U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-34409

RECON TECHNOLOGY, LTD

Room 601, No.1 Shui’an South Street

Chaoyang District

Beijing, 100012

People's Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Entry into Material Definitive Agreements

On January 31, 2024, Recon Technology, Ltd (the

“Company”) entered into a securities purchase agreement (the “Securities Purchase Agreement”), pursuant to which

the Company agreed to sell securities to various purchasers (the “Purchasers”) in a private placement transaction (the “Private

Placement”).

Pursuant to the Securities Purchase Agreement,

the Company agreed to transfer, assign, set over and deliver to the Purchasers and the Purchasers agree, severally and not jointly, to

acquire from the Company in the aggregate 100,000,000 of the Company’s Class A ordinary shares (the “Shares”) at USD$0.11

per share for USD$11,000,000.

On February 2, 2024, the Company closed the Private

Placement. There are 141,703,218 Shares outstanding after the issuance of the Shares purchased.

The Shares are being sold in transactions exempt

from registration under the Securities Act of 1933, as amended (the “Securities Act”). Each Purchaser understands that the

Shares have not been registered under the Securities Act. Such Purchaser will not sell or otherwise dispose of the Shares without registration

under the Securities Act, and under applicable state securities or “Blue Sky” laws, or pursuant to an exemption therefrom.

No placement agent was involved in the Private Placement.

A copy of the Securities Purchase Agreement is

filed as Exhibit 4.1 to this report and are incorporated by reference herein. The foregoing summary of the Securities Purchase Agreement

is subject to, and qualified in its entirety by reference to, such exhibit.

Exhibits

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

RECON TECHNOLOGY, LTD |

| |

|

| |

/s/ Shenping Yin |

| |

Shenping Yin |

| |

Chief Executive Officer |

| |

(Principal Executive Officer) |

Dated: February 5, 2024

Exhibit 4.1

FORM OF SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE

AGREEMENT (the “Agreement”), dated as of January 31, 2024, by and between Recon Technology, Ltd, a Cayman

Islands company, with headquarters located at Room 601, No. 1 Shui’an South Street, Chaoyang District, Beijing 100012, People’s

Republic of China (the “Company”), and the purchasers listed on Schedule A hereto (the “Buyers”).

RECITALS:

A. The Company and the Buyers are executing and delivering this Agreement in reliance upon the exemption from securities registration

afforded by the rules and regulations as promulgated by the United States Securities and Exchange Commission (the “SEC”) under

the Securities Act of 1933, as amended (the “1933 Act”);

B. Buyers desire to purchase and the Company desires to issue and sell, upon the terms and conditions set forth in this Agreement,

Class A Ordinary Shares, of the Company, $0.0925 par value per share of the Company (the “Ordinary Shares”) at a purchase

price of $0.11 per Ordinary Share, in the aggregate principal amount of $11,000,000.

C. Each Buyer wishes to purchase, upon the terms and conditions stated in this Agreement, such Shares as is set forth immediately

below its name on the signature pages hereto; and

NOW THEREFORE, the

Company and the Buyers severally (and not jointly) hereby agree as follows:

1.

Purchase and Sale of Share.

a.

Purchase of Shares. On the third business day following each Closing Date (as defined below), the Company shall issue and

sell to the Buyers and each Buyer agrees to purchase from the Company such Ordinary Shares as is set forth in Schedule A.

b.

Form of Payment. On the second business day following the Closing Date (as defined below), (i) each Buyer shall pay the

purchase price for the Ordinary Shares to be issued and sold to it at the Closing (as defined below) (the “Purchase Price”)

by wire transfer of immediately available funds to the Company, in accordance with the Company’s written wiring instructions, and

(ii) the Company shall deliver such Shares, to the Buyer, against delivery of such Purchase Price.

c.

Closing Date. The date and time of the issuance and sale of the Ordinary Shares pursuant to this Agreement (the “Closing

Date”) shall be on or about January 29, 2024, or such other mutually agreed upon time. The closing of the transactions contemplated

by this Agreement (the “Closing”) shall occur on the Closing Date at such location as may be agreed to by the parties.

2.

Buyers’ Representations and Warranties. Each Buyer represents and warrants to the Company that:

a.

