Pineapple Energy Inc. (NASDAQ: PEGY), a leading provider of

sustainable solar energy and back-up power to households and small

businesses, today announced financial results for the

fourth-quarter and full year ended December 31, 2023.

Pineapple CEO Kyle Udseth commented, “Pineapple Energy, and our

two core operating businesses Hawaii Energy Connection and

SUNation, were able to power through the adversity impacting the

residential solar industry and deliver a strong Q4 to cap off a

very strong 2023. Stubbornly high interest rates, uncertainty over

state-level policy and incentives, and general consumer malaise

around long-term big-ticket items certainly presented challenges.

But despite the headwinds, our solar professionals delivered solid

results and continued to power the energy transition by helping

individual homeowners take control of their electricity production,

storage, and consumption. We came in just shy of our revenue

guidance range, generating $79.6 million, and more importantly were

able to deliver positive adjusted EBITDA over the full year. In

2024, we anticipate interest rates to start to fall, hardware costs

to continue to decrease, and utilities to continue their streak of

double-digit annual price increases, which will support the value

proposition for rooftop solar – ideally paired with a battery. Not

only is this expected to continue to drive demand in the markets we

already operate in, but the economics and ROI of going solar should

improve in more states as well, paving the way for future

acquisitions and organic expansion. Until rates start coming down,

demand is likely to remain muted, but we are optimistic that the

back half of 2024 will shape up to be a period of accelerating

growth. We believe our strategy remains sound and will continue to

bear out in 2024.”

Pineapple CFO Eric Ingvaldson commented, “We are proud of the

results our employees delivered in 2023. Achieving $1.2 million in

positive pro forma adjusted EBITDA for the full year shows that we

were able to successfully control costs and gain operating

leverage. Our number one focus will continue to be generating

positive EBITDA and cash flow from operations. We continue to

pursue various funding sources to provide working capital for the

business and make sure adequate resources are available to meet our

obligations in 2024.”

Fourth Quarter Business Highlights

- Pro forma operating metrics

- Residential kW installed down 17% (Q4 2023 vs Q4 2022)

- Residential kW sold up 2% (Q4 2023 vs Q4 2022)

- Residential battery attachment rate up to 38% in Q4 2023, from

28% in Q4 2022

- Backlog declined to $36M as of December 31, 2023, down from

$39M as of October 31, 2023

Full Year Business Highlights

- Pro forma operating metrics

- Residential kW installed up 8% (2023 vs 2022)

- Residential kW sold down 1% (2023 vs 2022)

- Residential battery attachment rate up 3% to 40% in 2023, from

37% 2022

Fourth Quarter and Full Year 2023 GAAP Results from

Continuing Operations1

|

|

4th Quarter

2023 |

4th Quarter

2022 |

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$19,442,296 |

|

|

$17,183,616 |

|

|

$79,632,709 |

|

|

$27,522,099 |

|

|

Gross Profit |

|

$5,520,482 |

|

|

$5,005,131 |

|

|

$27,696,190 |

|

|

$7,377,445 |

|

|

Operating Expense |

|

$7,858,152 |

|

|

$8,550,236 |

|

|

$35,163,055 |

|

|

$17,826,124 |

|

|

Operating Loss |

|

($2,337,670 |

) |

|

($3,545,116 |

) |

|

($7,466,865 |

) |

|

($10,448,679 |

) |

|

Other Income |

|

$780,884 |

|

|

$3,017,849 |

|

|

$646,149 |

|

|

$7,182,860 |

|

|

Net Loss2 |

|

($1,677,358 |

) |

|

($17,403,394 |

) |

|

($6,939,892 |

) |

|

($20,141,948 |

) |

|

Cash, restricted cash & investments3 |

|

$5,396,343 |

|

|

$7,923,244 |

|

|

$5,396,343 |

|

|

$7,923,244 |

|

|

Diluted Loss per Share |

|

($0.16 |

) |

|

($2.58 |

) |

|

($0.69 |

) |

|

($2.99 |

) |

1 Includes continuing operations and excludes discontinued

operations.

