Swvl Records $3.1m Net Profit, 13% Net Margin, and an Eightfold Growth in Gross Profit

April 30 2024 - 6:00AM

Swvl Holdings Corp (“Swvl” or the “Company”) (Nasdaq: SWVL), a

technology provider for enterprise and government mobility

solutions with a global footprint, announces a significant

achievement in its financial performance for the fiscal year 2023.

The Company has successfully delivered positive net profit and

cashflow for the full year.

Continuing the positive momentum established in

the initial half of the fiscal year, Swvl completed the path to

profitability program initiated in 2022. The Company is committed

to boosting profitability further while concurrently resuming

strategic expansions into high-revenue markets.

Financial Highlights for Fiscal Year

Ended December 31, 2023:

- Net Profit: $3.1

million, a turnaround from a net loss of $123.6 million in

2022

- Gross Profit:

Increased more than eightfold to $4.1 million from $0.5 million in

2022

- Operating Profit:

$12.1 million, compared to an operating loss of $80.2 million in

2022

- Earnings Per

Share: Profitable growth boosted basic earnings per share

from continuing operations to $0.61

- Balance Sheet

Strength: Ended the year with a strong balance sheet, no

debt, and an equity value more than double that of the prior year,

at $5.9 million

- Equity

Book Value: Total equity book value of $5.9 million as of

December 31, 2023, compared to $2.6 million as of December 31,

2022

This result marks Swvl’s swift transition to

profitability, highlighting a focus on financial stability and

operational efficiency, and the effective implementation of

profitability strategies during the fiscal year. The Company’s

continuous efforts to maintain positive cash flow and profitability

support its upcoming planned expansion into high-revenue

markets.

Mostafa Kandil, CEO of Swvl, stated, “In 2023,

our team demonstrated exceptional skill and dedication, achieving

profitability. As we advance, our commitment to innovation will be

marked by the launch of a wide range of products slated for the

upcoming year and for our new potential markets. Additionally, in

the meantime, we are expanding our strategic partnerships into more

Gulf Cooperation Council (GCC) countries. Our focus today remains

towards improving profitability while resuming our high paced

growth.”

Post December 31, 2023, Swvl continued to make

strides to further solidify its financial position, focusing on

increasing margins and maintaining efficient operations. Swvl

remains focused on sustaining this positive momentum, further

strengthening its financial position, and continuing to deliver

enhanced value to its shareholders and stakeholders in the future

of the mobility landscape.

For detailed financial information, please see

Appendix A for the consolidated financial statements. This press

release, along with complete financial statements and the investor

presentation, can be found in the Investor Relations section of

Swvl’s website at https://www.swvl.com

About Swvl

Swvl is a global technology provider for

enterprise and government mobility solutions. The company’s

platform provides alternatives to public transportation for

individuals who cannot access or afford private options. Every day,

Swvl’s parallel mass transit systems empower individuals to go

where they want, when they want – making mobility safer, more

efficient, accessible, and environmentally friendly. Customers can

book their rides on an easy-to-use proprietary app with varied

payment options and access to high-quality private buses and

vans.

For additional information about Swvl, please

visit www.Swvl.com.

Forward Looking Statements

This press release contains “forward-looking

statements'' relating to future events. Forward-looking statements

generally are accompanied by words such as “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,”

“future,” “outlook” and similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. These forward-looking statements include, but

are not limited to, statements regarding future events and other

statements that are not historical facts. For example, Swvl is

using forward looking statements when it discusses its commitment

to boosting profitability further while concurrently resuming

strategic expansions into high-revenue markets, its intention to

launch of a wide range of products slated for the upcoming year,

its intention to expand strategic partnerships into more GCC

countries, and that its focus remains towards improving

profitability while resuming its high paced growth. These

statements are based on the current expectations of Swvl’s

management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on,

by any investor as a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of Swvl. These statements are subject to a

