NIO Inc. (NYSE: NIO; HKEX: 9866; SGX: NIO) (“NIO” or the

“Company”), a pioneer and a leading company in the premium smart

electric vehicle market, today announced its unaudited financial

results for the fourth quarter and full year ended December 31,

2023.

Operating Highlights for the Fourth

Quarter and Full Year of 2023

- Vehicle deliveries

were 50,045 in the fourth quarter of 2023, consisting of 33,679

premium smart electric SUVs and 16,366 premium smart electric

sedans, representing an increase of 25.0% from the fourth quarter

of 2022, and a decrease of 9.7% from the third quarter of 2023.

- Vehicle deliveries

were 160,038 in 2023, representing an increase of 30.7% from

2022.

Key Operating Results

|

|

|

2023 Q4 |

2023 Q3 |

2023 Q2 |

2023 Q1 |

|

Deliveries |

50,045 |

55,432 |

23,520 |

31,041 |

|

|

|

|

|

|

|

|

2022 Q4 |

2022 Q3 |

2022

Q2 |

2022 Q1 |

|

Deliveries |

40,052 |

31,607 |

25,059 |

25,768 |

|

|

|

|

|

|

Financial Highlights for the Fourth

Quarter of 2023

- Vehicle sales were

RMB15,438.7 million (US$2,174.5 million) in the fourth quarter of

2023, representing an increase of 4.6% from the fourth quarter of

2022 and a decrease of 11.3% from the third quarter of 2023.

- Vehicle

marginii was 11.9% in the fourth quarter of

2023, compared with 6.8% in fourth quarter of 2022 and 11.0% in the

third quarter of 2023.

- Total revenues

were RMB17,103.2 million (US$2,408.9 million) in the fourth quarter

of 2023, representing an increase of 6.5% from the fourth quarter

of 2022 and a decrease of 10.3% from the third quarter of

2023.

- Gross profit was

RMB1,279.2 million (US$180.2 million) in the fourth quarter of

2023, representing an increase of 105.7% from the fourth quarter of

2022 and a decrease of 16.0% from the third quarter of 2023.

- Gross margin was

7.5% in the fourth quarter of 2023, compared with 3.9% in the

fourth quarter of 2022 and 8.0% in the third quarter of 2023.

- Loss from

operations was RMB6,625.3 million (US$933.2 million) in

the fourth quarter of 2023, representing a decrease of 1.6% from

the fourth quarter of 2022 and an increase of 36.8% from the third

quarter of 2023. Excluding share-based compensation expenses,

adjusted loss from operations (non-GAAP) was RMB6,059.3 million

(US$853.4 million) in the fourth quarter of 2023, representing an

increase of 0.7% from the fourth quarter of 2022 and an increase of

42.9% from the third quarter of 2023.

- Net loss was

RMB5,367.7 million (US$756.0 million) in the fourth quarter of

2023, representing a decrease of 7.2% from the fourth quarter of

2022 and an increase of 17.8% from the third quarter of 2023.

Excluding share-based compensation expenses, adjusted net loss

(non-GAAP) was RMB4,801.7 million (US$676.3 million) in the fourth

quarter of 2023, representing a decrease of 5.2% from the fourth

quarter of 2022 and an increase of 21.5% from the third quarter of

2023.

- Cash and cash equivalents,

restricted cash, short-term investment and

long-term time deposits were RMB57.3 billion (US$8.1

billion) as of December 31, 2023.

Key Financial Results for the Fourth

Quarter of 2023

|

(in RMB million, except for percentage)

|

|

|

2023 Q4 |

2023 Q3 |

|

2022 Q4 |

|

% Changeiii |

|

|

|

|

|

|

|

QoQ |

YoY |

|

Vehicle Sales |

15,438.7 |

17,408.9 |

|

14,759.0 |

|

-11.3% |

4.6% |

|

Vehicle Margin |

11.9% |

11.0% |

|

6.8% |

|

90bp |

510bp |

|

|

|

|

|

|

|

|

|

|

Total Revenues |

17,103.2 |

19,066.6 |

|

16,063.5 |

|

-10.3% |

6.5% |

|

Gross Profit |

1,279.2 |

1,523.3 |

|

621.8 |

|

-16.0% |

105.7% |

|

Gross Margin |

7.5% |

8.0% |

|

3.9% |

|

-50bp |

360bp |

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

(6,625.3) |

(4,843.9) |

|

(6,736.1) |

|

36.8% |

-1.6% |

|

Adjusted Loss from Operations (non-GAAP) |

(6,059.3) |

(4,240.4) |

|

(6,015.7) |

|

42.9% |

0.7% |

|

|

|

|

|

|

|

|

|

|

Net Loss |

(5,367.7) |

(4,556.7) |

|

(5,786.1) |

|

17.8% |

-7.2% |

|

Adjusted Net Loss (non-GAAP) |

(4,801.7) |

(3,953.2) |

|

(5,065.6) |

|

21.5% |

-5.2% |

|

|

|

|

|

|

|

|

|

Financial Highlights for the Full

Year of 2023

- Vehicle sales were

RMB49,257.3 million (US$6,937.7 million) for the full year of 2023,

representing an increase of 8.2% from the previous year.

- Vehicle margin was

9.5% for the full year of 2023, compared with 13.7% for the

previous year.

- Total revenues

were RMB55,617.9 million (US$7,833.6 million) for the full year of

2023, representing an increase of 12.9% from the previous

year.

- Gross profit was

RMB3,051.8 million (US$429.8 million) for the full year of 2023,

representing a decrease of 40.7% from the previous year.

- Gross margin was

5.5% for the full year of 2023, compared with 10.4% for the

previous year.

- Loss from

operations was RMB22,655.2 million (US$3,190.9 million)

for the full year of 2023, representing an increase of 44.8% from

the previous year. Excluding share-based compensation expenses,

adjusted loss from operations (non-GAAP) was RMB20,286.1 million

(US$2,857.2 million) in 2023, representing an increase of 52.0%

from the previous year.