2 Includes $16,863,892 of deemed dividends

attributable to shareholders in the fourth quarter and full year

2022.

3 Includes restricted cash and liquid investments of

$1,821,060 as of December 31, 2023, and $5,735,704 as of December

31, 2022, earmarked for payment of contingent value rights.

Total revenue was $19.4 million in the fourth quarter of 2023,

up $2.3 million, or 13%, from the fourth quarter of 2022. Total

revenue was $79.6 million for the full year of 2023 up, $52.1

million or 189% from the full year of 2022. The increase in revenue

in both periods was due primarily to the SUNation acquisition in Q4

of 2022.

Total gross profit was $5.5 million in the fourth quarter of

2023, an increase of $0.5 million, or 10%, from the fourth quarter

of 2022. Total gross profit was $27.7 million for the full year of

2023, up $20.3 million, or 275% from the full year of 2022. Gross

profit in both periods increased due to increased revenue and an

improved gross profit margin. The gross profit margin improvements

were due to the SUNation acquisition and an improvement in

equipment costs and financing fees.

Total operating expenses were $7.9 million in the fourth quarter

of 2023, a decrease of $0.7 million, or 8%, from the fourth quarter

of 2022. The decrease in operating expenses was primarily a result

of the SUNation acquisition in Q4 of 2022 and related transaction

costs incurred because of the acquisition. Operating expenses in

the fourth quarter of 2023 included $1.1 million of amortization

and depreciation expense, $246,131 of stock-based compensation and

a $190,000 unfavorable fair value remeasurement of earnout

consideration.

Total operating expenses were $35.2 million for the full year of

2023, up $17.3 million, or 97% from the full year of 2022. The

increase in operating expenses was primarily due to increased costs

associated with the SUNation business acquired in Q4 of 2022.

Operating expenses in 2023 included $5.1 million of amortization

and depreciation expense, $1.2 million of stock-based compensation

and a $1.35 million unfavorable fair value remeasurement of earnout

consideration.

Other income was $780,884 in the fourth quarter of 2023, a

decrease of $2.2 million, from the fourth quarter of 2022. Other

income decreased primarily due to a $1.8 million decrease in

favorable fair value remeasurement of contingent value rights and

an increase in interest expense because of debt financing closed in

the second quarter of 2023. Other income was $646,149 for the full

year of 2023, a decrease of $6.5 million, from the full year of

2022. Other income decreased due to a $4.68 million favorable fair

value remeasurement of earnout consideration that occurred in 2022

and a decrease in the gain on sale of assets in 2023 vs 2022.

Net loss from continuing operations was $1.7 million, or ($0.16)

per diluted share in the fourth quarter of 2023. This was an

improvement from the net loss from continuing operations (after

taking into effect $16.9 million in deemed dividends) in the fourth

quarter of 2022 of $17.4 million, or ($2.58) per diluted share. Net

loss from continuing operations was $6.9 million or ($0.69) per

diluted share, for the full year of 2023. This was an improvement

from a net loss from continuing operations attributable to common

shareholders (after taking into effect $16.9 million in deemed

dividends) of $20.1 million or ($2.99) per diluted share for the

full year of 2022.

As of December 31, 2023, cash, cash equivalents, and restricted

cash were $5.4 million. Of that amount, $1.8 million was held as

restricted cash and investments that can only be used for the

legacy CSI business and will be distributed to holders of CVRs

(Contingent Value Rights).

