false

--12-31

0001805521

0001805521

2024-02-23

2024-02-23

0001805521

FFIE:ClassCommonStockParValue0.0001PerShareMember

2024-02-23

2024-02-23

0001805521

FFIE:RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 23, 2024

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39395 |

|

84-4720320 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 18455 S. Figueroa Street |

|

|

| Gardena, CA |

|

90248 |

| (Address of principal executive offices) |

|

(Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

FFIE |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

FFIEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 3.03 Material Modifications to Rights

of Security Holders

On February 23, 2024, Faraday

Future Intelligent Electric Inc. (the “Company”) filed a second amendment (the “Certificate of Amendment”)

to the Company’s Third Amended and Restated Certificate of Incorporation (as amended, the “Charter”) with the Secretary

of State of the State of Delaware to effect a reverse stock split at a ratio of 1:3 (the “Reverse Stock Split”) and to set

the number of authorized shares of common stock, par value $0.0001 per share, of the Company (the “Common Stock”) to 463,312,500

(which is 1,389,937,500 divided by 3). The Certificate of Amendment was authorized by the stockholders of the Company at the Company’s

Special Meeting of Stockholders held on February 5, 2024.

Pursuant to the Certificate of Amendment, effective as of 5:00 p.m.,

Eastern Time, on February 29, 2024 (the “Effective Time”), every three shares of the issued and outstanding Common Stock will

be automatically converted into one share of Common Stock, without any change in par value per share and the number of authorized shares

of Common Stock will be reduced to 463,312,500.

At the Effective Time, the number of shares of Common Stock reserved

for issuance under the Company’s Amended and Restated 2021 Stock Incentive Plan, the Company’s Smart King Ltd. Equity Incentive

Plan, and the Company’s Smart King Ltd. Special Talent Incentive Plan (collectively, the “Plans”), as well as the number

of shares subject to the then-outstanding awards under each of the Plans, were proportionately adjusted, using the 1-for-3 ratio, rounded

down to the nearest whole share. In addition, the exercise price of the then-outstanding options under each of the Plans was proportionately

adjusted, using the 1-for-3 ratio, rounded up to the nearest whole cent. Proportionate adjustments were made to the number of shares of

Common Stock issuable upon exercise or conversion of the Company’s outstanding warrants and convertible securities, as well as the

applicable exercise or conversion prices.

The Company’s Class A Common Stock is expected to begin trading

on The Nasdaq Capital Market on a split-adjusted basis at the opening of trading on March 1, 2024. The Class A Common Stock will continue

trading on the Nasdaq Capital Market under the symbol “FFIE” with a new CUSIP number (307359 703). The Class B Common Stock

will also have a new CUSIP number (307359 802). The Company’s publicly traded warrants will continue to be traded on the Nasdaq Capital

Market under the symbol “FFIEW” and the CUSIP number for the warrants will remain unchanged. However, under the terms of the

applicable warrant agreement, the number of shares of Class A Common Stock issuable on exercise of each warrant will be proportionately

decreased. Specifically, following effectiveness of the Reverse Stock Split, every three shares of Class A Common Stock that may be purchased

pursuant to the exercise of public warrants now represents one share of Class A Common Stock that may be purchased pursuant to such warrants.

Accordingly, for the Company’s warrants trading under the symbol “FFIEW”, every three warrants will be exercisable for

one share of Class A Common Stock at an exercise price of $2,760.00 per share of Class A Common Stock.

No fractional shares of Common Stock will be issued as a result

of the Reverse Stock Split. Stockholders who would otherwise receive a fractional share will instead be issued a full share in lieu

of such fractional share. The Reverse Stock Split affected all record holders of the Common Stock uniformly and did not affect any

record holder’s percentage ownership interest in the Company, except for de minimis changes as a result of the elimination of

fractional shares. Holders of Common Stock who hold in “street name” in their brokerage accounts do not have to take any

action as a result of the Reverse Stock Split. Their accounts will be automatically adjusted to reflect the number of shares owned.

Stockholders of record will be receiving information from Continental Stock Transfer & Trust Company regarding their stock

ownership following the Reverse Stock Split.

The foregoing description

of the Certificate of Amendment is a summary and is qualified in its entirety by the terms of the Certificate of Amendment, a copy

of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

The disclosure set forth under Item 3.03 above

is incorporated herein by reference.

