October 19, 2021 -- InvestorsHub NewsWire --

via pennymillions --

Benzinga

PAO Group, Inc. (OTC: PAOG)

stock is in play following its transformational announcement of

commercializing its first CBD nutraceuticals product into the $5.2

billion market. Better still, PAOG supported that news saying it

expects to enhance its new revenue stream with follow-on products

lined up to launch, possibly by the end of the year. If so, that

sets up the remainder of Q4 and all of 2022 to be a potentially

exponential period of growth for PAOG.

The clues have been in place. And not only have savvy investors

been paying attention, but many are also acting on the value

proposition by sending PAOG stock higher by roughly 220% since the

start of September. Part of those gains can also be attributed to

PAOG being in the right markets at the right time. While the

pandemic brought global industry to a grinding halt, not so for the

CBD therapeutics sector. In fact, that industry experienced a surge

in interest as people learned more about the benefits of CBD

compared to often over-prescribed and addictive prescription

narcotics.

That interest in the market benefits PAOG stock, and news of its

launch added to the more than 108% share price increase in October

alone. PAOG shares on Friday touched levels not seen in more than

six months.

The more excellent news is that increasing volume indicates that

momentum is on its side.

Sale Of The Century In PAOG

And it should be. Not only has PAOG successfully navigated the

logistical challenges of the past eighteen months, but they are

also doing what peer companies can’t do- getting a product to

market. Moreover, they have IP power to back up their position

after acquiring research into a patented CBD extraction method.

That interest paves the way for PAOG to evaluate opportunities in

the pharmaceuticals side of the business, which can be an

exponential value driver. Remember, Jazz Pharmaceuticals

(NASDAQ:JAZZ) bought

GW Pharma for $7.2 billion last year.

But while that’s a developing prospect, PAOG is taking care of

the nutraceuticals market opportunity now. And with shares of its

distribution partner North American Cannabis Holdings (OTC:USMJ)

also rising, it looks as though investors are expecting the

business to be generous on the revenues front. Shares in USMJ have

also recently closed at their highest levels in more than five

months. Thus, considering the trade as a tandem might not be a bad

consideration.

And it would be similar to investors in Tesla (NASDAQ:TSLA) buying

stock in the chipmakers that supply their essential components. In

either case, the dual rally in PAOG and USMJ is a bullish indicator

for the near term. Moreover, with a $5.2 billion nutraceuticals

market officially in play, current PAOG values appreciably

undervalue the opportunities in play.

Size Doesn’t Matter in Emerging Companies

In fact, looking at PAOG’s sub-penny share price, investors may

be getting the wrong impression. PAOG is indeed more valuable than

they look. And by leveraging its intellectual property and its now

revenue-generating assets, they are expected to get even

stronger.

The IP value alone supports a substantially higher market cap,

especially regarding extraction processes that could allow the

hundreds of companies wanting to enter the sector a chance to do

so. Plenty wants in, with the industry expected to explode in value

to a $16.4 billion market in the next six years. Thus, while the

commercialization news is exciting for PAOG and its investors,

untapped value is also in play.

Even better, it diversifies PAOG’s revenue-generating potential.

And they are taking advantage of its position. PAO Group is also

engaged in a partnership with Puration, Inc. (OTC:PURA) to

collectively market for multiple hemp growers and processors under

a single brand name – Farmersville Hemp. They intend to recruit

processing and cultivation partners to establish an industrial hemp

brand cooperative under the Farmersville Hemp Brand name. PAOG and

PURA describe its plan as similar to Sun-Maid Raisins, which

collectively markets for growers all selling under one brand name.

Thus, the strategy could combine the interests of many smaller

players to compete against the industry giants. The result could be

a more significant market share for each.

Moreover, it delivers more than an opportunity to compete in

competitive markets; it positions small companies to earn big

profits. And with PAOG working with PURA to leverage the strength

from its CBD extraction patent by helping build a lab on PURA’s

70-acre property in Farmersville, Texas, progress toward that goal

is accelerating.

Thus, from an investor’s perspective, PAOG’s partnership with

PURA will ultimately enhance its targeted mission to maximize

market penetration for its CBD-based nutraceuticals products.

Combining the potential added from USMJ and PURA, PAO Group is

assembling the pieces to create its own revenue-generating

juggernaut.

A Strategy In Motion With Two

Nutraceuticals

The most excellent news is that PAOG’s strategy is playing out

as it should. In Q3 of this year, PAOG provided a roadmap detailing

its latest developments to commercialize its CBD-based

nutraceutical product line. Part of that update put a timeline for

PAOG to commercialize its CBD-based nutraceuticals by the end of

this year. And PAOG delivered on that intention.

Better still, its nutraceuticals are targeting massive treatment

market opportunities. In fact, each provides effective relief for

chronic health issues. At least two are in play.

Its RespRX has been in development since the start of the year.

It utilizes CBD-based formulations to treat the symptoms of chronic

obstructive pulmonary disease (COPD). And it is being developed

with data from studies conducted as early as 2015 that shows CBD

has an inherent ability to open the bronchial passages. That

discovery could prove transformational to patients and to

PAOG.

