UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023 (Report No. 3)

Commission File Number: 001-41339

Swvl Holdings Corp

The Offices 4, One Central

Dubai World Trade Centre

Dubai, United Arab Emirates

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

CONTENTS

On

December 26, 2023, Swvl Holdings Corp (“Swvl”), Swvl Global FZE, a free zone limited liability company organized under the

laws of the United Arab Emirates, and Swvl’s Chief Executive Officer, Mostafa Kandil, executed an amendment to Mr. Kandil’s

employment agreement pursuant to which his annual base salary was reduced to $327,000. The amendment to Mr. Kandil’s employment

agreement is attached hereto as Exhibit 99.1 and incorporated herein by reference.

In

addition, on December 26, 2024, the Board of Directors of Swvl approved a grant of RSUs to Swvl’s Chief Executive Officer, Mostafa

Kandil, and its former Chief Financial Officer, Youssef Salem. Mr. Kandil was issued 1,758,242 RSUs and Mr. Salem was issued 557,692 RSUs,

each vesting on March 31, 2024. The RSUs were issued pursuant to their respective employment agreements with Swvl and were issued in consideration

for services provided to Swvl or its affiliates. The form of RSU agreement is attached hereto as Exhibit

99.2 and incorporated herein by reference.

This Report of Foreign Private

Issuer on Form 6-K (“Report”) is incorporated by reference into Swvl’s Registration Statement on Form S-8 (Registration No. 333-265464) filed with the Securities and Exchange Commission, to be a part thereof from the date on which this Report is submitted,

to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SWVL HOLDINGS CORP |

| |

|

|

| Date: December 29, 2023 |

By: |

/s/ Mostafa Kandil |

| |

Name: |

Mostafa Kandil |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

AMENDMENT NO. 1 TO EMPLOYMENT AGREEMENT

This AMENDMENT NO. 1 TO

EMPLOYMENT AGREEMENT (this “Amendment”) dated as of December 26, 2023, by and between Mostafa Kandil (the “Executive”)

Swvl Holdings Corp (formerly known as Pivotal Holdings Corp), a British Virgin Islands business company limited by shares incorporated

under the laws of the British Virgin Islands (the “Company”), and Swvl Global FZE, a free zone limited liability company

organized under the laws of the United Arab Emirates (“Swvl UAE”). Each of the Company, Swvl UAE and the Executive

shall be referred to collectively as the “Parties” and individually as a “Party.”

WHEREAS, the Company,

Swvl UAE and the Executive entered into an Employment Agreement dated as of July 28, 2021 (the “Employment Agreement”)

pursuant to which the Executive was employed by Swvl UAE and the Company upon the terms and conditions therein; and

WHEREAS, the Parties

desire to amend certain provisions of the Employment Agreement as set forth below.

NOW, THEREFORE, in

consideration of the mutual promises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

each of the parties agree with the others as follows:

1. Unless otherwise defined herein, all terms and conditions used in this Amendment shall have the meanings assigned to such terms

in the Employment Agreement.

2.

Section 2.01 (“Base Salary”) of the Employment Agreement is hereby deleted in its entirely and replaced with the following:

“SECTION 2.01.

Base Salary. During the Term, Swvl UAE shall, as compensation for the obligations set forth herein and for all services rendered by Executive

in any capacity during such employment under this Agreement, including services as an officer, employee or other appointee, as applicable,

with respect to Swvl UAE or the Company, pay Executive a base salary (“Base Salary”) at the annual rate of US$327,000 per

year, payable in accordance with Swvl UAE’s standard payroll practices as in effect from time to time. The Base Salary shall be

reviewed by the Board (or a duly authorized committee thereof) on an annual basis for increases but not decreases.”

3.

Except as herein amended, the Employment Agreement shall remain in full force and effect.

4.

Further Assurances. Each Party hereto, without additional consideration, shall cooperate, shall take such further action

and shall execute and deliver such further documents as may be reasonably requested by the other Party hereto in order to carry out the

provisions and purposes of this Amendment.