Item 7.01 Regulation FD

Disclosure.

On February

25, 2024, the Company issued a press release announcing the Reverse Stock Split and authorized share

reduction. A copy of the press release is attached hereto as Exhibit 99.1, and incorporated in this Item 7.01 by reference.

On February

25, 2024, Matthias Aydt, Global CEO of the Company, issued an open letter to share an updated master

plan 1.1 for the growth of the Company in 2024. A copy of the open letter is attached hereto as Exhibit 99.2, and incorporated in this

Item 7.01 by reference.

As provided

in General Instruction B.2 of Form 8-K, the information in this Item 7.01 and Exhibits 99.1 and 99.2 furnished hereunder shall not be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

The information provided in Item 5.03 is hereby

incorporated by reference.

The Company has registration statements on

Form S-3 (Nos. 333-271664, 333-268972, 333-269729, 333-268722, 333-272745, 333-272354 and 333-274247) and registration statements on Form

S-8 (File No. 333-266901, 333-271662 and 333-274248) on file with the Securities and Exchange Commission (the “Commission”).

Commission regulations permit the Company to incorporate by reference future filings made with the Commission pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offerings covered by registration statements filed on Form S-3

or Form S-8. The information incorporated by reference is considered to be part of the prospectus included within each of those registration

statements. Information in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically incorporated by

reference into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities

Act, the amount of undistributed shares of Common Stock deemed to be covered by the effective registration statements of the Company described

above are proportionately reduced as of the Effective Time to give effect to the Reverse Stock Split.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this Current

Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FARADAY FUTURE INTELLIGENT ELECTRIC INC. |

| |

|

| Date: February 26, 2024 |

By: |

/s/ Jonathan Maroko |

| |

Name: |

Jonathan Maroko |

| |

Title: |

Interim Chief Financial Officer |

3

Exhibit 3.1

SECOND CERTIFICATE OF AMENDMENT

TO THE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

FARADAY FUTURE INTELLIGENT ELECTRIC INC.

Faraday Future Intelligent Electric

Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation

Law of the State of Delaware (“DGCL”), hereby certifies as follows:

1. The

name of the Corporation is Faraday Future Intelligent Electric Inc. (originally incorporated as Property Solutions Acquisition Corp.).

2. The

original Certificate of Incorporation of the Corporation (the “Original Certificate”) was filed with the Secretary

of State of the State of Delaware on February 11, 2020.

3. The

Corporation amended and restated the Original Certificate, which was filed with the Secretary of State of the State of Delaware on July

21, 2020 (the “Amended and Restated Certificate”).

4. The

Corporation further amended and restated the Amended and Restated Certificate, which was filed with the Secretary of State of the State

of Delaware on July 21, 2021 (the “Second Amended and Restated Certificate”).

5. The

Corporation has four times amended the Second Amended and Restated Certificate, (i) which certificate of amendment to the Second Amended

and Restated Certificate was filed with the Secretary of State of the State of Delaware on November 22, 2022, (ii) which second certificate

of amendment to the Second Amended and Restated Certificate was filed with the Secretary of State of the State of Delaware on March 1,

2023, (iii) which Certificate of Designation of Preferences, Rights and Limitations of Series A Preferred Stock was filed with the Secretary

of State of the State of Delaware on June 16, 2023, and (iv) which Certificate of Elimination of Series A Preferred Stock was filed with

the Secretary of State of the State of Delaware on August 24, 2023.

6. The

Corporation further amended and restated the Second Amended and Restated Certificate, which was filed with the Secretary of State of the

State of Delaware on August 24, 2023 (the “Third Amended and Restated Certificate”).

7. The

Corporation has three times amended the Third Amended and Restated Certificate, (i) which Certificate of Designation of Preferences, Rights

and Limitations of Series A Preferred Stock was filed with the Secretary of State of the State of Delaware on December 21, 2023, (ii)

which Certificate of Elimination of Series A Preferred Stock was filed with the Secretary of State of the State of Delaware on February

5, 2024, and (iii) which certificate of amendment to the Third Amended and Restated Certificate was filed with the Secretary of State

of the State of Delaware on February 5, 2024.