Besides being a potentially best-in-class non -prescription

treatment for COPD, RespRx can benefit from multiple global studies

showing CBD as safe and lacking the often severe side effects

associated with current standards of care. To date, volumes of data

suggest that CBD-based alternatives have enormous potential to

become a preferred treatment method for COPD. And, with RespRX,

PAOG thinks it has the right product at the right time.

Still, there’s more firepower in the PAOG portfolio. A second

win could come through its CBD RELAX-RX, targeting treatment in the

$15 billion anxiety and depression market. Its promise stems from

the growing number of patients opting for CBD-based treatments over

pharmaceuticals to treat the often debilitating symptoms of

depression and anxiety. PAOG believes that its CBD RELAX-RX,

specially formulated to alleviate these conditions, can provide a

best-in-class solution. Again, its patented extraction process and

ability to create specific formulations add muscle to that

expectation.

There’s more good news. PAOG has additional interests in the CBD

nutraceutical space with EVERx CBD Sports Water.

Strengthening The Value Proposition

Enhancing its value proposition is PAOG’s interest in what could

become a staple in its revenue-generating arsenal, EVERx CBD Sports

Water. In a partnership with PURA, that product is already

generating revenues. In fact, through a distributorship agreement

with Alkame Holdings (OTC:ALKM), 2020

sales are expected to eclipse the $2 million level. And an update

in the first part of 2021 indicated that EVERx sales were staying

resilient despite the massive logistical hurdles put in place by

COVID-19. Still, the challenges worsened into the first quarter of

2021, potentially putting pressure on sales. That’s understandable.

Updates are expected to be provided in Q4.

Still, even if sales of EVERx were temporarily slowed, PAOG’s

primary value drivers are very much accelerating. In fact, with

commercialization confirmed, the revenue-generating wheels are not

only in motion but picking up speed. Couple sales with high

margins, the recipe to create shareholder value in the coming weeks

is complete. Hence, its share price rally could be a drop in the

bucket compared to what can happen if sales of its nutraceuticals

gain market traction.

A Breakout In Q4 2021

Better still, the rally can gain momentum sooner rather than

later. Not only is the commercialization news of its first

nutraceutical a big deal, but its portfolio could bring several

additional products into the market by the start of next year, if

not sooner. And with one revenue-generating catalyst now in play,

PAOG appears to be in its best position ever to capitalize on its

opportunities and create substantial shareholder value in the

process.

Even better, with a diversified portfolio that can create

several revenue streams, investors benefit from growth from a

company not reliant on a single product or platform. Hence, it’s

the sum of its parts that makes PAOG stock an attractive

proposition. And while its 220% increase since September and 108%

spike in October thus far is impressive, it may be appropriate to

expect more growth in the coming days, weeks, and quarters. After

all, in the past 24-hours, PAOG was transformed from a development

stage company to a commercial one. And that, in any market, is a

huge deal.

Disclaimers: Hawk Point Media LLC is responsible for the

production and distribution of this content. Hawk Point Media is

not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our reports/releases are

a commercial advertisement and are for general information purposes

ONLY. We are engaged in the business of marketing and advertising

companies for monetary compensation. Never invest in any stock

featured on our site or emails unless you can afford to lose your

entire investment. The information made available by Hawk Point

Media is not intended to be, nor does it constitute, investment

advice or recommendations. The contributors may buy and sell

securities before and after any particular article, report and

publication. In no event shall Hawk Point Media be liable to any

member, guest or third party for any damages of any kind arising

out of the use of any content or other material published or made

available by Hawk Point Media, including, without limitation, any

investment losses, lost profits, lost opportunity, special,

incidental, indirect, consequential or punitive damages. Past

performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you conduct a

complete and independent investigation of the respective companies

and consideration of all pertinent risks. Hawk Point Media was

compensated up to four-thousand-dollars by a third-party to

research, prepare, and syndicate written and visual content about

PAO Group, Inc for one-month. Readers are advised to review SEC

periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms

3, 4, 5 Schedule 13D. For some content, Hawk Point Media, its

authors, contributors, or its agents, may be compensated for

preparing research, video graphics, and editorial content. As part

of that content, readers, subscribers, and website viewers, are

expected to read the full disclaimers and financial disclosures as

part of this content.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

Source - https://www.benzinga.com/pressreleases/21/10/ab23435209/pao-group-inc-stock-gains-220-since-september-announces-commercial-launch-of-first-cbd-nutraceuti

Other stocks on the move include

PUGE and

TONR.

SOURCE: pennymillions

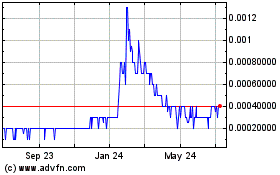

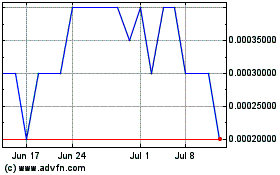

Tonner One World (PK) (USOTC:TONR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tonner One World (PK) (USOTC:TONR)

Historical Stock Chart

From Apr 2023 to Apr 2024