Hong Kong Bitcoin ETF Readies For Stellar Debut, Expected To Outshine $125M US Launch

April 29 2024 - 9:00PM

NEWSBTC

The eagerly anticipated Hong Kong Bitcoin ETF market is scheduled

to commence trading on Tuesday, marking a significant milestone in

the increasing adoption of the leading cryptocurrency and building

upon the success of the US ETF market. With their approval,

the newly regulated index funds are poised for a noteworthy debut,

surpassing the first-day inflows in the United States. HK Bitcoin

ETF Market Poised For Record-Breaking Debut Zhu Haokang, the

Digital Asset Management Supervisor and Family Wealth Supervisor at

Warsaw Fund expressed great confidence in the trading volume of

Hong Kong Bitcoin ETFs on its inaugural day. This volume

exceeded the scale achieved during the US launch on January

10th of this year, which amounted to over 125 million US

dollars. Related Reading: Crypto Analyst Says Altcoins Are

About To Enter A Parabolic Curve, Here’s Why Haokang further stated

that Huaxia, one of the three ETF issuers, is confident in becoming

the largest ETF issuer on the first day of trading. At the same

time, OSL, a digital asset platform, has already completed the

initial fundraising with two funds, including Huaxia.

Furthermore, the capital inflow during the Hong Kong spot Bitcoin

ETF’s first-day listing transaction has surpassed that of the US

spot ETF market. According to Haokang, this difference can be

attributed to two factors: the purchase and redemption of spot and

in-kind transactions, which are unavailable in the US spot Bitcoin

ETF. Unprecedented Investment Options One unique aspect of the

China Summer Fund’s Hong Kong spot ETF is its incorporation of Hong

Kong dollars, US dollars, and dual counter offers (RMB counters),

distinguishing it from the other two offerings. Additionally,

the fund features a non-listed share alongside the listed share,

further setting it apart from its counterparts. Given the physical

purchase method, investors, including Bitcoin miners, can directly

acquire the Hong Kong virtual asset spot ETF using the Bitcoin they

already hold. Moreover, outreach efforts have reportedly been

made to attract investors from countries and regions without ETF

offerings, such as Singapore and the Middle East, generating

significant interest. Despite the substantial market size of the

current US spot Bitcoin ETF market, Hong Kong’s utilization of cash

and in-kind subscriptions, coupled with the appeal of open trading

during Asian market hours, is expected to attract numerous American

investors, according to Haokang. Mainland Chinese Investors

Restricted Wayne Huang, OSL ETF and Trusteeship Business Manager,

highlighted that Victory Securities could facilitate physical

purchases, and the winning securities in China can also leverage

OSL’s support. Three vouchers enable physical purchases, with

more expected to follow suit. Following the ETF’s listing, various

voucher chambers of commerce are likely to participate, increasing

the overall ecosystem of the Bitcoin ETF market in May. Related

Reading: Ethereum Fees Dive: Will This Spark A Surge In Network

Activity? On the other hand, Zhu Haokang also clarified that

mainland Chinese investors are currently restricted from investing

in Hong Kong’s spot ETF market. However, qualified investors,

institutional investors, retail investors, and qualified

international investors in Hong Kong can participate in the spot

ETF race. Individuals seeking further details are advised to

consult voucher providers and sales channels while closely

monitoring potential regulatory adjustments and the development of

a specific regulatory framework in the future. Currently, BTC is

trading at $63,000 after failing to consolidate above the key

$66,000 level in recent days. However, the launch of the ETF market

in Hong Kong is expected to significantly impact the price of

BTC in the long run. Featured image from Shutterstock, chart

from TradingView.com

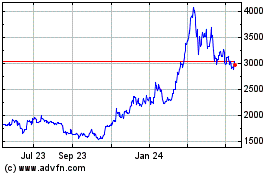

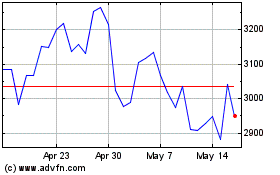

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024