8. The

first two paragraphs of Section 4.1 of the Third Amended and Restated Certificate of Incorporation are hereby amended and restated to

read in its entirety as follows:

“Section 4.1 Pursuant

to the DGCL, at 5:00 p.m. Eastern Time on February 29, 2024 (the “Effective Time”) each set of three (3) shares

of common stock, $0.0001 par value per share (the “Common Stock”) issued and outstanding or held by the Corporation

in treasury stock immediately prior to the Effective Time shall be combined into one (1) validly issued, fully paid and non-assessable

share of Common Stock, without any further action by the Corporation or the holder thereof, subject to the treatment of fractional share

interests as described below (the “Reverse Stock Split”). No certificates representing fractional shares of

Common Stock shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional

shares of Common Stock shall be entitled to receive the number of shares rounded up to the next whole number. Each certificate that immediately

prior to the Effective Time represented shares of Common Stock (each, an “Old Certificate”) shall thereafter

represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been

combined, subject to the elimination of fractional share interests as described above.

Immediately after the Effective

Time, the total number of shares of all classes of capital stock that the Corporation is authorized to issue is 473,312,500 shares, consisting

of two classes of stock: (i) 463,312,500 shares Common Stock, and (ii) 10,000,000 shares of Preferred Stock $0.0001 par value per share

(the “Preferred Stock”). The class of Common Stock shall be divided into two series of stock composed of (i)

443,625,000 shares of Class A Common Stock (the “Class A Common Stock”), and (ii) 19,687,500 shares of Class

B Common Stock (the “Class B Common Stock”). For the avoidance of doubt, the Class A Common Stock and Class

B Common Stock are separate series within a single class of Common Stock, and are referred to herein together as the “Common Stock.”.”

9. This

Second Amendment to the Third Amended and Restated Certificate of Incorporation was duly adopted in accordance with the provisions of

Section 242 of the DGCL.

[Signature Page Follows]

IN WITNESS WHEREOF, Faraday

Future Intelligent Electric Inc. has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 21st

day of February, 2024.

| |

FARADAY FUTURE INTELLIGENT ELECTRIC INC. |

| |

|

| |

By: |

/s/ Matthias Aydt |

| |

Name: |

Matthias Aydt |

| |

Title: |

Global Chief Executive Officer |

3

Exhibit 99.1

Faraday Future Announces

Reverse Stock Split

and Authorized Share

Reduction

Los Angeles, CA (February 25, 2024) -- Faraday Future Intelligent

Electric Inc. (NASDAQ: FFIE) (“Faraday Future”, “FF” or “Company”), a California-based global shared

intelligent electric mobility ecosystem company, today announced that the Company intends to implement a reverse stock split of the issued

and outstanding shares of the Company’s common stock, par value $0.0001 per share (the “common stock”), at a ratio of

1-for-3 (the “reverse stock split”), that is expected to become effective at 5:00 p.m. ET on February 29, 2024. The Company’s

common stock is expected to begin trading on a split-adjusted basis commencing upon market open on March 1, 2024.

As previously disclosed, at the Company’s Special Meeting of

Stockholders held on February 5, 2024, the Company’s stockholders voted to approve a proposal authorizing the Board of Directors

of the Company to amend the Company’s Third Amended and Restated Certificate of Incorporation (as amended, the “Charter”)

to effect a reverse stock split of the Company’s issued and outstanding common stock and a corresponding reduction in the total

number of shares of common stock the Company is authorized to issue. As a result of the reverse stock split, every three shares of the

Company’s issued and outstanding common stock will be automatically combined and converted into one issued and outstanding share

of common stock. The Company’s Class A common stock will trade under a new CUSIP number, 307359 703, effective March 1, 2024,

and remain listed on the Nasdaq Capital Market under the symbol “FFIE.” The Company’s Class B common

stock will have a new CUSIP number, 307359 802, effective March 1, 2024. The Company’s publicly traded warrants will continue

to be traded on the Nasdaq Capital Market under the symbol “FFIEW” and the CUSIP number for the warrants will remain

unchanged. However, under the terms of the applicable warrant agreement, the number of shares of Class A Common Stock issuable on exercise

of each warrant will be proportionately decreased. Specifically, following effectiveness of the Reverse Stock Split, every

three shares of Class A Common Stock that may be purchased pursuant to the exercise of public warrants now represents one share of Class