number of risks and uncertainties regarding Swvl’s business, and

actual results may differ materially. In addition, forward-looking

statements provide Swvl’s expectations, plans or forecasts of

future events and views as of the date of this communication. Swvl

anticipates that subsequent events and developments could cause

Swvl’s assessments and projections to change. However, while Swvl

may elect to update these forward-looking statements in the future,

Swvl specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing Swvl’s assessments as of any date subsequent to the

date of this communication. Accordingly, undue reliance should not

be placed upon any forward-looking statements. Except as otherwise

required by law, Swvl undertakes no obligation to publicly release

any revisions to these forward-looking statements to reflect events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events. More detailed information about the risks

and uncertainties affecting the Company is contained under the

heading “Risk Factors” in the Company’s annual report on Form 20-F

for the fiscal year ended December 31, 2023 filed with the U.S.

Securities and Exchange Commission (the “SEC”), which is available

on the SEC’s website, www.sec.gov, and in subsequent SEC

filings.

Contact

Investor.relations@Swvl.com

Consolidated statement of financial position –

As of 31 December 2023

(All amounts are shown in USD unless otherwise stated) |

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

| ASSETS |

|

|

|

| Non-current

assets |

|

|

|

| Property and equipment |

|

751,693 |

|

1,270,838 |

|

| Intangible assets |

|

225,776 |

|

10,534,278 |

|

| Right-of-use assets |

|

484,362 |

|

815,646 |

|

| Sublease receivables |

|

- |

|

553,029 |

|

| Deferred tax assets |

|

9,468,808 |

|

18,708,988 |

|

| |

|

10,930,639 |

|

31,882,779 |

|

| |

|

|

|

| Current

assets |

|

|

|

| Trade and other

receivables |

|

5,327,877 |

|

14,815,432 |

|

| Prepaid expenses and other

current assets |

|

2,142,194 |

|

3,298,377 |

|

|

Sublease receivables |

|

571,022 |

|

648,523 |

|

| Cash and cash equivalents |

|

2,922,755 |

|

1,538,347 |

|

| |

|

10,963,848 |

|

20,300,679 |

|

| Assets classified as held for

sale |

|

1,261 |

|

5,279,098 |

|

| Total

assets |

|

21,895,748 |

|

57,462,556 |

|

| |

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

| EQUITY |

|

|

|

| Share capital |

|

16,979 |

|

13,903 |

|

| Share premium |

|

347,295,152 |

|

343,435,529 |

|

| Employee share scheme

reserve |

|

507,677 |

|

773,666 |

|

| Foreign currency translation

reserve |

|

(11,466,066 |

) |

(4,347,257 |

) |

| Reserve of disposal groups

classified as held for sale |

|

2,106,737 |

|

(492,474 |

) |

| Accumulated losses |

|

(329,506,304 |

) |

(332,562,780 |

) |

| Equity attributable to

equity holders of the Parent Company |

|

8,954,175 |

|

6,820,587 |

|

| |

|

|

|

| Non-controlling interests |

|

(3,039,317 |

) |

(4,191,394 |

) |

| Total

equity |

|

5,914,858 |

|

2,629,193 |

|

| |

|

|

|

|

LIABILITIES |

|

|

|

| Non-current

liabilities |

|

|

|

| Provision for employees’ end

of service benefits |

|

- |

|

267,751 |

|

| Derivative warrant

liabilities |

|

