GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today

released financial results for the fourth quarter and fiscal year

ended February 3, 2024. The Company’s consolidated financial

statements, including GAAP and non-GAAP results, are below. The

Company’s Form 10-K and supplemental information can be found at

https://investor.gamestop.com.

FOURTH QUARTER OVERVIEW

- Net sales were $1.794 billion for

the fourth quarter, compared to $2.226 billion in the prior year's

fourth quarter.

- Selling, general and administrative

(“SG&A”) expenses were $359.2 million, or 20.0% of net sales,

for the fourth quarter, compared to $453.4 million, or 20.4% of net

sales, in the prior year's fourth quarter.

- Net income was $63.1 million for

the fourth quarter, compared to net income of $48.2 million for the

prior year’s fourth quarter.

- Cash, cash equivalents and

marketable securities were $1.199 billion at the close of the

quarter.

- Long-term debt remains limited to a

low-interest, unsecured term loan associated with the French

government's response to COVID-19.

FULL YEAR OVERVIEW

- Net sales were $5.273 billion for

fiscal year 2023, compared to $5.927 billion for fiscal year

2022.

- SG&A expenses were $1.324

billion, or 25.1% of net sales, for fiscal year 2023, compared to

$1.681 billion, or 28.4% of net sales, for fiscal year

2022.

- Net income was $6.7 million for

fiscal year 2023, compared to a net loss of $313.1 million for

fiscal year 2022.

- Adjusted EBITDA of $64.7 million

for fiscal year 2023, compared to adjusted EBITDA of ($192.7)

million for fiscal year 2022.

The Company will not be holding a conference call today.

Additional information can be found in the Company’s Form 10-K.

NON-GAAP MEASURES AND OTHER METRICS

As a supplement to the Company’s financial

results presented in accordance with U.S. generally accepted

accounting principles ("GAAP"), GameStop may use certain non-GAAP

measures, such as adjusted SG&A expenses, adjusted operating

income (loss), adjusted net income (loss), adjusted earnings (loss)

per share, adjusted EBITDA and free cash flow. The Company believes

these non-GAAP financial measures provide useful information to

investors in evaluating the Company’s core operating performance.

Adjusted SG&A expenses, adjusted operating income (loss),

adjusted net income (loss), adjusted earnings (loss) per share and

adjusted EBITDA exclude the effect of items such as certain

transformation costs, asset impairments, severance, as well as

divestiture costs. Free cash flow excludes capital expenditures

otherwise included in net cash flows (used in) provided by

operating activities. The Company’s definition and calculation of

non-GAAP financial measures may differ from that of other

companies. Non-GAAP financial measures should be viewed as

supplementing, and not as an alternative or substitute for, the

Company’s financial results prepared in accordance with GAAP.

Certain of the items that may be excluded or included in non-GAAP

financial measures may be significant items that could impact the

Company’s financial position, results of operations or cash flows

and should therefore be considered in assessing the Company’s

actual and future financial condition and performance.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS - SAFE HARBOR

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are based upon management’s

current beliefs, views, estimates and expectations, including as to

the Company’s industry, business strategy, goals and expectations

concerning its market position, strategic and transformation

initiatives, future operations, margins, profitability, sales

growth, capital expenditures, liquidity, capital resources,

expansion of technology expertise, and other financial and

operating information, including expectations as to future

operating profit improvement. Forward-looking statements are

subject to significant risks and uncertainties and actual

developments, business decisions, outcomes and results may differ

materially from those reflected or described in the forward-looking

statements. The following factors, among others, could cause actual

developments, business decisions, outcomes and results to differ

materially from those reflected or described in the forward-looking

statements: economic, social, and political conditions in the

markets in which we operate; the competitive nature of the

Company’s industry; the cyclicality of the video game industry; the

Company’s dependence on the timely delivery of new and innovative

products from its vendors; the impact of technological advances in

the video game industry and related changes in consumer behavior on

the Company’s sales; interruptions to the Company’s supply chain or

the supply chain of our suppliers; the Company’s dependence on

sales during the holiday selling season; the Company’s ability to

obtain favorable terms from its current and future suppliers and

service providers; the Company’s ability to anticipate, identify

and react to trends in pop culture with regard to its sales of

collectibles; the Company’s ability to maintain strong retail and

ecommerce experiences for its customers; the Company’s ability to

keep pace with changing industry technology and consumer

preferences; the Company’s ability to manage its profitability and

cost reduction initiatives; turnover in senior management or the

Company’s ability to attract and retain qualified personnel;