- Net loss was

RMB20,719.8 million (US$2,918.3 million) for the full year of 2023,

representing an increase of 43.5% from the previous year. Excluding

share-based compensation expenses, adjusted net loss (non-GAAP) was

RMB18,350.7 million (US$2,584.6 million) for the full year of 2023,

representing an increase of 51.1% from the previous

year.

|

Key Financial Results for Full Year 2023 |

(in RMB million, except for percentage)

|

|

|

|

2023 |

|

2022 |

|

%

Changeiii |

|

|

|

|

|

|

|

|

|

Vehicle Sales |

|

49,257.3 |

|

45,506.6 |

|

8.2% |

|

Vehicle Margin |

|

9.5% |

|

13.7% |

|

-420bp |

|

|

|

|

|

|

|

|

|

Total Revenues |

|

55,617.9 |

|

49,268.6 |

|

12.9% |

|

Gross Profit |

|

3,051.8 |

|

5,144.0 |

|

-40.7% |

|

Gross Margin |

|

5.5% |

|

10.4% |

|

-490bp |

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

(22,655.2) |

|

(15,640.7) |

|

44.8% |

|

Adjusted Loss from Operations (non-GAAP) |

|

(20,286.1) |

|

(13,344.8) |

|

52.0% |

|

|

|

|

|

|

|

|

|

Net Loss |

|

(20,719.8) |

|

(14,437.1) |

|

43.5% |

|

Adjusted Net Loss (non-GAAP) |

|

(18,350.7) |

|

(12,141.2) |

|

51.1% |

|

|

|

|

|

|

|

|

Recent

Developments

Deliveries in January and February 2024

- NIO delivered 10,055 vehicles in

January 2024 and 8,132 vehicles in February 2024. As of February

29, 2024, cumulative deliveries of NIO vehicles reached

467,781.

NIO Day and Launch of ET9

- On December 23, 2023, NIO held NIO

Day 2023 in Xi’an, China and launched the ET9, a smart electric

executive flagship. The ET9 is an epitome of NIO’s innovative

technologies, setting a new technological benchmark for smart

electric vehicles executive flagship.

Listed in MIIT’s Catalog of Vehicle

Manufacturers

- NIO has completed the filing

process for its electric passenger vehicle investment project with

the relevant authorities in Anhui Province, and has been included

in the Ministry of Industry and Information Technology's catalogue

of approved manufacturers.

Strategic Equity Investment from

CYVN

- On December 27, 2023, NIO closed

the US$2.2 billion strategic equity investment from CYVN

Investments RSC Ltd (“CYVN”), an investment vehicle based in Abu

Dhabi. Together with the previously completed transactions in July

2023, CYVN in aggregate beneficially owns approximately 20.1% of

the Company’s total issued and outstanding shares.

Completion of the Repurchase Right Offer

for Convertible Senior Notes due 2026

- On February 1, 2024, NIO completed

the repurchase right offer relating to its 0.00% Convertible Senior

Notes due 2026 (the “Notes”). US$300,536,000.00 aggregate principal

amount of the Notes were validly surrendered and not withdrawn

prior to the expiration of the repurchase right offer. Following

settlement of the repurchase, US$912,000.00 aggregate principal

amount of the Notes remain outstanding and continue to be subject

to the existing terms of the Indenture and the Notes.

Board Change

- On February 7, 2024, NIO appointed

Mr. Eddy Georges Skaf and Mr. Nicholas Paul Collins as new

directors of the Company’s board of directors. In addition, on the

same day, Mr. James Gordon Mitchell resigned as a director of the

Company.

Technology License Transaction

- On February 26, 2024, NIO

Technology (Anhui) Co., Ltd. (“NIO Technology”), a subsidiary of

NIO Inc., entered into a technology license agreement (the

“Technology License Agreement”) with Forseven Limited (“Forseven”),

a subsidiary of CYVN Holdings L.L.C. Pursuant to the Technology

License Agreement, NIO Technology will grant a non-exclusive and

non-transferrable worldwide license to Forseven to use certain of

NIO Technology’s existing and future technical information,

technical solutions, software and intellectual property rights

related to or subsisting in the smart electric vehicle

platforms of NIO Technology.

CEO and CFO

Comments

“In 2023, NIO set a new delivery record of

160,038 vehicles, ranking first in China’s premium BEV market with

an average transaction price over RMB 300,000,” said William Bin

Li, founder, chairman and chief executive officer of NIO, “At NIO

Day 2023, we unveiled ET9, our smart electric executive flagship,

showcasing a suite of our latest technologies, including our

self-developed AD chip, full-domain 900V architecture, advanced

intelligent chassis system and various other industry-leading

innovations.”

“We will soon start deliveries of 2024 NIO

products equipped with the highest computing power among production

vehicles and constantly enhance users' driving and digital

experience. Meanwhile, we plan to release Navigate on Pilot Plus

(NOP+) for urban roads to all NT2.0 users in the second quarter.

Our continuous investments in technologies, battery swapping

network and user community will bolster our competitive advantages

as we navigate the future competition,” added William Bin Li.

“Our vehicle margin continued to grow, reaching

11.9% in the fourth quarter of 2023,” added Steven Wei Feng, NIO's

chief financial officer, “In December 2023, we closed the US$2.2

billion strategic equity investment from CYVN, demonstrating our

unique positioning and competitiveness in the global smart EV

industry. Moving forward into 2024, we will prioritize our business

objectives, improve system capabilities and optimize cost

management efficiency.”

Financial Results for the Fourth

Quarter and Full Year of 2023

Revenues

- Total revenues in

the fourth quarter of 2023 were RMB17,103.2 million (US$2,408.9

million), representing an increase of 6.5% from the fourth quarter

of 2022 and a decrease of 10.3% from the third quarter of 2023.

- Total revenues for

the full year of 2023 were RMB55,617.9 million (US$7,833.6

million), representing an increase of 12.9% from the previous

year.

- Vehicle sales in

the fourth quarter of 2023 were RMB15,438.7 million (US$2,174.5

million), representing an increase of 4.6% from the fourth quarter

of 2022 and a decrease of 11.3% from the third quarter of 2023. The

increase in vehicle sales over the fourth quarter of 2022 was

mainly due to the increase in delivery volume, partially offset by

the lower average selling price as a result of changes in product

mix. The decrease in vehicle sales over the third quarter of 2023

was mainly attributed to a decrease in delivery volume.

- Vehicle sales for

the full year of 2023 were RMB49,257.3 million (US$6,937.7

million), representing an increase of 8.2% from the previous

year.

- Other sales in the

fourth quarter of 2023 were RMB1,664.5 million (US$234.4 million),

representing an increase of 27.6% from the fourth quarter of 2022

and an increase of 0.4% from the third quarter of 2023. The

increase in other sales over the fourth quarter of 2022 was mainly

due to the increase in sales of accessories and provision of power

solutions, as a result of continued growth in the number of our

users. Other sales remained relatively stable compared with the

third quarter of 2023.

- Other sales for

the full year of 2023 were RMB6,360.7 million (US$895.9 million),

representing an increase of 69.1% from the previous year.

