Mullen Streamlines Business Operations to Focus on Near Term Commercial Opportunities

April 08 2024 - 8:30AM

via IBN -- Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the

“Company”), an emerging electric vehicle (“EV”) manufacturer,

announces today the Company has initiated significant cost

reduction and consolidation measures, aligning budget to current

conditions. Actions are expected to drive an estimated $170 million

reduction in the Company’s operating and investing cash flow

expenses over the next 12 months when compared to operating and

investing cash flows for the 12 months ended Sept. 30, 2023.

Operating and investing cash flows were $179 million and $108

million, respectively, for the 12 months ended Sept. 30, 2023.

Reductions in operating cash flows are estimated to be

approximately $69 million and investment spending is estimated to

contract by $101 million over the next 12 months when compared to

the Company’s spend over the last fiscal year.

Mullen is making these changes to refine business operations and

better align focus on the commercial EV segment that has

opportunity to drive near term revenue for the Company, including

projected April sales of 100 commercial EVs by Randy Marion

Automotive Group (“RMA”).

“Momentum is increasing and we have transactions with fleets of

varying sizes and vocations,” said Brad Sigmon, Vice President of

Randy Marion Automotive Fleet Operations. “Building on March

transactions, our April goal is to move 100 units of Mullen

Commercial EVs.”

The overall changes are focused on long-term growth and are

intended to reduce the Company’s costs during a time when the

consumer EV sector and overall market has proved challenging. These

actions are intended to reduce the company’s operating outlay when

compared to the previous fiscal year.

The Company’s planned changes include the following:

- Prioritizing near term revenue opportunities and significantly

curtailing noncommercial programs

- Integration of Troy and Irvine engineering centers with focus

on building efficiency through consolidation

- Focus on expanding national commercial dealer network

“Our refined business operational focus will improve our

financial results and allow us to take advantage of current market

opportunities while also driving long-term growth and shareholder

value,” said David Michery, CEO and chairman of Mullen

Automotive.

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based

automotive company building the next generation of commercial

electric vehicles (“EVs”) with two United States-based vehicle

plants located in Tunica, Mississippi, (120,000 square feet) and

Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen

began commercial vehicle production in Tunica. In September 2023,

Mullen received IRS approval for federal EV tax credits on its

commercial vehicles with a Qualified Manufacturer designation that

offers eligible customers up to $7,500 per vehicle. As of January

2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen

THREE, a Class 3 EV cab chassis truck, are California Air Resource

Board (CARB) and EPA certified and available for sale in the

U.S.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical

facts are forward-looking statements within the meaning of Section

27A of the Securities Exchange Act of 1934, as amended. Any

statements contained in this press release that are not statements

of historical fact may be deemed forward-looking statements. Words

such as "continue," "will," "may," "could," "should," "expect,"

"expected," "plans," "intend," "anticipate," "believe," "estimate,"

"predict," "potential" and similar expressions are intended to

identify such forward-looking statements. All forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements, many of which are

generally outside the control of Mullen and are difficult to

predict. Examples of such risks and uncertainties include but are

not limited to the actual amount of expenses that the Company will

be able to minimize, whether the cost cutting measures will produce

improved financial results and long-term growth, the overall impact

on the Company from the realignment initiatives and cost cutting

measures, and whether the projected April sales of 100 commercial

EVs by Randy Marion Automotive Group will materialize. Additional

examples of such risks and uncertainties include but are not

limited to: (i) Mullen’s ability (or inability) to obtain

additional financing in sufficient amounts or on acceptable terms

when needed; (ii) Mullen's ability to maintain existing, and secure

additional, contracts with manufacturers, parts and other service

providers relating to its business; (iii) Mullen’s ability to

successfully expand in existing markets and enter new markets; (iv)

Mullen’s ability to successfully manage and integrate any

acquisitions of businesses, solutions or technologies; (v)

unanticipated operating costs, transaction costs and actual or

contingent liabilities; (vi) the ability to attract and retain

qualified employees and key personnel; (vii) adverse effects of

increased competition on Mullen’s business; (viii) changes in

government licensing and regulation that may adversely affect

Mullen’s business; (ix) the risk that changes in consumer behavior

could adversely affect Mullen’s business; (x) Mullen’s ability to

protect its intellectual property; and (xi) local, industry and

general business and economic conditions. Additional factors that

could cause actual results to differ materially from those

expressed or implied in the forward-looking statements can be found

in the most recent annual report on Form 10-K, quarterly reports on

Form 10-Q and current reports on Form 8-K filed by Mullen with the

Securities and Exchange Commission. Mullen anticipates that

subsequent events and developments may cause its plans, intentions

and expectations to change. Mullen assumes no obligation, and it

specifically disclaims any intention or obligation, to update any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by law.

Forward-looking statements speak only as of the date they are made

and should not be relied upon as representing Mullen’s plans and

expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

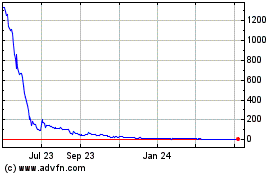

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Apr 2023 to Apr 2024