potential damage to the Company’s reputation or customers'

perception of the Company; the Company’s ability to maintain the

security or privacy of its customer, associate or Company

information; occurrence of weather events, natural disasters,

public health crises and other unexpected events; risks associated

with inventory shrinkage; potential failure or inadequacy of the

Company's computerized systems; the ability of the Company’s third

party delivery services to deliver products to the Company’s retail

locations, fulfillment centers and consumers and changes in the

terms the Company has with such service providers; the ability and

willingness of the Company’s vendors to provide marketing and

merchandising support at historical or anticipated levels;

restrictions on the Company’s ability to purchase and sell

pre-owned products; the Company’s ability to renew or enter into

new leases on favorable terms; unfavorable changes in the Company’s

global tax rate; legislative actions; the Company’s ability to

comply with federal, state, local and international laws and

regulations and statutes; potential future litigation and other

legal proceedings; the value of the Company's securities holdings;

concentration of the Company's investment portfolio into one or

fewer holdings; the recognition of losses in a particular security

even if the Company has not sold the security; volatility in the

Company’s stock price, including volatility due to potential short

squeezes; continued high degrees of media coverage by third

parties; the availability and future sales of substantial amounts

of the Company’s Class A common stock; fluctuations in the

Company’s results of operations from quarter to quarter; the

restrictions contained in the agreement governing the Company’s

revolving credit facility; the Company’s ability to generate

sufficient cash flow to fund its operations; the Company’s ability

to incur additional debt; risks associated with the Company’s

investment in marketable, nonmarketable and interest-bearing

securities, including the impact of such investments on Company’s

financial results; and the Company’s ability to maintain effective

control over financial reporting. Additional factors that could

cause results to differ materially from those reflected or

described in the forward-looking statements can be found in

GameStop's most recent Annual Report on Form 10-K and other filings

made from time to time with the SEC and available at

www.sec.gov or on the Company’s investor relations website

(https://investor.gamestop.com). Forward-looking statements

contained in this press release speak only as of the date of this

press release. The Company undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

GameStop Corp.

Consolidated Statements of Operations

(in millions, except per share data)