Investment Purpose. As of the date hereof, the Buyer is purchasing the Ordinary Shares for its own account and not with

a present view towards the public sale or distribution thereof, except pursuant to sales registered or exempted from registration under

the 1933 Act; provided, however, that by making the representations herein, the Buyer does not agree to hold any of the

Securities for any minimum or other specific term and reserves the right to dispose of the Securities at any time in accordance with or

pursuant to a registration statement or an exemption under the 1933 Act.

b.

Accredited Investor Status. The Buyer is an “accredited investor” as that term is defined in Rule 501(a) of

Regulation D (an “Accredited Investor”). Any of Buyer’s transferees, assignees, or purchasers must be “accredited

investors” in order to qualify as prospective transferees, permitted assignees in the case of Buyer’s or Holder’s transfer,

assignment or sale of the Ordinary Shares. The Buyer has provided such information as may be required to verify its status as an Accredited

Investor pursuant to Rule 506(c) of Regulation D, and all such materials provided were true, accurate, complete and not misleading as

of the time provided. Nothing has occurred or failed to occur since the date of verification that would be reasonably likely to result

in the Buyer ceasing to be considered an Accredited Investor.

c.

Reliance on Exemptions. The Buyer understands that the Ordinary Shares are being offered and sold to it in reliance upon

specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying

upon the truth and accuracy of, and the Buyer’s compliance with, the representations, warranties, agreements, acknowledgments and

understandings of the Buyer set forth herein in order to determine the availability of such exemptions and the eligibility of the Buyer

to acquire the Securities.

d.

Information. The Buyer and its advisors, if any, have been, and for so long as the Ordinary Shares remain outstanding will

continue to be, furnished with all materials relating to the business, finances and operations of the Company and materials relating to

the offer and sale of the Ordinary Shares which have been requested by the Buyer or its advisors. The Buyer and its advisors, if any,

have been, and for so long as the Ordinary Shares remain outstanding will continue to be, afforded the opportunity to ask questions of

the Company. The parties agree that the foregoing obligations will be satisfied in full by the Company’s filing of such reports

with the Securities and Exchange Commission as may be required pursuant to the Securities Exchange Act of 1934, as amended. Notwithstanding

the foregoing, the Company has not disclosed to the Buyer any material nonpublic information and will not disclose such information unless

such information is disclosed to the public prior to or promptly following such disclosure to the Buyer. Neither such inquiries nor any

other due diligence investigation conducted by Buyer or any of its advisors or representatives shall modify, amend or affect Buyer’s

right to rely on the Company’s representations and warranties contained in Section 3 below. The Buyer understands that its investment

in the Ordinary Shares involves a significant degree of risk. The Buyer is not aware of any facts that may constitute a breach of any

of the Company's representations and warranties made herein.

e.

Governmental Review. The Buyer understands that no United States federal or state agency or any other government or governmental

agency has passed upon or made any recommendation or endorsement of the Securities.

f.

Transfer or Re-sale. The Buyer understands that (i) the sale or re-sale of the Ordinary Shares has not been and is not being

registered under the 1933 Act or any applicable state securities laws, and the Ordinary Shares may not be transferred unless (a) the

Securities are sold pursuant to an effective registration statement under the 1933 Act, (b) in the case of subparagraphs (c), (d)

and (e) below, the Buyer shall have delivered to the Company, at the cost of the Buyer, an opinion of counsel that shall be in form, substance

and scope customary for opinions of counsel in comparable transactions to the effect that the Securities to be sold or transferred may

be sold, or transferred pursuant to an exemption from such registration, including the removal of any restrictive legend which opinion

shall be accepted by the Company, (c) the Securities are sold or transferred to an “affiliate” (as defined in Rule 144

promulgated under the 1933 Act (or a successor rule) (“Rule 144”) of the Buyer who agrees to sell or otherwise transfer the

Securities only in accordance with this Section 2(f) and who is an Accredited Investor, (d) the Securities are sold pursuant to Rule

144, or (e) the Securities are sold pursuant to Regulation S under the 1933 Act (or a successor rule) (“Regulation S”);

