Filed

Pursuant to Rule 424(b)(4)

Registration

No. 333-275137

PROSPECTUS

SINTX

TECHNOLOGIES, INC.

16,000,000 Units, Consisting of 3,400,000

Shares of Common Stock and 12,600,000 Pre-Funded Warrants,

16,000,000 Class E Warrants to Purchase Shares

of Common Stock, and

16,000,000 Class F Warrants to Purchase Shares of Common Stock

640,000 Placement Agent Warrants

to Purchase an Aggregate of Up To 640,000 Shares of Common Stock

Up to 45,240,000 Shares of Common Stock

Issuable upon the Exercise of the Pre-Funded Warrants, Class E Warrants, Class F Warrants, and Placement Agent Warrants

We

are offering on a best-efforts basis up to 16,000,000 units (the “Units”), each consisting of one share of common

stock, one Class E Warrant to purchase one share of common stock (the “Class E Warrants”), and one Class F Warrant to purchase

one share of common stock (the “Class F Warrants” and together with the Class E Warrants, the “Warrants”), at

public offering price of $0.25 per Unit.

Each

Class E Warrant will be immediately exercisable for one share of common stock at an exercise price of $0.25 per share and expire

five years after the issuance date. Each Class F Warrant will be immediately exercisable for one share of common stock at an exercise

price of $0.25 per share and expire eighteen months after the issuance date.

We

are also offering to each purchaser of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99%

(or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation

of this offering the opportunity to purchase Units consisting of one pre-funded warrant (in lieu of one share of common stock), one Class

E Warrant, and one Class F Warrant. A holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded

warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the purchaser,

9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant

will be exercisable for one share of common stock. The purchase price of each Unit including a pre-funded warrant will be equal to the

price per Unit including one share of common stock, minus $0.0001, and the remaining exercise price of each pre-funded warrant will equal

$0.0001 per share. The pre-funded warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised

at any time until all of the pre-funded warrants are exercised in full. For each Unit including a pre-funded warrant we sell (without

regard to any limitation on exercise set forth therein), the number of Units including a share of common stock we are offering will be

decreased on a one-for-one basis. The shares of common stock and pre-funded warrants, if any, can each be purchased in this offering

only with the accompanying Warrants as part of a Unit, but the components of the Units will immediately separate upon issuance. See “Description

of Securities” in this prospectus for more information.

We

are also registering the shares of common stock issuable from time to time upon the exercise of the Warrants and pre-funded warrants

included in the Units offered hereby. We are also registering the shares of common stock issuable from time to time upon the exercise

of the placement agent’s warrants.

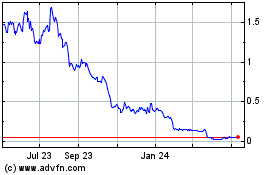

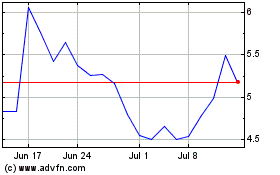

Our

common stock is listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “SINT.” On January 31, 2024, the

last reported sale price of our common stock was $0.235 per share. There is no established public trading market for the Warrants

or the pre-funded warrants. We do not intend to apply for listing of the Warrants or pre-funded warrants on any securities exchange or

recognized trading system. Without an active trading market, the liquidity of the Warrants and

pre-funded warrants will be limited.

The

Units will be offered at a fixed price and are expected to be issued in a single closing. We expect this offering to be completed not

later than two business days following the commencement of this offering and we will deliver all securities to be issued in connection

with this offering delivery versus payment/receipt versus payment upon receipt of investor funds received by us. Accordingly, neither

we nor the placement agent have made any arrangements to place investor funds in an escrow account or trust account since the placement

agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We

have engaged Maxim Group LLC as our exclusive placement agent (“Maxim” or the “placement agent”) to use its reasonable

best efforts to solicit offers to purchase our securities in this offering. The placement agent is not purchasing or selling any of the

securities we are offering and is not required to arrange for the purchase or sale of any specific number or dollar amount of the securities.