(unaudited) |

| |

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

Net sales |

|

$ |

1,793.6 |

|

|

$ |

2,226.4 |

|

| Cost of sales |

|

|

1,374.4 |

|

|

|

1,726.6 |

|

|

Gross profit |

|

|

419.2 |

|

|

|

499.8 |

|

| Selling, general and

administrative expenses |

|

|

359.2 |

|

|

|

453.4 |

|

| Asset impairments |

|

|

4.8 |

|

|

|

0.2 |

|

|

Operating earnings |

|

|

55.2 |

|

|

|

46.2 |

|

| Interest income, net |

|

|

(15.3 |

) |

|

|

(6.2 |

) |

| Other gain, net |

|

|

(0.5 |

) |

|

|

— |

|

|

Earnings before income taxes |

|

|

71.0 |

|

|

|

52.4 |

|

| Income tax expense, net |

|

|

7.9 |

|

|

|

4.2 |

|

| Net income |

|

$ |

63.1 |

|

|

$ |

48.2 |

|

| |

|

|

|

|

| Earnings per share: |

|

|

|

|

|

Basic earnings per share |

|

$ |

0.21 |

|

|

$ |

0.16 |

|

|

Diluted earnings per share |

|

|

0.21 |

|

|

|

0.16 |

|

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

Basic |

|

|

305.6 |

|

|

|

304.3 |

|

|

Diluted |

|

|

305.7 |

|

|

|

304.5 |

|

| |

|

|

|

|

| Percentage of Net Sales: |

|

|

|

|

| Net sales |

|

|

100.0 |

% |

|

|

100.0 |

% |

| Cost of sales |

|

|

76.6 |

% |

|

|

77.6 |

% |

|

Gross profit |

|

|

23.4 |

% |

|

|

22.4 |

% |

| Selling, general and

administrative expenses |

|

|

20.0 |

% |

|

|

20.4 |

% |

| Asset impairments |

|

|

0.3 |

% |

|

|

— |

% |

|

Operating earnings |

|

|

3.1 |

% |

|

|

2.1 |

% |

| Interest income, net |

|

|

(0.9 |

)% |

|

|

(0.3 |

)% |

| Other gain, net |

|

|

— |

% |

|

|

— |

% |

|

Earnings before income taxes |

|

|

4.0 |

% |

|

|

2.4 |

% |

| Income tax expense, net |

|

|

0.5 |

% |

|

|

0.2 |

% |

| Net income |

|

|

3.5 |

% |

|

|

2.2 |

% |

GameStop Corp.

Consolidated Statements of Operations

(in millions, except per share data)

(unaudited) |

| |

| |

|

53 weeks ended

February 3, 2024 |

|

52 weeks ended

January 28, 2023 |

|

Net sales |

|

$ |

5,272.8 |

|

|

$ |

5,927.2 |

|

| Cost of sales |

|

|

3,978.6 |

|

|

|

4,555.1 |

|

|

Gross profit |

|

|

1,294.2 |

|

|

|

1,372.1 |

|

| Selling, general and

administrative expenses |

|

|

1,323.9 |

|

|

|

1,681.0 |

|

| Asset impairments |

|

|

4.8 |

|

|

|

2.7 |

|

|

Operating loss |

|

|

(34.5 |

) |

|

|

(311.6 |

) |

| Interest income, net |

|

|

(49.5 |

) |

|

|

(9.5 |

) |

| Other loss, net |

|

|

1.9 |

|

|

|

— |

|

|

Income (loss) before income taxes |

|

|

13.1 |

|

|

|

(302.1 |

) |

| Income tax expense, net |

|

|

6.4 |

|

|

|

11.0 |

|

| Net income (loss) |

|

$ |

6.7 |

|

|

$ |

(313.1 |

) |

| |

|

|

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.02 |

|

|

$ |

(1.03 |

) |

|

Diluted earnings (loss) per share |

|

|

0.02 |

|

|

|

(1.03 |

) |

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

Basic |

|

|

305.1 |

|

|

|

304.2 |

|

|

Diluted |

|

|

305.2 |

|

|

|

304.2 |

|

| |

|

|

|

|

| Percentage of Net Sales: |

|

|

|

|

| Net sales |

|

|

100.0 |

% |

|

|

100.0 |

% |

| Cost of sales |

|

|

75.5 |

% |

|

|

76.9 |

% |

|

Gross profit |

|

|

24.5 |

% |

|

|

23.1 |

% |

| Selling, general and

administrative expenses |

|

|

25.1 |

% |

|

|

28.4 |

% |

| Asset impairments |

|

|

0.1 |

% |

|

|

— |

% |

|

Operating loss |

|

|

(0.7 |

)% |

|

|

(5.3 |

)% |

| Interest income, net |

|

|

(0.9 |

)% |

|

|

(0.2 |

)% |

| Other loss, net |

|

|

— |

% |

|

|

— |

% |

|

Income (loss) before income taxes |

|

|

0.2 |

% |

|

|

(5.1 |

)% |

| Income tax expense, net |

|

|

0.1 |

% |

|

|

0.2 |

% |

| Net income (loss) |

|

|

0.1 |

% |

|

|

(5.3 |

)% |

GameStop Corp.

Consolidated Balance Sheets

(in millions)

