false

0001737995

0001737995

2024-03-07

2024-03-07

0001737995

STSS:CommonStock0.0001ParValueMember

2024-03-07

2024-03-07

0001737995

STSS:CommonStockPurchaseWarrantsMember

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): March 7, 2024

Sharps

Technology, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

Nevada

(State

or Other Jurisdiction of Incorporation)

| 001-41355 |

|

82-3751728 |

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

105

Maxess Road, Melville, New York 11747

(Address

of Principal Executive Offices)

(631)

574 -4436

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

STSS |

|

NASDAQ

Capital Market |

| Common

Stock Purchase Warrants |

|

STSSW |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Cooperative

Sales and Distribution Agreement

On

March 4, 2024 (the “Effective Date”), Sharps Technology, Inc. (and its wholly-owned subsidiary Sharps Technology Acquisition

Corp., collectively, (the “Company”) entered into a Cooperative Sales and Distribution agreement (the “Agreement)

with Roncadelle Operations s.r.l (hereinafter, “ROP”).

In

conjunction with the execution of the Agreement, ROP appoints the Company as its exclusive distributor of ROP products in the United

States, Canada, Central and South America and their territories. The company appoints ROP as its exclusive distributor of Sharps products

in Europe, Middle East, APAC, South Africa and Australia and their territories. The Company and ROP agreed to bear their own separate

costs and expenses, including fees and other expenses, relating to external advisors and the preparation negotiation, execution and performance

of this Agreement and any related documents. The Agreement is effective as of the Effective Date for the initial period of one (1) year

(the “Initial Term”). Upon expiration of the Initial Term, the term of the Agreement shall automatically renew for additional

successive one year terms, unless either party provides written notice of non-renewal at least ninety (90) days prior to the end of the

then-current term, unless any renewal term is terminated earlier pursuant to the terms of the Agreement or applicable law.

Within

the Agreement, the Company and ROP agreed to keep information during the term of the Agreement and five years after the Agreement confidential.

The Agreement lays out exceptions to this confidentiality clause, as well as permitted disclosures to certain individuals.

In

connection therewith, the Company entered into an amendment to the Agreement, which provides more particulars with respect to the arrangement

with ROP.

Logistics

Services Agreement

On

March 8, 2024, the Company entered into a logistics service agreement with Owens & Minor Distribution, Inc., (hereinafter “O&M”)

for the Company’s use of O&M’s logistics services.

Item 8.01 Other Events

On

March 8, 2024 the Company and Nephron Pharmaceuticals Corporation terminated their distribution agreement dated December 8, 2022 .

The Nephron distribution agreement will be replaced by the Cooperative Sales and Distribution Agreement with ROP on the sales side

and by the Owens & Minor logistics services agreement on the warehousing side. The Company had no revenues from the Nephron

Distribution Agreement and does not believe that the cancellation is material. The Company continues to work with Nephron towards

the purchase of the Nephron facility pursuant to the Asset Purchase Agreement dated September 22, 2023.

Item

9.01 Exhibits

| ** |

The

Company has filed a redacted version of the Agreement, omitting the portions of the Agreement (indicated by asterisks) which the

Company desires to keep confidential. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

March 8, 2024

| SHARPS

TECHNOLOGY, INC. |

|

| |

|

| /s/

Robert M. Hayes |

|

| Robert

M. Hayes |

|

| Chief

Executive Officer |

|

Exhibit

10.1

Cooperative

Sales and Distribution Agreement

This

Cooperative Sales and Distribution Agreement (hereinafter the “Agreement”) is entered into as of this day 2024-03-01

(the “Effective Date”) by and between Roncadelle Operations s.r.l., a company formed and existing under the

laws of Italy, having its registered office in Castel Mella (BS, Italy), Via Renolda 10, VAT code and registration number VAT-ID Number

IT 04151620988, represented by Mr. Erik Ryckalts, CEO, duly authorized by way of the resolution of the board of directors (hereinafter,

“ROP”)