(ii) any sale of such Securities made in reliance on Rule 144 may be made only in accordance with the terms of said Rule and further,

if said Rule is not applicable, any re-sale of such Securities under circumstances in which the seller (or the person through whom the

sale is made) may be deemed to be an underwriter (as that term is defined in the 1933 Act) may require compliance with some other exemption

under the 1933 Act or the rules and regulations of the SEC thereunder; and (iii) neither the Company nor any other person is under any

obligation to register such Securities under the 1933 Act or any state securities laws or to comply with the terms and conditions of any

exemption thereunder (in each case). Notwithstanding the foregoing or anything else contained herein to the contrary, the Ordinary Shares

may be pledged as collateral in connection with a bona fide margin account or other lending arrangement. The Buyer understands

that, to the extent the Buyer is or becomes an affiliate of the company by virtue of its ownership of the Ordinary Shares, its ability

to sell its securities may be significantly limited.

g.

Legends. The Buyer understands that the Ordinary Shares have not been registered under the 1933 Act. Until such registration

or until the Ordinary Shares may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as

of a particular date that can then be immediately sold, the Ordinary Shares may bear a restrictive legend in substantially the following

form (and a stop-transfer order may be placed against transfer of the certificates for such Securities):

“NEITHER THE ISSUANCE AND SALE OF THE

SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED

OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT

REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES

MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.”

The legend set forth above

shall be removed and the Company shall issue a certificate without such legend to the holder of any Ordinary Share upon which it is stamped,

if, unless otherwise required by applicable state securities laws, (a) such Ordinary Share is registered for sale under an effective registration

statement filed under the 1933 Act or otherwise may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number

of securities as of a particular date that can then be immediately sold, and (b) such holder provides the Company with an opinion of counsel,

in form, substance and scope customary for opinions of counsel in comparable transactions, to the effect that a public sale or transfer

of such Ordinary Share may be made without registration under the 1933 Act, and that legend removal is appropriate, which opinion shall

be accepted by the Company so that the sale or transfer is effected. The Buyer agrees to sell all Ordinary Shares, including those represented

by a certificate(s) from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any.

h. Registration. The Company will use its reasonable best efforts to register the Ordinary Shares for resale by the Buyers.

The Buyers acknowledge and agree that the registration of Ordinary Shares may require one or more registration statements, and such Buyers

understand that they will bear all investment risk in connection with the Ordinary Shares. Additionally, the Buyers understand that, to

the extent the Ordinary Shares are not registered, it may be more difficult to sell such Ordinary Shares, if such sales are even possible.

The Company will bear the costs in connection with the filing and maintenance of effectiveness of the registration statements, including

payment of any filing and other fees.

i. Authorization; Enforcement. This Agreement has been duly and validly authorized. This Agreement has been duly executed and

delivered on behalf of the Buyer, and this Agreement constitutes a valid and binding agreement of the Buyer enforceable in accordance

with its terms.

ii. No Short Sales.

Buyer/Holder, its successors and assigns, agrees that so long as the Ordinary Shares remain outstanding, neither the Buyer/Holder nor

any of its affiliates shall enter into or effect any “short sales” of Ordinary Shares or hedging transaction which establishes

a short position with respect to the Ordinary Shares of the Company.

3.

Representations and Warranties of the Company. The Company represents and warrants to the Buyer that:

a.

Organization and Qualification. The Company and each of its subsidiaries, if any, is a corporation duly organized, validly

existing and in good standing under the laws of the jurisdiction in which it is incorporated, with full power and authority (corporate

and other) to own, lease, use and operate its properties and to carry on its business as and where now owned, leased, used, operated and

conducted.

b.

Authorization; Enforcement. (i) The Company has all requisite corporate power and authority to enter into and perform this

Agreement and to consummate the transactions contemplated hereby and thereby and to issue the Securities, in accordance with the terms

hereof and thereof, (ii) the execution and delivery of this Agreement, the issuance of the Ordinary Shares have been duly authorized by

the Company’s Board of Directors and no further consent or authorization of the Company, its Board of Directors, or its shareholders

is required, (iii) this Agreement has been duly executed and delivered by the Company by its authorized representative, and such authorized

representative is the true and official representative with authority to sign this Agreement and the other documents executed in connection

herewith and bind the Company accordingly, and (iv) this Agreement constitutes, and upon execution and delivery by the Company of the

Ordinary Shares, each of such instruments will constitute, a legal, valid and binding obligation of the Company enforceable against the

Company in accordance with its terms.

c.

