false

0001585608

0001585608

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36714 |

46-2956775 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

200 Pine Street, Suite 400

San Francisco, California |

94104 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share |

JAGX |

The Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive

Agreement.

Office Lease

As previously disclosed, on April 6, 2021, Jaguar Health, Inc.

(the “Company”) entered into an Office Lease Agreement (the “Lease”) with M & E, LLC, a California Limited

Liability Company (“Landlord”), to lease approximately 10,526 square feet of office space for two suites located at 200 Pine

Street, San Francisco, California 94104 (the “Premises”). The original term of the Lease provided that the lease began on

September 1, 2021 and would expire on August 31, 2024. On December 24, 2021, the Company entered into the First Amendment

to the Lease (the “First Amendment”), which, among other things, modified the Lease to begin on December 22, 2021 and

expire on February 28, 2025.

On October 25, 2023, the Company entered into a Second Amendment

to the Lease (the “Second Amendment”), which, among other things, modified the date of expiration for one of the suites covered

under the Lease from February 28, 2025 to August 31, 2030.

Pursuant to the Second Amendment, the base rent under the Lease was

modified to read as follows:

| |

SUITE 400 | | |

SUITE 600 | | |

| |

| MONTHLY PERIOD | |

Monthly

Basic Rental | | |

Monthly

Basic Rental | | |

TOTAL

MONTHLY

BASIC RENTAL | |

| 9/1/2023 – 2/29/2024 | |

$ | 17,587.33 | | |

$ | 21,683.56 | | |

$ | 39,270.89 | |

| 3/1/2024 – 8/31/2024 | |

$ | 17,587.33 | | |

$ | 22,334.07 | | |

$ | 39,921.40 | |

| 9/1/2024 – 2/28/2025 | |

$ | 18,114.95 | | |

$ | 22,334.07 | | |

$ | 40,449.02 | |

| 3/1/2025 – 8/31/2025 | |

$ | 18,114.95 | | |

| | | |

$ | 18,114.95 | |

| 9/1/2025 – 8/31/2025 | |

$ | 18,658.40 | | |

| | | |

$ | 18,658.40 | |

| 9/1/2026 – 8/31/2025 | |

$ | 19,218.15 | | |

| | | |

$ | 19,218.15 | |

| 9/1/2027 – 8/31/2025 | |

$ | 19,794.70 | | |

| | | |

$ | 19,794.70 | |

| 9/1/2028 – 8/31/2025 | |

$ | 20,388.54 | | |

| | | |

$ | 20,388.54 | |

| 9/1/2029 – 8/31/2025 | |

$ | 21,000.20 | | |

| | | |

$ | 21,000.20 | |

The description of the First Amendment and the Second Amendment contained

in this Current Report on Form 8-K do not purport to be complete and are qualified in their entirety by reference to the copy of

the First Amendment and the Second Amendment filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

Exhibit

No. |

|

Description |

| |

|

|

| 10.1 |

|

First Amendment to 200 Pine Street Office Lease, dated December 24, 2021, between Jaguar Health, Inc. and M & E, LLC. |

| |

|

|

| 10.2 |

|

Second Amendment to 200 Pine Street Office Lease, dated October 25, 2023, between Jaguar Health, Inc. and M & E, LLC. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

JAGUAR HEALTH, INC. |

| |

|

| |

|

| |

By: |

/s/ Lisa A. Conte |

| |

|

Name: |

Lisa A. Conte |

| |

|

Title: |

President and Chief Executive Officer |

Date: December 1, 2023

Exhibit 10.1

FIRST AMENDMENT TO LEASE

THIS FIRST AMENDMENT TO

LEASE (this “Amendment”) is entered into as of December 24, 2021 (the “Effective Date”),

by and between M & E, LLC., a California limited liability corporation (“Landlord”) and Jaguar Health, Inc.,

a Delaware corporation (“Tenant”), with reference to the following facts:

A. Landlord

and Tenant are parties to that certain Lease dated as of March 25, 2021, (the “Lease”), pursuant to which Landlord

leases to Tenant space (the “Premises”) containing approximately 10,526 rentable square feet (“RSF”)

described as Suite 400 and 600 on the fourth and sixth floors of the building located at 200 Pine Street, San Francisco, California

(the “Building”).

B. Due

to no fault of the Tenant, on or about July 17, 2021, the Building suffered from substantial water damage due to water intrusion

emanating from the roof of the building and all floors in the building suffered significant damage (the “Water Damage”).

