(Table of Contents)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities

Exchange Act of 1934

Cann American Corp.

(Exact Name of Registrant as Specified in Charter)

| Wyoming |

|

84-3208139 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

| 75 Union Ave., Rutherford, NJ |

|

07070 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: (551) 285-4350 |

With a copy to:

Anthony F. Newton

Law Office of Anthony F. Newton

16730 Creek Bend Drive

Sugar Land, Texas 77478

Tel: 832-452-0269

Securities to be registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule

12b-2 of the Exchange Act.

| Large Accelerated Filer |

|

☐ |

|

Accelerated Filer |

☐ |

| Non-accelerated Filer |

|

☒ |

|

Smaller Reporting Company |

☒ |

| |

|

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

We are filing this General Form for Registration of Securities on Form

10 (the “Registration Statement”) to register its common stock, par value $0.0001 per share, pursuant to Section 12(g)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless otherwise mentioned or unless the context

requires otherwise, when used in this Amendment, the terms “Company,” “we,” “us,” and “our”

refer to Cann American Corp., a Wyoming corporation, and its subsidiaries.

The Registration Statement will become effective as a matter of law

60 days after the Filing Date. Once effective, we will be subject to the requirements of Section 13(a) under the Exchange Act, which will

require us to file annual, quarterly, and current reports and proxy or information statements with the SEC, and we will be required to

comply with all other obligations of the Exchange Act applicable to issuers filing registration statements under Section 12(g) of the

Exchange Act. Our executive officers, directors, and stockholders beneficially owning 10% or more of our common stock will become subject

to Section 16 of the Exchange Act and will be required to file Forms 3, 4, and 5 with the SEC. Stockholders beneficially owning more than

5% of our common stock will be required to file Schedules 13D/G with the SEC pursuant to Sections 13(d) or (g) of the Exchange Act.

You may read and copy reports we filed with the SEC, for a copying

fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

for more information on its Public Reference Room. Our SEC filings will also be available free of charge by visiting the Company’s

filing page on the SEC’s website at http://www.sec.gov.

FORWARD-LOOKING STATEMENTS

This Registration Statement contains forward-looking statements that

involve substantial risks and uncertainties. Other than statements of historical fact, all statements in this Registration Statement,

including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects,

plans, and management objectives, are forward-looking statements. The words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,”

“potential,” “would,” “could,” “should,” “continue,” and similar expressions

are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

We may not achieve the plans, intentions, or expectations disclosed

in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events

could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements we make. We have included

important cautionary statements in this Registration Statement that we believe could cause actual results or events to differ materially

from the forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions,

mergers, dispositions, joint ventures, or investments we may make.

You should read this Registration Statement and the documents that

we have filed as exhibits to this Registration Statement with the understanding that our actual future results may be materially different

from what we expect. The forward-looking statements in this Registration Statement are made as of the date of this Registration Statement,

and we do not assume any obligation to update any forward-looking statements except as required by applicable law.

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

When this Registration Statement becomes effective, we will begin to

file reports, proxy statements, information statements, and other information with the SEC. You may read and copy this information, for

a copying fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

for more information on its Public Reference Room. Our SEC filings will also be available to the public from commercial document retrieval

services and at the website maintained by the SEC at http://www.sec.gov.

CANN AMERICAN CORP.

FORM 10

TABLE OF CONTENTS

ITEM 1. BUSINESS.

Overview

Cann American Corp. (“CNNA,” “we,”

“us,” or the “Company”) was originally incorporated in Nevada on August 25, 2004, as Deer Bay Resources

Inc. Our offices are located at 75 Union Ave., Rutherford, NJ 07070. Our telephone number is (551) 285-4350, and our email address is

info@prodigystemcell.com.

We are a therapeutics development company. Management is experienced

at business integration and re-branding potential. We intend to bring to market innovative brands with great potential. Our brands will

be unique as we focus on new markets that are still in need of development.

ITEM 1A. RISK FACTORS.

The following is only a summary of the risks pertaining

to our Company. Investment in our securities involves risks. You should carefully consider the following risk factors in addition to other

information contained in this Registration Statement. The occurrence of any of the following risks might cause you to lose all or part

of your investment. Some statements in this Registration Statement, including statements in the following risk factors, constitute “forward-looking

statements.”

Risks Relating to Operations

Our results could be materially and adversely

affected by the impact of the COVID-19 pandemic.

The aftermath of COVID-19 across the United States could materially

and adversely impact our business, including as a result of the loss of adequate labor, whether as a result of high absenteeism or challenges

in recruiting and retention or otherwise, prolonged closures, or series of temporary closures, of one or more fulfillment centers as a

result of a COVID-19 outbreak, a government order or otherwise, or supply chain or carrier interruptions or delays. Further, the COVID-19

pandemic has had and could continue to have a negative impact on economic conditions, which may adversely impact consumer demand for our

products, which may have a material adverse effect on our business, financial condition, and operating results. To the extent any of these

events occur, our business, financial condition, and operating results could be materially and adversely affected. The extent to which

the COVID-19 pandemic impacts our business will depend on future developments not within our control, including the duration and severity

of the COVID-19 pandemic and surges, the timing of widespread availability and taking of a COVID-19 vaccine in the United States, the

length of time COVID-19 related restrictions on dining options stay in effect and for economic and operating conditions to return to pre-pandemic

levels, together with resulting consumer behaviors, and numerous other uncertainties, all of which remain uncertain. The unavailability

and incapacity of Mr. Tucker, our only executive officer, due the COVID-19 would have a material adverse effect of our business.

Since we have a limited operating history,

it is difficult for potential investors to evaluate our business.

Our limited operating history makes it difficult for potential investors

to evaluate our business or prospective operations. Since our formation, we have not generated enough revenues to exceed our expenses.

As a result of us recently entering into the therapeutics space, we are subject to all the risks inherent in the initial organization,

financing, expenditures, complications, and delays inherent in new business lines. Investors should evaluate an investment in us in light

of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation

of our business plan. We may not be successful in implementing such a plan and cannot guarantee that, if implemented, we will ultimately

be able to attain profitability.

We do not currently have sufficient cash

flow to maintain our business.

We do not currently have enough cash flow to operate our business.

