UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

iClick

Interactive Asia Group Limited

(Name

of Issuer)

Class

A ordinary shares, $0.001 par value per share

(Title

of Class of Securities)

G47048

106

(CUSIP

Number)

November

24, 2023

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing

on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

2 of 8 |

| 1. |

NAME

OF REPORTING PERSON:

Hui Tung

Wai |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐ (b)

☐ |

|

| 3. |

SEC USE

ONLY

|

|

| 4. |

SOURCE

OF FUNDS

PF |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e): ☐

|

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Hong

Kong, China |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

143,345

Class A ordinary shares |

| 8. |

SHARED

VOTING POWER

-0- |

| 9. |

SOLE

DISPOSITIVE POWER

143,345

Class A ordinary shares |

| 10. |

SHARED

DISPOSITIVE POWER

-0- |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

143,345

Class A ordinary shares |

|

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.3%1

|

|

| 14. |

TYPE

OF REPORTING PERSON

IN |

|

| 1 | The

percent ownership calculation assumes that there is a total of 44,477,356 Class A Ordinary

Shares outstanding, as specified in the Merger Agreement (as defined herein) filed by the

Issuer with the U.S. Securities and Exchange Commission (the “SEC”) on

November 24, 2023. |

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

3 of 8 |

| 1. |

NAME

OF REPORTING PERSON:

Cheer

Lead Global Limited |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐ (b)

☐ |

|

| 3. |

SEC USE

ONLY

|

|

| 4. |

SOURCE

OF FUNDS

PF |

|

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e): ☐

|

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British

Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

143,345

Class A ordinary shares |

| 8. |

SHARED

VOTING POWER

-0- |

| 9. |

SOLE

DISPOSITIVE POWER

143,345

Class A ordinary shares |

| 10. |

SHARED

DISPOSITIVE POWER

-0- |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

143,345

Class A ordinary shares |

|

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.3%2

|

|

| 14. |

TYPE

OF REPORTING PERSON

CO |

|

| 2 | The

percent ownership calculation assumes that there is a total of 44,477,356 Class A Ordinary

Shares outstanding, as specified in the Merger Agreement filed by the Issuer with the SEC

on November 24, 2023. |

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

4 of 8 |

| ITEM

1. | SECURITIES

AND ISSUER |

This

Schedule 13D relates to Class A ordinary shares, par value $0.001 per share (the “Class A Ordinary Shares”), of iClick

Interactive Asia Group Limited, a company incorporated in the Cayman Islands (the “Issuer”), which address and principal

executive office is 15/F Prosperity Millennia Plaza, 663 King’s Road, Quarry Bay, Hong Kong S.A.R., People’s Republic of

China.

The

Issuer’s ordinary shares consist of Class A Ordinary Shares and Class B ordinary shares, par value of $0.001 per share (the “Class

B Ordinary Shares,” together with the Class A Ordinary Shares, the “Ordinary Shares”). The rights of the

holders of Class A Ordinary Shares and Class B Ordinary Shares are identical, except with respect to conversion rights and voting rights.

Each Class B Ordinary Share is convertible at the option of the holder at any time into one Class A Ordinary Share. Each Class B Ordinary

Share is entitled to twenty (20) votes per share, whereas each Class A Ordinary Share is entitled to one (1) vote per share.

The

Issuer’s American Depositary Shares (the “ADSs”) (one representing five Class A Ordinary Shares) are listed

on the NASDAQ Global Market under the symbol “ICLK.”

| Item

2. | Identity

and Background |

| (a) | This

Schedule 13D is being filed jointly on behalf of (1) Hui Tung Wai, a citizen of the People’s

Republic of China, and (2) Cheer Lead Global Limited (“Cheer Lead Global”),

a British Virgin Islands company (each a “Reporting Person” or collectively,

the “Reporting Persons”). |

| (b) | The

principal business address of the Reporting Persons is Unit 1803, 18/F, Stelux House, 698

Prince Edward Road East, San Po Kong. |

| (c) | Mr.

Hui is the sole shareholder and sole director of Cheer Lead Global. Mr. Hui’s principal

occupation is as Director of Infinity Global Fund SPC and Infinity Capital (Cayman Islands)

Limited, both of which are investment holding companies. The principal business of Cheer

Lead Global is the acquiring, holding, managing, supervising and disposing of investments

for its sole shareholder. |

| (d) | During

the last five years, none of the Reporting Persons has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors). |

| (e) | During

the last five years, none of the Reporting Persons has been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws. |

| (f) | See

paragraph (a) above for the citizenship of the Reporting Persons. |

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

5 of 8 |

| ITEM 3. |

SOURCE AND AMOUNT OF

FUNDS OR OTHER CONSIDERATION |

No

Class A Ordinary Shares were purchased by the Reporting Persons in connection with the transaction giving rise to the filing of

this Schedule 13D and thus no funds were used by any of the Reporting Persons for such purpose.