Issuance of Shares. The Ordinary Shares are duly authorized and reserved for issuance and, in accordance with its respective

terms, will be validly issued, fully paid and non-assessable, and free from all taxes, liens, claims and encumbrances with respect to

the issue thereof and shall not be subject to preemptive rights or other similar rights of shareholders of the Company and will not impose

personal liability upon the holder thereof.

d.

No Conflicts. The execution, delivery and performance of this Agreement and the consummation by the Company of the transactions

contemplated hereby and thereby (including, without limitation, the issuance of the Ordinary Shares) will not (i) conflict with or result

in a violation of any provision of the Certificate of Incorporation or By-laws, or (ii) violate or conflict with, or result in a breach

of any provision of, or constitute a default (or an event which with notice or lapse of time or both could become a default) under, or

give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture, patent, patent license

or instrument to which the Company or any of its Subsidiaries is a party, or (iii) result in a violation of any law, rule, regulation,

order, judgment or decree (including federal and state securities laws and regulations and regulations of any self-regulatory organizations

to which the Company or its securities are subject) applicable to the Company or any of its Subsidiaries or by which any property or asset

of the Company or any of its Subsidiaries is bound or affected (except for such conflicts, defaults, terminations, amendments, accelerations,

cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect). All consents, authorizations,

orders, filings and registrations which the Company is required to obtain pursuant to the preceding sentence have been obtained or effected

on or prior to the date hereof.

e.

Absence of Litigation. Except as disclosed in the Company’s Periodic Report filings with the SEC, there is no action,

suit, claim, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization

or body pending or, to the knowledge of the Company or any of its subsidiaries, threatened against or affecting the Company or any of

its subsidiaries, or their officers or directors in their capacity as such, that could have a material adverse effect. Schedule 3(f) contains

a complete list and summary description of any pending or, to the knowledge of the Company, threatened proceeding against or affecting

the Company or any of its subsidiaries, without regard to whether it would have a material adverse effect. The Company and its subsidiaries

are unaware of any facts or circumstances which might give rise to any of the foregoing.

f.

Acknowledgment Regarding Buyer’ Purchase of Securities. The Company acknowledges and agrees that the Buyer is acting

solely in the capacity of arm’s length purchasers with respect to this Agreement and the transactions contemplated hereby. The Company

further acknowledges that the Buyer is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with

respect to this Agreement and the transactions contemplated hereby and any statement made by the Buyer or any of its respective representatives

or agents in connection with this Agreement and the transactions contemplated hereby is not advice or a recommendation and is merely incidental

to the Buyer’s purchase of the Ordinary Shares. The Company further represents to the Buyer that the Company’s decision to

enter into this Agreement has been based solely on the independent evaluation of the Company and its representatives.

g.

No Integrated Offering. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf, has

directly or indirectly made any offers or sales in any security or solicited any offers to buy any security under circumstances that would

require registration under the 1933 Act of the issuance of the Ordinary Shares to the Buyer.

h.

Bad Actor. No officer or director of the Company would be disqualified under Rule 506(d) of the Securities Act as amended

on the basis of being a “bad actor” as that term is established in the September 19, 2013 Small Entity Compliance Guide

published by the Securities and Exchange Commission.

4.

Governing Law; Miscellaneous.

a.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia

without regard to principles of conflicts of laws. Any action brought by either party against the other concerning the transactions contemplated

by this Agreement shall be brought only in the state courts of Virginia or in the federal courts located in the Commonwealth of Virginia.

The parties to this Agreement hereby irrevocably waive any objection to jurisdiction and venue of any action instituted hereunder and

shall not assert any defense based on lack of jurisdiction or venue or based upon forum non conveniens. The Company and Buyer waive

trial by jury. The prevailing party shall be entitled to recover from the other party its reasonable attorney's fees and costs. In the

event that any provision of this Agreement or any other agreement delivered in connection herewith is invalid or unenforceable under any

applicable statute or rule of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall

be deemed modified to conform with such statute or rule of law. Any such provision which may prove invalid or unenforceable under any

law shall not affect the validity or enforceability of any other provision of any agreement. Each party hereby irrevocably waives personal

service of process and consents to process being served in any suit, action or proceeding in connection with this Agreement or any other