106,420 |

|

1,317,091 |

|

| Deferred purchase price |

|

- |

|

194,093 |

|

| Accounts payable, accruals and

other payables |

|

83,961 |

|

- |

|

| Lease liabilities |

|

1,021,716 |

|

1,592,111 |

|

| |

|

1,212,097 |

|

3,371,046 |

|

| |

|

|

|

| Current

liabilities |

|

|

|

| Deferred purchase price |

|

1,207,682 |

|

7,425,488 |

|

| Accounts payable, accruals and

other payables |

|

7,829,837 |

|

33,418,502 |

|

| Current tax liabilities |

|

627,068 |

|

1,027,404 |

|

| Due to related party |

|

131,523 |

|

- |

|

| Lease liabilities |

|

640,695 |

|

751,015 |

|

| |

|

10,436,805 |

|

42,622,409 |

|

| Liabilities directly

associated with assets classified as held for sale |

|

4,331,988 |

|

8,839,908 |

|

| Total

liabilities |

|

15,980,890 |

|

54,833,363 |

|

| Total equity and

liabilities |

|

21,895,748 |

|

57,462,556 |

|

Consolidated statement of comprehensive loss - For the year

ended 31 December 2023

(All amounts are shown in USD unless otherwise stated) |

|

|

|

|

|

2023 |

|

2022 |

|

2021 |

|

|

Continuing operations |

|

|

|

|

|

Revenue |

|

22,852,263 |

|

44,099,610 |

|

25,563,945 |

|

|

Cost of sales |

|

(18,741,277 |

) |

(43,581,963 |

) |

(31,349,979 |

) |

|

Gross income/(loss) |

|

4,110,986 |

|

517,647 |

|

(5,786,034 |

) |

|

|

|

|

|

|

|

General and administrative expenses |

|

(10,226,561 |

) |

(62,918,437 |

) |

(69,029,507 |

) |

|

Selling and marketing expenses |

|

(93,431 |

) |

(17,520,448 |

) |

(12,190,989 |

) |

|

Provision for expected credit losses |

|

(535,340 |

) |

(873,442 |

) |

(1,101,614 |

) |

|

Other income/(expenses), net |

|

18,834,177 |

|

548,823 |

|

(807 |

) |

|

Operating profit / (loss) |

|

12,089,831 |

|

(80,245,857 |

) |

(88,108,951 |

) |

|

|

|

|

|

|

|

Finance income |

|

97,553 |

|

209,434 |

|

126,449 |

|

|

Loss on disposal of subsidiaries |

|

(8,285,250 |

) |

- |

|

- |

|

|

Change in fair value of financial liabilities |

|

1,210,671 |

|

109,720,648 |

|

(44,330,400 |

) |

|

Change in fair value of deferred purchase price |

|

727,134 |

|

31,844,346 |

|

- |

|

|

Change in fair value of employee share compensation schemes |

|

(1,636,738 |

) |

36,155,857 |

|

- |

|

|

Recapitalization cost |

|

- |

|

(139,609,424 |

) |

- |

|

|

Impairment of financial assets |

|

- |

|

(10,000,880 |

) |

- |

|

|

Impairment of assets |

|

- |

|

(46,381,441 |

) |

- |

|

|

Finance cost |

|

(129,355 |

) |

(3,666,643 |

) |

(1,494,693 |

) |

|

Profit / (loss) before tax from continuing

operations |

|

4,073,846 |

|

(101,973,960 |

) |

(133,807,595 |

) |

|

|

|

|

|

|

|

Income tax benefit |

|

41,305 |

|

3,225,251 |

|

4,718,036 |

|

|

|

|

|

|

|

|

Profit / (loss) for the year from continuing

operations |

|

4,115,151 |

|

(98,748,709 |

) |

(129,089,559 |

) |

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

Loss for the year from discontinued operations |

|

(1,058,675 |

) |

(24,830,739 |

) |

(12,399,838 |

) |

|

Profit / (loss) for the year |

|

3,056,476 |

|

(123,579,448 |

) |

(141,489,397 |

) |

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Equity holders of the Parent Company |

