USDC Beats USDT In Transaction Volume By Over 400% – Details

April 30 2024 - 4:50AM

NEWSBTC

The seemingly unshakeable reign of Tether (USDT) as the king of

stablecoins faces a new challenger. Circle’s USD Coin (USDC) has

pulled off a surprise victory, recording a higher transaction

volume than Tether in April 2024, according to on-chain analytics

from payments giant Visa. Related Reading: Ethereum Fees Dive: Will

This Spark A Surge In Network Activity? This development marks a

significant shift in the stablecoin landscape. While Tether boasts

a staggering market capitalization of over $110 billion, USDC, with

its $33 billion valuation, has emerged as the more actively traded

coin. Visa’s data reveals USDC processed a whopping $456 billion –

which is 400% more – in transaction volume last week, compared to

Tether’s $89 billion. Stablecoin transactions. Source: Visa USDC: A

Slow And Steady Climb This victory wasn’t a sudden overnight

success. USDC has been steadily chipping away at Tether’s dominance

since late 2023. Visa’s data shows USDC’s monthly transactions

surpassed Tether’s for the first time in December 2023, with 145

million transactions compared to Tether’s 127 million. The April

figures solidify this trend, with USDC clocking in at over 166

million transactions against Tether’s nearly 164 million. Source:

Visa Experts point to several factors behind USDC’s rise. Increased

regulatory scrutiny surrounding Tether’s reserves and ongoing

concerns about its transparency may be driving users towards USDC,

perceived as a more regulated and auditable stablecoin.

Additionally, USDC’s partnership with Visa itself could be playing

a role. Visa launched a stablecoin analytics dashboard in April,

prominently featuring USDC alongside other major stablecoins. This

increased visibility might be attracting new users to the platform.

As of today, the market cap of cryptocurrencies stood at $2.2

trillion. Chart: TradingView.com Tether Still Holds The Crown (For

Now) Despite USDC’s impressive transaction volume surge, Tether

remains the undisputed king in terms of market capitalization. Its

$110 billion dwarfs USDC’s $33 billion, indicating a much larger

total value of outstanding coins. This suggests Tether is still the

preferred store of value for many crypto investors, even if they

aren’t actively trading it as frequently. Related Reading: Polygon

In Peril: Will MATIC Bounce Back Or Stay Stuck In The Sub-$1

Doldrums? Furthermore, Tether boasts a significantly larger user

base. While USDC processed more transactions in April, Tether saw

activity from over 34 million unique wallets compared to USDC’s

9.57 million. This could imply Tether is used for larger

transactions or by a wider range of individuals, while USDC caters

to a more active trading community. The Future Of Stablecoins: A

Two-Horse Race? The battle between USDC and Tether is far from

over. USDC’s recent success in transaction volume demonstrates its

growing influence within the crypto ecosystem. However, Tether’s

established user base and market cap dominance suggest it won’t be

easily dethroned. The evolving regulatory landscape and user

preferences for transparency and security will likely be key

factors shaping the future of stablecoins. Whether USDC can

maintain its momentum and challenge Tether’s market cap advantage,

or if Tether can regain its transaction volume lead, remains to be

seen. Featured image from Tap Global, chart from TradingView

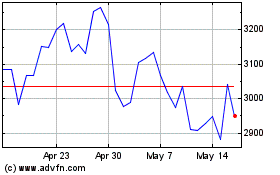

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

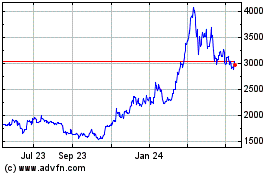

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024