-

on one hand -

and

Sharps

Technology, Inc., a company formed and existing under the laws of Nevada (U.S.A.), having its registered office in Melville (NY,

USA), 105 Maxess Road, Suite 124, registration number [•], represented by [Mr. Robert Hayes, CEO], duly authorized as an officer

of Sharps with single signature authority (hereinafter, “Sharps”)

-

on the other hand -

(hereinafter,

ROP and Sharps are each referred to as a “Party” and jointly as the “Parties”)

Whereas

| a) | ROP

is a leading developer and manufacturer of innovative safety engineering solutions for primary

drug packaging such as syringes and prefilled syringes, protected by proprietary designs,

innovative technology solutions and intellectual property rights. ROP has particular expertise

in the design, development and manufacture of such innovative passive safety devices, systems

and solutions that enhance the protection of medical personnel and patients from needlestick

infections. |

| b) | Sharps

has developed the Provensa® passive safety needle system and acquired the rights

and trade secrets of Safegard® active safety system and Sologard® standard

Luer lock system (hereinafter, “Sharps Producs”. |

| c) | ROP

has developed, inter alia, the SAFER® Retractable Safety Syringe and needles,

a passive safety solution with one-click coaxial needle retraction (hereinafter, “SAFER®”

or “ROP Products”). |

| d) | the

SAFER® platform and the SAFER® products are subject to patents and other intellectual

property rights, owned by ROP. |

| e) | Sharps

has developed Securegard®, Sologard® and Sologard® locking plus product lines

(hereinafter, respectively, “Securegard®”, “Sologard®”

and “Sologard® LP” and, collectively, “Sharps Products”) |

| f) | Sharps

Products are subject to patents and other intellectual property rights, owned by Sharps. |

| g) | ROP

and Sharps are willing to further the sales of ROP Products and Sharps Products and the development

of new products through this collaboration. |

Now

therefore, in consideration of the foregoing recitals

(the “Recitals”), which form an integral part of this Agreement, and the mutual covenants set forth herein and for

other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties, intending to be legally

bound by the terms and conditions of this Agreement, agree as follows.

| 1. | Definitions

and interpretations |

| 1.1. | Definitions.

Unless the context requires otherwise, in this Agreement: |

“Affiliate”

means, in relation to any person, any other person controlled by, controlling or under common control with such person, it being understood

that, for the purposes of this definition, “control” shall mean the possession, directly or indirectly, of the power to direct

or cause the direction of the management and policies of a person or entity, whether through the ownership of voting securities, by contract,

or otherwise. Control will be presumed to exist when any person or entity owns 50% or more of the voting securities or interest in another

entity or has the right to appoint or elect a majority of the directors or other governing body of the entity.

“Agreement”

means Cooperative Sales and Distribution agreement.

“Annex”

means any attachment to this Agreement.

“Authority”

means any multinational, international, supranational, national, European, federal, state, provincial or local governmental authority,

regulatory body or entity, or any political subdivision thereof, as well as any court of competent jurisdiction, arbitrator or arbitration

panel, social security body, central bank, tax authority, agency, registry, commission, including without limitation any division, department,

or other body thereof, having jurisdiction with respect to the provisions, activities and obligations contemplated under this Agreement.

“Confidential

Information” means any information related to the other Party, this Agreement, including its existence, negotiation, terms

and conditions and the transactions contemplated herein, and, more generally, any information relating to or obtained in connection with

the negotiation and performance of this Agreement or any connected or related agreements.

“Contact

Person” means the person appointed by either Party pursuant to Section 3.1.

“Currency

Adjustment Clause” means a provision within this agreement that permits the alteration of specified financial obligations to

reflect changes in currency exchange rates. This clause aims to protect the contracting parties from potential losses resulting from

currency value fluctuations between the time of agreement and the time of payment execution.

“Distribution

Agreement” means either ROP Distribution Agreement or Sharps Distribution Agreement, as the case may be.

“Effective

Date” means the date hereof.