|

3,056,476 |

|

(116,496,525 |

) |

(141,416,132 |

) |

|

Non-controlling interests |

|

- |

|

(7,082,923 |

) |

(73,265 |

) |

|

|

|

3,056,476 |

|

(123,579,448 |

) |

(141,489,397 |

) |

|

|

|

|

|

|

|

Profit / (loss) per share attributable to equity holders of

the Parent Company |

|

|

|

|

|

Basic |

|

0.45 |

|

(18.28 |

) |

(20.92 |

) |

|

Diluted |

|

0.28 |

|

(18.28 |

) |

(20.92 |

) |

|

|

|

|

|

|

|

Profit / (loss) per share attributable to equity holders of

the Parent Company for continuing operations |

|

|

|

|

|

Basic |

|

0.61 |

|

(14.61 |

) |

(19.10 |

) |

|

Diluted |

|

0.37 |

|

(14.61 |

) |

(19.10 |

) |

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

Items that may be reclassified subsequently to profit or

loss: |

|

|

|

|

|

Exchange differences on translation of foreign operations, net of

tax |

|

(5,299,295 |

) |

(5,290,594 |

) |

(409,511 |

) |

|

Total comprehensive loss for the year |

|

(2,242,819 |

) |

(128,870,042 |

) |

(141,898,908 |

) |

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Equity holders of the Parent Company |