(unaudited) |

| |

| |

|

February 3,

2024 |

|

January 28,

2023 |

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

921.7 |

|

$ |

1,139.0 |

|

Marketable securities |

|

|

277.6 |

|

|

251.6 |

|

Receivables, net of allowance of $4.4 and $2.2, respectively |

|

|

91.0 |

|

|

153.9 |

|

Merchandise inventories, net |

|

|

632.5 |

|

|

682.9 |

|

Prepaid expenses and other current assets |

|

|

51.4 |

|

|

96.3 |

|

Total current assets |

|

|

1,974.2 |

|

|

2,323.7 |

| Property and equipment, net of

accumulated depreciation of $851.2 and $1,006.8, respectively |

|

|

94.9 |

|

|

136.5 |

| Operating lease right-of-use

assets |

|

|

555.8 |

|

|

560.8 |

| Deferred income taxes |

|

|

17.3 |

|

|

18.3 |

| Other noncurrent assets |

|

|

66.8 |

|

|

74.1 |

|

Total assets |

|

$ |

2,709.0 |

|

$ |

3,113.4 |

| |

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

324.0 |

|

$ |

531.3 |

|

Accrued liabilities and other current liabilities |

|

|

412.0 |

|

|

602.3 |

|

Current portion of operating lease liabilities |

|

|

187.7 |

|

|

194.7 |

|

Current portion of long-term debt |

|

|

10.8 |

|

|

10.8 |

|

Total current liabilities |

|

|

934.5 |

|

|

1,339.1 |

| Long-term debt |

|

|

17.7 |

|

|

28.7 |

| Operating lease

liabilities |

|

|

386.6 |

|

|

382.4 |

| Other long-term

liabilities |

|

|

31.6 |

|

|

40.9 |

|

Total liabilities |

|

|

1,370.4 |

|

|

1,791.1 |

|

Stockholders’ equity |

|

|

1,338.6 |

|

|

1,322.3 |

|

Total liabilities and stockholders’ equity |

|

$ |

2,709.0 |

|

$ |

3,113.4 |

GameStop Corp.

Consolidated Statements of Cash Flows

(in millions)

(unaudited) |

| |

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

| Cash flows from operating

activities: |

|

|

|

|

|

Net income |

|

$ |

63.1 |

|

|

$ |

48.2 |

|

|

Adjustments to reconcile net income to net cash flows from

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

18.6 |

|

|

|

14.2 |

|

|

Gain on sale of digital assets |

|

|

— |

|

|

|

(0.1 |

) |

|

Digital asset impairments |

|

|

— |

|

|

|

0.1 |

|

|

Asset impairments |

|

|

4.8 |

|

|

|

0.2 |

|

|

Stock-based compensation expense, net |

|

|

8.2 |

|

|

|

7.9 |

|

|

Deferred income taxes |

|

|

(0.1 |

) |

|

|

(2.6 |

) |

|

Loss (gain) on disposal of property and equipment, net |

|

|

6.5 |

|

|

|

(2.6 |

) |

|

Other, net |

|

|

(2.1 |

) |

|

|

(5.7 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Receivables, net |

|

|

(0.7 |

) |

|

|

(30.1 |

) |

|

Merchandise inventories, net |

|

|

397.0 |

|

|

|

474.6 |

|

|

Prepaid expenses and other assets |

|

|

4.7 |

|

|

|

13.5 |

|

|

Prepaid income taxes and income taxes payable |

|

|

2.7 |

|

|

|

171.5 |

|

|

Accounts payable and accrued liabilities |

|

|

(512.2 |

) |

|

|

(354.9 |

) |

|

Operating lease right-of-use assets and lease liabilities |

|

|

(1.0 |

) |

|

|

2.8 |

|

|

Changes in other long-term liabilities |

|

|

(0.5 |

) |

|

|

1.2 |

|

|

Net cash flows (used in) provided by operating activities |

|

|

(11.0 |

) |

|

|

338.2 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

Capital expenditures |

|

|

(7.7 |

) |

|

|

(11.6 |

) |

|

Purchases of marketable securities |

|

|

(13.8 |

) |

|

|

(39.8 |

) |

|

Proceeds from maturities of marketable securities |

|

|

42.1 |

|

|

|

27.5 |

|

|

Proceeds from sale of digital assets |

|

|

— |

|

|

|

4.5 |

|

|

Other |

|

|

— |

|

|

|

0.3 |

|

|

Net cash flows provided by (used in) investing activities |

|

|

20.6 |

|

|

|

(19.1 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

Repayments of French term loans |

|

|

(2.7 |

) |

|

|

(3.9 |

) |

|

Settlement of stock-based awards |

|

|

(0.8 |

) |

|

|

(0.7 |

) |

|

Net cash flows used in financing activities |

|

|

(3.5 |

) |

|

|

(4.6 |

) |

| Exchange rate effect on cash,

cash equivalents and restricted cash |

|

|

3.6 |

|

|

|

22.0 |

|

| Increase in cash, cash

equivalents and restricted cash |

|

|

9.7 |

|

|

|

336.5 |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

929.2 |

|

|

|

859.5 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

938.9 |

|

|

$ |

1,196.0 |

|

| |

|

|

|

|

GameStop Corp.