Cost of Sales and Gross

Margin

- Cost of sales in

the fourth quarter of 2023 was RMB15,823.9 million (US$2,228.8

million), representing an increase of 2.5% from the fourth quarter

of 2022 and a decrease of 9.8% from the third quarter of 2023. Cost

of sales remained relatively stable compared with the fourth

quarter of 2022. The decrease in cost of sales over the third

quarter of 2023 was mainly attributable to a decrease in delivery

volume.

- Cost of sales for

the full year of 2023 was RMB52,566.1 million (US$7,403.8 million),

representing an increase of 19.1% from the previous year.

- Gross profit in

the fourth quarter of 2023 was RMB1,279.2 million (US$180.2

million), representing an increase of 105.7% from the fourth

quarter of 2022 and a decrease of 16.0% from the third quarter of

2023.

- Gross Profit for

the full year of 2023 was RMB3,051.8 million (US$429.8 million),

representing a decrease of 40.7% from the previous year.

- Gross margin in

the fourth quarter of 2023 was 7.5%, compared with 3.9% in the

fourth quarter of 2022 and 8.0% in the third quarter of 2023. The

increase of gross margin over the fourth quarter of 2022 was mainly

attributed to the increased vehicle margin. The decrease of gross

margin over the third quarter of 2023 was mainly attributed to the

decrease in margin from provision of power solutions as a result of

expanded power network, and partially offset by the higher vehicle

margin.

- Gross margin for

the full year of 2023 was 5.5%, compared with 10.4% for the full

year of 2022.

- Vehicle margin in

the fourth quarter of 2023 was 11.9%, compared with 6.8% in the

fourth quarter of 2022 and 11.0% in the third quarter of 2023. The

increase in vehicle margin from the fourth quarter of 2022 was

mainly attributable to (i) the decreased material cost per unit,

and (ii) the inventory provisions, accelerated depreciation on

production facilities, and losses on purchase commitments for the

previous generation of ES8, ES6 and EC6 recorded in the fourth

quarter of 2022. The increase in vehicle margin from the third

quarter of 2023 was mainly due to the decreased material cost per

unit.

- Vehicle margin for

the full year of 2023 was 9.5%, compared with 13.7% for the full

year of 2022.

Operating Expenses

- Research and development

expenses in the fourth quarter of 2023 were RMB3,972.1

million (US$559.5 million), representing a decrease of 0.2% from

the fourth quarter of 2022 and an increase of 30.7% from the third

quarter of 2023. Excluding share-based compensation expenses,

research and development expenses (non-GAAP) were RMB3,616.4

million (US$509.4 million), representing an increase of 1.8% from

the fourth quarter of 2022 and an increase of 36.8% from the third

quarter of 2023. Research and development expenses remained

relatively stable compared with the fourth quarter of 2022. The

increase in research and development expenses over the third

quarter of 2023 was mainly due to the incremental design and

development costs for new products and technologies as well as the

increased personnel costs in research and development

functions.

- Research and development

expenses for the full year of 2023 were RMB13,431.4

million (US$1,891.8 million), representing an increase of 23.9%

from the previous year. Excluding share-based compensation

expenses, research and development expenses (non-GAAP) were

RMB11,914.2 million (US$1,678.1 million), representing an increase

of 25.2% from the previous year.

- Selling, general and

administrative expenses in the fourth quarter of 2023 were

RMB3,972.7 million (US$559.5 million), representing an increase of

12.6% from the fourth quarter of 2022 and an increase of 10.1% from

the third quarter of 2023. Excluding share-based compensation

expenses, selling, general and administrative expenses (non-GAAP)

were RMB3,781.5 million (US$532.6 million), representing an

increase of 16.1% from the fourth quarter of 2022 and an increase

of 10.4% from the third quarter of 2023. The increase in selling,

general and administrative expenses over the fourth quarter of 2022

and the third quarter of 2023 was mainly attributable to (i) the

increase in personnel costs related to sales functions, and (ii)

the increase in sales and marketing activities.

- Selling, general and

administrative expenses for the full year of 2023 were

RMB12,884.6 million (US$1,814.8 million), representing an increase

of 22.3% from the previous year. Excluding share-based compensation

expenses, selling, general and administrative expenses (non-GAAP)

were RMB12,116.7 million (US$1,706.6 million), representing an

increase of 25.8% from last year.

Loss from Operations

- Loss from

operations in the fourth quarter of 2023 was RMB6,625.3

million (US$933.2 million), representing a decrease of 1.6% from

the fourth quarter of 2022 and an increase of 36.8% from the third

quarter of 2023. Excluding share-based compensation expenses,

adjusted loss from operations (non-GAAP) was RMB6,059.3 million

(US$853.4 million) in the fourth quarter of 2023, representing an

increase of 0.7% from the fourth quarter of 2022 and an increase of

42.9% from third quarter of 2023.

- Loss from

operations for the full year of 2023 was RMB22,655.2

million (US$3,190.9 million), representing an increase of 44.8%

from last year. Excluding share-based compensation expenses,

adjusted loss from operations (non-GAAP) was RMB20,286.1 million

(US$2,857.2 million) in 2023, representing an increase of 52.0%

from last year.

Net Loss and Earnings Per

Share/ADS

- Interest and investment

income in the fourth quarter of 2023 was RMB1,368.1

million (US$192.7 million), representing an increase of 288.7% from

the fourth quarter of 2022 and an increase of 375.0% from the third

quarter of 2023. The increase was primarily attributed to the

recycling of unrealized gain from other comprehensive income to

investment income of RMB977.3 million for the available-for-sale

debt investment.

- Net loss in the

fourth quarter of 2023 was RMB5,367.7 million (US$756.0 million),

representing a decrease of 7.2% from the fourth quarter of 2022 and

an increase of 17.8% from the third quarter of 2023. Excluding

share-based compensation expenses, adjusted net loss (non-GAAP) was

RMB4,801.7 million (US$676.3 million) in the fourth quarter of

2023, representing a decrease of 5.2% from the fourth quarter of

2022 and an increase of 21.5% from the third quarter of 2023.

- Net loss for the

full year of 2023 was RMB20,719.8 million (US$2,918.3 million),

compared with net loss of RMB14,437.1 million in 2022. Excluding

share-based compensation expenses, adjusted net loss (non-GAAP) was

RMB18,350.7 million (US$2,584.6 million) in 2023.

- Net loss attributable to

NIO’s ordinary shareholders in the fourth quarter of 2023

was RMB 5,592.8 million (US$787.7 million), representing a decrease

of 4.3% from the fourth quarter of 2022 and an increase of 20.8%

from the third quarter of 2023. Excluding share-based compensation

expenses and accretion on redeemable non-controlling interests to

redemption value, adjusted net loss attributable to NIO’s ordinary

shareholders (non-GAAP) was RMB 4,948.0 million (US$696.9 million)

in the fourth quarter of 2023.