“Force

Majeure” means fires, floods, acts of God, epidemics and pandemics, with the exclusion of Covid-19 outbreaks, acts of war,

embargoes, strikes, labour disputes, labour shortages, lack of or inability to obtain materials, fuel, supplies or other equipment, riots,

thefts, accidents, transportation delay, acts of terrorism, acts or failure to act of Government, major equipment breakdown, or any other

cause whatsoever, whether similar or dissimilar to those enumerated above, beyond the reasonable control of any of the Parties, and which

is unavoidable notwithstanding the care of the Party affected.

“Initial

Term” means the initial term of this Agreement.

“Parties”

means, jointly, the parties of this Agreement.

“Party”

means either party of this Agreement.

“Recitals”

means the recitals of this Agreement.

“Renewal

Term” means each renewal period of this Agreement.

“ROP”

means Roncadelle Operations s.r.l., a company formed and existing under the laws of Italy, having its registered office in Castel Mella

(BS, Italy), Via Renolda 10.

“ROP

Distribution Agreement” means the agreement by which Sharps appoints ROP as its Distributor for certain products in a certain

territory as outlined in Annex B.

“Sharps”

means Sharps Technology, Inc., a company formed and existing under the laws of Nevada (U.S.A.), having its registered office in Melville

(NY, USA), 105 Maxess Road, Suite 124.

“Sharps

Distribution Agreement” means the agreement by which ROP appoints Sharps as its Distributor for certain products in a certain

territory as outlined in Annex A.

“Tax”

or “Taxes” means all taxes, charges, duties, fees, levies or other assessments, including income, excise, property,

sales, value added, profits, license, withholding (with respect to compensation or otherwise), payroll, employment, net worth, capital

gains, transfer, stamp, social security, environmental, occupation and franchise taxes, imposed by any Authority, and including any interest,

penalties and additions attributable thereto.

“Term”

means the term of this Agreement as possibly renewed from time to time.

| 1.2. | Interpretation.

In this Agreement, except where the context indicates to the contrary: |

| (a) | references

to persons shall include individuals, bodies corporate (wherever incorporated), unincorporated

associations and partnerships, and Authorities, including their legitimate successors. |

| (b) | words

importing the singular will include the plural (and vice versa) and words denoting

a given gender will include all other genders. |

| (c) | headings

are for convenience only and will not affect interpretation of this Agreement. |

| (d) | any

reference to any enactment of statutory provision is a reference to it as it may have been,

or may from time to time be, amended, modified, consolidated, or re-enacted (with or without

modification) and includes all instruments or orders made under such enactment. |

| (e) | all

monetary amounts are expressed in the functional currency of the respective Supplier; under

the Currency Adjustment Clause as described in Annex A and B, prices can be adjusted if they

are moved above a ±5% change. |

| (f) | any

time or date refers to that time or date in Italy. |

| (g) | any

reference to a Section or an Annex is made to a section or annex to this Agreement. |

| (h) | any

reference to this Agreement includes its Annexes, which all form an integral part of this

Agreement. |

| (i) | the

expressions “cause” or “procure” or any undertakings of any fact,

action or omission of a third party shall be construed as an obligation pursuant to Article

1381 of the Italian Civil Code (promessa del fatto del terzo). |

| 2. | Sales

of the existing products |

| 2.1. | Sharps

Distribution Agreement. ROP hereby appoints Sharps as its exclusive Distributor of ROP

Products in the United States, Canada, Central and South America and their territories, consistent

with the terms and conditions set forth in Annex A which the Parties shall execute on the

date hereof (mutual “Cooperative Sales and Distribution Agreement”). |

| 2.2. | ROP

Distribution Agreement. Sharps shall appoint ROP as its exclusive Distributor of Sharps

Products in Europe, Middle East, APAC, South Africa and Australia and their territories,

consistent with the terms and conditions set forth in Annex B which the Parties shall execute

on the date hereof (mutual “Cooperative Sales and Distribution Agreement”). |

| 2.3. | Supplier

role. The Supplier will be responsible for manufacturing the products and obtaining certain

items and responsibilities including, but not limited to, all certifications for compliance

and providing to the Distributor. The Supplier will provide promotional literature and training

to adequately communicate the Supplier’s capabilities and technologies to the Distributor.