C. The

Lease by its terms was schedule to commence on September 1, 2021. However, due to the Water Damage Tenant was unable to occupy Suite 600

of the Building until late December 2021.

D. the

parties, therefore, desire to modify the Commencement Date of the Lease, among other terms and conditions outlined herein.

NOW, THEREFORE, in

consideration of the above recitals which by this reference are incorporated herein, the mutual covenants and conditions contained herein

and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

1. Commencement

Date. The Commencement Date is hereby modified to be December 22, 2021.

2. Rent

Commencement Date. The Rent Commencement Date is hereby modified to be March 1, 2022.

3. Monthly

Basic Rental.

(a) Generally.

During the Term, Tenant will pay as Monthly Basic Rental for the Premises the following:

| Period | |

Annual Rate

Per RSF | | |

Monthly Basic

Rental | |

| 3/1/22 — 2/28/23 | |

$ | 48.00 | | |

$ | 42,104.00 | |

| 3/1/23 — 2/28/24 | |

$ | 49.44 | | |

$ | 43,367.12 | |

| 3/1/24 — 2/28/25 | |

$ | 50.92 | | |

$ | 44,668.13 | |

All such Monthly Basic Rental shall be payable by Tenant in accordance

with the terms of the Lease.

(b) Fourth

(4th) Floor Rent prior to the Commencement Date. It is agreed and acknowledged that Tenant’s rent for the period

of September 1, 2021, until February 28, 2022, shall be $21,052.00, until the Commencement Date.

4. Condition

of Premises. Tenant is in possession of the Premises and will accept the Premises in its “as is” condition on the

Effective Date without any agreements, representations, understandings or obligations on the part of Landlord to (i) perform any

alterations, additions, repairs or improvements, (ii) fund or otherwise pay for any alterations, additions, repairs or improvements

to the Premises, or (iii) grant Tenant any free rent, concessions, credits or contributions of money with respect to the Premises,

except for the following:

| · | The sixth (6th) floor doors that were replaced/repaired by Landlord shall have their doorknobs re installed |

| · | The door on the first office off the sixth floor lobby needs to be adjusted, it sticks |

| · | Suite 600 and exterior callbox Tenant signage shall read “Jaguar Animal Health” |

| · | Landlord shall reimburse Tenant for IT work, not to exceed $900 |

| · | Landlord shall complete necessary repairs to restore the fourth (461) floor restrooms to good working

order and repair, work to be completed no later than January 10, 2022 |

| · | Landlord shall provide Tenant with 20 keys to Suite 600 and 20 keys to the stairwell door (if keyed

differently) |

| · | Landlord shall repair or replace damaged ceiling tiles on the fourth floor |

| · | Landlord shall replace baseboard on damaged walls on the fourth floor |

| · | Landlord shall replace damaged flooring on the fourth floor |

5. Miscellaneous.

(a) This

Amendment sets forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional

oral or written representations or agreements.

(b) Except

as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect.

(c) In

the case of any inconsistency between the provisions of the Lease and this Amendment, the provisions of this Amendment shall govern and

control.

(d) Submission

of this Amendment by Landlord is not an offer to enter into this Amendment. Landlord shall not be bound by this Amendment until Landlord

has executed and delivered the same to Tenant.

(e) Capitalized

terms used in this Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized terms are defined

therein and not redefined in this Amendment.

(f) Each

signatory of this Amendment represents hereby that he or she has the authority to execute and deliver the same on behalf of the party

hereto for which such signatory is acting.

(g) This

Amendment may be executed in multiple counterparts each of which is deemed an original but together constitute one and the same instrument.

This Amendment may be executed in so-called “pdf’ format and each party has the right to rely upon a pdf counterpart of this

Amendment signed by the other party to the same extent as if such party had received an original counterpart.

[SIGNATURES ARE ON FOLLOWING PAGE]

IN WITNESS WHEREOF,

Landlord and Tenant have duly executed this Amendment as of the Effective Date.

LANDLORD:

M & E, LLC.,

a California limited liability corporation

| By: |

/s/ Elsie Sze |

|

| Print Name: |

Elsie Sze |

|

| Its: |

Director & CEO |

|

TENANT:

Jaguar Health, Inc.,

a Delaware corporation

| By: |

/s/ Lisa Conte |

|

| Print Name: |

Lisa Conte |

|

| Its: |

CEO |

|

Exhibit 10.2

SECOND AMENDMENT TO 200 PINE STREET OFFICE

LEASE

This Second Amendment to

200 Pine Street Office Lease (“Second Amendment”) is made and entered into as of October 25, 2023 (“Effective

Date”) by and between M & E, LLC, a California limited liability company (“Landlord”), and Jaguar

Health, Inc. a Delaware corporation (“Tenant”). Landlord and Tenant are sometimes individually referred to as

a “Party” and sometimes collectively referred to as “Parties.”