- Net loss attributable to

NIO’s ordinary shareholders for the full year of 2023 was

RMB 21,147.0 million (US$2,978.5 million). The net loss

attributable to NIO’s ordinary shareholders was RMB14,559.4 million

in 2022. Excluding share-based compensation expenses and accretion

on redeemable non-controlling interests to redemption value,

adjusted net loss attributable to NIO’s ordinary shareholders

(non-GAAP) was RMB18,474.8 million (US$2,602.1 million) in

2023.

- Basic and diluted net loss

per ordinary share/ADS in the fourth quarter of 2023 were

both RMB3.18 (US$0.45), compared with RMB3.55 in the fourth quarter

of 2022 and RMB2.67 in the third quarter of 2023. Excluding

share-based compensation expenses and accretion on redeemable

non-controlling interests to redemption value, adjusted basic and

diluted net loss per share/ADS (non-GAAP) were both RMB2.81

(US$0.39), compared with RMB3.07 in the fourth quarter of 2022 and

RMB2.28 in the third quarter of 2023.

- Basic and diluted net loss

per ADS for the full year of 2023 were both RMB12.44

(US$1.75). Excluding share-based compensation expenses and

accretion on redeemable non-controlling interests to redemption

value, adjusted basic and diluted net loss per ADS (non-GAAP) were

both RMB10.87 (US$1.52) in 2023.

Balance Sheet

- Balance of cash and cash

equivalents, restricted cash, short-term investment and long-term

time deposits was RMB57.3 billion (US$8.1 billion) as of

December 31, 2023.

Business

Outlook

For the first quarter of 2024, the Company

expects:

- Deliveries of

vehicles to be between 31,000 and 33,000 vehicles,

representing a decrease of approximately 0.1% to an increase of

approximately 6.3% from the same quarter of 2023.

- Total

revenues to be between RMB10,499 million

(US$1,479 million) and RMB11,087 million (US$1,562 million),

representing a decrease of approximately 1.7% to an increase of

approximately 3.8% from the same quarter of 2023.

This business outlook reflects the Company’s

current and preliminary view on the business situation and market

condition, which is subject to change.

Conference

Call

The Company’s management will host an earnings conference call at

7:00 AM U.S. Eastern Time on March 5, 2024 (8:00 PM Beijing/Hong

Kong/Singapore Time on March 5, 2024).

A live and archived webcast of the conference

call will be available on the Company’s investor relations website

at https://ir.nio.com/news-events/events.

For participants who wish to join the conference

using dial-in numbers, please register in advance using the link

provided below and dial in 10 minutes prior to the call. Dial-in

numbers, passcode and unique access PIN would be provided upon

registering.

https://s1.c-conf.com/diamondpass/10037213-hg876t.html

A replay of the conference call will be

accessible by phone at the following numbers, until March 12,

2024:

|

United States: |

+1-855-883-1031 |

|

Hong Kong, China: |

+852-800-930-639 |

|

Mainland, China: |

+86-400-1209-216 |

|

Singapore: |

+65-800-1013-223 |

|

International: |

+61-7-3107-6325 |

|

Replay PIN: |

10037213 |

|

|

|

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the premium smart

electric vehicle market. Founded in November 2014, NIO’s mission is

to shape a joyful lifestyle. NIO aims to build a community starting

with smart electric vehicles to share joy and grow together with

users. NIO designs, develops, jointly manufactures and sells

premium smart electric vehicles, driving innovations in

next-generation technologies in assisted and intelligent driving,

digital technologies, electric powertrains and batteries. NIO

differentiates itself through its continuous technological

breakthroughs and innovations, such as the industry-leading battery

swapping technologies, Battery as a Service, or BaaS, as well as

proprietary NIO Assisted and Intelligent Driving and its

subscription services.

Safe Harbor

Statement

This press release contains statements that may constitute

“forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. NIO may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in announcements, circulars or other

publications made on the websites of each of The Stock Exchange of

Hong Kong Limited (the “SEHK”) and the Singapore Exchange

Securities Trading Limited (the “SGX-ST”), in press releases and

other written materials and in oral statements made by its

officers, directors or employees to third parties. Statements that

are not historical facts, including statements about NIO’s beliefs,

plans and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: NIO’s

strategies; NIO’s future business development, financial condition

and results of operations; NIO’s ability to develop and manufacture

a car of sufficient quality and appeal to customers on schedule and

on a large scale; its ability to ensure and expand manufacturing

capacities including establishing and maintaining partnerships with

third parties; its ability to provide convenient and comprehensive

power solutions to its customers; the viability, growth potential

and prospects of the newly introduced BaaS and ADaaS; its ability

to improve the technologies or develop alternative technologies in

meeting evolving market demand and industry development; NIO’s

ability to satisfy the mandated safety standards relating to motor

vehicles; its ability to secure supply of raw materials or other

components used in its vehicles; its ability to secure sufficient

reservations and sales of its vehicles; its ability to control

costs associated with its operations; its ability to build the NIO

brand; general economic and business conditions globally and in

China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in NIO’s filings with the SEC and the announcements and

filings on the websites of each of the SEHK and SGX-ST. All

information provided in this press release is as of the date of

this press release, and NIO does not undertake any obligation to

update any forward-looking statement, except as required under

applicable law.

Non-GAAP

Disclosure

The Company uses non-GAAP measures, such as adjusted cost of sales

(non-GAAP), adjusted research and development expenses (non-GAAP),

adjusted selling, general and administrative expenses (non-GAAP),

adjusted loss from operations (non-GAAP), adjusted net loss

(non-GAAP), adjusted net loss attributable to ordinary shareholders

(non-GAAP) and adjusted basic and diluted net loss per share/ADS

(non-GAAP), in evaluating its operating results and for financial

and operational decision-making purposes. The Company defines

adjusted cost of sales (non-GAAP), adjusted research and

development expenses (non-GAAP), adjusted selling, general and

administrative expenses (non-GAAP) and adjusted loss from

operations (non-GAAP) and adjusted net loss (non-GAAP) as cost of

sales, research and development expenses, selling, general and

administrative expenses, loss from operations and net loss

excluding share-based compensation expenses. The Company defines

adjusted net loss attributable to ordinary shareholders (non-GAAP),

adjusted basic and diluted net loss per share/ADS (non-GAAP) as net

loss attributable to ordinary shareholders and basic and diluted

net loss per share/ADS excluding share-based compensation expenses

and accretion on redeemable non-controlling interests to redemption

value. By excluding the impact of share-based compensation expenses

and accretion on redeemable non-controlling interests to redemption

value, the Company believes that the non-GAAP financial measures

help identify underlying trends in its business and enhance the

overall understanding of the Company’s past performance and future

prospects. The Company also believes that the non-GAAP financial

measures allow for greater visibility with respect to key metrics

used by the Company’s management in its financial and operational

decision-making.

