Warrantee Inc. Receives Nasdaq Notification Regarding Minimum Bid Price Deficiency

October 17 2023 - 6:30PM

Warrantee Inc. (Nasdaq: WRNT) (the “Company” or “Warrantee”), a

Japanese marketing and market research technology company, today

announced that the Company received a letter (the “Notification

Letter”) from the Listings Qualifications Department of the Nasdaq

Stock Market LLC (“Nasdaq”) on October 13, 2023, notifying the

Company that it is not in compliance with the minimum bid price

requirement as set forth under Nasdaq Listing Rule 5550(a)(2) for

continued listing on Nasdaq. This press release is issued pursuant

to Nasdaq Listing Rule 5810(b), which requires prompt disclosure

upon the receipt of a deficiency notification.

Nasdaq Listing Rule 5550(a)(2) requires listed

companies to maintain a minimum bid price of US$1.00 per share and

Listing Rule 5810(c)(3)(A) provides that a failure to meet the

minimum bid price requirement exists if the deficiency continues

for a period of 30 consecutive business days. Based on the closing

bid price of the Company's American Depositary Shares (“ADSs”) for

the 30 consecutive business days from August 30, 2023 to October

12, 2023, the Company no longer meets the minimum bid price

requirement.

The Notification Letter does not impact the

Company's listing on the Nasdaq Capital Market at this time. In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has

been provided 180 calendar days, or until April 10, 2024, to regain

compliance with Nasdaq Listing Rule 5550(a)(2). To regain

compliance, the Company's ADSs must have a closing bid price of at

least US$1.00 for a minimum of 10 consecutive business days. In the

event the Company does not regain compliance by April 10, 2024, the

Company may be eligible for additional time to regain compliance or

may face delisting.

The Company's operations are not affected by the

receipt of the Notification Letter. The Company intends to monitor

the closing bid price of its ADSs and may, if appropriate, consider

implementing available options, including, but not limited to,

implementing a reverse share split of its outstanding ADSs, to

regain compliance with the minimum bid price requirement under the

Nasdaq Listing Rules.

About Warrantee Inc.

Founded in Japan in 2013, Warrantee is a

Japanese marketing and market research technology company that

helps corporate sponsors unlock value through targeted marketing

campaigns while providing its corporate sponsors’ potential

customers who participate in its campaigns with extended warranty

coverage on durables or certain healthcare benefits sponsored by

its corporate sponsors. Warrantee focuses on developing a suite of

specialized marketing and market research services and these

services are designed to collect and leverage targeted and

specialty data of its corporate sponsors’ potential customers to

provide proprietary market insights to its corporate sponsors and

promote the sales of their products. At the core of Warrantee’s

current business of providing marketing campaign services is its

trinity model, which connects three stakeholders: corporate

sponsors, campaign participants, whom Warrantee also refers to as

users, and Warrantee, and is designed to benefit all three

stakeholders. For more information, please visit the Company’s

website: https://warrantee.com/.

Forward-Looking Statements

Certain statements in this announcement are

forward-looking statements. These forward-looking statements

involve known and unknown risks and uncertainties and are based on

the Company’s current expectations and projections about future

events that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs. Investors can find many (but not all) of these statements by

the use of words such as “may,” “will,” “should,” “believe,”

“expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,”

“continue,” “predict,” “project,” “potential,” “target,” “goal,” or

other similar expressions in this prospectus. The Company

undertakes no obligation to update or revise publicly any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company’s registration statement and other

filings with the U.S. Securities and Exchange Commission.

For investor and media inquiries, please

contact:

Warrantee Inc.

Investor Relations Department

Email: info@warrantee.co.jp

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: investors@ascent-ir.com

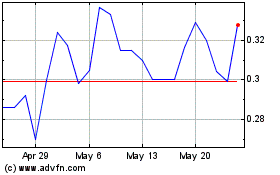

Warrantee (NASDAQ:WRNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Warrantee (NASDAQ:WRNT)

Historical Stock Chart

From Apr 2023 to Apr 2024