Therefore, we will be dependent upon additional capital in the form of either debt or equity to continue our operations and expand our

products to new markets. At present, we do not have arrangements to raise all of the needed additional capital, and we will need to identify

potential investors and negotiate appropriate arrangements with them. We may not be able to arrange enough investment within the time

the investment is required or that if it is arranged, that it will be on favorable terms. If we cannot get the needed capital, we may

not be able to become profitable and may have to curtail or cease our operations.

Our management has limited experience operating

a public company and is subject to the risks commonly encountered by early-stage companies.

Although our management has experience in operating small companies,

our current management has not managed expansion while being a public company. Many investors may treat us as an early-stage company.

Also, our management has not overseen a company with considerable growth. Because we have a limited operating history, our operating prospects

should be considered in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets.

We depend heavily on key personnel.

We believe our success depends heavily on the continued active participation

of our current executive officers. If we were to lose our executive officers' services, the loss could have a material adverse effect

on our business, financial condition, or operation results. Also, to achieve our future growth plans, we will need to recruit, hire, train,

and retain other highly qualified technical and managerial personnel. Competition for qualified employees is intense, and if we cannot

attract, retain and motivate these additional employees, their absence could have a materially adverse effect on our business, financial

condition, or results of operations.

Increased operating costs and obstacles

to cost recovery due to the pricing and cancellation terms of our food and support services contracts may constrain our ability to make

a profit.

Our profitability can be adversely affected to the extent we are faced

with cost increases for supplies, raw materials, wages, other labor-related expenses, especially when we cannot recover such increased

costs through increases in the prices for our products and services. In some cases, we will have to absorb any cost increases, which may

adversely impact our operating results.

Governmental regulations relating to therapeutics

may subject us to significant liability.

Regulations relating to therapeutics have not been fully developed.

We cannot assure you that we will be able to comply with any future laws and regulations. Rules and regulations in this area may significantly

increase the cost of compliance or expose us to liabilities.

If we fail to comply with applicable laws and regulations, including

those referred to above, we may be subject to investigations, criminal sanctions, or civil remedies, including fines, penalties, damages,

reimbursement, injunctions, seizures, or debarments from government contracts. The cost of compliance or the consequences of non-compliance,

including debarments, could have a material adverse effect on our business and operations results. Also, governmental units may make changes

in the regulatory frameworks within which we operate that may require either the Company as a whole or individual businesses to incur

substantial increases in costs to comply with such laws and regulations.

If a relationship with key business suppliers

and distributors were to be disrupted, we could experience disruptions to our operations and cost structure.

If critical suppliers to our business were disrupted, it could affect

our ability to source necessary supplies and raw materials needed to produce therapeutics. If our relationship with any of these key suppliers

or distributors were disrupted, if it was not already arranged, we would engage and source from alternative suppliers and distributors.

This disruption could affect our operations and cost structure.

Risks Related to Our Indebtedness

We are highly leveraged.

Our leverage could adversely affect our ability to raise additional

capital to fund our operations, limit our ability to react to changes in the economy or our industries, expose us to interest rate risk

to the extent of our variable rate debt and prevent us from meeting our obligations. This degree of leverage could have significant consequences,

including:

| |

· |

exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our senior secured credit facilities and our receivables facility, are at variable rates of interest; |

| |

|

|

| |

· |

requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest our indebtedness, thereby reducing our ability to use our cash flow to fund our operations, capital expenditures, and future business opportunities; |

| |

|

|

| |

· |

restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| |

|

|

| |

· |

limiting our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions, and general corporate or other purposes; and |

| |

|

|

| |

· |

limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our less highly leveraged competitors. |

We could incur additional indebtedness in

the future. If new indebtedness is added to our current debt levels, the related risks we now face could increase.

If due to such a deterioration in our financial performance, our cash

flows and capital resources were to be insufficient to fund our debt service obligations, we may be forced to reduce or delay investments

and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures

may not be successful and may not permit us to meet our scheduled debt service obligations. In addition, if we were required to raise

additional capital in the current financial markets, the terms of such financing, if available, could result in higher costs and greater

restrictions on our business. If we were to need to refinance our existing indebtedness, the conditions in the financial markets at that

time could make it difficult to refinance our existing indebtedness on acceptable terms or at all. If such alternative measures proved

unsuccessful, we could face substantial liquidity problems.

Risk Related to Therapeutics Markets

The therapeutics industry in which

we operate is highly competitive, and increased competition could reduce our sales and profitability.

The therapeutics industry in which we operate is highly competitive,

and increased competition could reduce our sales and profitability. We will compete in different markets within the therapeutics sector

on the basis of the uniqueness of our product offerings, the quality of our products, customer service, price, and distribution. Our markets

are highly competitive. Our competitors vary in size, and many may have greater financial and marketing resources than we do. Competitive

conditions could result in our experiencing reduced revenues, gross margins, and operating results and could cause an investor to lose

a substantial amount or all of their investment in our Company.

We may face a variety of risks associated

with our operation, any of which could adversely affect our financial condition and operations results.

We be required to obtain approvals, permits, and licenses from state

regulators and local municipalities to construct and operate in the therapeutic sector. We may face delays in obtaining the requisite

approvals, permits, financing, and licenses to manage the therapeutics markets, or we may not be able to obtain them at all. If we encounter

delays in obtaining or cannot get the requisite approvals, permits, financing, and licenses to construct and operate our therapeutics

markets in desirable locations, our financial condition and operations results may be adversely affected.

Shortages or interruptions in the availability

and delivery of third-party products we sell may increase costs or reduce revenues.

Possible shortages or interruptions in our supply of third-party products

caused by conditions beyond our control could adversely affect the availability, quality, and cost of items we buy and sell. Our inability

to effectively manage supply chain risk could increase our costs and limit the availability of products critical to our operations. We

will also rely on vendors and suppliers to construct and operate portions of our therapeutics markets. If we are unable to maintain our

relationship with our vendors and suppliers, or such vendors and suppliers cease to provide the services we need, or such vendors and

suppliers are unable to deliver our services on-time and at pre-negotiated prices, and we cannot engage alternative vendors and suppliers,

our ability to obtain new therapeutics or continue to operate existing therapeutics markets and our financial condition and operating

results may be adversely affected.

Defects, failures, or security breaches

in and inadequate upgrades of, or changes to therapeutics software could harm our business.