A Common Stock that may be purchased pursuant to such warrants. Accordingly, for the Company’s warrants trading under the symbol

“FFIEW”, every three warrants will be exercisable for one share of Class A Common Stock at an exercise price of $2,760 per

share of Class A Common Stock. The reverse stock split reduces the number of shares of common stock issuable upon the conversion of the

Company’s outstanding convertible securities, and the exercise or vesting of its outstanding stock options, restricted stock units

and private warrants in proportion to the ratio of the reverse stock split and causes a proportionate increase in the conversion and exercise

prices of such convertible securities, stock options, restricted stock units and private warrants. In addition, the authorized shares

of Common Stock will be reduced from 1,389,937,500 to 463,312,500.

No fractional shares of common stock will be issued as a result of

the reverse stock split. Stockholders of record who would otherwise be entitled to receive a fractional share will be entitled to receive

from the Company one full share of the post-reverse stock split common stock. The reverse stock split impacts all holders of the Company’s

common stock proportionally and will not impact any stockholder’s percentage ownership of the Company common stock.

Faraday Future has chosen its transfer agent, Continental Stock Transfer

& Trust Company, to act as exchange agent for the reverse stock split. Stockholders owning shares via a bank, broker or other nominee

will have their positions automatically adjusted to reflect the reverse stock split and will not be required to take further action in

connection with the reverse stock split, subject to brokers’ particular processes.

Additional information about the Reverse Stock Split and the related

Charter amendment can be found in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on

January 10, 2024, as supplemented on January 24, 2024.

ABOUT FARADAY FUTURE

Faraday Future is the pioneer of the Ultimate AI TechLuxury ultra spire

market in the intelligent EV era, and the disruptor of the traditional ultra-luxury car civilization epitomized by Ferrari and Maybach.

FF is not just an EV company, but also a software-driven intelligent internet company. Ultimately FF aims to become a User Company by

offering a shared intelligent mobility ecosystem. FF remains dedicated to advancing electric vehicle technology to meet the evolving needs

and preferences of users worldwide, driven by a pursuit of intelligent and AI-driven mobility.

FOLLOW FARADAY FUTURE:

https://www.ff.com/

https://www.ff.com/us/mobile-app/

https://twitter.com/FaradayFuture

https://www.facebook.com/faradayfuture/

https://www.instagram.com/faradayfuture/

www.linkedin.com/company/faradayfuture/

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements”

within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this

press release the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,”

“plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar expressions (or the negative versions of such words

or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include statements regarding

the expected timing and implementation of the reverse split and the commencement of trading of the Company’s post-split common stock,

involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s

control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes include, among others: the Company’s ability to continue as a

going concern and improve its liquidity and financial position; the Company’s ability to remediate its material weaknesses in internal

control over financial reporting; risks related to the restatement of the Company’s previously issued consolidated financial statements;

the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and

expectation of continued losses; increased operating expenses; incorrect assumptions and analyses developed by management; the market

performance of the Company’s common stock; the Company ability to regain compliance with Nasdaq listing requirements; the Company’s

ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates

of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the

Company’s vehicles; the success of other competing manufacturers; the performance and security of the Company’s vehicles;

the Company’s ability to receive funds from, satisfy the conditions precedent of, and close on the various financings described

elsewhere by the Company; the result of current and future financing efforts, the failure of any of which could result in the Company

seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s ability to cover future warranty claims;

insurance coverage; the outcome of the Securities and Exchange Commission (“SEC”) investigation relating to the matters that

were the subject of the Special Committee investigation; the success of the Company’s remedial measures taken in response to the

Special Committee findings; the Company’s dependence on its suppliers and contract manufacturers; the Company’s ability to

develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; general economic and market

conditions impacting demand for the Company’s products; risks related to the Company’s operations in China; risks related

to the Company’s stockholders who own a significant amount of the Company’s common stock; potential cost, headcount and salary

reduction actions may not be sufficient or may not achieve their expected results; the ability of the Company to attract and retain directors

and employees; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; and volatility of the

Company’s stock price. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and

the other risks and uncertainties described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K/A

for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, as well as the risk factors

incorporated by reference in Item 8.01 of the Current Report on Form 8-K/A filed with the SEC on December 28, 2023, and other documents

filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could

cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company

does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events

or otherwise, except as required by law.