Fourth Quarter and Full Year 2023 Pro Forma

Comparisons

To facilitate analysis of the Company’s operating business,

below is an unaudited pro forma presentation of results as if the

Company had completed the SUNation merger, the CSI merger, and the

HEC/E-Gear asset acquisition as of January 1, 2022:

| |

|

Three Months Ended December 31 |

|

Twelve Months Ended December 31 |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue |

$ |

19,442,296 |

|

$ |

23,537,582 |

|

$ |

79,632,709 |

|

|

73,990,209 |

|

| Gross

Profit |

|

5,520,482 |

|

|

7,710,730 |

|

|

27,696,190 |

|

|

23,788,906 |

|

| Net (Loss)

Income |

|

(1,677,358 |

) |

|

1,005,577 |

|

|

(6,937,872 |

) |

|

(357,441 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA* |

|

207,947 |

|

|

(170,536 |

) |

|

1,236,048 |

|

|

(3,311,746 |

) |

* Adjusted EBITDA is a non-GAAP financial measure. See

“Pro Forma Results and Non-GAAP Financial Measures” and the

reconciliations in this release for further information.

Fourth quarter pro forma revenue declined 17% compared to the prior

year due to a decrease in residential kW installed of 17% and a 6%

decrease in commercial revenue, partially offset by a 6% increase

in service and other revenue. Full year pro forma revenue increased

8% compared to the prior year due to an 8% increase in residential

kW installed a 4% increase in commercial revenue and a 15% increase

in service and other revenue.

Fourth quarter pro forma gross profit decreased 28% from the

prior year due to a decrease in revenue, a change in revenue mix

and an increase in indirect costs. Full year pro forma gross profit

increased 16% from the prior year due to an increase in revenue and

margin improvement on reduced equipment costs and financing

fees.

Fourth quarter pro forma net loss increased by $2.7 million from

the prior year due to the decrease in gross profit and the $1.8

million decrease in favorable fair value remeasurement of

contingent value rights. Full year pro forma net loss increased

$6.6 million from the prior year due to a $4.7 million decrease in

gain on fair value remeasurement of the merger earnout

consideration in 2022, a $1.9 million decrease in an employee

retention credit recognized by SUNation in the third quarter of

2022, and a $1.7 million increase in interest expense, partially

offset by an overall improvement in gross profit on increased

revenues.

Fourth quarter pro forma adjusted EBITDA increased 222%, or

$378,483, driven by increased operating leverage by controlling

costs at SUNation, HEC (Hawaii Energy Connection) and Corporate.

Full year pro forma adjusted EBITDA increased 135%, or $4.7

million, from the prior year.

The unaudited pro forma financial information above is not

necessarily indicative of consolidated results of operations of the

combined business had the acquisition occurred at the beginning of

the respective period, nor is it necessarily indicative of future

results of operations of the combined company. The above unaudited

pro forma results are not adjusted for the level of corporate

overhead costs needed to support the go-forward strategy and

instead include a higher cost structure based on operating legacy

businesses and the structure in place while carrying out plans to

complete the CSI merger transaction. The unaudited pro forma

financial information above includes adjustments to amortization

expense for intangible assets totaling $0 and $167,708 and excludes

transaction costs totaling $0 and $1,003,946 for the three months

ended December 31, 2023, and 2022, respectively. The unaudited pro

forma financial information above includes adjustments to

amortization expense for intangible assets totaling $0 and

$1,706,086 and excludes transaction costs totaling $2,020 and

$4,208,063 for the twelve months ended December 31, 2023, and 2022,

respectively.

Status of Contingent Value Rights

The CVR (Contingent Value Rights) liability as of December 31,

2023, was estimated at $1.7 million and represents the estimated

fair value as of that date of the legacy CSI assets to be

distributed to CVR holders.

About Pineapple Energy

Pineapple is focused on growing leading local and regional solar,

storage, and energy services companies nationwide. Our vision is to

power the energy transition through grass-roots growth of solar

electricity paired with battery storage. Our portfolio of brands

(SUNation, Hawaii Energy Connection, E-Gear, Sungevity, and Horizon

Solar Power) provide homeowners and small businesses with an

end-to-end product offering spanning solar, battery storage, and

grid services.