Defects, failures, or security breaches in and inadequate upgrades

of, or changes to therapeutics software could harm our business. Any therapeutics system depends on sophisticated software, hardware,

computer networking, and communication services that may contain undetected errors or may be subject to failures or complications. These

errors, losses, or complications may arise when new, changed, or enhanced products or services are added. Future upgrades, improvements,

or changes that may be necessary to expand and maintain our business could result in delays or disruptions or may not be timely or appropriately

made, any of which could seriously harm our operations. Further, certain aspects of the operating systems relating to our business are

provided by third parties, including telecommunications. Accordingly, the effectiveness of these operating systems is, to a certain degree,

dependent on the actions and decisions of third parties over whom we may have limited control.

General Risks

The market for our common stock may be thinly

traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire

to liquidate your shares.

The market for our common stock may be thinly traded on the Over-the-Counter

(OTC) Markets, meaning that the number of persons interested in purchasing our shares at or near ask prices at any given time may be relatively

small or non-existent. This situation is attributable to several factors, including the fact that we are a small company that is relatively

unknown to stock analysts, stockbrokers, institutional investors, and others in the investment community. Even if we came to such persons'

attention, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the

purchase of our shares until we became more seasoned and viable. Consequently, there may be periods of several days or more when trading

activity in our shares is minimal or non-existent compared to a seasoned issuer, which has a large and steady volume of trading activity

that will generally support continuous sales without an adverse effect on our share price. We cannot assure you that a broader or more

active public trading market for our common shares will develop or be sustained or that current trading levels will be maintained.

Our Series A Preferred Stock may lead

to conflicts of interest and could negatively impact the price of our securities.

Except as otherwise required by law or by

the Articles of Incorporation and except as set forth below, the outstanding shares of Series A Preferred Stock shall vote together with

the shares of Common Stock and other voting securities of the Company as a single class and, regardless of the number of shares of Series

A Preferred Stock outstanding and as long as at least one of such shares of Series A Preferred Stock is outstanding shall represent four-fifths

(80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Company or action by written consent of

shareholders. Each outstanding share of the Series A Preferred Stock shall represent its proportionate share of the 80% that is allocated

to the outstanding shares of Series A Preferred Stock. We are currently authorized to issue 500,000 shares of Series A Preferred Stock.

Our sole officer and director, Jason R. Tucker, owns 500,000 shares of Series A Preferred Stock of the Company, representing 100% of the

issued and outstanding Series A Preferred Stock. As a result, Mr. Tucker has the ability to influence significantly all matters requiring

approval by our stockholders. Mr. Tucker may have interests that differ from other stockholders, and they may vote in a way with which

other stockholders disagree and either or both may be adverse in the future to the interests of other stockholders. The concentration

of ownership of our voting securities may have the effect of delaying, preventing or deterring a change of control of our Company, could

deprive our stockholders of an opportunity to receive a premium for their securities as part of a sale of our Company, and consequently

may affect the market price of our common stock. This concentration of ownership of our voting securities may also have the effect of

influencing the completion of a change in control that may not necessarily be in the best interests of all of our stockholders.

Also, in the event of any voluntary or involuntary

liquidation, dissolution, or winding up of the Company, the holders of the Series B Preferred Stock are senior to the Common Stock and

the holders of shares of the Series B Preferred Stock are entitled to be paid, out of the assets of the Company available for distribution

to its stockholders, whether from capital surplus or earnings, an amount equal to at least $0.997 per share of the assets so distributed.

The availability of shares for sale in the

future could reduce the market price of our common stock.

In the future, we may issue securities to raise cash for acquisitions

or otherwise. We may also acquire interests in other companies by using a combination of cash and common stock or just common stock. We

may also issue securities convertible into our common stock. Any of these events may dilute your ownership interest in our company and

adversely impact our common stock price.

Also, sales of a substantial amount of our common stock in the public

market or the perception that these sales may occur could reduce our common stock's market price and impair our ability to raise additional

capital through the sale of our securities.

The indemnification provisions in our articles

of incorporation under Wyoming law may result in substantial expenditures by our company and may discourage lawsuits against our directors,

officers, and employees.

Our articles of incorporation contain provisions that eliminate our

directors' liability for monetary damages to our company and stockholders. Our bylaws also require us to indemnify our officers and directors.

We may also have contractual indemnification obligations under our agreements with our directors, officers, and employees. These indemnification

obligations could result in our Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors,

officers, and employees that we may not recoup.

Our common stock will be deemed a “penny

stock,” making it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9, which establishes the definition of

a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share,

subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve

a person’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to be purchased. Generally, brokers may be less willing to execute

transactions in securities subject to the “penny stock” rules, making it more difficult for investors to dispose of our common

stock if and when such shares are eligible for sale and may cause a decline in the market value of its stock.

As an issuer of a “penny stock,”

the federal securities laws' protection relating to forward-looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking

statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers

of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon

a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because we

failed to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

We are classified as a “smaller reporting

company,” and we cannot be sure if the reduced disclosure requirements applicable to smaller reporting companies will make our common

stock less attractive to investors.

We are currently a “smaller reporting company.” Specifically,

“smaller reporting companies” may provide simplified executive compensation disclosures in their filings; are exempt from

the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation

report on the effectiveness of internal control over financial reporting, and have certain other decreased disclosure obligations in their

SEC filings. Reduced disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder

for investors to analyze our results of operations and financial prospects.

Because directors and officers currently

and for the foreseeable future will continue to control the Company, you will not likely be able to elect directors or have any say in

the Company’s policies.

Our stockholders are not entitled to cumulative voting rights. Consequently,

a majority vote will decide the election of directors and all other matters requiring stockholder approval. As long as at least one share

of our Series A Preferred Stock is outstanding, the preferred stock will represent 80% of all votes entitled to be voted at any annual

or special meeting of stockholders. Jason R. Tucker, our President, holds all outstanding shares of our Series A Preferred Stock and will

continue to have, voting control of the Company.

We do not expect to pay dividends in the

future; any return on investment may be limited to our common stock’s value.

We do not currently anticipate paying cash dividends in the foreseeable

future. The payment of dividends on our common stock will depend on earnings, financial condition, and other business and economic factors

affecting it at such time as the Board may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable

future to increasing our capital base and development and marketing efforts. There can be no assurance that we will ever have sufficient

earnings to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is

at the sole discretion of our Board of Directors. If we do not pay dividends, our common stock may be less valuable because a return on

your investment will only occur if our stock price appreciates.