The non-GAAP financial measures are not

presented in accordance with U.S. GAAP and may be different from

non-GAAP methods of accounting and reporting used by other

companies. The non-GAAP financial measures have limitations as

analytical tools and when assessing the Company’s operating

performance, investors should not consider them in isolation, or as

a substitute for net loss or other consolidated statements of

comprehensive loss data prepared in accordance with U.S. GAAP. The

Company encourages investors and others to review its financial

information in its entirety and not rely on a single financial

measure.

The Company mitigates these limitations by

reconciling the non-GAAP financial measures to the most comparable

U.S. GAAP performance measures, all of which should be considered

when evaluating the Company’s performance.

For more information on the non-GAAP financial

measures, please see the table captioned “Unaudited Reconciliation

of GAAP and Non-GAAP Results” set forth at the end of this press

release.

Exchange Rate

This announcement contains translations of certain Renminbi amounts

into U.S. dollars at specified rates solely for the convenience of

the reader. Unless otherwise stated, all translations from Renminbi

to U.S. dollars were made at the rate of RMB7.0999 to US$1.00, the

noon buying rate in effect on December 29, 2023 in the H.10

statistical release of the Federal Reserve Board. The Company makes

no representation that the Renminbi or U.S. dollars amounts

referred could be converted into U.S. dollars or Renminbi, as the

case may be, at any particular rate or at all.

For more information, please visit:

http://ir.nio.com.

Investor Relations

ir@nio.com

Media Relations

global.press@nio.com

Source: NIO

| |

NIO

INC.

Unaudited Consolidated Balance Sheets

(All amounts in thousands) |

| |

| |

As of |

| |

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2023 |

| |

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

19,887,575 |

|

|

|

32,935,111 |

|

|

|

4,638,813 |

|

| Restricted cash |

|

3,154,240 |

|

|

|

5,542,271 |

|

|

|

780,613 |

|

| Short-term investments |

|

19,171,017 |

|

|

|

16,810,107 |

|

|

|

2,367,654 |

|

| Trade and notes

receivables |

|

5,118,170 |

|

|

|

4,657,652 |

|

|

|

656,017 |

|

| Amounts due from related

parties |

|

1,380,956 |

|

|

|

1,722,603 |

|

|

|

242,624 |

|

| Inventory |

|

8,191,386 |

|

|

|

5,277,726 |

|

|

|

743,352 |

|

| Prepayments and other current

assets |

|

2,246,408 |

|

|

|

3,434,763 |

|

|

|

483,776 |

|

| Total current

assets |

|

59,149,752 |

|

|

|

70,380,233 |

|

|

|

9,912,849 |

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

| Long-term restricted cash |

|

113,478 |

|

|

|

144,125 |

|

|

|

20,300 |

|

| Property, plant and equipment,

net. |

|

15,658,666 |

|

|

|

24,847,004 |

|

|

|

3,499,627 |

|

| Intangible assets, net |

|

— |

|

|

|

29,648 |

|

|

|

4,176 |

|

| Land use rights, net |

|

212,603 |

|

|

|

207,299 |

|

|

|

29,197 |

|

| Long-term investments |

|

6,356,411 |

|

|

|

5,487,216 |

|

|

|

772,858 |

|

| Right-of-use assets -

operating lease |

|

7,374,456 |

|

|

|

11,404,116 |

|

|

|

1,606,236 |

|

| Other non-current assets |

|

7,398,559 |

|

|

|

4,883,561 |

|

|

|

687,835 |

|

| Total non-current

assets |

|

37,114,173 |

|

|

|

47,002,969 |

|

|

|

6,620,229 |

|

| Total

assets |

|

96,263,925 |

|

|

|

117,383,202 |

|

|

|

16,533,078 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

4,039,210 |

|

|

|

5,085,411 |

|

|

|

716,265 |

|

| Trade and notes payable |

|

25,223,687 |

|

|

|

29,766,134 |

|

|

|

4,192,472 |

|

| Amounts due to related

parties |

|

384,611 |

|

|

|

561,625 |

|

|

|

79,103 |

|

| Taxes payable |

|

286,300 |

|

|

|

349,349 |

|

|

|

49,205 |

|

| Current portion of operating

lease liabilities |

|

1,025,968 |

|

|

|

1,743,156 |

|

|

|

245,518 |

|

| Current portion of long-term

borrowings |

|

1,237,916 |

|

|

|

4,736,087 |

|

|

|

667,064 |

|

| Accruals and other

liabilities |

|

13,654,362 |

|

|

|

15,556,354 |

|

|

|

2,191,067 |

|

| Total current

liabilities |

|

45,852,054 |

|

|

|

57,798,116 |

|

|

|

8,140,694 |

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Long-term borrowings |

|

10,885,799 |

|

|

|

13,042,861 |

|

|

|

1,837,049 |

|

| Non-current operating lease

liabilities |

|

6,517,096 |

|

|

|

10,070,057 |

|

|

|

1,418,338 |

|

| Deferred tax liabilities |

|

218,189 |

|

|

|

212,347 |

|

|

|

29,908 |

|

| Other non-current

liabilities |

|

5,144,027 |

|

|

|

6,663,805 |

|

|

|

938,578 |

|

| Total non-current

liabilities |

|

22,765,111 |

|

|

|

29,989,070 |

|

|

|

4,223,873 |

|

| Total

liabilities |

|

68,617,165 |

|

|

|

87,787,186 |

|

|

|

12,364,567 |

|

| |

NIO

INC.

Unaudited Consolidated Balance Sheets

(All amounts in thousands) |

| |

| |

As of |

| |

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2023 |

| |

RMB |

|

RMB |

|

US$ |

|

MEZZANINE EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Redeemable non-controlling

interests |

|

3,557,221 |

|

|

|

3,860,384 |

|

|

|

543,724 |

|

| Total mezzanine

equity |

|

3,557,221 |

|

|

|

3,860,384 |

|

|

|

543,724 |

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Total NIO Inc.

shareholders’

equity |

|

23,868,165 |

|

|

|

25,546,233 |

|

|

|

3,598,111 |

|

| Non-controlling

interests |

|

221,374 |

|

|

|

189,399 |

|

|

|

26,676 |

|

| Total shareholders’

equity |

|

24,089,539 |

|

|

|

25,735,632 |

|

|

|

3,624,787 |

|

| Total liabilities,

mezzanine equity and shareholders’

equity |

|

96,263,925 |

|

|

|

117,383,202 |

|

|

|

16,533,078 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

NIO

INC.