Because there is no minimum offering amount required as a condition to closing in this offering the actual public offering amount, placement

agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering

amounts set forth above and throughout this prospectus. We have agreed to pay the placement agent the placement agent fees set forth

in the table below. See “Plan of Distribution” in this prospectus for more information.

| | |

Per Common

Stock Unit | | |

Per

Pre-Funded Warrant Unit | | |

Total | |

| Public

Offering Price | |

$ | 0.25 | | |

$ | 0.2499 | | |

$ | 3,998,740 | |

| Placement

Agent fees(1) | |

$ | 0.0175 | | |

$ | 0.0175 | | |

$ | 279,912 | |

| Proceeds,

before expenses, to us | |

$ | 0.2325 | | |

$ | 0.2324 | | |

$ | 3,718,828 | |

| (1) |

In

connection with this Offering, we have agreed to pay to Maxim as placement agent a cash fee equal to 7% of the gross proceeds received

by us in the Offering. We have also agreed to provide Maxim for all expenses related to the Offering including up to $100,000 for

reimbursement of legal expenses in connection with its engagement as placement agent and to grant Maxim warrants to purchase a number

of shares of common stock equal to 4% of the total number of Units being sold in the Offering. We have also agreed that a portion

of this compensation may be paid to Ascendiant Capital Markets, LLC. See “Plan of Distribution.” |

The

above summary of offering proceeds to us does not give effect to any exercise of the Warrants being issued in this offering.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 7 of the

prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Maxim

Group LLC

The

date of this prospectus is January 31, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC,

includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related

exhibits filed with the SEC before making your investment decision.

You

should rely only on the information provided in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments

thereto. Neither we nor the placement agent have authorized anyone else to provide you with different information. We do not, and the

placement agent and its affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information

that others may provide to you. If anyone provides you with different or inconsistent information, you should not rely on it. You should

assume that the information in this prospectus is accurate only as of the date hereof, regardless of the time of delivery of this prospectus

or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We

are not, and the placement agent is not, offering to sell or seeking offers to purchase these securities in any jurisdiction where the

offer or sale is not permitted. We and the placement agent have not done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the securities as to distribution of the prospectus outside of the United States.

Unless

the context otherwise requires, references in this prospectus to “SINTX,” “the Company,” “we,” “us”

and “our” refer to SINTX Technologies, Inc. and our subsidiaries. Solely for convenience, trademarks and tradenames referred

to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that

we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights,

to these trademarks and tradenames.

PROSPECTUS

SUMMARY

This

summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that

you should consider before investing. Before you decide to invest in our Units, you should read this entire prospectus carefully, including

the section entitled “Risk Factors” and any information incorporated by reference herein.

Company

Overview

We

are an advanced ceramics company formed in December 1996 and are focused on providing solutions in a variety of biomedical,

technical, and antipathogenic applications. We have grown from focusing primarily on the research, development and commercialization

of medical devices manufactured with silicon nitride to becoming an advanced ceramics company engaged in diverse fields, including biomedical,

technical and antipathogenic applications. This diversification enables us to focus on our core competencies, which are the manufacturing,

research, and development of products comprised from advanced ceramic materials for external partners. We seek to connect with new customers,

partners and manufacturers to help them realize the goal of leveraging our expertise in advanced ceramics to create new, innovative products

across these sectors.

SINTX

Core Business

Biomedical

Applications: Since our inception, we have been focused on medical grade silicon nitride. SINTX silicon nitride products are biocompatible,

bioactive, antipathogenic, and have shown superb bone affinity. Spinal implants made from SINTX silicon nitride have been successfully

implanted in humans since 2008 in the US, Europe, Brazil, and Taiwan. This established use, along with its inherent resistance to bacterial

adhesion and bone affinity – means that it may also be suitable in other fusion device applications such as arthroplasty

implants, foot wedges, and dental implants. Bacterial infection of any biomaterial implants is always a concern. SINTX silicon nitride

is inherently resistant to bacterial colonization and biofilm formation, making it antibacterial. SINTX silicon nitride products can

be polished to a smooth and wear-resistant surface for articulating applications, such as bearings for hip and knee replacements.