ITEM 2. FINANCIAL INFORMATION.

Managements’ Discussion and Analysis of Financial Condition

and Results of Operations

The following discussion summarizes the significant factors affecting

the operating results, financial condition and liquidity, and cash flows of our company for the years ended February 28, 2023, and

2022. You should read this discussion together with the consolidated financial statements, related notes, and other financial information

included in this Form 10. Except for historical information, the matters discussed in this Management’s Discussion and Analysis

of Financial Condition and Results of Operations are forward-looking statements that involve risks and uncertainties and are based upon

judgments concerning various factors beyond our control. These risks could cause our actual results to differ materially from any future

performance suggested below.

Overview

Cann American Corp. (“CNNA,” “we,”

“us,” or the “Company”) was originally incorporated in Nevada on August 25, 2004, as Deer Bay Resources

Inc. Our offices are located at 75 Union Ave., Rutherford, NJ 07070. Our telephone number is (551) 285-4350, and our email address is

info@prodigystemcell.com.

We are a therapeutics development company. Management is experienced

at business integration and re-branding potential. We intend to bring to market innovative brands with great potential. Our brands will

be unique as we focus on new markets that are still in need of development.

History

The

Company was originally incorporated under the laws of the state of Nevada on August 25, 2004, as Deer Bay Resources Inc. On January 27,

2011, the Company entered into a plan of merger with Bioflamex Corporation whereby the Company would be the surviving entity, with the

Company renamed Bioflamex Corporation and the Company's articles of incorporation amended accordingly. On February 8, 2011, the Company

received notice from FINRA that its application for a name change had processed and the new symbol would be BFLX. On July 16, 2012, the

Company entered into a plan of merger with Terra Asset Management. On October 10, 2012, the Company announced its intention to unwind

the plan of merger due to Terra Asset Management’s failure to provide audited financial statements. On October 17, 2012, the Company

announced termination of the Merger Agreement, returning all Parties to their original positions regarding ownership of Terra Asset Management

and the Company, directorships and management positions, debts and liabilities, the issuance of shares, and all other matters, with all

Parties recognizing the original transaction as set forth in the Merger Agreement as null and void and having no force or effect. The

Parties further agreed to a mutual release from any liabilities arising from the transaction.

On January 15, 2013, the Company filed a form 15-12G certification

and notice of termination of registration under section 12(g) of the Securities Exchange Act of 1934 for suspension of duty to file reports

under sections 13 and 15(d) of the Securities Exchange Act of 1934. On February 20, 2013, the Company re-domiciled from the State of Nevada

to the State of Wyoming. On February 25, 2013, the Company amended its articles of incorporation to create 500,000 shares of Series A

Preferred Stock with a par value of $0.00001, and 1,500,000 shares of Series B. Preferred Stock with a par value $0.00001. On November

25, 2014, the Company’s board of directors approved a name change from Bioflamex Corp to Canamed4Pets, Inc. In March 2015, the Company

received notice from FINRA that its application for a name change had been processed and the new symbol would be CNNA.

On March 22, 2016, as a consequence of delinquent annual filings,

the State of Wyoming dissolved the Company. On January 10, 2019, Jason Black retained Hathaway and Kunz, LLP to petition the

District Court of Wyoming for reinstatement of the Company. On March 19, 2019, Hathaway and Kunz LLP submitted a petition with the

District Court of Wyoming on behalf of Mr. Black to reinstate the Company and for Hathaway and Kunz LLP to act as the

Company’s registered agent. On April 30, 2019, the District Court of Wyoming granted Mr. Black’s petition to set aside

the Company’s administrative dissolution and Hathaway and Kunz LLP was appointed as registered agent.

On May 15, 2019, the Company acquired Cannequipt LLC as a wholly owned

subsidiary. On August 21, 2019, the Company entered into a plan and agreement of merger with Cann American Holdings, LLC, a California

company pursuant to which the Company’s CEO, Jason Black, had been the Managing Member since 2015. The Company would be the surviving

entity, with the name changed to Cann American Corp and the Articles of Incorporation amended accordingly. On September 17, 2019, the

State of Wyoming approved the Company’s plan and agreement of merger and Canamed4Pets, Inc. became Cann American Corp. On September

23, 2019, the State of California approved the Company’s plan and agreement of merger and merged out Cann American Holdings, LLC.

On December 20, 2019, FINRA, having received all adequate documents pertaining to historical conversions, resolutions and changes of control,

and following an initial application on September 18, 2019, approved the Company’s name change from Canamed4Pets, Inc. to Cann American

Corp.

On February 4, 2020, the Company was qualified by SEC for Tier 1 Reg

A issuances. On November 13, 2020, FINRA approved the Company's application for a 1 for 10 reverse split of its Common Stock. On March

12, 2021, the Company initiated filings with the SEC to extend its Reg A offering for an additional twelve (12) months. On September 30,

2021, following notice from SEC that it no longer qualified for Reg A issuances due to the Investment Company Act of 1940, the Company

filed a withdrawal of its application to extend its Reg A offerings.

On December 10, 2021, the Company launched its signature CBD and Delta

8 vape line “C-Juice”. On June 1, 2022, the Company entered into a 12-month lease agreement of 10,000 square feet of land

in Glencoe, Oklahoma to develop a hemp farming operation.

On January 30, 2023, the Company entered a letter of intent

to acquire Prodigy Stem Cell, LLC (“Prodigy”), with an effective acquisition date of March 1, 2023, in consideration

of $50,000 and the issuance of 1,000,000 shares of Series B Preferred Stock to Prodigy’s sole member, Peter Caruso. On March 1, 2023,

the Company appointed Peter Caruso as a Director of the Company. On May 10, 2023, the Company completed the acquisition of Red

Sand Health, LLC, d/b/a Liberty Health Plus (“Red Sand”) as a wholly owned subsidiary of the Company, in consideration of

the issuance of 500,000 shares of Series B Preferred Stock to Red Sand’s sole member, Michael G. Kramer. Upon finalization the Company's

board of directors further approved changing the Red Sand Health, LLC, d/b/a from Liberty Health Plus to d/b/a Prodigy Health Plus. On

May 10, 2023, the Company appointed Michael G. Kramer as a Director of the Company.