Both parties will act in a Supplier role in accordance with this agreement |

| 2.4. | Distributor

role. The Distributor will be responsible for engaging with customers and pursuing sales

of the agreed upon products. Both parties will act in a Distributor role in accordance with

this agreement |

| 2.5. | Consignment

stock. Pursuant to the provisions of the relevant Distribution Agreement, Annex A and

Annex B products shall be delivered by the Supplier to the Distributor on a consignment basis

and shall be stored in specifically designated areas of the Distributor’s warehouse

which must at all times comply with the storage conditions for the products. The Supplier

shall retain the title to the products until the Distributor withdraws the products from

the designated consigned inventory areas. The Supplier shall use commercially reasonable

efforts to ensure that it always maintains sufficient consignment stock to accommodate the

expected demand for products but, at a maximum, [two (2)] months of the total yearly expected

purchases of the products. The Distributor shall keep the Supplier informed of Distributor’s

estimated demand for products from customers, providing its sales forecast as described in

the relevant Distributor Agreements in Annex A or Annex B respectively. |

| 2.6. | Pricing.

The initial pricing for the products shall be as stipulated in the respective distribution

agreement detailed in Appendix A or Appendix B herein. This shall also extend to any requisite

adjustments in pricing that may arise due to prevailing market conditions. The transfer prices,

as delineated in the pertinent distribution agreements detailed in Annex A and Annex B encompass,

but are not limited to, fixed costs as agreed upon initially. These fixed costs shall be

subject to periodic reviews and modifications, enabling both companies to promptly adapt

to fluctuations in market and logistical conditions. |

| 2.7. | Sales

targets. Initial sales targets are stipulated and delineated within the respective Distribution

Agreements detailed in Annex A or Annex B. These targets shall be established and subject

to annual review as outlined in the aforementioned annexes. |

| 2.8. | Requesting

approvals and/or clearances. The delineation of roles and responsibilities is as follows: |

| 2.8.1. | Distributor:

Due to their greater familiarity with the jurisdiction’s regulatory framework and procedural

specifics, the Distributor shall bear the responsibility for securing all mandatory approvals

and registrations, in addition to ensuring full compliance with the local legal and regulatory

mandates pertinent to the distribution and sale of the product within their allocated territory. |

| 2.8.2. | Supplier:

The Supplier is required to ascertain and affirm that the product adheres to all applicable

regulatory standards necessary for its sale within the designated territory. This obligation

includes the procurement of any requisite approvals or certifications to comply with both

local and broader regulatory requirements. |

| 3.1. | Promptly

following the Effective Date, each Party shall deliver to the other Party a written notice

containing the name and contact details of its appointed contact person (the “Contact

Person”) who will (a) serve as such Party’s primary point of contact under

this Agreement, (b) have overall responsibility for managing and coordinating the performance

of such Party’s obligations under this Agreement (and the related agreements) and be

responsible for the day-to-day implementation of this Agreement and all the related agreements,

including attempted resolution of any issues that may arise during the performance of any

Party’s obligations hereunder, (c) be authorized to act for and on behalf of such Party

with respect to all operational matters relating to this Agreement and the related agreements

and (d) will provide guidance on the steps the Parties shall take in their cooperations under

this Agreement and the related agreements. The foregoing provision will not limit either

Party’s ability to communicate with the other Party’s relevant contact person(s)

with respect to any particular matter. |

| 3.2. | In

no event shall the Contact Person be authorized to amend or change the provisions of this

