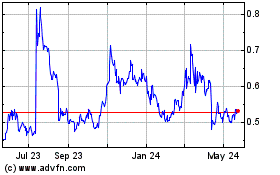

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024