Marin Software’s Stockholders and Board of Directors Approve Reverse Stock Split

April 05 2024 - 4:00PM

Business Wire

Marin Software Incorporated (NASDAQ: MRIN), a leading provider

of digital marketing software for performance-driven advertisers

and agencies, announced that at its annual meeting of stockholders

held today, stockholders voted to approve a proposal authorizing

the Board of Directors to effect a reverse stock split of Marin’s

outstanding shares of common stock at a ratio of not less than

1-for-4 and not more than 1-for-6, with the exact ratio to be set

within that range at the discretion of the Board of Directors, and

a proposal to reduce the number of authorized shares of Marin’s

common stock from 142,857,143 to that number of shares equal to

142,857,143 multiplied by two times the stock split ratio. Marin’s

Board of Directors has determined that the reverse stock split

ratio will be 1-for-6 (the “Reverse Stock Split”). The Reverse

Stock Split is expected to take effect at 5:00 p.m. Eastern Time on

April 12, 2024 and Marin expects that its common stock will trade

on a split-adjusted basis on at the opening of trading on April 15,

2024.

Upon the effectiveness of the Reverse Stock Split, every 6

shares of Marin’s issued and outstanding common stock will be

automatically combined and converted into one issued and

outstanding share of common stock with any fractional amounts

rounded down and paid in cash in lieu of the fractional amount. The

Reverse Stock Split will reduce the number of shares of outstanding

common stock from approximately 18.4 million to approximately 3.1

million. The Reverse Stock Split will not affect any stockholder’s

ownership percentage of Marin’s common stock.

At the opening of trading on April 15, 2024, Marin’s common

stock will continue to trade on the Nasdaq Capital Market under the

symbol “MRIN,” but will be assigned a new CUSIP number (56804T 304)

and will trade on a split-adjusted basis.

Broadridge Corporate Issuer Solutions, Inc., Marin’s transfer

agent, will provide instructions to registered stockholders

regarding the process for exchanging their stock certificates.

Stockholders holding their shares in street name do not need to

take any action. Additional information regarding the reverse stock

split and reduction in the number of authorized shares of Marin’s

common stock approved by stockholders can be found in Marin’s

definitive proxy statement filed with the Securities and Exchange

Commission on March 5, 2024, as amended on March 28, 2024.

About Marin Software

Marin Software Incorporated’s mission is to give advertisers the

power to drive higher efficiency and transparency in their paid

marketing programs that run on the world’s largest publishers.

Marin Software offers a unified SaaS advertising management

platform for search, social, and eCommerce advertising. Marin

Software helps digital marketers convert precise audiences, improve

financial performance, and make better decisions. Headquartered in

San Francisco with offices worldwide, Marin Software’s technology

powers marketing campaigns around the globe. For more information

about Marin Software, please visit www.marinsoftware.com.

Forward-Looking Statements

This press release contains forward-looking statements

including, among other things, Marin’s expectations regarding the

timing of the Reverse Stock Split, when Marin’s common stock will

trade on an as-adjusted basis, and when the reduction in authorized

shares of Marin’s capital stock will occur. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors, including Nasdaq’s timing for approval of trading on a

split-adjusted basis and the filing of a Certificate of Amendment

to our Certificate of Incorporation to effectuate the Reverse Stock

Split, that may cause actual results, performance, or achievements

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. You should refer to the section entitled “Risk Factors”

set forth in Marin’s annual and quarterly reports and other filings

Marin makes with the Securities and Exchange Commission from time

to time for a discussion of important factors that may cause actual

results to differ materially from those expressed or implied by

Marin’s forward-looking statements. The forward-looking statements

speak only as of the date of this Current Report on Form 8-K. Marin

undertakes no obligation to publicly update any forward-looking

statements or reasons why actual results might differ, whether as a

result of new information, future events or otherwise, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240405733506/en/

Investor Relations Contact:

Investor Relations, Marin Software

ir@marinsoftware.com

Media Contact:

Wesley MacLaggan

Marketing, Marin Software

(415) 399-2580

press@marinsoftware.com

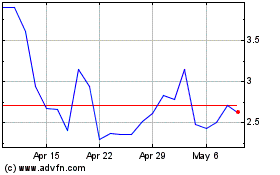

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Apr 2023 to Apr 2024