5.

Counterparts. This Amendment may be signed in counterparts with the same effect as if the signature on each counterpart

were upon the same instrument. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf”

format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature

is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original thereof.

6.

Headings. The headings of Articles and Sections in this Amendment are provided for convenience only and will not affect

its construction or interpretation.

7.

Waiver. Neither any failure nor any delay by any party in exercising any right, power or privilege under this Amendment

or any of the documents referred to in this Amendment will operate as a waiver of such right, power or privilege, and no single or partial

exercise of any such right, power or privilege will preclude any other or further exercise of such right, power or privilege.

8.

Severability. The invalidity or unenforceability of any provisions of this Amendment pursuant to any applicable law shall

not affect the validity of the remaining provisions hereof, but this Amendment shall be construed as if not containing the provision held

invalid or unenforceable in the jurisdiction in which so held, and the remaining provisions of this Amendment shall remain in full force

and effect. If the Amendment may not be effectively construed as if not containing the provision held invalid or unenforceable, then the

provision contained herein that is held invalid or unenforceable shall be reformed so that it meets such requirements as to make it valid

or enforceable.

9.

Governing Law. This Amendment shall be governed by and construed in accordance with the laws of the State of New York, without

giving effect to the choice of law principles thereof. Any disputes arising from this Amendment shall be resolved pursuant to Section

6.06 of the Employment Agreement.

[REMAINDER OF PAGE LEFT BLANK INTENTIONALLY]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment No. 1 to Employment Agreement to be duly executed as of the day and year first above written.

| |

Company: |

| |

|

| |

SWVL HOLDINGS CORP |

| |

|

| |

By: |

/s/ Abdullah Mansour |

| |

Name: Abdullah Mansour |

| |

Title: CFO |

| |

|

| |

SWVL GLOBAL FZE |

| |

|

| |

By: |

/s/ Abdullah Mansour |

| |

Name: Abdullah Mansour |

| |

Title: CFO |

| |

|

| |

Executive: |

| |

|

| |

/s/ Mostafa Kandil |

| |

Mostafa Kandil |

Exhibit 99.2

NOTICE OF RESTRICTED STOCK UNIT AWARD

Swvl Holdings

Corp

Unless otherwise defined in this RSU Agreement

(as defined below), capitalized terms used in this Notice of Restricted Stock Unit Award (this “Notice of Grant”) shall

have the same meanings ascribed to them in the Swvl Holdings Corp 2021 Omnibus Incentive Compensation Plan, as amended from time to time

(the “Plan”). Notwithstanding the preceding sentence, this RSU Award (as defined below) shall not be treated as having

been issued under the Plan.

SECTION 1. General. The Participant named

below has been granted an award of restricted stock units (“RSUs” or the “RSU Award”), subject to

the terms and conditions set forth in this Notice of Grant and the Restricted Stock Unit Agreement attached hereto as Annex A (together,

this “RSU Agreement”). Each RSU represents the right to receive one Share or, if determined by the Committee in its

sole discretion, an amount of cash equal to the Fair Market Value of one Share. The RSUs shall be credited to a separate book-entry account

maintained for the Participant on the books of the Company.

| Participant Name: |

[*] |

| |

|

| Address: |

The Offices 4, One Central, Dubai, UAE |

| |

|

| Total Number of RSUs: |

[*] |

| |

|

| Grant Date: |

19 December 2023 |

| |

|

| Vesting Commencement Date: |

19 December 2023 |

SECTION 2. Vesting. Commencing on the Vesting

Commencement Date, the RSUs shall vest on 31 March 2024 (such date, a “Vesting Date”); provided, that the Participant

remains continuously in active service with the Company or one of its Affiliates from the Grant Date through such Vesting Date.

SECTION 3. Settlement. Except as otherwise

provided herein, each vested RSU will be settled in Shares as soon as practicable (and in no case more than thirty (30) days) after the

applicable Vesting Date.