Consolidated Statements of Cash Flows

(in millions)

(unaudited) |

| |

| |

|

53 weeks ended

February 3, 2024 |

|

52 weeks ended

January 28, 2023 |

| Cash flows from operating

activities: |

|

|

|

|

|

Net income (loss) |

|

$ |

6.7 |

|

|

$ |

(313.1 |

) |

|

Adjustments to reconcile net income (loss) to net cash flows from

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

56.2 |

|

|

|

61.7 |

|

|

Asset impairments |

|

|

4.8 |

|

|

|

2.7 |

|

|

Stock-based compensation expense, net |

|

|

22.2 |

|

|

|

40.1 |

|

|

Gain on sale of digital assets |

|

|

— |

|

|

|

(7.2 |

) |

|

Digital asset impairments |

|

|

— |

|

|

|

34.0 |

|

|

Deferred income taxes |

|

|

(0.1 |

) |

|

|

(2.6 |

) |

|

Loss on disposal of property and equipment, net |

|

|

1.5 |

|

|

|

2.5 |

|

|

Other, net |

|

|

0.8 |

|

|

|

1.2 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Receivables, net |

|

|

65.0 |

|

|

|

(16.8 |

) |

|

Merchandise inventories, net |

|

|

39.9 |

|

|

|

229.6 |

|

|

Prepaid expenses and other assets |

|

|

10.4 |

|

|

|

(25.2 |

) |

|

Prepaid income taxes and income taxes payable |

|

|

(2.4 |

) |

|

|

172.4 |

|

|

Accounts payable and accrued liabilities |

|

|

(397.7 |

) |

|

|

(66.2 |

) |

|

Operating lease right-of-use assets and lease liabilities |

|

|

(8.1 |

) |

|

|

(4.9 |

) |

|

Changes in other long-term liabilities |

|

|

(2.9 |

) |

|

|

— |

|

|

Net cash flows (used in) provided by operating

activities |

|

|

(203.7 |

) |

|

|

108.2 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

Capital expenditures |

|

|

(34.9 |

) |

|

|

(55.9 |

) |

|

Purchases of marketable securities |

|

|

(326.8 |

) |

|

|

(276.8 |

) |

|

Proceeds from maturities and sales of marketable securities |

|

|

312.6 |

|

|

|

27.5 |

|

|

Proceeds from sale of property and equipment |

|

|

13.1 |

|

|

|

— |

|

|

Proceeds from sale of digital assets |

|

|

2.8 |

|

|

|

81.9 |

|

|

Other |

|

|

— |

|

|

|

0.6 |

|

|

Net cash flows used in investing activities |

|

|

(33.2 |

) |

|

|

(222.7 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

Repayments of French term loans |

|

|

(10.7 |

) |

|

|

(3.9 |

) |

|

Settlement of stock-based awards |

|

|

(0.9 |

) |

|

|

(4.0 |

) |

|

Net cash flows used in financing activities |

|

|

(11.6 |

) |

|

|

(7.9 |

) |

| Exchange rate effect on cash,

cash equivalents and restricted cash |

|

|

(8.6 |

) |

|

|

(1.5 |

) |

| Decrease in cash, cash

equivalents and restricted cash |

|

|

(257.1 |

) |

|

|

(123.9 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

1,196.0 |

|

|

|

1,319.9 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

938.9 |

|

|

$ |

1,196.0 |

|

GameStop Corp.

Schedule I

Sales Mix

(in millions)