Forward Looking Statements

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, among others, statements regarding future

financial performance, future growth or growth opportunities,

future opportunities, future cost reductions, future flexibility to

pursue acquisitions, future cash flows and future earnings. These

statements are based on the Company’s current expectations or

beliefs and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements here due to changes in

economic, business, competitive or regulatory factors, and other

risks and uncertainties, including those set forth in the Company’s

filings with the Securities and Exchange Commission. The

forward-looking statements in this press release speak only as of

the date of this press release. The Company does not undertake any

obligation to update or revise these forward-looking statements for

any reason, except as required by law.

Contacts:

Pineapple Energy

Kyle Udseth

Chief Executive Officer

+1 (952) 996-1674

Kyle.Udseth@pineappleenergy.com

Eric Ingvaldson

Chief Financial Officer

+1 (952) 996-1674

Eric.Ingvaldson@pineappleenergy.com

|

|

|

|

|

PINEAPPLE ENERGY INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

ASSETS |

| |

December 31 |

|

December 31 |

| |

2023 |

|

2022 |

| CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

3,575,283 |

|

|

$ |

2,187,540 |

|

|

Restricted cash and cash equivalents |

|

1,821,060 |

|

|

|

3,068,938 |

|

|

Investments |

|

— |

|

|

|

2,666,766 |

|

|

Trade accounts receivable, less allowance for credit losses of

$94,085 and $108,636, respectively |

|

5,010,818 |

|

|

|

5,564,532 |

|

|

Inventories, net |

|

3,578,668 |

|

|

|

6,054,493 |

|

|

Employee retention credit |

|

— |

|

|

|

1,584,541 |

|

|

Related party receivables |

|

46,448 |

|

|

|

116,710 |

|

|

Prepaid expenses |

|

1,313,082 |

|

|

|

2,152,058 |

|

|

Costs and estimated earnings in excess of billings |

|

57,241 |

|

|

|

777,485 |

|

|

Other current assets |

|

376,048 |

|

|

|

634,362 |

|

|

Current assets held for sale |

|

— |

|

|

|

1,154,099 |

|

|

TOTAL CURRENT ASSETS |

|

15,778,648 |

|

|

|

25,961,524 |

|

| |

|

|

|

|

|

| PROPERTY, PLANT AND EQUIPMENT,

net |

|

1,511,878 |

|

|

|

1,190,932 |

|

| OTHER ASSETS: |

|

|

|

|

|

|

Goodwill |

|

20,545,850 |

|

|

|

20,545,850 |

|

|

Right of use assets |

|

4,516,102 |

|

|

|

4,166,838 |

|

|

Intangible assets, net |

|

15,808,333 |

|

|

|

20,546,810 |

|

|

Other assets |

|

12,000 |

|

|

|

12,000 |

|

|

Noncurrent assets held for sale |

|

— |

|

|

|

2,271,533 |

|

|

TOTAL OTHER ASSETS |

|

40,882,285 |

|

|

|

47,543,031 |

|

| TOTAL ASSETS |

$ |

58,172,811 |

|

|

$ |

74,695,487 |

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

7,677,261 |

|

|

$ |

7,594,181 |

|

|

Accrued compensation and benefits |

|

1,360,148 |

|

|

|

859,774 |

|

|

Operating lease liabilities |

|

394,042 |

|

|

|

220,763 |

|

|

Accrued warranty |

|

268,004 |

|

|

|

276,791 |

|

|

Other current liabilities |

|

867,727 |

|

|

|

961,986 |

|

|

Related party payables |

|

— |

|

|

|

2,181,761 |

|

|

Income taxes payable |

|

5,373 |

|

|

|

1,650 |

|

|

Refundable customer deposits |

|

2,112,363 |

|

|

|

4,285,129 |

|

|

Billings in excess of costs and estimated earnings |

|

440,089 |

|

|

|

2,705,409 |

|

|

Contingent value rights |

|

1,691,072 |

|

|

|

— |

|

|

Earnout consideration |

|

2,500,000 |

|

|

|

— |

|

|

Current portion of loans payable |

|

1,654,881 |

|

|

|

346,290 |

|

|

Current portion of loans payable - related party |

|

3,402,522 |

|

|

|

5,339,265 |

|

|

Current liabilities held for sale |

|

— |

|

|

|

1,161,159 |

|

|

TOTAL CURRENT LIABILITIES |

|

22,373,482 |

|

|

|

25,934,158 |

|

| LONG TERM LIABILITIES: |

|

|

|

|

|

|

Loans payable and related interest |

|

8,030,562 |

|

|

|

3,138,194 |

|

|

Loans payable and related interest - related party |

|

2,097,194 |

|

|

|

4,635,914 |

|

|

Deferred income taxes |

|

41,579 |

|

|

|

— |

|

|

Operating lease liabilities |

|

4,193,205 |

|

|

|

3,961,340 |

|

|

Earnout consideration |

|

1,000,000 |

|

|

|

2,150,000 |

|

|

Contingent value rights |

|

— |

|

|

|

7,402,714 |

|

|

Long term liabilities held for sale |

|

— |

|

|

|

250,875 |

|

|

TOTAL LONG-TERM LIABILITIES |

|

15,362,540 |

|

|

|

21,539,037 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Convertible preferred stock, par value $1.00 per share; 3,000,000

