U.S. Dollar Higher Following Strong PCE Inflation Data

April 26 2024 - 9:22AM

RTTF2

The U.S. dollar moved up against its major counterparts in the

New York session on Friday, as the Federal Reserve's preferred

measure of inflation, the personal consumption expenditures price

index, exceeded expectations on an annual basis in March.

Data from the Commerce Department showed that the annual rate of

consumer price growth accelerated to 2.7 percent in March from 2.5

percent in February. Economists had expected the pace of growth to

tick up to 2.6 percent.

The annual rate of growth by core consumer prices in March came

in unchanged from February at 2.8 percent, while economists had

expected the pace of growth to slow to 2.6 percent.

On a monthly basis, the consumer price index rose by 0.3 percent

in March, matching the increase seen in February as well as

economist estimates.

Excluding food and energy prices, core consumer prices also

climbed by 0.3 percent for the second straight month, in line with

expectations.

The data reinforced hopes that the central bank will be cutting

interest rates by September.

The greenback jumped to a 3-day high of 1.0673 against the euro,

2-day high of 1.2449 against the pound and a 34-year high of 157.59

against the yen, from an early fresh 2-week low of 1.0752, 2-week

low of 1.2540 and a 2-day low of 154.95, respectively. The

greenback is likely to find resistance around 1.05 against the

euro, 1.22 against the pound and 160.00 against the yen.

The greenback recovered to 1.3695 against the loonie and 0.6517

against the aussie, off its early more than 2-week lows of 1.3632

and 0.6554, respectively. The greenback is seen finding resistance

around 1.39 against the loonie and 0.63 against the aussie.

The greenback moved up to 0.9150 against the franc, from an

early 3-day low of 0.9095. If the currency rises further, it may

find resistance around the 0.93 level.

The greenback advanced to 0.5929 against the kiwi, reversing

from an early low of 0.5969. The greenback is poised to challenge

resistance around the 0.58 level.

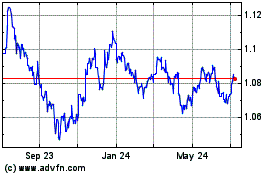

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

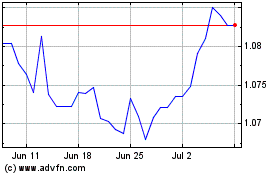

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024