We

believe that silicon nitride has a superb combination of properties that make it suited for long-term human implantation. Other biomaterials

are based on bone grafts, metal alloys, and polymers- all of which have well-known practical limitations and disadvantages. In contrast,

silicon nitride has a legacy of success in the most demanding and extreme industrial environments. As a human implant material, silicon

nitride offers bone ingrowth, resistance to bacterial and viral infection, ease of diagnostic imaging, resistance to corrosion, and superior

strength and fracture resistance, among other advantages, all of which claims are validated in our large and growing inventory of peer-reviewed,

published literature reports. We believe that our versatile silicon nitride manufacturing expertise positions us favorably to introduce

new and innovative devices in the medical and non-medical fields.

In

June 2022, we acquired TA&T, a nearly 40-year-old business with a mission to transition advanced materials and process technologies

from a laboratory environment to commercial products and services. TA&T has supplied ceramics for use in several biomedical applications.

These products were made via 3D printing and include components for surgical instruments as well as conceptual and prototype dental implants.

Technical

Applications: It is our belief that our silicon nitride has the best combination of mechanical,

thermal, and electrical properties of any technical ceramic material. It is a high-performance technical ceramic with high strength,

toughness, and hardness, and is extremely resistant to thermal shock and impact. It is also an electrically insulating ceramic material.

Typically, it is used in applications where high load-bearing capacity, thermal stability, and wear resistance are required. Our AS9100D

certification and ITAR registration have facilitated entry into the aerospace portion of this market.

We

entered the ceramic armor market through the purchase of assets from B4C, LLC and a technology partnership with Precision Ceramics USA.

We intend to develop and manufacture high-performance ceramics for personnel, aircraft, and vehicle armor including a 100% Boron Carbide

material for ultimate lightweight performance in ballistic applications, and a composite material made of Boron Carbide and Silicon Carbide

for exceptional multi-hit performance against ballistic threats. We have signed a 10-year lease for a building near our headquarters

in Salt Lake City, UT that houses development and manufacturing activities for SINTX Armor.

TA&T’s

primary area of expertise is material processing and fabrication know-how for a broad spectrum of monolithic ceramic, ceramic composite,

and coating materials. Primary technologies include Additive Manufacturing (3D Printing) of ceramics and metals, low-cost fabrication

of fiber reinforced ceramic matrix composites (CMCs) and refractory chemical vapor deposited (CVD) coatings, transparent ceramics for

ballistic armor and optical applications, and magnetron sputtered (PVD) coatings for lubrication, wear resistance and environmental barrier

coatings for CMCs. TA&T also provides a host of services that include 3D printing, PVD-CVD coatings, material processing-CMCs, CIP,

PS, HP, HIP, and material characterization for powders and finished parts-TGA/DSC, PSD. SA, Dilatometry, UV-VIS and FTIR transmission,

haze and clarity.

Antipathogenic

Applications: Today, there is a global need to improve protection against pathogens in everyday life. SINTX believes that by incorporating

its unique composition of silicon nitride antipathogenic powder into products such as face masks, filters, and wound care devices, it

is possible to manufacture surfaces that inactivate pathogens, thereby limiting the spread of infection and disease. The discovery in

2020 that SINTX silicon nitride inactivates SARS-CoV-2, the virus which causes the disease COVID-19, has opened new markets and applications

for our material.

We

presently manufacture advanced ceramic powders and components in our manufacturing facilities based in Salt Lake City, Utah.

Our

Strategy

Our

goal is to become a leading advanced ceramics company. Key elements of our strategy to achieve this goal are the following:

| ● |

Develop

new products with anti-pathogenic properties, including inactivation of the SARS-CoV-2 virus, utilizing our silicon nitride technology.

We have conducted multiple tests for over 10 years which have identified and verified the antipathogenic properties of our silicon

nitride powders, fully dense components, and silicon nitride-containing composites. Our research has explored the fundamental mechanisms

responsible for these antipathogenic properties with the objective of developing commercial products and revenue from them. We have

several partnerships exploring opportunities in face masks, filters, wound care, and coatings. |

| |

|

| ● |

Develop

additional commercial opportunities outside of the medical device market. We have pursued the development of non-medical uses

for our silicon nitride since selling the retail spine business in 2018. In 2019, we became ITAR-registered and obtained AS9100D

certification of our quality management system. We have hired experienced business development employees to identify new markets

and applications for our materials and develop commercial relationships. We made the first shipments of non-medical products in our

history in 2020, and several of these have transitioned from prototype to regular production orders. We expect the launch of SINTX