Critical Accounting Policies

This “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” section is based upon our consolidated financial statements, which have been prepared in accordance

with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of consolidated

financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities, net sales

and expenses, and related disclosures. On an ongoing basis, we evaluate our estimates, including, but not limited to, those related to

inventories, income taxes, accounts receivable allowance, fair value derivatives, and reserve for warranty claims. We base our estimates

on historical experience, performance metrics, and various other assumptions that we believe to be reasonable under the circumstances,

the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results will differ from these estimates under different assumptions or conditions. We apply the following

critical accounting policies in the preparation of our consolidated financial statements:

Use of Estimates

Financial statements prepared under accounting principles generally

accepted in the U.S. require management to make estimates and assumptions that affect the reported amounts of assets and liabilities at

the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Among other things,

management estimates include the estimated collectability of its accounts receivable, the valuation of long-lived assets, warranty reserves,

the assumptions used to calculate derivative liabilities, assumptions used to value equity instruments issued for financing and compensation,

and the valuation of deferred tax assets. Actual results could differ from those estimates.

Revenue Recognition

We recognize revenue under Accounting Standard Update (“ASU”)

No. 2014-09. This standard provides authoritative guidance clarifying the principles for recognizing revenue and developing a common

revenue standard for U.S. GAAP. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of

promised goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange

for those goods or services.

Under this guidance, revenue is recognized when control of promised

goods or services is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange

for those goods or services. We review our sales transactions to identify contractual rights, performance obligations, and transaction

prices, including the allocation of prices to separate performance obligations, if applicable. Revenue and costs of sales are recognized

once products are delivered to the customer’s control, and performance obligations are satisfied.

Recent Accounting Pronouncements

See Note 2 of Notes to Consolidated Financial Statements in this Form

10 for management’s discussion of recent accounting pronouncements.

Results of Operations for the Fiscal Year

Ended February 28, 2023, Compared to the Fiscal Year Ended February 28, 2022.

Revenue

We had $0 in revenues for the fiscal year ended February 28, 2023,

and revenues of $0 for the fiscal year ended February 28, 2022.

Cost of Sales

We incurred $0 in cost of sales for the fiscal year ended February 28, 2023,

and $0 in cost sales for the fiscal year ended February 28, 2022.

Operating Expenses

General & Administrative Expenses

General and administrative expenses include professional fees, costs

associated with marketing, press releases, public relations, rent, sponsorships, and other expenses. We incurred general and administrative

expenses of $145,939 for the fiscal year ended February 28, 2023, versus $198,757 for the fiscal year ended February 28, 2022,

a decrease of $52,818 (26.57%). This decrease was due to having significantly lower professional fees in 2023.

Other Income (Expense)

Our other income and expenses include losses on bank charges, loan

interest, non-cash interest and loan amortization, and gain in fair value of derivative liabilities. We recognized other income of $4,231,130

for the fiscal year ended February 28, 2023, and recognized other income of $14,399,414 for the fiscal year ended February 28, 2022,

each due to the valuation of the Company’s derivative liabilities.

Net Gains

We incurred a net gain of $3,821,549 for the fiscal year ended February 28, 2023,

and a net gain of $10,541,276 for the fiscal year ended February 28, 2022. In 2023 compared to 2022, we experienced lower operating

expenses, and significantly decreased total other income.

Liquidity and Capital Resources

Liquidity and Capital Resources for the Fiscal Year Ended February 28,

2023, Compared to the Fiscal Year Ended February 28, 2022

| | |

Fiscal Year Ended February 28, | |

| | |

2023 | | |

2022 | |

| Summary of Cash Flows: | |

| | |

| |

| Net cash used by operating activities | |

$ | 5,016 | | |

$ | (342,725 | ) |

| Net cash used by investing activities | |

$ | 0 | | |

$ | 0 | |

| Net cash provided by financing activities | |

$ | 5,317 | | |

$ | 275,139 | |

| Net increase (decrease) in cash and cash equivalents | |

$ | 10,333 | | |

$ | (67,586 | ) |

| Beginning cash and cash equivalents | |

$ | 555 | | |

$ | 68,141 | |

| Ending cash and cash equivalents | |

$ | 10,888 | | |

$ | 55 | |

Operating Activities

For the fiscal year ended February 28, 2023, we used $5,016

of cash in operations, which included our net income of $3,821,549, offset by a $30,600 expense for a amortization of a debt discount,

a gain in the change in fair value of derivatives of $4,231,130, a $215,149 expense for loan interest, a $17,893 expense for financing

costs, a decrease of other current assets of $150,700, and an increase of current liabilities of $255. Cash flows remained relatively

consistent year-over-year.

Investing Activities

The Company did not have cash flows from investing activities.

Financing Activities

Net cash provided by financing activities was $5,317 for the fiscal

year ended February 28, 2023, which consisted of $100,018 of proceeds from notes, less $15 from the sale of stock, $76,793 from

payment of related party loans, and $17,893 in financing costs.

Future Capital Requirements

Our current available cash and cash equivalents are insufficient to

satisfy our liquidity requirements. Our capital requirements for the fiscal year ending February 28, 2024, will depend on numerous

factors, including management’s evaluation of the timing of projects to pursue. Subject to our ability to generate revenues and

cash flow from operations and our ability to raise additional capital (including through possible joint ventures or partnerships), we

expect to incur substantial expenditures to carry out our business plan, as well as costs associated with our capital raising efforts

and being a public company.

Our plans to finance our operations include seeking equity and debt

financing, alliances or other partnership agreements, or other business transactions that would generate sufficient resources to ensure

the continuation of our operations.

The sale of additional equity or debt securities may result in further

dilution to our stockholders. If we raise additional funds through the issuance of debt securities or preferred stock, these securities

could have rights senior to those of our common stock and could contain covenants that would restrict our operations. Any such required

additional capital may not be available on reasonable terms, if at all. If we were unable to obtain additional financing, we may be required

to reduce the scope of, delay or eliminate some or all of our planned activities and limit our operations, which could have a material

adverse effect on our business, financial condition, and operations results.

Inflation

The amounts presented in our consolidated financial statements do not

provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than reported

if the effects of inflation were reflected either by charging operations with amounts representing replacement costs or using other inflation

adjustments.