RECITALS

A. Landlord

owns the commercial mixed-use building located at 200 Pine Street, San Francisco, California (“Building”).

B. Landlord

and Tenant entered into the 200 Pine Street Office entered into as of March 15, 2021 (“Original Lease”) by which

Landlord leased to Tenant that portion of the Building located on the fourth (4th) and sixth (6th) floors of the

Building and known as Suite 400 and Suite 600, as depicted on Exhibit A to the Original Lease. Since the Original

Lease was executed, the Building was remeasured so that the total Rentable Area of the Building is 10,992 RSF. In calculating the Monthly

Basic Rental in the chart in Paragraph 7 of this Second Amendment,

(i) For

Suite 400 the Rentable Area of 5,735 square feet was used, as determined from the remeasurement of the Building; and

(ii) For

Suite 600, the Rentable Area of 5,263 square feet was used, as stated in the Original Lease The Monthly Basic Rental for Suite 600

was determined by taking 50% of the Monthly Basic Rental as indicated in the chart in Paragraph 3 of the First Amendment.

C. The

Parties entered into the First Amendment to Lease (“First Amendment”) as of December 24, 2021, which First Amendment

modified the Commencement Date to be December 22, 2021, the Rent Commencement Date to be March 1, 2022, and the Expiration

Date to be February 28, 2025.

D. The

Original Lease, as amended by the First Amendment and this Second Amendment, is referred to as the “Lease.”

E. The

Parties enter into this Second Amendment to accomplish the following:

(i) Tenant’s

occupancy of Suite 400 and Suite 600 will continue under the terms of the Original Lease as amended by the First Amendment

and this Second Amendment;

(ii) Tenant’s

occupancy of Suite 600 will have an Expiration Date of February 28, 2025; and

(iii) Tenant’s

occupancy of Suite 400 will have a Commencement Date of September 1, 2023 and will have an Expiration Date of August 31,

2030.

| Page 1 | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

The Parties enter into this

Second Amendment to amend following terms of the Original Lease.

TERMS OF SECOND AMENDMENT

1. Recitals.

The Recitals are incorporated into these Terms of Second Amendment as though each Recital was restated in full in these Terms of Second

Amendment.

2. Base

Year: Section 1.2 of the Original Lease titled “Base Year” is deleted in its entirety and is replaced by the

following:

The Base Year for Suite 600 is the calendar year of 2022.

The Base Year for Suite 400 is the calendar year of 2024.

3. Expiration

Date. Section 1.8 of the Original Lease titled “Expiration Date” as amended by the First Amendment is further

amended to read as follows:

The Expiration Date for Suite 600 is February 28,

2025.

The Expiration Date for Suite 400 is August 31,

2030.

4. Landlord’s

Notice Address. Section 1.13 of the Original Lease titled “Landlord’s Notice Address” is deleted in its

entirety and is replaced with the following:

1.13 Landlord’s

Notice Address. c/o Transwestern, 123 Mission Street, Suite 1180, San Francisco, CA 94105, Attn. Somia Shaikh, Property Manager,

Direct: 415.489.1750; email: Somia.Shaikh@transwestern.com, or such other address as Landlord shall designate from time to time.

5. Tenant’s

Proportionate Share. Section 1.21 of the Original Lease titled “Tenant’s Proportionate Share” is deleted

in its entirety and is replaced by the following:

1.21 Tenant’s

Proportionate Share: Suite 400 is 12.58% (5,735 RSF of Suite 400 / 45,591 RSF of the Building) and Suite 600 is 12.87%

(50% of Tenant’s Proportionate Share of 25.74% as stated in Section 1.21 of the Original Lease).

6. Option

to Renew.

(a) Section 3.3

of the Original Lease titled “Option to Renew” is amended by striking the words “three (3)” in the third line

of the first paragraph in Section 3.3 and replacing these stricken words with “five (5).”