Armor may generate revenue from new products. The acquisition of TA&T brings revenue from multiple markets that we have previously

not participated in. |

| |

|

| ● |

Develop

new silicon nitride manufacturing technologies. Our current manufacturing process has allowed us to successfully produce spinal

implants for over 10 years. Over 40,000 of our spinal implants manufactured with silicon nitride have been implanted into patients,

with an excellent safety record. We have made advancements in our processes – including the purchase of new manufacturing

equipment – which we have leveraged to develop new porous and textured implants. In 2021, SINTX purchased new equipment for

its research and development team to develop new composite products of silicon nitride with rigid polymers and fabrics. We have received

three NIH grants over the last fifteen months in order to develop 3D printed silicon nitride / polymer implantable medical devices. |

| |

|

| ● |

Apply

our silicon nitride technology platform to new medical opportunities. We believe our biomaterial expertise, flexible manufacturing

process, and strong intellectual property will allow us to transition currently available medical device products made of inferior

biomaterials and manufacture them using silicon nitride and our technology platform to improve their characteristics. We are seeking

partnerships to utilize our capabilities and manufacture products for medical OEM and private label partnerships. We see specific

opportunities in markets such as foot and ankle, dental, maxillofacial, and arthroplasty. |

Intellectual

Property

We

rely on a combination of patents, trademarks, trade secrets, nondisclosure agreements, proprietary information ownership agreements and

other intellectual property measures to protect our intellectual property rights. We believe that to have a competitive advantage, we

must continue to develop and maintain the proprietary aspects of our technologies.

We

have fifteen issued U.S. patents, fifteen foreign patents, eighteen pending U.S. non-provisional patent applications, one

hundred twenty-three pending foreign applications and one pending PCT patent application. Our first issued patent expired in 2016,

with the last of these patents expiring in 2039.

We

have three U.S. patents directed to articulating implants using our high-strength, high toughness doped silicon nitride solid ceramic.

These issued patents, which include US 7,666,229; US 9,051,639; and US 9,517,136 will expire in November 2023, September 2032, and March

2034, respectively.

We

also have one U.S. patent related to our CSC technology that are directed to implants that have both a dense load-bearing, or cortical,

component and a porous, or cancellous, component, together with a surface coating. The issued patent US 9,649,197 will expire in July

2035.

In

addition, U.S. Patent No. 10,806,831 directed to antibacterial implants and U.S. Patent No. 11,191,787 directed to antipathogenic devices

were recently issued which will expire in 2037 and 2039, respectively.

With

respect to PCT patent application serial no. PCT/US2018/014781 directed to antibacterial biomedical implants, we entered the national

stage in Europe, Australia, Brazil, Canada, China, Japan, Hong Kong, and South Korea as well as one divisional patent application filed

in Europe and two divisional applications filed in Japan to seek potential patent protection for our proprietary technologies in those

countries.

With

respect to PCT patent application serial no. PCT/US2019/026789 directed to methods for improving the wear performance of ceramic-polyethylene

or ceramic-ceramic articulation couples utilized in orthopaedic joint prostheses, we entered the national stage in Australia, Brazil,

Canada, Europe, Japan, Korea, and Mexico to seek patent protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2019/048072 directed to antipathogenic devices and methods, we entered the national stage

in Europe, Japan, Mexico, Australia, Brazil, Canada, South Korea, China, and India to seek patent protection for our proprietary technologies

in those countries.

With

respect to PCT application serial no. PCT/US2020/037170 directed to methods of surface functionalization of zirconia-toughened alumina

with silicon nitride, we entered the national stage in Europe, Australia, Brazil, Canada, China, India, Japan, and Mexico to seek patent

protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/014725 directed to antifungal composites and methods thereof, we entered the national

stage in Europe, Brazil, Japan, Australia, Canada, China, India, Mexico, and South Korea to seek patent protection for our proprietary

technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/027258 directed to antipathogenic face mask, we entered the national stage in Australia,

Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek patent protection for our proprietary technologies in those

countries.