Agreement. Each Party may change its Contact Person from time to time by written notice to

the other Party. |

| 4. | Representations

and warranties |

| 4.1. | ROP’s

representations. ROP represents and warrants to Sharps that the following representations

and warranties are true correct and complete on the Effective Date: |

| 4.1.1. | Organization

and standing |

| (a) | ROP

is a limited liability company duly formed, organized and validly existing and in good standing

under the laws of Italy. |

| | | |

| (b) | ROP

is not insolvent nor is involved in, or subject to, any insolvency proceedings or similar

composition with creditor proceedings and there a no circumstances that require or would

trigger any such proceedings to be started. |

| 4.1.2. | Power

and authority |

| (a) | ROP

has all the requisite corporate power and authority to execute and deliver this Agreement

and to perform its obligations hereunder. |

| | | |

| (b) | Any

corporate resolutions, whether required by the law or by ROP’s articles of association,

granting authority and/or signatory powers to the individual(s) executing any documents on

behalf of ROP will be validly taken prior to execution and any evidence of such resolutions

delivered by ROP will be true, accurate and correct. |

| (a) | No

consent, approval, permit, exemption, order, or authorization of, or registration, qualification,

designation, declaration or filing with, any Authority is required on the part of ROP in

relation to the consummation and performance of the transactions contemplated herein. |

| (a) | The

execution and delivery of this Agreement and the consummation and performance of the transactions

contemplated herein will not conflict with, or result in the breach of, or constitute a default

under, or give rise to a right of termination, cancellation or acceleration of, ROP’s

articles of association or any agreement or other instrument by which ROP is bound or to

which any assets of ROP are subject or be in breach of any judgment, order, injunction, award,

decree, law or regulation applicable to ROP. |

| 4.2. | Sharps’

representations. Sharps represents and warrants to ROP that the following representations

and warranties are true correct and complete on the Effective Date: |

| 4.2.1. | Organization

and standing |

| (a) | Sharps

is a corporation duly formed, organized and validly existing and in good standing under the

laws of Nevada (U.S.A.). |

| (b) | Sharps

is not insolvent nor is involved in, or subject to, any insolvency proceedings or similar

composition with creditor proceedings and there a no circumstances that require or would

trigger any such proceedings to be started |

| 4.2.2. | Power

and authority |

| (a) | Sharps

has all the requisite corporate power and authority to execute and deliver this Agreement

and to perform its obligations hereunder. |

| (b) | Any

corporate resolutions, whether required by the law or by Sharps’ articles of association,

granting authority and/or signatory powers to the individual(s) executing any documents on

behalf of Sharps will be validly taken prior to execution and any evidence of such resolutions

delivered by Sharps will be true, accurate and correct. |

| (a) | No

consent, approval, permit, exemption, order, or authorization of, or registration, qualification,

designation, declaration or filing with, any Authority is required on the part of Sharps

in relation to the consummation and performance of the transactions contemplated herein. |

| (a) | The

execution and delivery of this Agreement and the consummation and performance of the transactions

contemplated herein will not conflict with, or result in the breach of, or constitute a default

under, or give rise to a right of termination, cancellation or acceleration of, Sharps’

articles of association or any agreement or other instrument by which Sharps is bound or

to which any assets of Sharps are subject or be in breach of any judgment, order, injunction,

award, decree, law or regulation applicable to Sharps. |

| 4.3. | ROP’s

indemnification obligation. ROP agrees and undertakes to indemnify and hold Sharps harmless

against any and all losses incurred or suffered by Sharps that would have not been so incurred

or suffered had ROP’s representations under Section 4.1 been true, correct and complete. |

| 4.4. | Sharps’

indemnification obligation. Sharps agrees and undertakes to indemnify and hold ROP harmless

against and any and all losses incurred or suffered by ROP that would have not been so incurred

or suffered had Sharps’ representations under Section 4.2 been true, correct and complete. |

| 5.1. | Term.