On

November 24, 2023, the Issuer entered into an Agreement and Plan of Merger (the “Merger Agreement”) with TSH Investment

Holding Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (“Parent”)

and TSH Merger Sub Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly-owned

subsidiary of Parent (“Merger Sub”), pursuant to which, and subject to the terms and conditions thereof, Merger Sub

will merge with and into the Issuer, with the Issuer continuing as the surviving company and becoming a wholly-owned subsidiary of Parent

(the “Merger”). The descriptions of the Merger and the Merger Agreement set forth in Item 4 below are incorporated

by reference in their entirety in this Item 3. The information disclosed in this paragraph does not purport to be complete and is qualified

in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 99.2 and is incorporated herein by reference

in its entirety.

It

is anticipated that the Buyer Group (as defined below) intend to fund the Merger through a combination of (i) equity financing provided

by the Sponsor (as defined below) in an aggregate amount of up to US$8,000,000 in cash pursuant to an equity commitment letter, dated

November 24, 2023, by and among Huang Jianjun and Rise Chain Investment Limited (together, the “Sponsor”) and Parent,

(ii) rollover financing comprised of the Rollover Shares (as defined below) pursuant to the Support Agreement (as defined below), and

(iii) debt financing provided by New Age SP II (“Lender”) pursuant to a facility agreement, dated as

of November 24, 2023, by and between Merger Sub and Lender.

The

information set forth in or incorporated by reference in Items 4 and 5 of this Schedule 13D is incorporated by reference in its entirety

into this Item 3.

| ITEM 4. |

PURPOSE OF TRANSACTION |

On

November 24, 2023, the Issuer announced in a press release that it had entered into the Merger Agreement with Parent and Merger Sub,

pursuant to which, and subject to the terms and conditions thereof, Merger Sub will merge with and into the Issuer, with the Issuer continuing

as the surviving company and becoming a wholly-owned subsidiary of Parent.

Pursuant to the Merger Agreement, at the effective time of

the Merger (the “Effective Time”), each Ordinary Share issued and outstanding immediately prior to the Effective Time,

will be cancelled in exchange for the right to receive US$0.816 in cash per Ordinary Share without interest, except for (i) the Ordinary

Shares held by Parent and Merger Sub, (ii) the Ordinary Shares held by the Issuer and any of its subsidiaries or in its treasury, (iii)

the Ordinary Shares owned by Igomax Inc., Jian Tang, Bubinga Holdings Limited, Wing Hong Sammy Hsieh (collectively, the “Founders

Group”) and Huang Jianjun (the Founders Group, together with Mr. Huang and Rise Chain Investment Limited, a company wholly

owned by Mr. Huang, the “Buyer Group”), Marine Central Limited, Creative Big Limited, Cheer Lead Global Limited, Huge

Superpower Limited, Capable Excel Limited, Infinity Global Fund SPC, Integrated Asset Management (Asia) Limited, Chan Nai Hang, Likeable

Limited, Tsang Hing Sze, Lau Ying Wai, Chik Yu Chung Roni, Tse Kok Yu Ryan, Imen Pang, Zhao Yong and Yang Xin (such shareholders collectively,

but excluding Rise Chain Investment Limited, the “Rollover Shareholders”, and such Ordinary Shares, the “Rollover

Shares”), (iv) the Ordinary Shares held by the Issuer and the depositary of the Issuer’s ADS program and reserved for

issuance and allocation pursuant to the Issuer’s share incentive plan ((i) – (iv), collectively, the “Excluded Shares”),

and (v) the Ordinary Shares that are held by shareholders who have validly exercised and not effectively withdrawn or lost their rights

to dissent from the Merger pursuant to Section 238 of Companies Act (Revised) of the Cayman Islands (the “Dissenting Shares”).

Immediately prior to the effective time of the Merger, the Rollover Shares will be cancelled for no cash consideration, and the Rollover

Shareholders will subscribe for or otherwise receive newly issued shares of Parent. Each Dissenting Share issued and outstanding immediately

prior to the Effective Time will be cancelled for the right to receive the fair value of such Shares determined in accordance with, the

provisions of Section 238 of the Companies Act (Revised) of the Cayman Islands.