With

respect to PCT application serial no. PCT/US2021/027263 directed to systems and methods for rapid inactivation of SARS-CoV2 by silicon

nitride, copper, and aluminum nitride, we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South

Korea, and Mexico to seek patent protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/038364 directed to antipathogenic devices and methods thereof for antifungal applications,

we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek patent protection

for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/028975 directed to methods for laser coating of silicon nitride on a metal substrate,

we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek patent protection

for our proprietary technologies in those countries.

With

respect to PCT application serial no PCT/US2021/028641 directed to methods of silicon nitride laser cladding, we entered the national

stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek patent protection for our proprietary

technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/027270 directed to antiviral compositions and devices and methods of use thereof, we

entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek patent protection

for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/056461 directed to systems and methods for selective laser sintering of silicon nitride

and metal composites, we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico

to seek patent protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/056452 directed to systems and methods for hot-isostatic pressing to increase nitrogen

content in silicon nitride, we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and

Mexico to seek patent protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2021/062650 directed to nitride based antipathogenic compositions and devices and method

of use therof, we entered the national stage in Australia, Brazil, Canada, China, Europe, India, Japan, South Korea, and Mexico to seek

patent protection for our proprietary technologies in those countries.

With

respect to PCT application serial no. PCT/US2022/023868 directed to systems and methods for physical vapor deposition silicon nitride

coatings having antimicrobial and osteogenic enhancements, we entered the national stage in Australia, Brazil, Canada, China, Europe,

India, Japan, South Korea, and Mexico to seek patent protection for our proprietary technologies in those countries.

In

relation to the sale of our spine implant business to CTL Medical under the Asset Purchase Agreement dated September 5, 2018, we assigned

our entire right to forty-eight (48) U.S. patents, two (2) foreign patents and three (3) pending patent applications from our patent

portfolio to CTL Medical under that transaction. In addition, three (3) U.S. patents (U.S. patent nos. 9,399,309; 9,517,136; and 9,649,197)

directed to silicon nitride manufacturing processes were licensed to CTL Medical under an irrevocable, fully paid-up, worldwide license

for a ten-year term with CTL Medical also having a Right of First Negotiation to acquire these patents if SINTX decides to later sell

these IP assets to a third party.

Our

remaining issued patents and pending applications are directed to additional aspects of our products and technologies including, among

other things:

| ● |

designs

for intervertebral fusion devices; |

| |

|

| ● |

designs

for hip implants; |

| |

|

| ● |

designs

for knee implants; |

| |

|

| ● |

implants

with improved antibacterial characteristics; |

| |

|

| ● |

implants

with improved wear performance and surface functionalization |

| |

|

| ● |

antipathogenic,

antibacterial, antimicrobial, antifungal, and antiviral compositions, devices, and methods; and |

| |

|

| ● |

methods

and systems for hot-isostatic pressing laser cladding, laser coating, and laser sintering of silicon nitride. |

We

also expect to rely on trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain

our intellectual property position. However, trade secrets are difficult to protect. We seek to protect the trade secrets in our proprietary

technology and processes, in part, by entering into confidentiality agreements with commercial partners, collaborators, employees, consultants,

scientific advisors and other contractors and into invention assignment agreements with our employees and some of our commercial partners

and consultants. These agreements are designed to protect our proprietary information and, in the case of the invention assignment agreements,

to grant us ownership of the technologies that are developed.

Recent

Developments

Amendment

to Equity Distribution Agreement

On

October 12, 2023, we entered into an amendment to our Equity Distribution Agreement (the “Distribution Agreement”) with Maxim,

pursuant to which (1) the expiration date of the Distribution Agreement was extended to the earlier of: (i) the sale of shares having

an aggregate offering price of $15,000,000, (ii) the termination by either us or Maxim upon the provision of fifteen (15) days written

notice, or (iii) February 25, 2025 and (2) updates were made to references to the Company’s registration statement on Form S-3

filed on October 12, 2023. No other changes were made to the terms of the Distribution Agreement.