SECTION 4. Termination of Service. If at

any time prior to the final Vesting Date the Participant’s service with the Company and its Affiliates terminates for any reason

(including any termination of service by the Participant for any reason, or by the Company and its Affiliates with or without cause),

then all unvested RSUs shall be cancelled immediately and the Participant shall not be entitled to receive any payments with respect thereto.

SECTION 5. Participant Obligations and Acknowledgments.

(a)

Participant has received and has had an opportunity to review this RSU Agreement (and the Plan to the extent its provisions are

incorporated herein) and agrees to be bound by all of its terms and provisions.

(b)

Participant acknowledges that all or a portion of this RSU Award may be forfeited and/or the Shares issued upon settlement recouped

if the Company’s financial statements are required to be restated due to noncompliance with any financial reporting requirement

under the Federal securities laws. In addition, Participant acknowledges this RSU Award shall be governed by the terms of the Swvl Holdings

Corp Clawback Policy. Such action, whether or not taken, shall not be the Company’s exclusive remedy with respect to such matters.

(c)

By the Participant’s acceptance hereof (whether written, electronic or otherwise), the Participant agrees, to the fullest

extent permitted by law, that in lieu of receiving documents in paper format, the Participant accepts the electronic delivery of any documents

the Company, or any third party involved in administering this RSU Award that the Company may designate, may deliver in connection with

this RSU Award (including, as applicable, the RSU Agreement, the Plan, annual and quarterly reports, and all other communications and

information) whether through the Company’s intranet or the internet site of another such third party or via email, or such other

means of electronic delivery specified by the Company. Furthermore, the Participant and the Company agree that this RSU Award is governed

by the terms and conditions of this RSU Agreement.

(d)

The Participant confirms acceptance of this RSU Award by completing, signing and returning this Notice of Grant. If the Participant

wishes to reject this RSU Award, the Participant must so notify the Company’s stock plan administrator in writing no later than

sixty (60) days after the Grant Date. If within such sixty (60) day period the Participant neither affirmatively accepts nor affirmatively

rejects this RSU Award, the Participant will be deemed to have accepted this RSU Award at the end of such sixty (60) day period pursuant

to the terms and conditions set forth in this RSU Agreement.

| PARTICIPANT | |

SWVL HOLDINGS CORP |

| | |

|

| | |

By: |

|

| | |

|

Name: |

| | |

|

Title: |

ANNEX A

RESTRICTED STOCK UNIT AGREEMENT

SWVL HOLDINGS CORP

The Participant has been granted restricted stock

units (“RSUs”), subject to the terms, restrictions and conditions of the Notice of Restricted Stock Unit Award (the

“Notice of Grant”) and this Restricted Stock Unit Agreement (together, the “RSU Agreement”). Unless

otherwise defined in the RSU Agreement, capitalized terms shall have the same meanings ascribed to them in the Swvl Holdings Corp 2021

Omnibus Incentive Compensation Plan, as amended from time to time (the “Plan”).

SECTION 1. Dividend Equivalents. Each RSU

shall be credited with dividend equivalents, which shall be withheld by the Company and credited to the Participant’s account. Dividend

equivalents credited to the Participant’s account and attributable to an RSU shall be distributed in cash (without interest) or

Shares at the Company’s discretion to the Participant at the same time as the underlying Share is delivered upon settlement of such

RSU and, if such RSU is forfeited, the Participant shall have no right to such dividend equivalents.