Unaudited Consolidated Statements of Comprehensive Loss

(All amounts in thousands, except for share and per

share/ADS data) |

| |

| |

Three Months Ended |

| |

December 31, 2022 |

|

September 30, 2023 |

|

December 31, 2023 |

|

December 31, 2023 |

| |

RMB |

|

RMB |

|

RMB |

|

US$ |

|

Revenues: |

|

|

|

|

|

|

|

|

Vehicle sales |

|

14,759,016 |

|

|

|

17,408,864 |

|

|

|

15,438,709 |

|

|

|

2,174,497 |

|

|

Other sales |

|

1,304,498 |

|

|

|

1,657,687 |

|

|

|

1,664,467 |

|

|

|

234,435 |

|

| Total

revenues |

|

16,063,514 |

|

|

|

19,066,551 |

|

|

|

17,103,176 |

|

|

|

2,408,932 |

|

| Cost of

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle sales |

|

(13,749,365 |

) |

|

|

(15,491,494 |

) |

|

|

(13,600,327 |

) |

|

|

(1,915,566 |

) |

|

Other sales |

|

(1,692,391 |

) |

|

|

(2,051,734 |

) |

|

|

(2,223,621 |

) |

|

|

(313,190 |

) |

| Total cost of

sales |

|

(15,441,756 |

) |

|

|

(17,543,228 |

) |

|

|

(15,823,948 |

) |

|

|

(2,228,756 |

) |

| Gross

profit |

|

621,758 |

|

|

|

1,523,323 |

|

|

|

1,279,228 |

|

|

|

180,176 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and

development |

|

(3,980,578 |

) |

|

|

(3,039,089 |

) |

|

|

(3,972,127 |

) |

|

|

(559,462 |

) |

|

Selling, general and

administrative |

|

(3,527,371 |

) |

|

|

(3,609,319 |

) |

|

|

(3,972,706 |

) |

|

|

(559,544 |

) |

|

Other operating

income |

|

150,057 |

|

|

|

281,174 |

|

|

|

40,295 |

|

|

|

5,675 |

|

| Total operating

expenses |

|

(7,357,892 |

) |

|

|

(6,367,234 |

) |

|

|

(7,904,538 |

) |

|

|

(1,113,331 |

) |

| Loss from

operations |

|

(6,736,134 |

) |

|

|

(4,843,911 |

) |

|

|

(6,625,310 |

) |

|

|

(933,155 |

) |

| Interest and investment

income |

|

351,960 |

|

|

|

288,014 |

|

|

|

1,368,062 |

|

|

|

192,688 |

|

| Interest

expenses |

|

(70,669 |

) |

|

|

(88,546 |

) |

|

|

(163,881 |

) |

|

|

(23,082 |

) |

| Gain on extinguishment of

debt |

|

118,400 |

|

|

|

170,193 |

|

|

|

— |

|

|

|

— |

|

| Share of income of equity

investees |

|

251,439 |

|

|

|

7,781 |

|

|

|

32,373 |

|

|

|

4,560 |

|

| Other income/(losses),

net |

|

315,699 |

|

|

|

(88,645 |

) |

|

|

253,891 |

|

|

|

35,760 |

|

| Loss before income tax

expense |

|

(5,769,305 |

) |

|

|

(4,555,114 |

) |

|

|

(5,134,865 |

) |

|

|

(723,229 |

) |

| Income tax

expense |

|

(16,796 |

) |

|

|

(1,610 |

) |

|

|

(232,880 |

) |

|

|

(32,800 |

) |

| Net

loss |

|

(5,786,101 |

) |

|

|

(4,556,724 |

) |

|

|

(5,367,745 |

) |

|

|

(756,029 |

) |

| Accretion on redeemable

non-controlling interests to redemption

value |

|

(72,581 |

) |

|

|

(77,159 |

) |

|

|

(78,767 |

) |

|

|

(11,094 |

) |

| Net loss/(profit) attributable

to non-controlling

interests |

|

11,603 |

|

|

|

5,254 |

|

|

|

(146,261 |

) |

|

|

(20,600 |

) |

| Net loss attributable

to ordinary shareholders of NIO

Inc. |

|

(5,847,079 |

) |

|

|

(4,628,629 |

) |

|

|

(5,592,773 |

) |

|

|

(787,723 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

(5,786,101 |

) |

|

|

(4,556,724 |

) |

|

|

(5,367,745 |

) |

|

|

(756,029 |

) |

| Other comprehensive

loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized losses

related to available-for-sale debt securities, net of

tax |

|

(24,495 |

) |

|

|

— |

|

|

|

(770,560 |

) |

|

|

(108,531 |

) |

| Change in unrealized gains on

cash flow

hedges |

|

817 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Foreign currency translation

adjustment, net of nil

tax |

|

(134,783 |

) |

|

|

(61,222 |

) |

|

|

(200,131 |

) |

|

|

(28,188 |

) |

| Total other

comprehensive

loss |

|

(158,461 |

) |

|

|

(61,222 |

) |

|

|

(970,691 |

) |

|

|

(136,719 |

) |

| Total comprehensive

loss |

|

(5,944,562 |

) |

|

|

(4,617,946 |

) |

|

|

(6,338,436 |

) |

|

|

(892,748 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion on redeemable

non-controlling interests to redemption

value |

|

(72,581 |

) |

|

|

(77,159 |

) |

|

|

(78,767 |

) |

|

|

(11,094 |

) |

| Net loss/(profit) attributable

to non-controlling

interests |

|

11,603 |

|

|

|

5,254 |

|

|

|

(146,261 |

) |

|

|

(20,600 |

) |

| Other comprehensive loss

attributable to non-controlling

interests |

|

5,229 |

|

|

|

— |

|

|

|

156,026 |

|

|

|

21,976 |

|

| Comprehensive loss

attributable to ordinary shareholders of NIO

Inc. |

|

(6,000,311 |

) |

|

|

(4,689,851 |

) |

|

|

(6,407,438 |

) |

|

|

(902,466 |

) |

| |

|

|

|

|

|

|

|

| Weighted average

number of ordinary shares/ADS used in computing net loss per

share/ADS |

|

|

|

|

|

|

|

| Basic and

diluted |

|

1,647,356,108 |

|

|

|

1,735,661,387 |

|

|

|

1,761,324,976 |

|

|

|

1,761,324,976 |

|

| Net loss per share/ADS

attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

(3.55 |

) |

|

|

(2.67 |

) |

|

|

(3.18 |

) |

|

|

(0.45 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NIO

INC.