This Agreement shall be effective as of the Effective Date for the initial period of one

(1) year (the “Initial Term”). Upon expiration of the Initial Term, the

term of this Agreement shall automatically renew for additional successive one year terms,

unless either Party provides written notice of non-renewal at least ninety (90) days prior

the end of the then-current term (each a “Renewal Term” and together with

the Initial Term, the “Term”), unless any Renewal Term is earlier terminated

pursuant to the terms of this Agreement or applicable law. |

| 5.2. | Termination

for Material Breach: For the purposes of this Agreement, a “Material Breach”

shall mean any significant failure by either Party to fulfil its obligations under this Agreement,

which significantly undermines the essence of the Agreement to the other Party. In the event

of a Material Breach by either Party, the non-breaching Party shall provide written notice

to the breaching Party, outlining the nature of the breach. The breaching Party shall have

twenty (20) days from receipt of notice to remedy the breach. If the breach remains uncured

after this period, the non-breaching Party may terminate the Agreement forthwith. |

| 5.3. | Termination

for Convenience: Either Party may terminate this Agreement at any time without cause, upon

giving ninety (90) days’ written notice to the other Party. |

| 5.4. | Cross-termination .

This Agreement shall automatically terminate upon termination, for any cause, of either Distribution

Agreement referred to herein. |

| 6.1. | Confidentiality

obligation. The Parties undertake to maintain strictly confidential the Confidential

Information during the Term of this Agreement and for five (5) years after its termination. |

| 6.2. | Exceptions.

The Parties may disclose the Confidential Information that: |

| (a) | is

or becomes available to the public other than in result of a breach of the provisions under

this Section 5; |

| (b) | was

disclosed to third parties with the prior written consent of the disclosing Party. |

| (c) | was

already known by the receiving Party before disclosure. |

| (d) | was

disclosed in compliance with any applicable law or binding order of any authority having

jurisdiction on the receiving Party. |

| (e) | is

necessary to defend in any judicial or arbitration proceedings any rights hereunder. |

| 6.3. | Permitted

disclosures. The Parties may disclose the Confidential Information to their employees,

advisors, directors, and agents, and to their Affiliates’ employees, advisors, directors,

and agents, to the extent that such employees, advisors, directors, and agents need to know

the Confidential Information. |

| 6.4. | Public

Disclosure: All public communications concerning the transactions described in this Agreement,

including but not limited to press releases, statements, and other publicity, must receive

joint approval from both parties prior to release. Given Sharps’ public company obligations,

the necessity to disclose the existence and broad terms of this Agreement is recognized,

yet it is agreed that sensitive details, especially pricing, can be kept confidential. The

parties commit to collaboratively determine the timing and specifics of disclosures to adhere

to regulatory obligations while protecting shared interests. |

| 7.1. | Notices.

Any notice to be given pursuant or in connection to this Agreement shall be only valid and

effective, on the date of delivery, if given to the other Party in writing, in English and

served or delivered by registered mail or courier with return receipt to the following addresses: |

| i. | if

to ROP: |

| | Roncadelle

Operations s.r.l. |

| | Via

Renolda 10 |

| | 25030

Castel Mella, BS – Italy |

| | Attn:

Mr.Erik Ryckalts |

| ii. | if

to Sharps: |

| | | 105

Maxess Road, Ste. #124 |

| | | Melville,

New York 11747 |

| | | Attn:

Mr. Robert Hayes |

or

to such other address that a Party may notify in writing to the other at any time pursuant to this Section.

| 8.1. | Costs.

Each Party shall bear its own costs and expenses, including fees and other expenses, relating

to external advisors and the preparation, negotiation, execution and performance of this