SECTION 2. Tax Withholding. Solely to the

extent applicable, vesting and settlement of the RSUs shall be subject to the Participant satisfying any applicable U.S. Federal, state

and local tax withholding obligations and non-U.S. tax withholding obligations. In this regard, the Participant authorizes the Company

and its Affiliates to withhold all applicable taxes legally payable by the Participant from the Participant’s wages or other cash

compensation paid to the Participant by the Company or its Affiliates. Such tax withholding obligation shall be satisfied by the Participant

(a) by making a payment in cash (certified check, wire transfer or bank draft) to the Company, (b) subject to the Company’s approval,

from the proceeds of the sale of all or a portion of the Shares, through a voluntary sale or through a mandatory sale arranged by the

Company (on the Participant’s behalf and the Participant hereby authorizes such sales by this authorization) or (c) subject to the

Company’s approval, by the withholding of Shares by the Company having a Fair Market Value equal to such tax withholding amount

(but not in excess of the applicable individual maximum statutory rate) from the Shares that otherwise would be issued to the Participant

in respect of such settlement. The Company may also, in its discretion, withhold any delivery of cash pursuant to Section 1 of this Restricted

Stock Unit Agreement and apply such amount to its withholding obligation.

SECTION 3. Rights as a Shareholder. The

Participant shall not be deemed for any purpose, nor have any of the rights or privileges of, a shareholder of the Company in respect

of any Shares underlying the RSUs unless, until and to the extent that (a) the Company shall have issued and delivered to the Participant

the Shares underlying the vested RSUs and any dividend equivalent to be settled in Shares and (b) the Participant’s name shall

have been entered as a shareholder of record with respect to such Shares on the books of the Company. The Company shall cause the actions

described in clauses (a) and (b) of the preceding sentence to occur promptly following settlement in Shares as contemplated by this RSU

Agreement, subject to compliance with applicable laws.

SECTION 4. Administration, Incorporation by

Reference.

(a) The

Committee shall have final authority to interpret and construe this RSU Agreement, including any related interpretation of provisions

of the Plan incorporated herein, and to make any and all determinations hereunder and thereunder, and its decision shall be binding and

conclusive upon the Participant and his or her legal representative in respect of any questions arising under this RSU Agreement.

(b) The

following provisions of the Plan shall apply to this RSU Agreement pursuant to this incorporation by reference:

(i) Section

4(b);

(ii) Section

7(c);

(iii) Section

8; and

(iv) Sections

9(a), (c), (e), (h), (l), (m), (s) and (t).

SECTION 5. Compliance with Applicable Laws.

The granting and settlement of this RSU Award, and any other obligations of the Company under this RSU Agreement, shall be subject to

all applicable laws as may be required. The Committee shall have the right to impose such restrictions on the RSUs as it deems reasonably

necessary or advisable under applicable U.S. Federal securities laws, the rules and regulations of any stock exchange or market upon which

Shares are then listed or traded and any blue sky or state securities laws applicable to such Shares. The Participant agrees to take all

steps the Committee or the Company determines are reasonably necessary to comply with all applicable provisions of U.S. Federal and state

securities law (and any other applicable laws) in exercising his or her rights under this RSU Agreement.

SECTION 6. Miscellaneous.

(a)

Waiver. Any right of the Company or its Affiliates contained in this RSU Agreement may be waived in writing by the Committee.

No waiver of any right hereunder by any party shall operate as a waiver of any other right, or as a waiver of the same right with respect

to any subsequent occasion for its exercise or as a waiver of any right to damages. No waiver by any party of any breach of this RSU Agreement

shall be held to constitute a waiver of any other breach or a waiver of the continuation of the same breach.

(b)

Notices. All notices, requests, consents and other communications to be given hereunder to any party shall be deemed to

be sufficient if contained in a written instrument and shall be deemed to have been duly given when delivered in person, by telecopy,

by nationally recognized overnight courier or by first-class registered or certified mail, postage prepaid, addressed to such party at

the address set forth below or such other address as may hereafter be designated in writing by the addressee to the addresser:

(i)

if to the Company, to:

Swvl Holdings Corp

(ii)

if to the Participant, to the Participant’s home address on file with the Company. Notices may also be delivered to the Participant

through the Company’s inter-office or electronic mail system, at any time he or she is employed by or provided services to the Company

or any of its Affiliates.

