UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities

Exchange Act of 1934

(Amendment No. 2)

Swvl Holdings Corp.

(Name of Issuer)

Class A Ordinary

Shares, par value $0.0025 per share

(Title of Class of

Securities)

G86302125

(CUSIP Number)

Mostafa Kandil

Swvl Holdings Corp.

The Offices 4, One

Central

Dubai World Trade Center

Dubai, United Arab

Emirates

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

January 11, 2024

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check

the following box ¨.

The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP No. 0001875609

| 1 |

|

NAMES OF REPORTING PERSONS

Mostafa Kandil |

| 2 |

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

(a) ¨ (b) þ

(1)

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS)

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE

OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE

OF ORGANIZATION

Egypt |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7 |

|

SOLE

VOTING POWER

451,743 |

| |

8 |

|

SHARED

VOTING POWER

0 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

451,743 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

451,743 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.6%(2) |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

| (1) |

This Schedule 13D/A is filed by Mostafa Kandil (the “Reporting Person”). The Reporting Person expressly disclaims status as a “group” for the purposes of this Schedule 13D. |

| (2) |

Based upon 6,791,605 Class A ordinary shares, $0.0025 par value per share (the “Class A Ordinary Shares”), issued and outstanding as of October 30, 2023, as reported in Swvl Corp’s (the “Issuer”) Annual Report on Form 20-F/A filed with the Securities and Exchange Commission (the “SEC”) on October 31, 2023. |

This Amendment No. 2 to Schedule 13D, which

amends and supplements the Schedule 13D initially filed with the SEC on April 7, 2022, as amended on Schedule 13D/A filed with the SEC

on January 8, 2024 (as amended, the “Schedule 13D”) by the Reporting Person, is being filed to reflect a material change

in the percentage of the Class A Ordinary Shares of the Issuer beneficially owned by the Reporting Person, as more fully described in

Item 6 below.

Item 1. Security and Issuer.

This Schedule 13D/A relates to the Ordinary

Shares of the Issuer.

The address of the principal executive office

of the Issuer is The Offices 4, One Central, Dubai World Trade Centre, Dubai, United Arab Emirates.

On January 5, 2023, the Issuer effected a

one-for-twenty-five reverse split of its Ordinary Shares. Unless indicated otherwise by the context, all share amounts in this Schedule

13D/A have been adjusted to give retroactive effect to the reverse stock split.

Item 2. Identity and Background.

There have been no material changes to the

information previously reported in the Schedule 13D with respect to the Reporting Person.

Item 3. Source or Amount of Funds

or Other Consideration.

“Item 3. Source and Amount of Funds or Other Consideration”

of the Schedule 13D is hereby amended to add the following:

The Reporting Person purchased the following Ordinary Shares in open

market transactions: 5 Ordinary Shares on December 28, 2023; 14,039 Ordinary Shares on December 29, 2023; 241 Ordinary Shares on January

2, 2024; 20,000 Ordinary Shares on January 3, 2024; 15,000 Ordinary Shares on January 4, 2024; 30,715 Ordinary Shares on January 5, 2024;

23,250 Ordinary Shares on January 8, 2024 and 46,500 Ordinary Shares on January 11, 2024, with his personal funds.

Item 4. Purpose of Transaction.

There have been no material changes to the information previously reported

in Item 4 of the Schedule 13D with respect to the Reporting Person.

Item 5. Interest in Securities

of the Issuer.

(a) The aggregate percentage of shares of

Class A Ordinary Shares reported beneficially owned by the Reporting Person is determined in accordance with SEC rules and is based

upon 6,791,605 shares of Class A Ordinary Shares outstanding, which is the total number of shares of Class A Ordinary Shares

outstanding as reported in the Issuer’s Annual Report on Form 20-F/A filed with the SEC on October 31, 2023. The applicable SEC

rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with

respect to those securities and include shares of Class A Ordinary Shares issuable upon the conversion or exercise of other securities

that are immediately convertible or exercisable, or are convertible or exercisable within 60 days of the filing of this Schedule. The

Reporting Person disclaims beneficial ownership of the securities held by Mahmoud Nouh Mohamed Mohamed Nouh, Ahmed Mahmoud Ismail Mohamed

Sabbah, DiGame Africa, VNV (Cyprus) Limited, Memphis Equity Ltd., Badia Impact Fund C.V., Blu Stone Ventures 1 Limited, Alcazar Fund 1

SPV 4, Luxor Capital Partners Offshore Master Fund, LP, Luxor Capital Partners, LP, Luxor Wavefront, LP, Lugard Road Capital Master Fund,

LP, and any other person from time to time party to the Shareholders Agreement.

(b) These shares are held directly by the

Reporting Person. Pursuant to the Shareholders Agreement, the Reporting Person (and each other shareholder party thereto) irrevocably

appointed as its proxy and attorney-in-fact the Issuer and any person designated in writing by the Issuer to vote or deliver

a written resolution in respect of the shares beneficially owned by him (and each other shareholder party thereto) in accordance with

the specified voting commitments further described below in Item 6. As such, the Issuer possesses power to direct the voting of the shares

beneficially owned by the Reporting Person with respect to the matters provided in the Shareholders Agreement.

The aggregate number and percentage of the

Class A Ordinary Shares beneficially owned by the Reporting Person and, for the Reporting Person, the number of shares as to which

there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the

disposition, or shared power to dispose or to direct the disposition are set forth on rows 7 through 11 and row 13 of the cover pages

of this Schedule 13D/A and are incorporated herein by reference.

(c) Except as set forth in this Schedule 13D/A,

the Reporting Person has not effected any transaction in Class A Ordinary Shares in the past 60 days.

(d) To the best knowledge of the Reporting

Person, no one other than the Reporting Person has the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, the Class A Ordinary Shares reported herein as beneficially owned by the Reporting Person.

(e) Not applicable.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

There have been no material changes to the

information previously reported in the Schedule 13D.

Item 7. Material to Be Filed

as Exhibits.

| |

1. |

Shareholders

Agreement, dated July 28, 2021, by and among the Issuer and the Reporting Person, Mahmoud Nouh Mohamed Mohamed Nouh, Ahmed Mahmoud

Ismail Mohamed Sabbah, DiGame Africa, VNV (Cyprus) Limited, Memphis Equity Ltd., Badia Impact Fund C.V., Blu Stone Ventures 1 Limited,

Alcazar Fund 1 SPV 4, Luxor Capital Partners Offshore Master Fund, LP, Luxor Capital Partners, LP, Luxor Wavefront, LP, and Lugard

Road Capital Master Fund, LP. |

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 12, 2024

| |

MOSTAFA KANDIL |

| |

|

|

| |

By: |

/s/ Mostafa Kandil |

| |

|

Name: Mostafa Kandil |

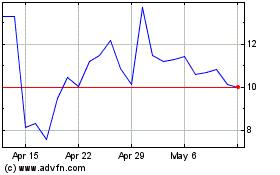

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Apr 2023 to Apr 2024