(b) This

Option to Renew shall apply separately to Tenant’s occupancy of only Suite 400 and not to Suite 600.

| Page 2 | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

7. Monthly

Basic Rental. The Monthly Basic Rental chart depicted in Paragraph 3 of the First Amendment is deleted in its entirety and is

replaced by the following:

| | |

SUITE 400 | | |

SUITE 600 | | |

| |

MONTHLY

PERIOD | |

Annual

Rent/RSF | | |

Monthly

Basic Rental | | |

Annual

Rent/RSF | | |

Monthly

Basic

Rental | | |

TOTAL

MONTHLY

BASIC

RENTAL | |

| 9/1/2023

- 2/29/2024 | |

$ | 36.80 | | |

$ | 17,587.33 | | |

$ | 49.44 | | |

$ | 21,683.56 | | |

$ | 39,270.89 | |

| 3/1/2024 - 8/31/2024 | |

$ | 36.80 | | |

$ | 17,587.33 | | |

$ | 50.92 | | |

$ | 22,334.07 | | |

$ | 39,921.40 | |

| 9/1/2024 - 2/28/2025 | |

$ | 37.90 | | |

$ | 18,114.95 | | |

$ | 50.92 | | |

$ | 22,334.07 | | |

$ | 40,449.02 | |

| 3/1/2025 - 8/31/2025 | |

$ | 37.90 | | |

$ | 18,114.95 | | |

| | | |

| | | |

$ | 18,114.95 | |

| 9/1/2025 - 8/31/2026 | |

$ | 39.04 | | |

$ | 18,658.40 | | |

| | | |

| | | |

$ | 18,658.40 | |

| 9/1/2026 - 8/31/2027 | |

$ | 40.21 | | |

$ | 19,218.15 | | |

| | | |

| | | |

$ | 19,218.15 | |

| 9/1/2027 - 8/31/2028 | |

$ | 41.42 | | |

$ | 19,794.70 | | |

| | | |

| | | |

$ | 19,794.70 | |

| 9/1/2028 - 8/31/2029 | |

$ | 42.66 | | |

$ | 20,388.54 | | |

| | | |

| | | |

$ | 20,388.54 | |

| 9/1/2029 - 8/31/2030 | |

$ | 43.94 | | |

$ | 21,000.20 | | |

| | | |

| | | |

$ | 21,000.20 | |

8. Rebate

of Overpayment of Rent. As indicated in the above chart, Tenant overpaid the Monthly Basic Rental due for the month of September 2023

by Four Thousand Ninety-Six and 33/100 Dollars ($4,096.23) ($21,683.56 - $17,587.33). Landlord shall rebate this overpayment to Tenant

or credit to this overpayment to Tenant’s account as Landlord elects. If Tenant overpays the Monthly Basic Rent for the month of

October 2023, Landlord shall likewise rebate or credit this overpayment to Tenant or to Tenant’s account.

9. Tenant

Improvement Allowance.

(a) Landlord

shall provide Tenant with a Tenant improvement Allowance (“TIA”) of not to exceed Eighty-Six Thousand Twenty-Five

Dollars ($86,025) ($15.00 per RSF x 5,735 RSF) beginning on March 1, 2025. Such TIA shall be reimbursed to Tenant for work completed

in Suite 400 by Tenant or applied towards work completed by Landlord at Tenant’s request.

(b) Within

thirty (30) days after receipt of a request for disbursement from Tenant, Landlord shall disburse a portion of the TIA (up to the whole

thereof) to Tenant for reimbursement to Tenant for Hard Costs actually paid by Tenant to contractors, subcontractors, materialmen and

suppliers with respect to the Tenant Improvements theretofore completed or services performed or supplies furnished in connection therewith.

(c) Landlord

shall have no obligation to make any disbursement from the TIA if Tenant is in default of this Lease on the date of disbursement. Furthermore,

Landlord’s obligation to make a disbursement from the TIA shall be subject to Landlord’s receipt of:

(i) a

request for such disbursement from Tenant signed by an authorized officer of Tenant;

(ii) copies

of paid invoices or other evidence reasonably satisfactory to Landlord of the Hard Costs actually paid or to be paid from proceeds by

Tenant;

| Page 3 | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

(iii) copies

of all contracts, work orders, change orders and other materials relating to the work or materials which is the subject of the requested

disbursement;

(iv) a

certificate of Tenant’s independent licensed architect stating, in his opinion, that the Tenant Improvements were performed in

a good and workmanlike manner and substantially in accordance with the final detailed plans and specifications for such Tenant Improvements,

as approved by Landlord;

(v) no

lien on account of work done for or materials furnished to Tenant or any of its contractors or subcontractors shall have been filed against

any of the Property and not have been paid or bonded and, in either event, discharged of record; and

(vi) lien

waivers from the general contractor and all subcontractors and materialmen involved in the Tenant Improvements and any other work performed

on the Premises.

