T2 Biosystems Shareholders Vote for CRG Debt Conversion into Equity

April 11 2024 - 4:05PM

T2 Biosystems, Inc. (NASDAQ:TTOO), a leader in the rapid detection

of sepsis-causing pathogens and antibiotic resistance genes, today

announced results from the special meeting of stockholders on April

11, 2024. T2 Biosystems Stockholders voted for the approval of

conversion of $15 million of its term loan with entities affiliated

with CRG Servicing LLC (“CRG”) into T2 Biosystems equity.

“We appreciate our stockholders demonstrating

their continued support for the Company by attending and voting at

the special meeting earlier today. Following the debt conversion,

we are expecting to strengthen our balance sheet by reducing both

our total debt and quarterly interest payments to CRG by 36

percent. In addition, this decision signifies another step towards

regaining compliance with the Nasdaq listing requirements that we

continue to believe is in the best interest of both the Company and

its stockholders,” said John Sperzel, Chairman and CEO at T2

Biosystems.

On February 15, 2024, T2 Biosystems entered into

a Securities Purchase Agreement with CRG to facilitate the debt

conversion. Pursuant to the terms of the Securities Purchase

Agreement, within 10 business days of receiving stockholder

approval of the transaction, CRG will cancel $15 million of

loans outstanding under the CRG Term Loan Agreement in exchange for

the issuance of an aggregate of $15 million of shares of common

stock at a price per share of the lower of (i) the average closing

price of our common stock on Nasdaq for the five consecutive

trading days immediately preceding the date of issuance and (ii)

the closing price of our common stock on Nasdaq on the trading day

immediately preceding the date of issuance; provided that in the

event this would result in CRG beneficially owning more than 49.99%

of the Company’s outstanding shares of common stock (or in the case

of one of the CRG entities, 9.99%, calculated without considering

convertible securities held by CRG), the Company will issue shares

of the newly designated Convertible Preferred Stock representing

the excess above 49.99% or 9.99%, as applicable. CRG agreed to

waive prepayment premiums and back-end fees associated

with such principal amounts of loans exchanged for equity.

About T2 Biosystems

T2

Biosystems, a leader in the rapid detection of sepsis-causing

pathogens and antibiotic resistance genes, is dedicated to

improving patient care and reducing the cost of care by helping

clinicians effectively treat patients faster than ever before. T2

Biosystems’ products include the T2Dx® Instrument, the

T2Bacteria® Panel, the T2Candida® Panel, the

T2Resistance® Panel, and the T2Biothreat™ Panel, and are

powered by the proprietary T2 Magnetic Resonance (T2MR®)

technology. T2 Biosystems has an active pipeline of future

products, including the U.S. T2Resistance Panel, the Candida auris

test, and the T2Lyme™ Panel. For more information, please visit

www.t2biosystems.com.

Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking statements, including, without

limitation, statements about the Company’s ability to regain

compliance with the listing requirements of the Nasdaq Capital

market, as well as statements that include the words “expect,”

“may,” “should,” “anticipate,” and similar statements of a future

or forward-looking nature. These forward-looking statements are

based on management’s current expectations. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to, (i) any inability to (a) realize anticipated

benefits from commitments, contracts or products; (b) successfully

execute strategic priorities; (c) bring products to market; (d)

expand product usage or adoption; (e) obtain customer testimonials;

(f) accurately predict growth assumptions; (g) realize anticipated

revenues; (h) incur expected levels of operating expenses; or (i)

increase the number of high-risk patients at customer facilities;

(ii) failure of early data to predict eventual outcomes; (iii)

failure to make or obtain anticipated FDA filings or clearances

within expected time frames or at all; or (iv) the factors

discussed under Item 1A. “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, filed

with the U.S. Securities and Exchange Commission, or SEC, on April

1, 2024, and other filings the Company makes with the SEC from time

to time, including our Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K. These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While the Company may elect to

update such forward-looking statements at some point in the future,

unless required by law, it disclaims any obligation to do so, even

if subsequent events cause its views to change. Thus, no one should

assume that the Company’s silence over time means that actual

events are bearing out as expressed or implied in such

forward-looking statements. These forward-looking statements should

not be relied upon as representing the Company’s views as of any

date subsequent to the date of this press release.

Investor Contact:

Philip

Trip Taylor, Gilmartin Group

ir@T2Biosystems.com

415-937-5406

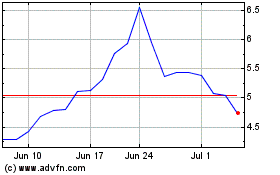

T2 Biosystems (NASDAQ:TTOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

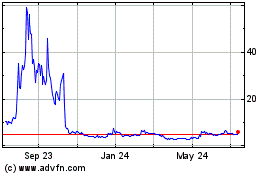

T2 Biosystems (NASDAQ:TTOO)

Historical Stock Chart

From Apr 2023 to Apr 2024