(unaudited) |

| |

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

| Net Sales: |

|

Net

Sales |

|

Percent

of Total |

|

Net

Sales |

|

Percent

of Total |

| |

|

|

|

|

|

|

|

|

|

Hardware and accessories(1) |

|

$ |

1,094.6 |

|

61.0 |

% |

|

$ |

1,242.8 |

|

55.8 |

% |

| Software(2) |

|

|

465.3 |

|

26.0 |

% |

|

|

670.4 |

|

30.1 |

% |

| Collectibles |

|

|

233.7 |

|

13.0 |

% |

|

|

313.2 |

|

14.1 |

% |

|

Total |

|

$ |

1,793.6 |

|

100.0 |

% |

|

$ |

2,226.4 |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

53 weeks ended

February 3, 2024 |

|

52 weeks ended

January 28, 2023 |

| Net Sales: |

|

Net

Sales |

|

Percent

of Total |

|

Net

Sales |

|

Percent

of Total |

| |

|

|

|

|

|

|

|

|

| Hardware and

accessories(1) |

|

$ |

2,996.8 |

|

56.8 |

% |

|

$ |

3,140.0 |

|

53.0 |

% |

| Software(2) |

|

|

1,522.0 |

|

28.9 |

% |

|

|

1,822.6 |

|

30.7 |

% |

| Collectibles |

|

|

754.0 |

|

14.3 |

% |

|

|

964.6 |

|

16.3 |

% |

|

Total |

|

$ |

5,272.8 |

|

100.0 |

% |

|

$ |

5,927.2 |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

| (1) Includes

sales of new and pre-owned hardware, accessories, hardware bundles

in which hardware and digital or physical software are sold

together in a single SKU, interactive game figures, strategy

guides, mobile and consumer electronics. |

| (2) Includes

sales of new and pre-owned gaming software, digital software and PC

entertainment software. |

GameStop Corp.

Schedule II

(in millions)

(unaudited) |

Non-GAAP results

The

following tables reconcile the Company's SG&A expenses,

operating earnings (loss), net income (loss) and earnings (loss)

per share as presented in its consolidated statements of operations

and prepared in accordance with U.S. generally accepted accounting

principles ("GAAP") to its adjusted SG&A expenses, adjusted

operating income (loss), adjusted net income (loss), adjusted

earnings (loss) per share and adjusted EBITDA. The diluted

weighted-average shares outstanding used to calculate adjusted

earnings per share may differ from GAAP weighted-average shares

outstanding. Under GAAP, basic and diluted weighted-average shares

outstanding are the same in periods where there is a net loss. The

tax adjustments below for the 14 and 53 weeks ended

February 3, 2024, respectively, include provisions for the tax

effects of non-GAAP adjustments. The reconciliations below are from

continuing operations only.