Transaction Document by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such

party at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient

service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any

other manner permitted by law.

b. Counterparts; Signatures by Facsimile. This Agreement may be executed in one or more counterparts, each of which shall be

deemed an original but all of which shall constitute one and the same agreement and shall become effective when counterparts have been

signed by each party and delivered to the other party. This Agreement, once executed by a party, may be delivered to the other party hereto

by facsimile transmission of a copy of this Agreement bearing the signature of the party so delivering this Agreement.

c. Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the

interpretation of, this Agreement.

d. Severability. In the event that any provision of this Agreement is invalid or unenforceable under any applicable statute

or rule of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall be deemed modified

to conform with such statute or rule of law. Any provision hereof which may prove invalid or unenforceable under any law shall not affect

the validity or enforceability of any other provision hereof.

e.

Entire Agreement; Amendments. This Agreement and the instruments referenced herein contain the entire understanding of the

parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither the Company

nor the Buyer makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement

may be waived or amended other than by an instrument in writing signed by the majority in interest of the Buyer.

f. Notices. All notices, demands, requests, consents, approvals, and other communications required or permitted hereunder shall

be in writing and, unless otherwise specified herein, shall be (i) personally served, (ii) deposited in the mail, registered or certified,

return receipt requested, postage prepaid, (iii) delivered by reputable air courier service with charges prepaid, (iv) via electronic

mail or (v) transmitted by hand delivery, telegram, or facsimile, addressed as set forth below or to such other address as such party

shall have specified most recently by written notice. Any notice or other communication required or permitted to be given hereunder shall

be deemed effective (a) upon hand delivery or delivery by facsimile, with accurate confirmation generated by the transmitting facsimile

machine, at the address or number designated below (if delivered on a business day during normal business hours where such notice is to

be received) or delivery via electronic mail, or the first business day following such delivery (if delivered other than on a business

day during normal business hours where such notice is to be received) or (b) on the second business day following the date of mailing

by express courier service, fully prepaid, addressed to such address, or upon actual receipt of such mailing, whichever shall first occur.

The addresses for such communications shall be, as to the Company, the address set forth above and, as to each Buyer, the address set

forth in Schedule A hereto. Each party shall provide notice to the other party of any change in address.

g. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors

and assigns. Neither the Company nor the Buyer shall assign this Agreement or any rights or obligations hereunder without the prior written

consent of the other.

h. Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

i. Survival. The representations and warranties of the Company and the agreements and covenants set forth in this Agreement

shall survive the closing hereunder notwithstanding any due diligence investigation conducted by or on behalf of the Buyer. The Company

agrees to indemnify and hold harmless the Buyer and all their officers, directors, employees and agents for loss or damage arising as

a result of or related to any breach or alleged breach by the Company of any of its representations, warranties and covenants set forth

in this Agreement or any of its covenants and obligations under this Agreement, including advancement of expenses as they are incurred.

j. Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things,

and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

k.

No Strict Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express

their mutual intent, and no rules of strict construction will be applied against any party.

l.

Reserved.

IN WITNESS WHEREOF, the undersigned Buyer and the Company have caused this Agreement to be duly

executed as of the date first above written.

Company

Recon Technology, Ltd

| |

|

|

| By: |

/s/ Yin Shenping |

|

| Name: |

Yin Shenping, CEO |

|

| |

|

|

| |

|

|

| Buyers |

|

| |

|

|

| |

|

| Name: [●] |

|

|

| |

|

|

SCHEDULE A

LIST OF BUYERS

| Name |

Address |

Shares |

Price |

Amount |

|

[●]

|

[●]

|

[●] |

$0.11 |

$[●]

|

| |

|

|

|

|

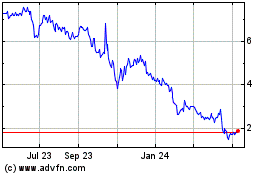

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Mar 2024 to Apr 2024

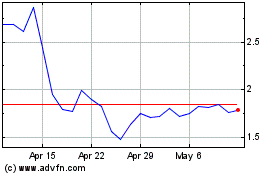

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Apr 2023 to Apr 2024