(d) In

no event shall the aggregate amount paid by Landlord to Tenant under this Section exceed the amount of the TIA. It is expressly

understood and agreed that Tenant shall complete, at its sole cost and expense, the Tenant Improvements, whether or not the TIA is sufficient

to fund such completion. Any costs to complete the Tenant Improvements in excess of the TIA shall be the sole responsibility and obligation

of Tenant.

(e) All

Tenant Improvements shall comply with the applicable terms of the Lease, including, but not limited to, Section 13 of the Original

Lease titled “Alterations.”

10. Security

Deposit. Pursuant to the Original Lease, Landlord currently is holding a cash Security Deposit in the amount of Forty-Four Thousand

Six Hundred Sixty-Eight and 13/100 Dollars ($44,668.13) which Landlord will continue to hold throughout the Term of this Lease. No portion

of the Security Deposit shall be returned to Tenant at the end of the Term of the Lease for Suite 600.

11. Brokerage

Commission. Upon full execution of a Lease Amendment between Landlord and Tenant, Tenant’s representative, Recreate (“Tenant’s

Broker”) shall earn and be due a commission , in an amount equal to $3.00 per RSF per year of the Lease Term not to exceed $15.00

per RSF commissions due for any partial Lease years shall be prorated. Such commission shall be paid 50% no later than January 31,

2024 and 50% no later than March 31, 2025 provided Tenant is not in default of the Lease at the time.

12. Lease

Remains in Effect. Except as amended by this Second Amendment, the terms of the Original Lease, as previously amended by the

First Amendment, remain in effect.

13. Conflict

in Terms. If there is any conflict between the terms of this Second Amendment and the terms of the Original Lease, as amended

by the First Amendment, the terms of this Second Amendment shall control.

14. Reliance

on Counsel. In entering into this Second Amendment, each Party has had the opportunity to rely upon the advice of its attorney

or its consultants and has not relied upon any representation of law or fact by the other Party. It is further acknowledged by each Party

that the Party executing this Second Amendment:

| Page 4 | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

(a) Fully

understands and voluntarily accepts the terms, meaning, and significance of this Second Amendment;

(b) Has

had ample time to obtain all of the legal advice that the Party deems necessary; and

(c) Has

had ample time to review this Second Amendment.

15. Execution.

This Second Amendment may be executed in multiple counterparts, all of which shall constitute one and the same Second Amendment. Delivery

of an executed counterpart of this Second Amendment by email or by electronic means (e.g., DocuSign) shall be as effective as delivery

of a manually executed counterpart of this Second Amendment. This Second Amendment may be executed by a Party’s signature transmitted

by email, and copies of this Second Amendment executed and delivered by means of signatures sent by email or electronic means shall have

the same force and effect as copies executed and delivered with original signatures.

16. Cooperation.

The Parties to this Second Amendment will cooperate in all manners necessary to effectuate the terms of this Second Amendment including,

but not limited to, executing all necessary documents.

17. Interpretation.

No provision of this Second Amendment is to be interpreted for or against any Party because that Party, or that Party’s representative,

drafted such provision.

The remainder of this page is intentionally

left blank. Signature page follows.

| Page 5 | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

| LANDLORD |

|

TENANT |

| |

|

|

| M&E LLC, |

|

Jaguar Health, Inc. |

| a California limited liability company |

|

A Delaware corporation |

| |

|

|

| /s/ Caroline Sze |

|

/s/ Lisa Conte |

| By: Caroline Sze |

|

By: Lisa Conte |

| Its: Manager |

|

Its: Chief Executive Officer |

| Signature Page | Second Amendment to 200 Pine Street Office Lease for Jaguar Health, Inc. |

v3.23.3

Cover

|

Oct. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity File Number |

001-36714

|

| Entity Registrant Name |

JAGUAR HEALTH, INC.

|

| Entity Central Index Key |

0001585608

|

| Entity Tax Identification Number |

46-2956775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200 Pine Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94104

|

| City Area Code |

415

|

| Local Phone Number |

371-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.0001 Per Share

|

| Trading Symbol |

JAGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

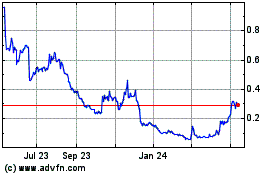

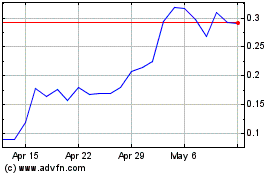

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Apr 2023 to Apr 2024