Each

ADS issued and outstanding immediately prior to the Effective Time (other than ADSs representing the Excluded Shares), together with

each Ordinary Share represented by such ADSs, will be cancelled in exchange for the right to receive US$4.08 in cash per ADS without

interest.

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

6 of 8 |

The

Merger, which is currently expected to close in the first quarter of 2024, is subject to customary closing conditions including an affirmative

vote of shareholders representing at least two-thirds of the voting power of the outstanding Ordinary Shares present and voting in person

or by proxy at a meeting of the Issuer’s shareholders. The purpose of the Transactions (as defined below), including the Merger,

is to acquire all of the shares of the Ordinary Shares held by shareholders of the Issuer other than the Rollover Shares.

Following

consummation of the Merger, the Issuer will become a wholly-owned subsidiary of the Parent. In addition, if the Merger is consummated,

the Issuer will be privately-held by the Rollover Shareholders, including the Reporting Persons, and its ADSs will no longer be listed

on the Nasdaq Global Market.

Concurrently

with the execution of the Merger Agreement, Parent and the Rollover Shareholders executed a support agreement (the “Support

Agreement”), pursuant to which, each of the Rollover Shareholders has agreed to, subject to the terms and conditions set forth

therein and among other obligations, (i) the cancellation of the Rollover Shares held by such Rollover Shareholders for no consideration,

(ii) subscribe for newly issued ordinary shares of Parent immediately prior to the closing of the Merger and (iii) vote in

favor of authorization and approval of the Merger Agreement and the transactions contemplated by the Merger Agreement (the “Transactions”),

including the Merger. The information disclosed in this paragraph does not purport to be complete and is qualified in its entirety by

reference to the Support Agreement, a copy of which is filed as Exhibit 99.3 and incorporated herein by reference

in its entirety.

The

information set forth in Item 3 is incorporated herein by reference in its entirety.

Except

as described above, the Reporting Persons have no plans or proposals which relate to or would result in any of the actions specified

in paragraphs (a) through (j) of Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, formulate

other purposes, plans or proposals regarding the Issuer, or any other actions that could involve one or more of the types of transactions

or have one or more of the results described in paragraphs (a) through (j) of Item 4 of Schedule 13D.

| ITEM 5. |

INTEREST IN SECURITIES

OF THE ISSUER |

| (a)-(b) | The

responses of each of the Reporting Persons with respect to Rows 11, 12, and 13 of the cover

pages of this Schedule 13D that relate to the aggregate number and percentage of Class

A Ordinary Shares (including but not limited to footnotes to such information) are incorporated

herein by reference. |

The

responses of each of the Reporting Persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Schedule 13D that relate

to the number of Class A Ordinary Shares as to which such Reporting Persons have sole or shared power to vote or to direct the vote of

and sole or shared power to dispose of or to direct the disposition of (including but not limited to footnotes to such information) are

incorporated herein by reference.

As

a result of entering into the Support Agreement, the Reporting Persons may be deemed to be a member of a “group” with certain

other shareholders of the Issuer that entered into the Support Agreement (collectively, the “Other Rollover Shareholders,”

and with the Reporting Persons, the “Rollover Shareholders Group”) pursuant to Section 13(d) of the Exchange

Act, who are separately reporting beneficial ownership on Schedules 13D. The Rollover Shareholders Group is deemed to collectively own

17,492,686 Class A Ordinary Shares in the aggregate, representing 13,107,608 Class A Ordinary Shares (including 10,107,975

Class A Ordinary Shares represented by 2,021,595 ADSs) and 4,385,078 Class A Ordinary Shares issuable upon conversion of 4,385,078

Class B Ordinary Shares held by the Rollover Shareholders Group. Such aggregate ownership represents 39% of the outstanding Class A

Ordinary Shares and 69% of the total voting power of the Ordinary Shares (Class A Ordinary Shares and Class B Ordinary Shares, which

vote together) as of November 24, 2023.

However,

each Reporting Person expressly disclaims beneficial ownership of the Ordinary Shares beneficially owned (or deemed to be beneficially

owned) by any of the Other Rollover Shareholders and neither the filing of this Schedule 13D nor any of its contents shall be deemed

to constitute an admission that any of the Reporting Persons beneficially owns any Ordinary Shares that are beneficially owned (or deemed

to be beneficially owned) by any of the Other Rollover Shareholders.

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

7 of 8 |

The

Reporting Persons are only responsible for the information contained in this Schedule 13D and assume no responsibility for information

contained in the Schedules 13D filed by the Other Rollover Shareholders. The filing of this Schedule 13D shall not be construed as an

admission that any of the Reporting Persons is, for purposes of Section 13(d) or 13(g) of the Act or for any other purpose, the

beneficial owner of any securities (other than the securities directly held by such Reporting Person) covered by this Schedule 13D.