shares authorized; 28,000 shares issued and outstanding |

|

28,000 |

|

|

|

28,000 |

|

|

Common stock, par value $0.05 per share; 112,500,000 and 75,000,000

shares authorized, respectively; 10,246,605 and 9,915,586 shares

issued and outstanding, respectively |

|

512,330 |

|

|

|

495,779 |

|

|

Additional paid-in capital |

|

46,977,870 |

|

|

|

45,798,069 |

|

|

Accumulated deficit |

|

(27,081,411 |

) |

|

|

(19,089,134 |

) |

|

Accumulated other comprehensive loss |

|

— |

|

|

|

(10,422 |

) |

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) |

|

20,436,789 |

|

|

|

27,222,292 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$ |

58,172,811 |

|

|

$ |

74,695,487 |

|

| |

|

|

|

|

|

|

PINEAPPLE ENERGY INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

|

|

|

|

|

|

| |

Year Ended December 31 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

| Sales |

$ |

79,632,709 |

|

|

$ |

27,522,099 |

|

| Cost of sales |

|

51,936,519 |

|

|

|

20,144,654 |

|

|

Gross profit |

|

27,696,190 |

|

|

|

7,377,445 |

|

| Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative expenses |

|

29,072,558 |

|

|

|

12,211,135 |

|

|

Amortization expense |

|

4,738,477 |

|

|

|

3,133,460 |

|

|

Transaction costs |

|

2,020 |

|

|

|

2,231,529 |

|

|

Fair value remeasurement of SUNation earnout consideration |

|

1,350,000 |

|

|

|

— |

|

|

Impairment loss |

|

— |

|

|

|

250,000 |

|

|

Total operating expenses |

|

35,163,055 |

|

|

|

17,826,124 |

|

| Operating loss from continuing

operations |

|

(7,466,865 |

) |

|

|

(10,448,679 |

) |

| Other income (expenses): |

|

|

|

|

|

|

Investment and other income |

|

191,584 |

|

|

|

119,634 |

|

|

Gain on sale of assets |

|

437,116 |

|

|

|

1,229,883 |

|

|

Fair value remeasurement of earnout consideration |

|

— |

|

|

|

4,684,000 |

|

|

Fair value remeasurement of contingent value rights |

|

2,674,966 |

|

|

|

2,125,949 |

|

|

Interest and other expense |

|

(2,657,517 |

) |

|

|

(976,606 |

) |

|

Other income, net |

|

646,149 |

|

|

|

7,182,860 |

|

| Operating loss from continuing

operations before income taxes |

|

(6,820,716 |

) |

|

|

(3,265,819 |

) |

| Income tax expense |

|

119,176 |

|

|

|

12,237 |

|

| Net loss from continuing

operations |

|

(6,939,892 |

) |

|

|

(3,278,056 |

) |

| Net loss from discontinued

operations, net of tax |

|

(1,192,275 |

) |

|

|

(7,074,184 |

) |

| Net loss |

|

(8,132,167 |

) |

|

|

(10,352,240 |

) |

| Other comprehensive income

(loss), net of tax: |

|

|

|

|

|

|

Unrealized gains (losses) on available-for-sale securities |

|

10,422 |

|

|

|

(10,422 |

) |

| Total other comprehensive

income (loss) |

|

10,422 |

|

|

|

(10,422 |

) |

| Comprehensive loss |

$ |

(8,121,745 |

) |

|

$ |

(10,362,662 |

) |

| |

|

|

|

|

|

|

Less: Deemed dividend on extinguishment of Convertible Preferred

Stock |

|

— |

|

|

|

(13,239,892 |

) |

|

Less: Deemed dividend on modification of PIPE Warrants |

|

— |

|

|

|

(3,624,000 |

) |

| Net loss attributable to

common shareholders |

$ |

(8,132,167 |

) |

|

$ |