Agreement and any related documents. |

| 8.2. | Force

Majeure. If either Party is prevented, hindered, or delayed in performing any of its

obligations under this Agreement by an event of Force Majeure, then it shall notify the other

in writing of such event within ten (10) days after the occurrence of such event, under penalty

of forfeiture (a pena di decadenza). Within another ten (10) days the affected Party

shall submit to the other documentary evidence of the circumstances thereof and the possible

impact on its performance of this Agreement. Subject to due delivery of a Force Majeure notice,

the Party affected by Force Majeure shall be excused from performance of its obligations

under the Agreement for such period of time as such Force Majeure event lasts. The Party

affected by the event of Force Majeure shall use reasonable efforts to mitigate the effect

thereof upon its performance of the Agreement. If the Force Majeure event lasts for more

than two (2) months, the Party not affected by Force Majeure may terminate the Agreement

by giving a written notice to the other Party. |

| 8.3. | No

joint venture. Nothing in this Agreement shall be construed as intended to give rise

to any partnership, joint venture, or agency relationship between the Parties. Neither Party

shall have authority to commit or bind the other in any manner. |

| 8.4. | No

assignment. Except as otherwise provided in this Agreement, neither Party may assign

this Agreement as well as any rights, interests, or obligations hereunder without the prior

written consent of the other Party. |

| 8.5. | Amendments.

This Agreement may not be waived, changed, amended, or supplemented orally but only by a

written instrument duly executed by both Parties. |

| 8.6. | No

waiver. No failure or delay by any Party in exercising any right, power or privilege

under this Agreement shall be construed as a waiver thereof nor shall any single partial

exercise thereof preclude any other further exercise thereof or the exercise of any other

right, power, or privilege. |

| 8.7. | Entire

agreement. This Agreement constitutes the entire agreement between the Parties in respect

of the subject matter hereof and supersedes and terminates any prior agreements, arrangements,

or understandings, whether written or oral, including any representation given by the Parties,

relating to the same matter. |

| 8.8. | Further

assurance. The Parties hereby agree to execute and deliver in good faith all such instruments

and documents and to perform all such acts and do all such other things as may be reasonably

necessary to further the purposes of this Agreement, provided however that the provisions

of such further instruments and documents shall not affect the understanding contained herein

which shall continue to be fully and exclusively valid and enforceable between the Parties. |

| 8.9. | Invalidity.

In the event that any provision of this Agreement, or part thereof, or any other instrument

or agreement connected to this Agreement is found to be invalid or unenforceable, the validity

of the whole Agreement or the relevant instrument or agreement shall not be affected. In

such case, the Parties shall amend this Agreement, or the affected instrument or agreement,

in order to ensure validity and enforceability. |

| 8.10. | Applicable

law. The construction, validity, and performance of this Agreement and any disputes arising

out of it shall be governed by and construed in accordance with the laws of Switzerland,

without giving effect to any choice or conflict of law provision or rule that would cause

the application of the laws of any jurisdiction other than those of Switzerland. |

| 8.11. | Jurisdiction.

Any dispute, controversy, or claim arising out of or in relation to this Agreement, including

the validity, invalidity, breach, or termination thereof, shall be resolved by arbitration

administered by the International Chamber of Commerce (ICC) in accordance with its arbitration

rules. The place of arbitration shall be Geneva, Switzerland, and the language of the arbitration

shall be English. The arbitration award shall be final and binding upon the parties and may

be entered as a judgment in any court of competent jurisdiction |

| 9.1. | The

following document are attached as Annexes to this Agreement: |

| ● | Annex

A: Sharps Distribution Agreement |

| ● | Annex

B: ROP Distribution Agreement |

*

* *

In

witness whereof, the Parties have caused this Agreement to be duly executed and delivered by their proper and duly authorized officers

as of the day and year first above written.

| On

behalf of: Roncadelle Operations s.r.l. |

|

On behalf of: Sharps Technology Inc. |

| Name: |

Erik Ryckalts |

|

Name: |

Robert

Hayes |

| Position: |

CEO |

|

Position: |

|

| Signature: |

|

|

Signature: |

|

Exhibit

10.2

AMENDMENT_1 TO THE COOPERATIVE SALES AND DISTRIBUTION AGREEMENT

This

Amendment is made effective as of March 4, 2024, by and between:

Roncadelle

Operations s.r.l., a company formed and existing under the laws of Italy, having its registered office in Castel Mella (BS, Italy), Via

Renolda 10, VAT code and registration number VAT-ID Number IT 04151620988, represented by Mr. Erik Ryckalts, CEO, duly authorized by

way of the resolution of the board of directors (hereinafter referred to as “ROP”),

AND

Sharps

Technology, Inc., a company formed and existing under the laws of Nevada (U.S.A.), having its registered office in Melville (NY, USA),

105 Maxess Road, Suite 124, Federal ID 82-3751728 represented by Mr. Robert Hayes, CEO, duly authorized as an officer of Sharps with

single signature authority (hereinafter referred to as “Sharps”).