Equipment

Failure

On

October 6, 2023, a furnace used for our SINTX Armor manufacturing operations overheated and is no longer functional. We are continuing

to evaluate the extent of the damage to the furnace. In addition, we are coordinating with our insurance carrier and have filed a claim

to cover the cost of either repairing or replacing the furnace, which is estimated to be approximately $1 million. Further, we are working

with third parties to temporarily outsource the process performed by the non-functional furnace, and do not expect a significant decrease

in long-term production capacity. No assurance can be given that our insurance carrier will cover the cost of repairing or replacing

the furnace or that we will be successful in temporarily outsourcing the process. Failure to obtain insurance proceeds to cover the claim

or to outsource the process could have an adverse effect on the operations of our SINTX Armor business and our results of operations.

Preliminary

Fourth Quarter and Full Year 2023 Revenue

Preliminary

unaudited estimated revenue was approximately $902,000 in Q4 2023 and $2.6 million for the year ended December 31, 2023. This represents

a 18% increase in revenue over Q4 2022, and a 68% increase in revenue over the year ended December 31, 2022. We exceeded the annual revenue

of any prior year since selling the spine business in 2018, when we restructured to expand into the defense, aerospace, and industrial

markets for advanced ceramic materials.

Commercial

revenues of $583,000 in Q4 2023 and $1.2 million for the full year ended December 31, 2023 were achieved primarily by selling products

in the biomedical, aerospace, and energy markets. Government contracts within these markets made up $319,000 in Q4 and $1.4 million for

the full year. Customer adoption of new product offerings led to commercial revenue exceeding government contracts in Q4, for the first

time since acquisition of the Maryland site. Our sites in both Utah and Maryland both contributed to the full year revenue result.

Corporate

Information

Our

headquarters is located at 1885 West 2100 South, Salt Lake City, Utah 84119, and our telephone number is (801) 839-3500. We maintain

a website at https://www.sintx.com. Information on the website is not incorporated by reference and is not a part of this prospectus.

Summary

of the Offering

| Securities

to be Offered |

|

16,000,000

Units

at a public offering price of $0.25 per Unit. Each Unit consists of one share

of common stock, one Class E Warrant, and one Class F Warrant.

We

are also offering to each purchaser, with respect to the purchase of Units that would otherwise result in the purchaser’s beneficial

ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately

following the consummation of this offering, the opportunity to purchase one pre-funded warrant in lieu of one share of common stock.

A holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrant if the holder, together

with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the purchaser, 9.99%) of the number

of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable

for one share of common stock. The purchase price per pre-funded warrant will be equal to the price per share of common stock, minus

$0.0001, and the exercise price of each pre-funded warrant will equal $0.0001 per share. The pre-funded warrants will be immediately

exercisable (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity until all of the pre-funded

warrants are exercised in full. For more information regarding the pre-funded warrants, you should carefully read the section titled

“Description of Securities Included in this Offering” in this prospectus.

The

Units will not be certificated or issued in stand-alone form. The shares of common stock and pre-funded warrants, if any, can each

be purchased in this offering only with the accompanying Warrants as part of a Unit, but the components of the Units will

immediately separate upon issuance. We are also registering the shares of common stock issuable from time to time upon exercise of

the Warrants and pre-funded warrants included in the Units offered hereby. |

| |

|

|

| Size

of Offering |

|

$3,998,740 |

| |

|

|

| Subscription

Price Per Unit |

|

$0.25

(or $0.2499 per Unit including one pre-funded

warrant in lieu of one share of common stock) |

| |

|

|

| Description

of the Class E Warrants |

|

Each

Class E Warrant will have an exercise price of $0.25 per share, will be exercisable upon issuance and will expire five

years from issuance. Each Class E Warrant is exercisable for one share of common stock, subject to adjustment in the event of stock

dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our shares of common

stock as described herein. The terms of the Class E Warrants will be governed by a Warrant Agency Agreement, dated as of the closing

date of this offering, that we expect to be entered into between us and Equiniti Trust Company, LLC or its affiliate (the “Warrant

Agent”). This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Class E Warrants.