(27,216,132 |

) |

| |

|

|

|

|

|

| Basic net loss per share: |

|

|

|

|

|

|

Continuing operations |

$ |

(0.69 |

) |

|

$ |

(2.99 |

) |

|

Discontinued operations |

|

(0.12 |

) |

|

|

(1.05 |

) |

|

|

$ |

(0.81 |

) |

|

$ |

(4.04 |

) |

| Diluted net loss per

share: |

|

|

|

|

|

|

Continuing operations |

$ |

(0.69 |

) |

|

$ |

(2.99 |

) |

|

Discontinued operations |

|

(0.12 |

) |

|

|

(1.05 |

) |

|

|

$ |

(0.81 |

) |

|

$ |

(4.04 |

) |

|

|

|

|

|

|

|

| Weighted Average Basic Shares

Outstanding |

|

10,035,970 |

|

|

|

6,741,446 |

|

| Weighted Average Dilutive

Shares Outstanding |

|

10,035,970 |

|

|

|

6,741,446 |

|

Pro Forma Results and Non-GAAP Financial Measures

This press release includes unaudited pro forma information, which

represents the results of operations as if the Company had

completed the CSI merger, the HEC and E-Gear asset acquisitions and

the SUNation acquisition as of January 1, 2022. The unaudited pro

forma financial information presented in this press release is not

necessarily indicative of consolidated results of operations of the

combined business had the acquisitions occurred at the beginning of

the respective period, nor is it necessarily indicative of future

results of operations of the combined company.

For the three months ended December 31, 2023, and 2022, the

unaudited pro forma financial information includes adjustments to

amortization expense for intangible assets totaling $0 and

$167,708, respectively, and excludes transaction costs totaling $0

and $1,003,946, respectively. For the years ended December 31,

2023, and 2022, the unaudited pro forma financial information

includes adjustments to amortization expense for intangible assets

totaling $0 and $1,706,086, respectively, and excludes transaction

costs totaling $2,020 and $4,208,063, respectively.

This press release also includes non-GAAP financial measures

that differ from financial measures calculated in accordance with

U.S., (United States) generally accepted accounting principles

(“GAAP”). Adjusted EBITDA is a non-GAAP financial measure provided

in this release, and is net loss, on a pro forma basis calculated

in accordance with GAAP, adjusted for pro forma interest, income

taxes, depreciation, amortization, stock compensation, gain on sale

of assets, and non-cash fair value remeasurement adjustments as

detailed in the reconciliations presented below in this press

release.

These non-GAAP financial measures are presented because the

Company believes they are useful indicators of its operating

performance. Management uses these measures principally as measures

of the Company’s operating performance and for planning purposes,

including the preparation of the Company’s annual operating plan

and financial projections. The Company believes these measures are

useful to investors as supplemental information and because they

are frequently used by analysts, investors, and other interested

parties to evaluate companies in its industry. The Company also

believes these non-GAAP financial measures are useful to its

management and investors as a measure of comparative operating

performance from period to period.