All such notices, requests, consents and other communications shall

be deemed to have been delivered in the case of personal delivery (including for this purpose by use of the Company’s inter-office

or electronic mail system) or delivery by telecopy, on the date of such delivery, in the case of nationally recognized overnight courier,

on the next business day, and in the case of mailing, on the third business day following such mailing if sent by certified mail, return

receipt requested.

(c)

Beneficiary. The Participant may file with the Committee a written designation of a beneficiary on such form as may be prescribed

by the Committee and may, from time to time, amend or revoke such designation. If no beneficiary is designated, if the designation is

ineffective, or if the beneficiary dies before the balance of the Participant’s benefit is paid, the balance shall be paid to the

Participant’s estate. Notwithstanding the foregoing, however, the Participant’s beneficiary shall be determined under applicable

law if such law does not recognize beneficiary designations under an award of this type and such law is not preempted by laws that recognize

the provisions of this Section 6(c) of the Restricted Stock Unit Agreement.

(d)

Successors. The terms of this RSU Agreement shall be binding upon and inure to the benefit of the Company or any of its

Affiliates and their successors and assigns, and of the Participant and the beneficiaries, executors, administrators, heirs and successors

of the Participant.

(e)

Governing Law, Venue and Waiver of a Jury Trial. The validity, construction and effect of this RSU Award shall be determined

in accordance with the laws of the State of Delaware, without giving effect to the conflict of laws provisions thereof. In the event that

Section 6(f) of this Restricted Stock Unit Agreement is found to be invalid or unenforceable, the Participant and the Company (on

behalf of itself and its Affiliates) each consents to jurisdiction in the United States District Court for the State of Delaware, and

each waives any other requirement (whether imposed by statute, rule of court or otherwise) with respect to personal jurisdiction or service

of process and waives any objection to jurisdiction based on improper venue or improper jurisdiction. Additionally, in the event that

Section 6(f) of this Restricted Stock Unit Agreement is found to be invalid or unenforceable, the Participant hereby waives, to the

fullest extent permitted by applicable law, any right the Participant may have to a trial by jury in respect to any litigation directly

or indirectly arising out of, under or in connection with this RSU Agreement.

(f)

Confidentiality. Participant hereby agrees to keep confidential the existence of, and any information concerning, any dispute

arising out of or relating to this RSU Agreement, except that the Participant may disclose information concerning such dispute to the

court that is considering such dispute or to Participant’s legal counsel (provided, that such counsel agrees not to disclose

any such information other than as necessary to the prosecution or defense of the dispute).

(g)

Signature and Acceptance. This RSU Agreement shall be deemed to have been accepted and signed by the Participant and the

Company as of the Grant Date upon the Participant’s acceptance of the Notice of Grant.

(h)

Headings and Construction. Headings are given to the Sections and subsections of the Plan that are referred to in this RSU

Agreement solely as a convenience to facilitate reference. Such headings shall not be deemed in any way material or relevant to the construction

or interpretation of the Plan or any provision thereof. Whenever the words “include”, “includes” or “including”

are used in this RSU Agreement or the Plan, they shall be deemed to be followed by the words “but not limited to”, and the

word “or” shall not be deemed to be exclusive.

(i)

Source of Shares; No Fractional Shares; No Registration. Any Shares delivered under this RSU Award may consist, in whole

or in part, of authorized and unissued shares or treasury shares. No fractional Shares shall be issued or delivered pursuant to this RSU

Award and the Committee shall determine whether cash, other securities or other property shall be paid or transferred in lieu of any fractional

Shares or whether such fractional Shares or any rights thereto shall be cancelled, terminated or otherwise eliminated. The Participant

acknowledges and agrees that this RSU Award, and any resulting shares received thereunder, shall not be required to be registered with

the U.S. Securities and Exchange Commission.

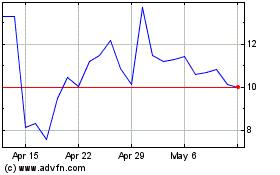

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Swvl (NASDAQ:SWVL)

Historical Stock Chart

From Apr 2023 to Apr 2024