CONTACTS

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

Exhibit

99.2

Faraday

Future Announces Updated Master Plan 1.1 to Strategically Position Itself for Growth in 2024

| ● | An

open letter from Matthias Aydt, Global CEO of Faraday Future. |

Los

Angeles, CA (Feb. 25, 2024) -- Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE) (“Faraday Future”, “FF”

or “Company”), a California-based global shared intelligent electric mobility ecosystem company, today released an open letter

from Matthias Aydt, Global CEO of FF, to share an updated master plan 1.1 for the growth of Faraday Future in 2024.

Opportunities

and Accomplishments

I’m

issuing this letter to align expectations as to where FF stands today and where we hope to lead FF in 2024. FF has made great strides

in the past 12 months, under limited funding and strong headwinds from the markets, including the changing landscape of the EV business.

FF entered

the revenue generation phase in 2023 and established a closed-loop operation from user acquisition and delivery to user operations while

launching the process of adding industry leaders and partnering with our first users and Co-Creation Officers. There were significant

changes in FF’s business foundation, including the addition of a new management team that we believe collectively boasts the strongest

capabilities in the history of FF. We believe that during this critical period for business growth, the Company is now structurally best

positioned for the next development phase since its inception.

| ● | FF

is only one of five new EV companies globally that has passed US homologation requirements, others include Tesla, Lucid, Rivian, and

Fisker. |

| ● | $3

billion invested capital to date to create an industry leading EV platform, I.A.I. technology, product development and manufacturing

capabilities. |

| ● | 660

patents filed or issued utility and design patents for both EV and I.A.I. technology competitiveness. |

| ● | 10,000

capacity - future potential annual production capacity at FF’s self-operated manufacturing facility in Hanford, California with $200+

million invested. |

| ● | Dual

Home Deep cultural roots in both the US and China provide competitive advantage across two of the largest EV markets with anticipated

movement into the Middle East Markets in 2024. |

| ● | High-profile

vehicle owners and Co-Creation Officers such as Chris Brown, Motev and others, demonstrating strong brand power. |

| ● | Direct

sales online with anticipated targeted in-person experience centers and FF partner stores across target markets such as the US, China,

Europe, and the Middle East. |

| ● | Phase

Two of the Company’s Three-Phase Delivery Plan for the Company’s FF 91 2.0 Futurist Alliance launched in the third quarter 2023. |

FF also

signed an agreement with the Abu Dhabi Investment Office (ADIO) to unleash generative AI and advanced EVs for Abu Dhabi’s SAVI cluster.

Abu Dhabi’s SAVI cluster builds on the strength of Abu Dhabi’s industrial base and supports the UAE’s target of half

of all cars on the roads being electric by 2050.

The Middle

East market presents exciting opportunities for smart and autonomous vehicles and is well aligned with FF product technology and brand

positioning. We look forward to this being our first of many future endeavors and collaborations in the Middle East.

We believe that

the FF 91 2.0 is a vehicle uniquely positioned to provide new markets representing a new generation of aiEV users with a fully integrated,

optimized software and hardware architecture to create a true All-Ability Hypercar. This vehicle includes full connectivity and personalized

AI services and features.

Key

Deliverables Since Previous Announcement of FF’s Master Plan on October 2023

| ● | Gradually

evolving the corporate orientation and direction towards a continuous operation with similar priorities in regard to production and sales

as well as enhancing the product power of the product palette. |

| ● | Actively

managing costs and expenses and focusing on improving Company-wide efficiency. |

| ● | Expanding

our market presence into TechLuxury markets beyond the U.S with adequate volumes. |

| ● | Focusing

on cashflow breakeven and next growth steps. |

| ● | Continuous

product and technology enhancements to maintain unique position in the market. |

| ● | Took

action to investigate short selling to protect shareholder interest. |

Have

resulted in:

| ● | A

lean and flat organization dedicated to Product Definition, Product Execution, Product Delivery, User Operation, Corporate Development

and supporting functional areas. |

| ● | Manufacturing,

supply chain and product quality improvements. |

| ● | Reasonable

cost structure and optimized costs and expenses. |

| ● | A

successful market launch in one of the most important TechLuxury markets, the UAE. |