Going Concern

The accompanying audited 2023 financial statements have been prepared

on a going concern basis. For the fiscal year ended February 28, 2023, we had a net loss of $145,939, had net cash gain from

operating activities of $10,333, had a negative working capital deficit of ($2,924,707), an accumulated deficit of ($8,483,265) and stockholders’

deficit of ($2,810,082). Our ability to continue as a going concern depends on our ability to obtain the necessary financing to meet our

obligations and repay our liabilities arising from normal business operations when they come due, fund possible future acquisitions, and

generate profitable operations in the future. Our management plans to provide for our capital requirements by continuing to issue additional

equity and debt securities. The outcome of these matters cannot be predicted at this time, and there are no assurances that, if achieved,

we will have sufficient funds to execute our business plan or generate positive operating results. The financial statements do not include

any adjustments that might result from the outcome of this uncertainty.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Quantitative and Qualitative Disclosures

about Market Risk

In the ordinary course of our business, we are not exposed to market

risk of the sort that may arise from changes in interest rates or foreign currency exchange rates or that may otherwise arise from transactions

in derivatives.

The preparation of financial statements in conformity with U.S. GAAP

requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure

of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates. Our significant estimates and assumptions include the fair

value of our common stock, stock-based compensation, the recoverability and useful lives of long-lived assets, and the valuation allowance

relating to our deferred tax assets.

Contingencies

Certain conditions may exist as of the date the financial statements

are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to

occur. In consultation with its legal counsel as appropriate, our management assesses such contingent liabilities, and such assessment

inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against us

or unasserted claims that may result in such proceedings, we, in consultation with legal counsel, evaluates the perceived merits of any

legal proceedings or unasserted claims, as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates it is probable that a material loss has been incurred and the amount of the liability can

be estimated, then the estimated liability would be accrued in our financial statements. If the assessment indicates a potentially material

loss contingency is not probable, but is reasonably possible, or is likely, but cannot be estimated, then the nature of the contingent

liability, together with an estimate of the range of possible loss, if determinable and material, would be disclosed. Loss contingencies

considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

ITEM 3. PROPERTIES.

We do not own or lease any property. We currently have an agreement

for a virtual office. Our business mailing address is 75 Union Ave., Rutherford, NJ 07070. We believe our facilities are adequate to meet

our current and near-term needs.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table and footnotes to it sets forth information regarding

the number of shares of common stock beneficially owned by (i) each director and named executive officer of our Company, (ii) named executive

officers, executive officers, and directors of the Company as a group, and (iii) each person known by us to be the beneficial owner of

5% or more of our issued and outstanding shares of common stock. In calculating any percentage in the following table of common stock

beneficially owned by one or more persons named therein, the following table is based on 401,666,851 shares of Common Stock outstanding

as of the filing date of this Form 10 and any shares of common stock the person has the right to acquire within the 60 days following

the filing date of this Form 10. Unless otherwise further indicated in the following table, the footnotes to it or elsewhere in this report,

the persons and entities named in the following table have sole voting and sole investment power concerning the shares set forth opposite

the stockholder’s name, subject to community property laws, where applicable. Unless as otherwise indicated in the following table

and the footnotes, our named executive officers and directors’ address in the following table is c/o Cann American Corp., 75 Union

Ave., Rutherford, NJ 07070.

| Name and Address of Beneficial Owner (1) | |

Common Stock Beneficially Held (2) | | |

Percent of Class (3) | |

| Named Executive Officers and Directors | |

| | | |

| | |

| Jason R. Tucker | |

| 1,612,667,404 | (4) | |

| 79.59% | |

| Peter Caruso | |

| 10,000,000 | (5) | |

| .4928% | |

| Michael G. Kramer | |

| 5,000,000 | (6) | |

| .2464% | |

| | |

| | | |

| | |

| All Executive Officers and Directors as a group (3 Persons) | |

| | | |

| 80.33% | |

| | |

| | | |

| | |

| 5% or More Stockholders | |

| | | |

| | |

| None | |

| | | |

| | |

| |

(1) |

Unless as otherwise indicated in the following table and the footnotes, our named executive officers and directors’ address in the following table is c/o Cann American Corp., 75 Union Ave., Rutherford, NJ 07070. |

| |

|

|

| |

(2) |

Under Rule 13d-3 of the Exchange Act, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the number of shares beneficially owned by such person (and only such person) because of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the above table does not necessarily reflect the person’s actual ownership or voting power concerning the number of shares of common stock outstanding on the date of this Form 10. |

| |

|

|

| |

(3) |

In calculating any percentage in the following table of common stock beneficially owned by one or more persons named therein, the following table is based on 401,666,851 shares of common stock as of the filing date of this Form 10 and any shares of common stock the person has the right to acquire within the 60 days following the filing date of this Form 10. |

| |

|

|

| |

(4) |

Consists of 1,612,667,404 shares of Common Stock issuable upon the conversion of the 500,000 shares of Series A Preferred Stock held by Mr. Tucker. The Series A Preferred Stock are convertible into such number of shares of common stock resulting in approximately 80% of the outstanding shares of common stock of the Company on a post-conversion basis. |

| |

|

|

| |

(5) |

Consists of 10,000,000 shares of Common Stock

voting rights in connection with the issuance of 1,000,000 shares of Series B Preferred Stock to Mr. Caruso.

|

| |

|

|

| |

(6) |

Consists of 5,000,000 shares of Common Stock voting

rights in connection with the issuance of 500,000 shares of Series B Preferred Stock to Mr. Kramer.

|

Changes in Control

There are no arrangements known

to us the operation of which may at a subsequent date result in a Change in Control of the Company.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS.

The following table sets forth the names, positions, and ages of our

current executive officers and directors. All directors serve until the next annual meeting of stockholders or until their successors

are elected and qualified.

Directors are elected to serve until the next annual meeting of stockholders

until their successors are elected and qualified. Directors are elected by a plurality of the votes cast at the annual meeting of stockholders

and hold office until the expiration of the term for which they were elected and until a successor has been elected and qualified.

A majority of the authorized number of directors constitutes a quorum

of the Board of Directors for the transaction of business. The directors must be present at the meeting to constitute a quorum. However,

any action required or permitted to be taken by the Board of Directors may be taken without a meeting if all Board members individually

or collectively consent in writing to the action.

