Is SUI Sinking? TVL Tanks As Crypto Price Fails To Keep Afloat

April 26 2024 - 6:30AM

NEWSBTC

For crypto investors, the last several weeks have been a

rollercoaster, with many assets seeing price dips and failing to

post meaningful gains. The short-term outlook is bleak, despite

some analysts’ continued optimism on the market’s long-term

prospects. Related Reading: Shiba Inu Price Prediction: Can Meme

Coin Hit $0.001 This Year? Investor Makes Daring Call Halving Hype

Fades Even the granddaddy of cryptocurrencies, Bitcoin (BTC),

hasn’t been immune to the market downturn. Currently trading around

$63,500, BTC is down 4% in the past day and a staggering 14% from

its all-time high of over $73,000. This sluggish performance

follows the recent Bitcoin halving event, which some enthusiasts

believed would trigger a price surge. However, market experts had

predicted otherwise, and it seems their forecasts were on point.

The halving, which cuts the number of new Bitcoins entering

circulation in half every four years, is intended to control

inflation and theoretically increase scarcity over time. However,

its impact on short-term price movements appears minimal. SUI

Ecosystem Feels The Squeeze One cryptocurrency experiencing a

particularly harsh beating is Sui (SUI), the native token of the

Sui blockchain ecosystem. SUI has been on a downward trajectory for

the past week, plummeting a staggering 30% from its all-time high

of $2.20. This week alone, SUI has dipped as low as $1.15 before

experiencing a brief uptick, only to fall again. The current price

sits around $1.18, reflecting a 10% loss in the past 24 hours. SUI

24-hour price action. Source: Coingecko SUI’s TVL Tumbles Adding to

Sui’s woes is the significant decline in its total value locked.

TVL refers to the total amount of cryptocurrency locked in DeFi

(Decentralized Finance) protocols within a particular blockchain

ecosystem. Source: Defillama A high TVL indicates strong user

activity and locked funds, which are seen as positive indicators

for the health of the ecosystem. Unfortunately for Sui, its TVL has

tumbled 30% from its record high earlier this year, currently

sitting at around $535 million according to DefiLlama data. This

drop in TVL suggests a decrease in user engagement and locked funds

within the Sui ecosystem, mirroring the broader negative sentiment.

SUIUSD trading at $1.18 on the daily chart: TradingView.com Broader

Market Correction Or Underlying Issues? The current market slump

isn’t limited to Sui or even Bitcoin. Major altcoins like Ethereum,

Solana, and Curve DAO have also seen losses ranging from 3% to 7%

over the past week. This suggests a broader market correction

rather than an issue specific to Sui. Related Reading: Stellar The

New Star: XLM On Tear As Analyst Predicts $0.47 Price Target

Analysts point to several factors potentially contributing to the

downturn, including rising inflation concerns, ongoing geopolitical

tensions, and a general risk-off sentiment among investors. What

Lies Ahead For Crypto? While the short-term outlook for the crypto

market appears uncertain, many analysts remain optimistic about the

long-term potential of the technology. The underlying innovation

and potential for disruption across various sectors continue to

attract interest. However, navigating the current volatility will

likely require a strong stomach and a long-term investment horizon

for those looking to weather the storm. Featured image from

Charleston Dermatology, chart from TradingView

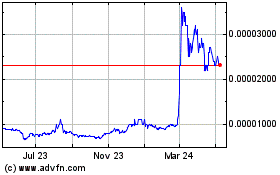

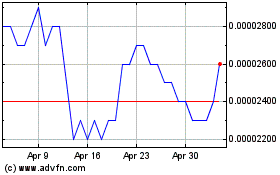

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024