Unaudited Consolidated Statements of Comprehensive Loss

(All amounts in thousands, except for share and per

share data) |

| |

| |

For the Year Ended December

31, |

| |

2022 |

|

2023 |

|

2023 |

| |

RMB |

|

RMB |

|

US$ |

|

Revenues: |

|

|

|

|

|

|

Vehicle sales |

|

45,506,581 |

|

|

|

49,257,270 |

|

|

|

6,937,741 |

|

|

Other sales |

|

3,761,980 |

|

|

|

6,360,663 |

|

|

|

895,881 |

|

| Total

revenues |

|

49,268,561 |

|

|

|

55,617,933 |

|

|

|

7,833,622 |

|

| Cost of

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle sales |

|

(39,271,801 |

) |

|

|

(44,587,572 |

) |

|

|

(6,280,028 |

) |

|

Other sales |

|

(4,852,767 |

) |

|

|

(7,978,565 |

) |

|

|

(1,123,757 |

) |

| Total cost of

sales |

|

(44,124,568 |

) |

|

|

(52,566,137 |

) |

|

|

(7,403,785 |

) |

| Gross

profit |

|

5,143,993 |

|

|

|

3,051,796 |

|

|

|

429,837 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and

development |

|

(10,836,261 |

) |

|

|

(13,431,399 |

) |

|

|

(1,891,773 |

) |

|

Selling, general and

administrative |

|

(10,537,119 |

) |

|

|

(12,884,556 |

) |

|

|

(1,814,752 |

) |

|

Other operating income

|

|

588,728 |

|

|

|

608,975 |

|

|

|

85,772 |

|

| Total operating

expenses |

|

(20,784,652 |

) |

|

|

(25,706,980 |

) |

|

|

(3,620,753 |

) |

| Loss from

operations |

|

(15,640,659 |

) |

|

|

(22,655,184 |

) |

|

|

(3,190,916 |

) |

| Interest and investment

income |

|

1,358,719 |

|

|

|

2,210,018 |

|

|

|

311,275 |

|

| Interest

expenses |

|

(333,216 |

) |

|

|

(403,530 |

) |

|

|

(56,836 |

) |

| Gain on extinguishment of

debt |

|

138,332 |

|

|

|

170,193 |

|

|

|

23,971 |

|

| Share of income of equity

investees |

|

377,775 |

|

|

|

64,394 |

|

|

|

9,070 |

|

| Other (losses)/income,

net |

|

(282,952 |

) |

|

|

155,191 |

|

|

|

21,858 |

|

| Loss before income tax

expense |

|

(14,382,001 |

) |

|

|

(20,458,918 |

) |

|

|

(2,881,578 |

) |

| Income tax

expense |

|

(55,103 |

) |

|

|

(260,835 |

) |

|

|

(36,738 |

) |

| Net

loss |

|

(14,437,104 |

) |

|

|

(20,719,753 |

) |

|

|

(2,918,316 |

) |

| Accretion on redeemable

non-controlling interests to redemption

value |

|

(279,355 |

) |

|

|

(303,163 |

) |

|

|

(42,700 |

) |

| Net loss/(profit) attributable

to non-controlling interests |

|

157,014 |

|

|

|

(124,051 |

) |

|

|

(17,472 |

) |

| Net loss attributable

to ordinary shareholders of NIO

Inc. |

|

(14,559,445 |

) |

|

|

(21,146,967 |

) |

|

|

(2,978,488 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

(14,437,104 |

) |

|

|

(20,719,753 |

) |

|

|

(2,918,316 |

) |

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized

gains/(losses) related to available-for-sale debt securities, net

of tax |

|

746,336 |

|

|

|

(770,560 |

) |

|

|

(108,531 |

) |

| Foreign currency translation

adjustment, net of nil

tax |

|

717,274 |

|

|

|

11,514 |

|

|

|

1,622 |

|

| Total other

comprehensive

income/(loss) |

|

1,463,610 |

|

|

|

(759,046 |

) |

|

|

(106,909 |

) |

| Total comprehensive

loss |

|

(12,973,494 |

) |

|

|

(21,478,799 |

) |

|

|

(3,025,225 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Accretion on redeemable

non-controlling interests to redemption

value |

|

(279,355 |

) |

|

|

(303,163 |

) |

|

|

(42,700 |

) |

| Net loss/(profit) attributable

to non-controlling

interests |

|

157,014 |

|

|

|

(124,051 |

) |

|

|

(17,472 |

) |

| Other comprehensive

(income)/loss attributable to non-controlling interests |

|

(151,299 |

) |

|

|

156,026 |

|

|

|

21,976 |

|

| Comprehensive loss

attributable to ordinary shareholders of NIO

Inc. |

|

(13,247,134 |

) |

|

|

(21,749,987 |

) |

|

|

(3,063,421 |

) |

| |

|

|

|

|

|

| Weighted average

number of ordinary shares/ADS used in computing net loss per

share |

|

|

|

|

|

| Basic and

diluted |

|

1,636,999,280 |

|

|

|

1,700,203,886 |

|

|

|

1,700,203,886 |

|

| Net loss per share/ADS

attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

(8.89 |

) |

|

|

(12.44 |

) |

|

|

(1.75 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

NIO

INC.

