MCD Stock: Is McDonald’s a Good Buy Right Now?

December 11 2023 - 4:55AM

Finscreener.org

McDonaldU+02019s (NYSE:MCD)

has ambitious expansion plans to open approximately 9,000 new

outlets and increase its loyalty program membership by 100 million

over the next four years. These goals are crucial to the companyU+02019s strategy

to enhance revenue growth.

For 2024, McDonaldU+02019s

anticipates a 4% increase in net new restaurants. The company

expects that these new outlets will drive around 2% of its

systemwide sales growth next year. Post-2024, McDonald’s aims for

an annual growth rate in restaurant count of between 4% and 5%,

with new locations projected to contribute 2.5% to systemwide sales

growth during this time.

To facilitate these growth

objectives, McDonaldU+02019s plans to allocate $2.5 billion to

capital expenditures in 2024, an increase from the $2.3 billion

earmarked for 2023. From 2025 to 2027, capital expenditure is

expected to rise by about $400 million each year.

The fast-food giant is targeting

a global presence of 50,000 restaurants by 2027. At the end of the

third quarter, McDonald’s had 41,198 restaurants. The question

arises as to which regions will be critical to this

expansion.

Over the next four years, the

breakdown of new McDonald’s locations is as follows:

- 900 new restaurants in the

U.S.

- 1,900 in international

markets.

- 7,000 in its International

Developmental Licensed (IDL) markets division.

The international markets,

including France, Canada, and Australia, contribute 50% of

McDonald’s total sales. Notably, the IDL segment, with a

significant focus on China, is expected to account for over half of

the new restaurant openings.

Risks associated with MCD’s aggressive expansion

plans

McDonaldU+02019s ambitious growth

strategy is set against a backdrop of global economic

uncertainties. McDonaldU+02019s faces challenges with China, the

fast-food chainU+02019s second-largest market, still recovering

from pandemic impacts and instability in the Middle East affecting

sales. Moreover, while the U.S. economy is not yet in a

recession, some experts anticipate a downturn.

Here are three significant risks

McDonaldU+02019s must navigate as it enters 2024:

The Vulnerability of Low-Income Customers

Earlier in the year, CEO Chris

Kempczinski anticipated a mild to moderate recession in the U.S.

and a more severe one in Europe for 2023. These forecasts have yet

to materialize. Kempczinski acknowledged his misjudgment, noting

the resilience of consumers but also pointing out the reduced

spending among low-income customers last quarter. Retailers

like Walmart (NYSE:WMT) also observed this trend.

Although McDonaldU+02019s often

benefits when higher-income consumers opt for more affordable

dining options, the low-income segment remains a crucial part of

its customer base. Bernstein analyst Danilo Gargiulo expressed

concerns over the financial well-being of these

consumers.

CompetitionU+02019s Promotional Tactics

Post-pandemic, McDonaldU+02019s

moved away from temporary menu items to attract customers, focusing

instead on brand marketing, such as promotions featuring

celebritiesU+02019 favorite orders. This strategy has been

successful despite inflationary pressures. McDonaldU+02019s spends

substantially on marketing, significantly more than its closest

rivals.

However, with low-income diners

visiting less, competitors might increase promotional activities to

attract traffic. This could lead McDonaldU+02019s to weigh the

benefits of short-term traffic against potential long-term brand

impacts. Citi Research analyst Jon Tower speculated how McDonald’s

might adjust to a more promotion-driven market.

Risks in Aggressive Expansion

McDonaldU+02019s investor

presentations highlighted accelerated expansion plans, aiming for

50,000 global locations by 2027. However, past experiences show

that rapid expansion can have adverse effects, such as

cannibalizing sales at existing locations and distractions from

other business aspects.

While investors are generally

wary of expansion plans in the current economic climate, analysts

like BarclaysU+02019 Jeffrey Bernstein acknowledge McDonald’s

strengths and recent focus on remodeling over new

construction.

J.P. Morgan Securities analyst

John Ivankoe also positively views McDonaldU+02019s expansion of a

remodeled base and towards top franchisees. CEO Kempczinski

reassured investors, emphasizing lessons learned from prioritizing

quantity over quality and detailed planning for growth

opportunities.

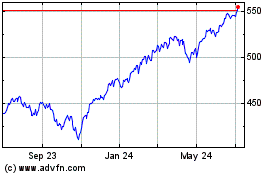

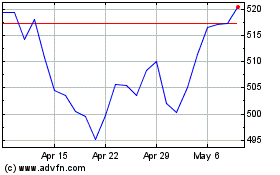

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024