The non-GAAP financial measures presented in this release should

not be considered as an alternative to, or superior to, their

respective GAAP financial measures, as measures of financial

performance or cash flows from operations as a measure of

liquidity, or any other performance measure derived in accordance

with GAAP, and they should not be construed to imply that the

Company’s future results will be unaffected by unusual or

non-recurring items. In addition, these measures do not reflect

certain cash requirements such as tax payments, debt service

requirements, capital expenditures and certain other cash costs

that may recur in the future. Adjusted EBITDA contains certain

other limitations, including the failure to reflect our cash

expenditures, cash requirements for working capital needs and cash

costs to replace assets being depreciated and amortized. In

evaluating non-GAAP financial measures, you should be aware that in

the future the Company may incur expenses that are the same as or

similar to some of the adjustments in this presentation. The

Company’s presentation of non-GAAP financial measures should not be

construed to imply that its future results will be unaffected by

any such adjustments. Management compensates for these limitations

by primarily relying on the Company’s GAAP results in addition to

using non-GAAP financial measures on a supplemental basis. The

Company’s definition of these non-GAAP financial measures is not

necessarily comparable to other similarly titled captions of other

companies due to different methods of calculation.

Reconciliation of Non-GAAP to GAAP Financial

Information

Reconciliation of Pro Forma Net Loss to Pro Forma Adjusted

EBITDA:

|

|

Three Months Ended December 31 |

|

Twelve Months Ended December 31 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Pro Forma Net

Loss |

$ |

(1,677,358 |

) |

|

$ |

1,005,577 |

|

|

$ |

(6,937,872 |

) |

|

$ |

(357,441 |

) |

|

Interest expense |

|

789,940 |

|

|

|

353,961 |

|

|

|

2,657,517 |

|

|

|

1,065,945 |

|

|

Interest income |

|

(21,619 |

) |

|

|

(6,459 |

) |

|

|

(139,560 |

) |

|

|

(23,188 |

) |

|

Income taxes |

|

120,572 |

|

|

|

(5,182 |

) |

|

|

119,176 |

|

|

|

204,453 |

|

|

Depreciation |

|

95,099 |

|

|

|

70,421 |

|

|

|

397,943 |

|

|

|

317,300 |

|

|

Amortization |

|

1,038,382 |

|

|

|

1,216,698 |

|

|

|

4,738,477 |

|

|

|

4,866,793 |

|

|

Impairment loss |

|

- |

|

|

|

250,000 |

|

|

|

- |

|

|

|

250,000 |

|

|

Stock compensation |

|

246,131 |

|

|

|

285,707 |

|

|

|

1,212,956 |

|

|

|

309,205 |

|

|

Gain on sale of assets |

|

- |

|

|

|

(750 |

) |

|

|

(437,116 |

) |

|

|

(1,229,883 |

) |

|

FV remeasurement of contingent value rights |

|

(1,522,693 |

) |

|

|

(3,340,509 |

) |

|

|

(2,674,966 |

) |

|

|

(2,125,949 |

) |

|

FV remeasurement of earnout consideration |

|

190,000 |

|

|

|

- |

|

|

|

1,350,000 |

|

|

|

(4,684,000 |

) |

|

Legacy CSI receivables write off |

|

949,493 |

|

|

|

- |

|

|

|

949,493 |

|

|

|

- |

|

|

Employee retention credit |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,904,981 |

) |

| Pro Forma Adjusted

EBITDA |

$ |

207,947 |

|

|

$ |

(170,536 |

) |

|

$ |

1,236,048 |

|

|

$ |

(3,311,746 |

) |

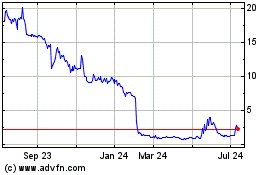

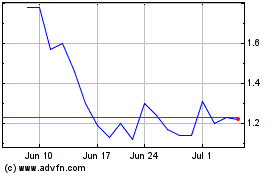

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024