| ● | Confirmation

of a solidified execution plan for 2024 and 2025 and beyond with clearer projection of profitability. |

| ● | A

start of definition and conceptualization of the next generation revolutionizing product enhancement. |

| ● | Communications

with various securities brokers regarding our short selling analysis. |

Product

and Technology

FF 91

comes from our disruptive approach to innovation across intelligent technology, user-centric design, and EV propulsion. It is a user-centric

experience designed for people with many talents, many obligations and many goals in life. FF has addressed these complex needs in a

single vehicle that combines the luxury of an intelligent connected space, with the capabilities of a hyper-dynamic EV powertrain and

predictive AI architecture. Together, these elements work to elevate a user’s potential, and provide them the ultimate freedom

to do what they want, when they want and how they want.

The FF

91 has tri-motor powertrain capability, 1050 hp, is faster than Lamborghini Urus, and has a reported 381 miles EPA.

It is

also the first AI capable car able to run Zoom, ChatGPT, livestream, has a strong computing capacity with self-designed software and

hardware platform including Nvidia chips and 5G*3 access point connectivity.

As we

recently announced, we continuously keep our product at the forefront through over-the-air (OTA) upgrades. These OTA upgrades significantly

enhance the interaction between the user’s smartphone and their vehicle, making functions more intuitive and user-friendly. In

addition to supporting conventional functions like unlocking doors, air conditioning, and charging, it also enables comprehensive control

of in-car screens, enhancing the experience of in-car entertainment and work activities.

Beyond

the outstanding performance, technology, and agility of our product we have discussed in the past, we would request that everyone who

has the chance to get into our car should take that opportunity to be amazed by the experience.

Financial

Updates

We are continuing

to make progress on future funding and believe we will successfully close on an additional round of capital from strategic and financial

investors. We are currently also working to tighten restrictions to convertible note holders

for their conversion and paused both our ATM program and ELOC.

We are succeeding

in reducing our monthly cash burn by cutting back on spending that is no longer necessary given our more advanced stage of development

while continuing to balance investments into the business that are critical to moving the Company forward.

We are prioritizing

cash flow breakeven over volume to avoid scaling production too quickly, which has been an issue for many competitors. As such, we believe

we will be cash flow breakeven at a lower vehicle production/delivery figure than that of our competitors. Additionally, our market (in

terms of price point) is far less crowded.

Cost Reduction:

Bill of Materials (BoM)

Significant

reduction in cost - some of this is coming naturally with improvements in manufacturing efficiency but we are also targeting specific

elements of the BoM, switching suppliers, and/or insourcing the production where available and cost effective.

This is yielding

meaningful, fruitful results – one example was taking a key component of the vehicle bringing the production in-house, this led

to approximately $50,000 savings on a single element of the BoM. We are working on various other opportunities and low-hanging fruit

that still exists in terms of continuously and meaningfully reducing the BoM in the near term.

Next

Steps

| 1. | Operations:

Operation optimization and upgrade to achieve sustainability in the near future. |

| ● | Cost

reduction and spending efficiency, including daily operation and FF91 material cost. |

| ● | Continue

product deliveries to celebrities and opinion leaders. |

| ● | Achieve

industry-leading advantages in product and technology powers and “Ultimate AI TechLuxury” Top Brand momentum through the

FF Co-Creation model. |

| ● | Focus

on U.S, China Dual Home market & Middle East 3rd Pole. |

| ● | Achieve

industrial implementation in the Middle East, access and localization of products and technologies, and establishment of a user ecosystem. |

| 2. | Product

and technology: Continuously enhance the product and technology powers of the FF 91 2.0. |

| ● | Middle

East product planning and implementation: Launch FF 91 2.0 aiFalcon this year. |

| ● | Research

and develop the next-generation product FF 92, maintaining FF’s leading edge in product and technology powers. |

| ● | Focus

on the application research and development of AI technology, continue to lead in the vertical application of generative AI in the mobility

field. |

| 3. | Manufacturing/Supply

Chain: Progress the equipment commissioning and upgrading of FF ieFactory to lay the foundation for increased production. |