The

information set forth in Items 2 and 4 above is hereby incorporated by reference. Mr. Hui is the sole shareholder and sole director of

Cheer Lead Global. Pursuant to Section 13(d) of the Exchange Act and the rules promulgated thereunder, Mr. Hui may be

deemed to beneficially own all of the Class A Ordinary Shares held by Cheer Lead Global.

| (c) | Except

as disclosed in this Schedule 13D, the Reporting Persons have not entered into any transactions

in the Ordinary Shares (including Class A Ordinary Shares represented by ADSs) during the

past sixty days. |

| (d) | Except

as disclosed in this Schedule 13D, no person is known to have the right to receive or the

power to direct the receipt of dividends from, or the proceeds from the sale of, the Class

A Ordinary Shares, other than the Reporting Persons. |

| ITEM 6. |

CONTRACTS, ARRANGEMENTS,

UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER. |

The

information set forth in Items 3, 4 and 5 of this Schedule 13D is hereby incorporated by reference in its entirety into this Item 6.

Except as otherwise described herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between

the Reporting Persons and any other person with respect to the voting or disposition of the Class A Ordinary Shares owned by the Reporting

Persons.

| ITEM

7. | MATERIAL

TO BE FILED AS EXHIBITS |

| Exhibit 99.1 |

|

Joint Filing Agreement, dated December 14, 2023, by and between the Reporting Persons. |

| Exhibit 99.2 |

|

Agreement

and Plan of Merger, dated as of November 24, 2023, by and between TSH Investment Holding Limited, TSH Merger Sub Limited and iClick

Interactive Asia Group Limited, incorporated herein by reference to Exhibit 99.2 to the Report on Form 6-K furnished by

the Issuer to the SEC on November 24, 2023. |

| Exhibit 99.3 |

|

Support

Agreement, dated November 24, 2023, by and among TSH Investment Holding Limited, Igomax Inc., Jian Tang, Bubinga Holdings Limited,

Wing Hong Sammy Hsieh, Huang Jianjun, Marine Central Limited, Creative Big Limited, Cheer Lead Global Limited, Huge Superpower Limited,

Capable Excel Limited, Infinity Global Fund SPC, Integrated Asset Management (Asia) Limited, Chang Nai Hang, Likeable Limited, Tsang

Hing Sze, Lau Ying Wai, Chik Yu Chung Roni, Tse Kok Yu Ryan, Imen Pang, Zhao Yong and Yang Xin, incorporated herein by reference

to Exhibit 99.5 to the Schedule 13D/A filed by the Founders Group with the SEC on November 27, 2023. |

CUSIP

No. G47048 106 |

SCHEDULE

13D |

Page

8 of 8 |

SIGNATURE

After

reasonable inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated:

December 14, 2023 |

Hui

Tung Wai |

| |

|

|

| |

/s/

Hui Tung Wai |

| |

Hui

Tung Wai |

| |

|

|

| |

Cheer

Lead Global Limited |

| |

|

|

| |

By: |

/s/

Hui Tung Wai |

| |

Name: |

Hui

Tung Wai |

| |

Title: |

Director |

Exhibit

99.1

AGREEMENT

OF JOINT FILING

The

parties listed below agree that the Schedule 13D to which this agreement is attached as an exhibit, and all further amendments thereto,

shall be filed on behalf of each of them. This Agreement is intended to satisfy Rule 13d-1(k)(1) under the Securities Exchange Act of

1934, as amended. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of

which together shall constitute one and the same instrument.

Dated:

December 14, 2023 |

Hui

Tung Wai |

| |

|

|

| |

/s/

Hui Tung Wai |

| |

Hui

Tung Wai |

| |

|

|

| |

Cheer

Lead Global Limited |

| |

|

|

| |

By: |

/s/

Hui Tung Wai |

| |

Name: |

Hui

Tung Wai |

| |

Title: |

Director |

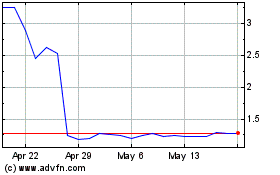

iClick Interactive Asia (NASDAQ:ICLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

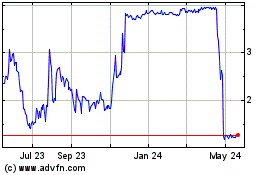

iClick Interactive Asia (NASDAQ:ICLK)

Historical Stock Chart

From Apr 2023 to Apr 2024