Executive officers are appointed by and serve at the pleasure of the

Company's Board of Directors, subject to any contractual arrangements.

| Name | |

Age | | |

Title |

| Jason R. Tucker | |

46 | | |

Director, President, Chief Financial Officer, Treasurer and Secretary |

| Michael G. Kramer | |

44 | | |

Director |

| Peter Caruso | |

47 | | |

Director |

Professional Experience

Jason R. Tucker–Director, President,

CEO, and CFO

Mr. Tucker has 18 years of business development and project management

experience. From December 2020 until October 2021, Mr. Tucker served as Chief Executive Officer of General Entertainment Ventures Inc.

k/n/a General Enterprise Ventures, Inc. (GEVI).

Michael G. Kramer–Director

Mr. Kramer is an accomplished entrepreneur with over 20 years of business

development experience in the technology sector, and 12 years of experience in law enforcement. Mr. Kramer is founder and President of

Red Sand Health, LLC d/b/a Prodigy Health Plus, a wholly owned subsidiary of the Company.

Peter Caruso–Director

Mr. Caruso has over 20 years of business development experience, and

is founder and President of Prodigy Stem Cell, LLC, a wholly owned subsidiary of the Company.

Executive Officers of Prodigy Stem Cell

LLC

| Name |

|

Age |

|

|

Title |

| Peter Caruso |

|

|

47 |

|

|

President |

Professional Experience

Peter Caruso–President

Mr. Caruso has over 20 years of business development experience, and

is founder and President of Prodigy Stem Cell, LLC.

Executive Officers of Red Sand Health, LLC

d/b/a Prodigy Health Plus

| Name |

|

Age |

|

|

Title |

| Michael G. Kramer |

|

|

44 |

|

|

President |

Professional Experience

Michael G. Kramer–President

Mr. Kramer is an accomplished entrepreneur with over 20 years of business

development experience in the technology sector, and 12 years of experience in law enforcement. Mr. Kramer is founder and President of

Red Sand Health, LLC d/b/a Prodigy Health Plus.

Significant Employees

We do not have any significant employees other than our current director

and executive officers named in this Registration Statement.

Legal Proceedings

During the past ten years, none of the following events would apply

to any of our directors or executive officers:

| |

· |

A petition under the federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing; |

| |

|

|

| |

· |

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

· |

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities: |

| |

o |

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings-and-loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; |

| |

|

|

| |

o |

Engaging in any type of business practice; or |

| |

|

|

| |

o |

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or State securities laws or federal commodities laws; |

| |

· |

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity; |

| |

|

|

| |

· |

Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| |

|

|

| |

· |

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| |

|

|

| |

· |

Such person was the subject of, or a party to, any federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: |

| |

o |

Any federal or State securities or commodities law or regulation; or |

| |

|

|

| |

o |

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or |

| |

|

|

| |

o |

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

· |

Such person was the subject of, or a party to, any sanction or order, not subsequently reversed. suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Director Independence

We are not currently subject to listing requirements of any national

securities exchange or inter-dealer quotation system, which has requirements that a majority of the Board of Directors be “independent”

and, as a result, we are not at this time required to have our board of directors comprised of a majority of “independent directors.”

Family Relationships

There are no familial relationships among any of our directors or officers.

Audit Committee

We currently do not have a separately standing Audit Committee due

to our limited size, and our Board performs the functions that an Audit Committee would otherwise perform.

Compensation Committee

We do not have a Compensation Committee due to our limited size, and

our Board performs the functions that a Compensation Committee would otherwise perform. Our Board intends to form a Compensation Committee

when needed.

Other Committees

We do not have a standing nominating committee. Further, we do not

have a policy concerning the consideration of any director candidates recommended by security holders. To date, no security holders have

made any such recommendations. Our board of directors performs all functions that committees would otherwise perform. Given our Board's

present size, it is not practical for us to have committees other than those described above or to have more than two directors on such

committees. If we can grow our business and increase our operations, we intend to expand the size of our Board and our committees and

allocate responsibilities accordingly.

Potential Conflicts of Interest

Because we do not have an audit or Compensation Committee comprised

of independent directors, the functions that such committees would have performed are performed by our directors. Our Board of Directors

has not established an Audit Committee and does not have a financial expert, nor has our Board established a nominating committee. Our

Board believes that such committees are not necessary since we only have one director, and to date, such director has been performing

such committees' functions. Thus, there is a potential conflict of interest in that our director and officers have the authority to determine

issues concerning management compensation, nominations, and audit issues that may affect management decisions. We are not aware of any

other conflicts of interest with any of our executive officers or directors.

ITEM 6. EXECUTIVE COMPENSATION.

Executive Compensation

The Company did not have any compensation for its executives.

Non-Executive Compensation

The Company did not have any compensation for its non-executives.

Employment Agreements

There were no employment agreement as of February 28, 2023.

Outstanding Equity Awards at Fiscal Year-End

There were no outstanding equity awards awarded to our named executive

officer as of February 28, 2023.

Director Compensation

At this time, our directors do not receive cash compensation for serving

as members of our board of directors. The term of office for each director is one year or until his/her successor is elected at our annual

meeting and qualified. The duration of office for each of our officers is at the pleasure of the board of directors. The board of directors

has no nominating, auditing committee, or compensation committee. Therefore, the selection of a person or election to the board of directors

was neither independently made nor negotiated at arm’s length.

During the fiscal year ended February 28, 2023, our sole

director, Mr. Tucker, received no compensation for director services.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR

INDEPENDENCE.

Other than as given below, since March 1, 2023, there have

been no transactions, and there currently are no proposed transaction in which we were or are to be a participant and in which any related

person has or will have a direct or indirect material interest involving the lesser of $120,000 or one percent (1%) of the average of

our total assets as of the end of last two completed fiscal years. A related person is any executive officer, director, nominee for director,

or holder of 5% or more of our common stock, or an immediate family member of any of those persons.

Pursuant to an Assignment Agreement dated February 28, 2023,

between Jason Black and Jason R. Tucker, Mr. Black assigned 500,000 shares of the Series A Preferred Stock of the Company to Mr. Tucker.

On March 15, 2023, Mr. Black resigned as the President and Chief Executive Officer and from the Board of Directors of the Company;

and Jason R. Tucker was appointed to the Board of Directors of the Company, and as the President, Chief Executive Officer, Treasurer,

and Secretary of the Company.

ITEM 8. LEGAL PROCEEDINGS.