|

(2,242,819 |

) |

(121,787,119 |

) |

(141,825,643 |

) |

|

Non-controlling interests |

|

- |

|

(7,082,923 |

) |

(73,265 |

) |

|

|

|

(2,242,819 |

) |

(128,870,042 |

) |

(141,898,908 |

) |

Consolidated statement of cash flows - For

the year ended 31 December 2023

(All amounts are shown in USD unless otherwise stated) |

|

|

|

|

2023 |

|

2022 |

|

2021 |

|

| |

|

|

|

| Profit / (loss) before tax

from continued operations |

4,073,846 |

|

(101,973,960 |

) |

(133,807,595 |

) |

| Loss before tax from

discontinued operations |

(1,058,675 |

) |

(24,830,739 |

) |

(12,399,838 |

) |

| Profit / (loss) for

the year before tax |

3,015,171 |

|

(126,804,699 |

) |

(146,207,433 |

) |

| |

|

|

|

| Adjustments to reconcile

profit before tax to net cash flows: |

|

|

|

| Depreciation of property and

equipment |

356,288 |

|

604,304 |

|

182,402 |

|

| Depreciation of right-of-use

assets |

364,116 |

|

1,216,495 |

|

541,218 |

|

| Amortization of intangible

assets |

32,375 |

|

2,455,243 |

|

15,963 |

|

| Provision for expected credit

losses |

535,340 |

|

873,442 |

|

1,327,104 |

|

| Loss from sale of

subsidiaries |

8,285,250 |

|

- |

|

- |

|

| Other income |

(18,834,177 |

) |

- |

|

- |

|

| Gain on recognition of

sublease receivable |

- |

|

(87,026 |

) |

- |

|

| Sublease income |

(37,706 |

) |

(8,340 |

) |

- |

|

| Provision for employees’ end

of service benefits, net of reversals |

- |

|

(171,447 |

) |

704,614 |

|

| Finance cost |

12,192 |

|

3,466,593 |

|

1,400,067 |

|

| Listing costs |

- |

|

139,609,424 |

|

- |

|

| Change in fair value of

deferred purchase price |

(727,134 |

) |

(31,844,346 |

) |

- |

|

| Change in fair value of

financial liabilities |

(1,210,671 |

) |

(109,720,648 |

) |

44,330,400 |

|

| Impairment of assets |

- |

|

46,381,441 |

|

- |

|

| Impairment of financial

assets |

- |

|

10,000,880 |

|

- |

|

| Employee share-based payments

charges / (reversals) |

285,651 |

|

(36,155,857 |

) |

33,611,231 |

|

| |

(7,923,305 |

) |

(100,184,541 |

) |

(64,094,434 |

) |

| Changes in working

capital: |

|

|

|

| Trade and other

receivables |

3,917,812 |

|

(11,489,377 |

) |

(4,825,451 |

) |

| Prepaid expenses and other

current assets |

995,660 |

|

(2,584,987 |

) |

(868,620 |

) |

| Accounts payable, accruals and

other payables |

(6,471,125 |

) |

(3,571,712 |

) |

8,259,002 |

|

| Current tax liabilities |

244,206 |

|

793,105 |

|

(635,821 |

) |

| Due to related parties |

131,523 |

|

- |

|

36,091 |

|

| |

(9,105,229 |

) |

(117,037,512 |

) |

(62,129,233 |

) |

| Payment of employees’ end of

service benefits |

- |

|

(635,314 |

) |

(5,507 |

) |

|

Net cash flows used in operating activities |

(9,105,229 |

) |

(117,672,826 |

) |

(62,134,740 |

) |

| |

|

|

|

| Cash flows from an

investing activity |

|

|

|

| Purchase of property and

equipment |

(17,237 |

) |

(817,586 |

) |

(319,471 |

) |

| Proceeds from disposal of

subsidiaries |

8,400,000 |

|

- |

|

- |

|

| Purchase of financial

assets |

- |

|

- |

|

(10,000,880 |

) |

| Payment for acquisition of

subsidiary, net of cash acquired |

- |

|

(743,292 |

) |

(823,446 |

) |

| Sublease rentals received |

668,236 |

|

138,410 |

|

- |

|

| Purchase of financial

assets |

- |

|

(5,000,010 |

) |

- |

|

| Purchase of intangible

assets |

(258,151 |

) |

(1,666,934 |

) |

(2,222 |

) |

| Net cash flows

generated from / (used in) investing activities |

8,792,848 |

|

(8,089,412 |

) |

(11,146,019 |

) |

| |

|

|

|

| Cash flows from

financing activities |

|

|

|

| Proceeds from issuance of

share capital |

789,462 |

|

60,787,038 |

|

- |

|

| Proceeds from issuance of

convertible notes |

- |

|

26,336,000 |

|

73,206,415 |

|

| Proceed from PIPE

subscription |

- |

|

39,664,000 |

|

- |

|

| Payments of external loan |

- |

|

(134,830 |

) |

- |

|

| Repayment of loan from related

party |

- |

|

(195,270 |

) |

- |

|

| Finance cost paid |

- |

|

(543,432 |

) |

(2,653 |

) |

| Finance lease liabilities

paid, net of accretion |

(445,571 |

) |

(850,773 |

) |

(482,389 |

) |

| Net cash flows

generated from financing activities |

343,891 |

|

125,062,733 |

|

72,721,373 |

|

| |

|

|

|

| Net increase /

(decrease) in cash and cash equivalents |

31,510 |

|

(699,505 |

) |

(559,386 |

) |

| Cash and cash equivalents at

the beginning of the year |

2,696,276 |

|

9,529,723 |

|

10,348,732 |

|

| Effects of exchange rate

changes on cash and cash equivalents |

196,230 |

|

(6,133,942 |

) |

(259,623 |

) |

| Cash and cash

equivalents at the end of the year |

2,924,016 |

|

2,696,276 |

|

9,529,723 |

|

| Non-cash financing and

investing activities: |

|

|

|

| Settlement of deferred

purchase price |

5,377,829 |

|

- |

|

- |

|

| Issuance of shares during the

year |

3,073,237 |

|

3,432,493 |

|

- |

|

| Fair value of shares

earnouts |

- |

|

(75,550,455 |

) |

- |

|

| Acquisitions of

non-controlling interests |

- |

|

(3,036,641 |

) |

- |

|

| Costs attributable to the

issuance of shares |

- |

|

8,467,766 |

|

- |

|

| Conversion of convertible

notes |

- |

|

145,952,505 |

|

- |

|

| Property and equipment

additions through acquisition of business |

- |

|

(586,452 |

) |

- |

|

| Intangible assets additions

through acquisition of business |

- |

|

(20,580,000 |

) |

- |

|

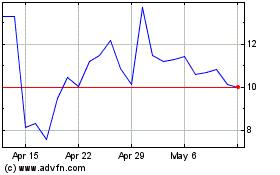

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Apr 2023 to Apr 2024