For more information regarding the Class E Warrants, you should carefully read the section titled “Description of Securities

Included in this Offering” in this prospectus. |

| Description of the Class F Warrants |

|

Each Class F Warrant will have an exercise price of $0.25

per share, will be exercisable upon issuance and will expire eighteen months from issuance. Each Class F Warrant is exercisable

for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications,

reorganizations or similar events affecting our shares of common stock as described herein. The terms of the Class F Warrants will

be governed by a Warrant Agency Agreement, dated as of the closing date of this offering, that we expect to be entered into between

us and the Warrant Agent. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the

Class F Warrants. For more information regarding the Class F Warrants, you should carefully read the section titled “Description

of Securities Included in this Offering” in this prospectus. |

| Placement Agent Warrants |

|

We have agreed to issue to the placement agent warrants to purchase a number of shares of common stock equal to 4% of the total number of securities being sold in the Offering. The placement agent’s warrants will be exercisable at any time, and from time to time, in whole or in part, during the four and one-half year period commencing 180 days from the effective date of the registration statement of which this prospectus forms a part. The placement agent’s warrants will be exercisable at a price per share equal to 110.0% of the exercise price of the Warrants. We are also registering the shares of common stock issuable upon the exercise of the placement agent warrants. |

| |

|

|

| Common Stock Outstanding Prior to This Offering |

|

5,320,672 shares |

| |

|

|

| Common Stock Outstanding after This Offering |

|

8,720,672 shares (assuming

no exercise of pre-funded warrants, Warrants or placement agent’s warrants issued in connection with this offering),

or 53,960,672 shares if the pre-funded warrants, Warrants and placement agent’s warrants are exercised in full. |

| |

|

|

| Use of Proceeds |

|

Assuming no exercise of the warrants

issued in connection with this offering, we estimate the net proceeds of the Offering will be approximately $3.37 million.

We intend to use the net proceeds from this offering for general corporate purposes, which may include research and development expenses,

capital expenditures, working capital and general and administrative expenses, and potential acquisitions of or investments in businesses,

products and technologies that complement our business, although we have no present commitments or agreements to make any such acquisitions

or investments as of the date of this prospectus. We expect to use any proceeds we receive from the exercise of Warrants for substantially

the same purposes and in substantially the same manner. Pending these uses, we intend to invest the funds in short-term, investment

grade, interest-bearing securities. It is possible that, pending their use, we may invest the net proceeds in a way that does not

yield a favorable, or any, return for us. See “Use of Proceeds.” Our management

will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application

of the net proceeds from this offering. See “Risk Factors” for a discussion of certain risks that may affect our intended

use of the net proceeds from this offering. |

| |

|

|

| Market for Common Stock |

|

Our common stock is listed on Nasdaq under the symbol “SINT.” |

| |

|

|

| Market for Pre-Funded Warrants and Warrants |

|

There is no established public trading market for the pre-funded warrants or Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the pre-funded warrants or Warrants on any securities exchange or recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and Warrants will be limited. |

| |

|

|

| Risk Factors |

|

An investment in our securities is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

|

| Best Efforts Offering |

|

We have agreed to offer and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 39 of this prospectus. |

The number of shares of common stock to be outstanding

after this offering is based on 5,320,672 shares of common stock outstanding as of December 31, 2023 and excludes:

| ● |

1,154,200

shares of common stock sold subsequent to December 31, 2023, pursuant to the Equity Distribution Agreement; |

| ● |

27,515

shares of common stock issuable upon the exercise of outstanding options and restricted stock units granted as of December 31, 2023

under our equity incentive plans at a weighted average exercise price of $113.54 per share; |

| ● |

1,244,754

shares of common stock issuable upon the exercise of outstanding warrants issued as of December 31, 2023; |

| ● |

80,473

shares of our common stock issuable upon the conversion of 26 shares of series B convertible preferred stock outstanding as of December

31, 2023; |

| ● |

338

shares of our common stock issuable upon the conversion of 50 shares of series C convertible preferred stock outstanding as of December

31, 2023; and |

| ● |

11,919

shares of common stock reserved for issuance upon conversion of 180 shares of the Series D Preferred Stock outstanding as of December

31, 2023. |

Unless otherwise indicated, the information in this

prospectus, including the number of shares outstanding after this offering, does not reflect (i) any issuance, exercise, vesting, expiration,

or forfeiture of any additional equity awards under our incentive plans that occurred after December 31, 2023 or (ii) the effect

of the “full-ratchet” anti-dilution adjustment of the conversion price of our outstanding Series B Convertible Preferred