WHEREAS

ROP and Sharps have entered into a Cooperative Sales and Distribution Agreement, including Annex A and Annex B (collectively referred

to as “the AGREEMENT”), establishing the terms of their mutual distribution and consignment arrangements.

WHEREAS

the Parties wish to amend the AGREEMENT to clarify and enhance the terms specified in section 2.5 of the Cooperative Sales and Distribution

Agreement and section 2.2 of Annex A and Annex B in both the United States and Europe, and to establish reciprocal arrangements for the

benefit of both parties.

NOW,

THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the Parties agree to amend the consignment stock Agreement as follows:

| 1. | Reciprocal

Stock: Both parties agree in general to maintain stock, whether on consignment or purchased

stock at each other’s facilities, ROP in Europe and Sharps in the United States, under

mutually agreed conditions as outlined in the AGREEMENT. |

| 2. | European

Logistics Options: The Parties mutually evaluate and agree upon the most

suitable logistics model for the operations in Europe to enhance efficiency and cost-effectiveness.

The options under consideration include: |

| i. | Common

Warehouse at ROP’s Facility: Investigating the feasibility of integrating Sharps

products into ROP’s existing European warehouse for consolidated stock management. |

| ii. | Joint

Warehouse at Sharps facility in Europe: Assessing the benefits and practicality

of establishing a joint warehouse at Sharps’ European facility to leverage combined

logistics and sterilization services. |

| iii. | Separate

Warehouses with Coordinated Order and Delivery Management: Maintaining distinct warehousing

facilities while ensuring close coordination on order and delivery management. |

The

Parties commit to a collaborative decision-making process to select the most advantageous logistics strategy, considering factors such

as cost, efficiency, and the potential for enhanced service delivery.

| 3. | Buy-Back

Guarantee: ROP and Sharps agree to a reciprocal buy-back guarantee, allowing either

party to return unsold products from purchased inventory after a period of three (3) months. |

This

Buy-Back Guarantee is universally applicable to stock in the United States. In Europe, it is only applicable under Option I (Common Consignment

Warehouse at ROP’s Facility). For other logistics options, specific conditions will be mutually determined by the Parties.

| 4. | Flexible

Payment Terms: The Parties agree to adapt the payment terms to allow for payments within

90 days after the sale of products. |

| 5. | Stock

Level Adjustments: The Parties commit to quarterly reviews of stock levels and demand

forecasts, allowing adjustments to be made to consignment stock levels as necessary. |

| 6. | General

Provisions: Except as expressly modified by this Amendment, all terms and conditions

of the Agreement and its Annexes shall remain in full force and effect. |

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the date first above written.

| Roncadelle Operations s.r.l. |

|

Sharps

Technology, Inc. |

| |

|

|

|

| By:

|

|

|

By:

|

|

| Name:

|

Erik Ryckalts |

|

Name:

|

Robert

Hayes |

| Title: |

CEO |

|

Title: |

CEO

Date: |

| Date: |

|

|

Date: |

|

Exhibit 10.3

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=STSS_CommonStock0.0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=STSS_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

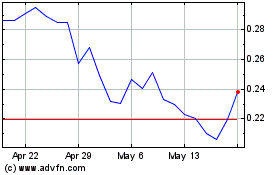

Sharps Technology (NASDAQ:STSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sharps Technology (NASDAQ:STSS)

Historical Stock Chart

From Apr 2023 to Apr 2024