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

53 Weeks Ended

February 3, 2024 |

|

52 Weeks Ended

January 28, 2023 |

| Adjusted SG&A

Expenses |

|

|

|

|

|

|

|

|

|

SG&A expenses |

|

$ |

359.2 |

|

|

$ |

453.4 |

|

|

$ |

1,323.9 |

|

|

$ |

1,681.0 |

|

|

Transformation costs(1) |

|

|

(0.3 |

) |

|

|

(0.5 |

) |

|

|

(5.0 |

) |

|

|

(0.9 |

) |

| Adjusted SG&A

expenses |

|

$ |

358.9 |

|

|

$ |

452.9 |

|

|

$ |

1,318.9 |

|

|

$ |

1,680.1 |

|

| |

|

|

|

|

|

|

|

|

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

53 Weeks Ended

February 3, 2024 |

|

52 Weeks Ended

January 28, 2023 |

| Adjusted Operating

Income (Loss) |

|

|

|

|

|

|

|

|

|

Operating earnings (loss) |

|

$ |

55.2 |

|

$ |

46.2 |

|

$ |

(34.5 |

) |

|

$ |

(311.6 |

) |

|

Transformation costs(1) |

|

|

0.3 |

|

|

0.5 |

|

|

5.0 |

|

|

|

0.9 |

|

|

Asset impairments |

|

|

4.8 |

|

|

0.2 |

|

|

4.8 |

|

|

|

2.7 |

|

| Adjusted operating income

(loss) |

|

$ |

60.3 |

|

$ |

46.9 |

|

$ |

(24.7 |

) |

|

$ |

(308.0 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

53 Weeks Ended

February 3, 2024 |

|

52 Weeks Ended

January 28, 2023 |

| Adjusted Net Income

(Loss) |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

63.1 |

|

|

$ |

48.2 |

|

$ |

6.7 |

|

$ |

(313.1 |

) |

|

Transformation costs(1) |

|

|

0.3 |

|

|

|

0.5 |

|

|

5.0 |

|

|

0.9 |

|

|

Asset impairments |

|

|

4.8 |

|

|

|

0.2 |

|

|

4.8 |

|

|

2.7 |

|

|

Divestitures and other(2) |

|

|

(0.5 |

) |

|

|

— |

|

|

0.9 |

|

|

— |

|

| Adjusted net income

(loss) |

|

$ |

67.7 |

|

|

$ |

48.9 |

|

$ |

17.4 |

|

$ |

(309.5 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Adjusted Earnings

(Loss) Per Share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.22 |

|

|

$ |

0.16 |

|

$ |

0.06 |

|

$ |

(1.02 |

) |

|

Diluted |

|

$ |

0.22 |

|

|

$ |

0.16 |

|

$ |

0.06 |

|

$ |

(1.02 |

) |

| |

|

|

|

|

|

|

|

|

| Number of shares used in

adjusted calculation |

|

|

|

|

|

|

|

|

|

Basic |

|

|

305.6 |

|

|

|

304.3 |

|

|

305.1 |

|

|

304.2 |

|

|

Diluted |

|

|

305.7 |

|

|

|

304.5 |

|

|

305.2 |

|

|

304.2 |

|

| |

|

|

|

|

|

|

|

|

(1) For the fourth

quarter and fiscal year 2023, transformation costs include

severance, stock-based compensation forfeitures related to

workforce optimization efforts in the U.S., and other costs in

connection with our transformation initiatives. This amount

excludes accelerated lease amortization and fixed asset costs which

have not been factored into our non-GAAP measures. For the fourth

quarter and fiscal year 2022, transformation costs includes the

impact of stock-based compensation forfeitures partially offset by

cash severance costs related to workforce optimization efforts in

connection with our transformation initiatives.

(2) Divestitures and other includes an overall net loss from our

divestiture of business operations in Europe. |

| |

|

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

53 Weeks Ended

February 3, 2024 |

|

52 Weeks Ended

January 28, 2023 |

| Reconciliation of

Adjusted EBITDA to Net Income (Loss) |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

63.1 |

|

|

$ |

48.2 |

|

|

$ |

6.7 |

|

|

$ |

(313.1 |

) |

|

Interest income, net |

|

|

(15.3 |

) |

|

|

(6.2 |

) |

|

|

(49.5 |

) |

|

|

(9.5 |

) |

|

Depreciation and amortization |

|

|

18.6 |

|

|

|

14.2 |

|

|

|

56.2 |

|

|

|

61.7 |

|

|

Income tax expense, net |

|

|

7.9 |

|

|

|

4.2 |

|

|

|

6.4 |

|

|

|

11.0 |

|

| EBITDA |

|

$ |

74.3 |

|

|

$ |

60.4 |

|

|

$ |

19.8 |

|

|

$ |

(249.9 |

) |

|

Stock-based compensation expense |

|

|

9.1 |

|

|

|

21.4 |

|

|

|

34.2 |

|

|

|

53.6 |

|

|

Transformation costs(1) |

|

|

0.3 |

|

|

|

0.5 |

|

|

|

5.0 |

|

|

|

0.9 |

|

|

Asset impairments |

|

|

4.8 |

|

|

|

0.2 |

|

|

|

4.8 |

|

|

|

2.7 |

|

|

Divestitures and other(2) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

0.9 |

|

|

|

— |

|

| Adjusted EBITDA |

|

$ |

88.0 |

|

|

$ |

82.5 |

|

|

$ |

64.7 |

|

|

$ |

(192.7 |

) |

| |

|

|

|

|

|

|

|

|

(1) For the fourth

quarter and fiscal year 2023, transformation costs include

severance, stock-based compensation forfeitures related to

workforce optimization efforts in the U.S., and other costs in

connection with our transformation initiatives. This amount

excludes accelerated lease amortization and fixed asset costs which

have not been factored into our non-GAAP measures. For the fourth

quarter and fiscal year 2022, transformation costs includes the

impact of stock-based compensation forfeitures partially offset by

cash severance costs related to workforce optimization efforts in

connection with our transformation initiatives.

(2) Divestitures and other includes an overall net loss from our

divestiture of business operations in Europe.

|

GameStop Corp.