We anticipate that we (including any future subsidiaries) will become

subject to claims and legal proceedings arising in the ordinary course of business from time to time. It is not feasible to predict the

outcome of any such proceedings, and we cannot assure that their ultimate disposition will not have a materially adverse effect on our

business, financial condition, cash flows, or results of operations. As of the filing of this Form 10, we are not a party to any pending

legal proceedings, nor are we aware of any civil proceeding or government authority contemplating any legal proceeding.

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANTS COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS.

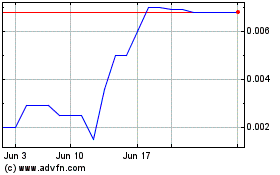

Our common stock is quoted on the OTC Pink under the symbol “CNNA.”

The table below sets forth for the periods indicated the quarterly high and low bid prices reported by OTC Markets. Limited trading volume

has occurred during these periods. These quotations reflect inter-dealer prices without retail mark-up, mark-down, or commission and may

not necessarily represent actual transactions.

| Fiscal Year Ended February 28, 2023 | |

| Quarter | |

High | | |

Low | |

| First | |

$ | 0.0093 | | |

$ | 0.0024 | |

| Second | |

$ | 0.0046 | | |

$ | 0.0015 | |

| Third | |

$ | 0.0098 | | |

$ | 0.0020 | |

| Fourth | |

$ | 0.0149 | | |

$ | 0.0005 | |

| Fiscal Year Ended February 28, 2022 |

| Quarter | |

High | | |

Low | |

| First | |

$ | 0.0295 | | |

$ | 0.0095 | |

| Second | |

$ | 0.0179 | | |

$ | 0.0105 | |

| Third | |

$ | 0.0270 | | |

$ | 0.0026 | |

| Fourth | |

$ | 0.0108 | | |

$ | 0.0046 | |

Our common stock is considered to be “penny stock” under

rules promulgated by the SEC. Under these rules, broker-dealers participating in transactions in these securities must first deliver a

risk disclosure document which describes risks associated with these stocks, broker-dealers’ duties, customers’ rights and

remedies, market and other information and make suitability determinations approving the customers for these stock transactions based

on financial situation, investment experience, and objectives. Broker-dealers must also disclose these restrictions in writing, provide

monthly account statements to customers, and obtain each customer's specific written consent. With these restrictions, the likely effect

of designation as a penny stock is to decrease broker-dealers' willingness to make a market for the stock, reduce the liquidity of the

stock, and increase the transaction cost of sales purchases of these stocks compared to other securities.

Dividend Policy

We have never declared a cash dividend on our common stock, and our

board of directors does not anticipate that we will pay cash dividends in the foreseeable future. Any future determination to pay cash

dividends will be at the discretion of our board of directors and depend upon our financial condition, operating results, capital requirements,

restrictions in our agreements, and other factors that our board of directors deems relevant.

We

are obligated to pay dividends to certain holders of our preferred stock, which we pay out of legally available funds from time to time,

or reach arrangements with our holders of preferred stock to convert limited quantities of preferred stock at favorable conversion prices

instead of dividend payments.

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES.

The table below sets forth all of the securities the Company has sold

within the past three years that were not registered under the Securities Act, including sales of reacquired securities, new issues, securities

issued in exchange for property, services, or other securities, new securities resulting from the modification of outstanding securities.

No underwriters were involved in connection with these issuances, and the Company used any proceeds from such sales for working capital

purposes.

|

Date of Transaction

(MM/DD/YYYY) |

Transaction type (e.g., new issuance, cancellation, shares returned to treasury) |

Amount of Securities Sold |

Title of Securities |

Value of shares issued ($/per share) at Issuance |

Individual/ Entity Shares were issued to (entities must have individual with voting / investment control disclosed). |

Consideration |

Cash Received |

1933 Securities Ac Registration Exemption |

| |

|

|

|

|

|

|

|

|

| 2/24/2020 |

New |

3,333,334 |

Common |

0.015 |

Investor |

Cash |

$50,000 |

Section 4(a)(2) |

| 4/30/2020 |

New |

9,666,667 |

Common |

0.0001 |

Consultant |

Services |

|

Section 4(a)(2) |

| 6/8/2020 |

New |

11,000,000 |

Common |

0.015 |

Investor |

Cash |

$165,000 |

Section 4(a)(2) |

| 6/10/2020 |

New |

666,667 |

Common |

0.015 |

Investor |

Cash |

$10,000 |

Section 4(a)(2) |

| 6/23/2020 |

New |

3,333,334 |

Common |

0.015 |

Investor |

Cash |

$50,000 |

Section 4(a)(2) |

| 7/7/2020 |

New |

10,000,000 |

Common |

0.015 |

Investor |

Cash |

$150,000 |

Section 4(a)(2) |

| 7/7/2020 |

New |

1,000,000 |

Common |

0.015 |

Consultant |

Services |

|

Section 4(a)(2) |

| 9/2/2021 |

New |

20,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 9/20/2021 |

New |

20,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 10/16/2021 |

New |

20,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 10/28/2022 |

New |

25,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 11/15/2022 |

New |

25,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 12/1/2022 |

New |

30,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 12/12/2022 |

New |

30,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

| 12/21/2022 |

New |

30,000,000 |

Common |

0.0001 |

Debt Holder |

Debt Conversion |

|

Section 3(a)(9) |

ITEM 11. DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED.

Common Stock

We are authorized to issue 1,998,000,000 shares of common stock, $0.0001

par value. The holders of common stock are entitled to equal dividends and distributions, with respect to the common stock when, as, and

if declared by the board of directors from funds legally available for such dividends. No holder of common stock has any preemptive right

to subscribe for any of our stock nor are any shares subject to redemption. Upon our liquidation, dissolution, or winding up, and after

payment of creditors and any amounts payable to senior securities, the assets will be divided pro-rata on a share-for-share basis among

the holders of the shares of common stock.

Holders of our common stock do not have cumulative voting rights so

that the holders of more than 50% of the shares voting for the election of directors will be able to elect 100% of the directors if they

choose to do so, and in that event, the holders of the remaining shares will not be able to elect any members to the board of directors.

No holder of shares of capital stock possessing voting power shall have the right to cumulate their voting power in the election of directors.

At each meeting of holders of shares of capital stock for the election

of directors at which a quorum is present, a nominee for election as a director in an uncontested election shall be elected to the board

of directors if the number of votes cast for such nominee’s election exceeds the number of votes cast against such nominee’s