| ● | Comprehensively

improve the factory manufacturing system and promote the continuous upgrade of the production and manufacturing quality system. |

| ● | Promote

global supply chain integration and establish a global strategic supplier system. |

| ● | Further

promote supplier quality and capacity enhancement and improve the supply chain quality performance system and cost reduction. |

| ● | Continue

and accelerate current plans to bring strategic investors. |

| ● | Globally

optimize and upgrade the Company’s financial system in the three regions, improve financial efficiency, and establish healthy and sustainable

cash management. |

We believe

that FF has the foundations to support future growth, subject to obtaining additional needed funding. We’ve triumphed over the challenging

moments many times in our past, and FF has been bolstered by many achievements. Since the start of deliveries in 2023, and leading into

2024, the Company has consistently taken measures to reduce operational and supply chain costs in support of our strategic objectives.

We believe

that these steps will only help us succeed moving forward. With our unique DNA and the support of our global employees, our present and

future users, and our many stakeholders, we remain steadfast in our belief that we stand on the cusp of an extraordinary surge of energy

and success!

Sincerely,

Matthias

Aydt

FORWARD LOOKING

STATEMENTS

This communication

includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this communication the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,”

“may,” “will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These

forward-looking statements, which include statements regarding the ability of the Company to execute on its updated master plan and its

overall effectiveness, involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which

are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the

forward-looking statements. Important factors, among others, that may affect actual results or outcomes include, among others: the Company’s

ability to continue as a going concern and improve its liquidity and financial position; the Company’s ability to remediate its

material weaknesses in internal control over financial reporting; risks related to the restatement of the Company’s previously

issued consolidated financial statements; the Company’s limited operating history and the significant barriers to growth it faces;

the Company’s history of losses and expectation of continued losses; increased operating expenses; incorrect assumptions and analyses

developed by management; the market performance of the Company’s common stock; the Company ability to regain compliance with Nasdaq

listing requirements; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these

development programs; the Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market;

the rate and degree of market acceptance of the Company’s vehicles; the success of other competing manufacturers; the performance

and security of the Company’s vehicles; the Company’s ability to receive funds from, satisfy the conditions precedent of,

and close on the various financings described elsewhere by the Company; the result of current and future financing efforts, the failure

of any of which could result in the Company seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s

ability to cover future warranty claims; insurance coverage; the outcome of the Securities and Exchange Commission (“SEC”)

investigation relating to the matters that were the subject of the Special Committee investigation; the success of the Company’s

remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturers;

the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks;

general economic and market conditions impacting demand for the Company’s products; risks related to the Company’s operations

in China; risks related to the Company’s stockholders who own a significant amount of the Company’s common stock; potential

cost, headcount and salary reduction actions may not be sufficient or may not achieve their expected results; the ability of the Company

to attract and retain directors and employees; any adverse developments in existing legal proceedings or the initiation of new legal

proceedings; and volatility of the Company’s stock price. The foregoing list of factors is not exhaustive. You should carefully

consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s

Annual Report on Form 10-K/A for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30,

2023, as well as the risk factors incorporated by reference in Item 8.01 of the Current Report on Form 8-K/A filed with the SEC on December

28, 2023, and other documents filed by the Company from time to time with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and the Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by law.

CONTACTS

Investors

(English): ir@faradayfuture.com

Investors

(Chinese): cn-ir@faradayfuture.com

Media:

john.schilling@ff.com

5

v3.24.0.1

Cover

|

Feb. 23, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 23, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-39395

|

| Entity Registrant Name |

Faraday Future Intelligent Electric Inc.

|

| Entity Central Index Key |

0001805521

|

| Entity Tax Identification Number |

84-4720320

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

18455 S. Figueroa Street

|

| Entity Address, City or Town |

Gardena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90248

|

| City Area Code |

424

|

| Local Phone Number |

276-7616

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

FFIE

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

FFIEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

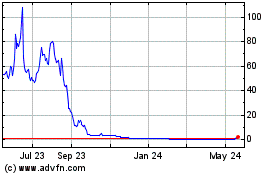

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

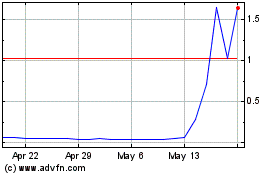

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Apr 2023 to Apr 2024