Unaudited Reconciliation of GAAP and Non-GAAP Results

(All amounts in thousands, except for share and per

share/ADS data) |

| |

| |

Three Months Ended December 31, 2023

|

|

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

(15,823,948 |

) |

|

|

19,120 |

|

|

|

— |

|

|

|

(15,804,828 |

) |

| Research and development

expenses |

|

(3,972,127 |

) |

|

|

355,694 |

|

|

|

— |

|

|

|

(3,616,433 |

) |

| Selling, general and

administrative expenses |

|

(3,972,706 |

) |

|

|

191,235 |

|

|

|

— |

|

|

|

(3,781,471 |

) |

| Total |

|

(23,768,781 |

) |

|

|

566,049 |

|

|

|

— |

|

|

|

(23,202,732 |

) |

| Loss from operations |

|

(6,625,310 |

) |

|

|

566,049 |

|

|

|

— |

|

|

|

(6,059,261 |

) |

| Net loss |

|

(5,367,745 |

) |

|

|

566,049 |

|

|

|

— |

|

|

|

(4,801,696 |

) |

| Net loss attributable to

ordinary shareholders of NIO Inc. |

|

(5,592,773 |

) |

|

|

566,049 |

|

|

|

78,767 |

|

|

|

(4,947,957 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted (RMB) |

|

(3.18 |

) |

|

|

0.33 |

|

|

|

0.04 |

|

|

|

(2.81 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted (USD) |

|

(0.45 |

) |

|

|

0.05 |

|

|

|

0.01 |

|

|

|

(0.39 |

) |

| |

Three Months Ended September 30, 2023 |

|

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

(17,543,228 |

) |

|

|

22,197 |

|

|

|

— |

|

|

|

(17,521,031 |

) |

| Research and development

expenses |

|

(3,039,089 |

) |

|

|

395,856 |

|

|

|

— |

|

|

|

(2,643,233 |

) |

| Selling, general and

administrative expenses |

|

(3,609,319 |

) |

|

|

185,496 |

|

|

|

— |

|

|

|

(3,423,823 |

) |

| Total |

|

(24,191,636 |

) |

|

|

603,549 |

|

|

|

— |

|

|

|

(23,588,087 |

) |

| Loss from operations |

|

(4,843,911 |

) |

|

|

603,549 |

|

|

|

— |

|

|

|

(4,240,362 |

) |

| Net loss |

|

(4,556,724 |

) |

|

|

603,549 |

|

|

|

— |

|

|

|

(3,953,175 |

) |

| Net loss attributable to

ordinary shareholders of NIO Inc. |

|

(4,628,629 |

) |

|

|

603,549 |

|

|

|

77,159 |

|

|

|

(3,947,921 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted (RMB) |

|

(2.67 |

) |

|

|

0.35 |

|

|

|

0.04 |

|

|

|

(2.28 |

) |

| |

Three Months Ended December 31,

2022 |

|

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of

sales |

|

(15,441,756 |

) |

|

|

23,522 |

|

|

|

— |

|

|

|

(15,418,234 |

) |

| Research and development

expenses |

|

(3,980,578 |

) |

|

|

426,701 |

|

|

|

— |

|

|

|

(3,553,877 |

) |

| Selling, general and

administrative

expenses |

|

(3,527,371 |

) |

|

|

270,257 |

|

|

|

— |

|

|

|

(3,257,114 |

) |

|

Total |

|

(22,949,705 |

) |

|

|

720,480 |

|

|

|

— |

|

|

|

(22,229,225 |

) |

| Loss from

operations |

|

(6,736,134 |

) |

|

|

720,480 |

|

|

|

— |

|

|

|

(6,015,654 |

) |

| Net

loss |

|

(5,786,101 |

) |

|

|

720,480 |

|

|

|

— |

|

|

|

(5,065,621 |

) |

| Net loss attributable to

ordinary shareholders of NIO

Inc. |

|

(5,847,079 |

) |

|

|

720,480 |

|

|

|

72,581 |

|

|

|

(5,054,018 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted

(RMB) |

|

(3.55 |

) |

|

|

0.44 |

|

|

|

0.04 |

|

|

|

(3.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NIO

INC.

Unaudited Reconciliation of GAAP and Non-GAAP Results

(All amounts in thousands, except for share and per

share data) |

| |

Year Ended December 31, 2023 |

|

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

(52,566,137 |

) |

|

|

83,972 |

|

|

|

— |

|

|

|

(52,482,165 |

) |

| Research and development

expenses |

|

(13,431,399 |

) |

|

|

1,517,206 |

|

|

|

— |

|

|

|

(11,914,193 |

) |

| Selling, general and

administrative expenses |

|

(12,884,556 |

) |

|

|

767,863 |

|

|

|

— |

|

|

|

(12,116,693 |

) |

| Total |

|

(78,882,092 |

) |

|

|

2,369,041 |

|

|

|

— |

|

|

|

(76,513,051 |

) |

| Loss from operations |

|

(22,655,184 |

) |

|

|

2,369,041 |

|

|

|

— |

|

|

|

(20,286,143 |

) |

| Net loss |

|

(20,719,753 |

) |

|

|

2,369,041 |

|

|

|

— |

|

|

|

(18,350,712 |

) |

| Net loss attributable to

ordinary shareholders of NIO Inc. |

|

(21,146,967 |

) |

|

|

2,369,041 |

|

|

|

303,163 |

|

|

|

(18,474,763 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted (RMB) |

|

(12.44 |

) |

|

|

1.39 |

|

|

|

0.18 |

|

|

|

(10.87 |

) |

| Net loss per ADS attributable

to ordinary shareholders, basic and diluted (USD) |

|

(1.75 |

) |

|

|

0.20 |

|

|

|

0.03 |

|

|

|

(1.52 |

) |

| (All amounts in

thousands, except for share and per share data) |

| |

| |

Year Ended December 31, 2022 |

|

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

| |

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

(44,124,568 |

) |

|

|

66,914 |

|

|

|

— |

|

|

|

(44,057,654 |

) |

| Research and development

expenses |

|

(10,836,261 |

) |

|

|

1,323,370 |

|

|

|

— |

|

|

|

(9,512,891 |

) |

| Selling, general and

administrative expenses |

|

(10,537,119 |

) |

|

|

905,612 |

|

|

|

— |

|

|

|

(9,631,507 |

) |

| Total |

|

(65,497,948 |

) |

|

|

2,295,896 |

|

|

|

— |

|

|

|

(63,202,052 |

) |

| Loss from operations |

|

(15,640,659 |

) |

|

|

2,295,896 |

|

|

|

— |

|

|

|

(13,344,763 |

) |

| Net loss |

|

(14,437,104 |

) |

|

|

2,295,896 |

|

|

|

— |

|

|

|

(12,141,208 |

) |

| Net loss attributable to

ordinary shareholders of NIO Inc. |

|

(14,559,445 |

) |

|

|

2,295,896 |

|

|

|

279,355 |

|

|

|

(11,984,194 |

) |

| Net loss per share/ADS

attributable to ordinary shareholders, basic and diluted (RMB) |

|

(8.89 |

) |

|

|

1.40 |

|

|

|

0.17 |

|

|

|

(7.32 |

) |

i All translations from RMB to

USD for the fourth quarter and full year of 2023 were made at the

rate of RMB7.0999 to US$1.00, the noon buying rate in effect on

December 29, 2023 in the H.10 statistical release of the Federal

Reserve Board.

ii Vehicle margin is the margin of new vehicle

sales, which is calculated based on revenues and cost of sales

derived from new vehicle sales only.

iii Except for gross margin and vehicle margin,

where absolute changes instead of percentage changes are

calculated.

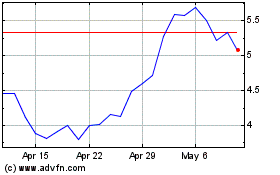

NIO (NYSE:NIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Apr 2023 to Apr 2024