Schedule III

(in millions)

(unaudited) |

Non-GAAP results

The following table reconciles the Company's

cash flows (used in) provided by operating activities as presented

in its Consolidated Statements of Cash Flows and prepared in

accordance with GAAP to its free cash flow. Free cash flow is

considered a non-GAAP financial measure. Management believes,

however, that free cash flow, which measures our ability to

generate additional cash from our business operations, is an

important financial measure for use by investors in evaluating the

Company’s financial performance.

| |

14 Weeks Ended

February 3, 2024 |

|

13 Weeks Ended

January 28, 2023 |

|

53 Weeks Ended

February 3, 2024 |

|

52 Weeks Ended

January 28, 2023 |

|

Net cash flows (used in) provided by operating activities |

$ |

(11.0 |

) |

|

$ |

338.2 |

|

|

$ |

(203.7 |

) |

|

$ |

108.2 |

|

|

Capital expenditures |

|

(7.7 |

) |

|

|

(11.6 |

) |

|

|

(34.9 |

) |

|

|

(55.9 |

) |

| Free cash flow |

$ |

(18.7 |

) |

|

$ |

326.6 |

|

|

$ |

(238.6 |

) |

|

$ |

52.3 |

|

Non-GAAP Measures and Other Metrics

Adjusted EBITDA, adjusted SG&A expenses,

adjusted operating income (loss), adjusted net income (loss), and

adjusted earnings (loss) per share are supplemental financial

measures of the Company’s performance that are not required by, or

presented in accordance with GAAP. We believe that the presentation

of these non-GAAP financial measures provides useful information to

investors in assessing our financial condition and results of

operations.

We define adjusted EBITDA as net income (loss)

before income taxes, plus net interest income, depreciation and

amortization, stock-based compensation expense, transformation

costs, business divestitures, fixed asset impairments, severance

and certain other non-cash charges. Net income (loss) is the GAAP

financial measure most directly comparable to adjusted EBITDA. Our

non-GAAP financial measures should not be considered as an

alternative to the most directly comparable GAAP financial measure.

Furthermore, non-GAAP financial measures have limitations as an

analytical tool because they exclude some but not all items that

affect the most directly comparable GAAP financial measures. Some

of these limitations include:

- certain items excluded from

adjusted EBITDA are significant components in understanding and

assessing a company’s financial performance, such as a company’s

cost of capital and tax structure;

- adjusted EBITDA does not reflect

our cash expenditures or future requirements for capital

expenditures or contractual commitments;

- adjusted EBITDA does not reflect

changes in, or cash requirements for our working capital

needs;

- although depreciation and

amortization are non-cash charges, the assets being depreciated and

amortized will often have to be replaced in the future, and

adjusted EBITDA does not reflect any cash requirements for such

replacements; and

- our computations of adjusted EBITDA

may not be comparable to other similarly titled measures of other

companies.

We compensate for the limitations of adjusted

EBITDA, adjusted SG&A expenses, adjusted operating income

(loss), adjusted net income (loss), and adjusted earnings (loss)

per share as analytical tools by reviewing the comparable GAAP

financial measure, understanding the differences between the GAAP

and non-GAAP financial measures and incorporating these data points

into our decision-making process. Adjusted EBITDA, adjusted

SG&A expenses, adjusted operating income (loss), adjusted net

income (loss), and adjusted earnings (loss) per share is provided

in addition to, and not as an alternative to, the Company’s

financial results prepared in accordance with GAAP, and should not

be considered in isolation or as a substitute for analysis of our

results as reported under GAAP. Because adjusted EBITDA, adjusted

SG&A expenses, adjusted operating income (loss), adjusted net

income (loss), and adjusted earnings (loss) per share may be

defined and determined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

Contact

GameStop Corp. Investor Relations

(817) 424-2001

ir@gamestop.com

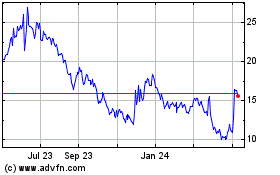

GameStop (NYSE:GME)

Historical Stock Chart

From Mar 2024 to Apr 2024

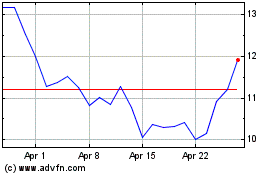

GameStop (NYSE:GME)

Historical Stock Chart

From Apr 2023 to Apr 2024