Stock and the exercise price of our outstanding October 2022 warrants.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision with respect to our securities, we urge you to

carefully consider the risks described in the “Risk Factors” section herein and in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2022 under the heading “Item 1A. Risk Factors,” and as described or may be described in any

subsequent quarterly report on Form 10-Q under the heading “Item 1A. Risk Factors,” as well as in any applicable prospectus

supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus, together with

all of the other information contained in this prospectus, or any applicable prospectus supplement. For a description of these reports

and documents, and information about where you can find them, see “Where You Can Find More Information” and “Incorporation

by Reference.” These risk factors relate to our business, intellectual property, regulatory matters, and ownership of our common

stock. In addition, the following risk factors present material risks and uncertainties associated with the Offering. The risks and uncertainties

incorporated by reference into this prospectus or described below are not the only ones we face. Additional risks and uncertainties not

presently known or which we consider immaterial as of the date hereof may also have an adverse effect on our business. If any of the

matters discussed in the following risk factors were to occur, our business, financial condition, results of operations, cash flows or

prospects could be materially adversely affected, the market price of our common stock could decline and you could lose all or part of

your investment in our securities.

Risks

Related to Our Business and Strategy

We

have experienced, and may in the future experience, equipment failures and other manufacturing malfunctions, which have and may in the

future limit the supply of our products or result in adverse effects to our operations.

The

process of manufacturing our products is complex, highly regulated, and subject to several risks. For example, the process of manufacturing

our products is extremely susceptible to product loss due to equipment failure or malfunction, improper installation or operation of

equipment, or vendor or operator error. Even minor deviations from normal manufacturing processes for any of our products could result

in reduced production yields, product defects, and other supply disruptions. In addition, the manufacturing facilities in which our products

are made could be adversely affected by equipment failures, labor shortages, natural disasters, power failures and numerous other factors.

Starting

in October 2023, a furnace used in our SINTX Armor manufacturing process overheated and is currently non-functional. We have filed a

claim with our insurance carrier for the repair or replacement of the furnace, and are currently working with third parties to coordinate

the outsourcing of that portion of the manufacturing process. However, no assurance can be given that our insurance carrier will cover

the cost of repairing or replacing the furnace or that we will be successful in outsourcing the process. Failure to obtain insurance

proceeds to cover the repair of the furnace or to outsource the process could have an adverse effect on the operations of our SINTX Armor

business. Even if the furnace is repaired or replaced, we cannot guarantee that product or operational loss due to other such equipment

failure will not happen in the future.

Any

adverse developments affecting manufacturing operations for our products may result in shipment delays, inventory shortages, product

failures, withdrawals or recalls, or other interruptions in the supply of our products. We also may need to take inventory write-offs

and incur other charges and expenses for product candidates that fail to meet specifications, undertake costly remediation efforts, or

seek costlier manufacturing alternatives.

We

may be required to incur financial statement charges, such as asset or goodwill impairment charges, which may, in turn, have a further

adverse effect on our results of operations and financial condition.

If

our business, results of operations or financial condition are adversely affected by one or more circumstances, such as the failure to

repair or replace our furnace as described above, or from other risk factors described in this prospectus and elsewhere in our public

filings, we then may be required under applicable accounting rules to incur impairment charges associated with reducing the carrying

value on our financial statements of certain assets, such as goodwill, intangible assets or tangible assets. We cannot assure you that

a material impairment charge of our assets, including the furnace or other manufacturing equipment, will not occur in a future period.

Any impairment charge could have a material adverse effect on our financial position and results of operations in the period of recognition.

Risks

Related to This Offering and Ownership of Our Securities

There

is currently a limited market for our securities, and any trading market that exists in our securities may be highly illiquid and may

not reflect the underlying value of our net assets or business prospects.

Although

our common stock is traded on Nasdaq, there is currently a limited market for our common stock and an active market may never develop.

Investors are cautioned not to rely on the possibility that an active trading market may develop.

The

best efforts structure of this offering may have an adverse effect on our business plan.

The

placement agent is offering the securities in this offering on a best efforts basis. The placement agent is not required to purchase

any securities, but will use its best efforts to sell the securities offered. As a “best efforts” offering, there can be

no assurance that the offering contemplated hereby will ultimately be consummated or will result in any proceeds being made available

to us. The success of this offering will impact our ability to use the proceeds to execute our business plan. We may have insufficient

capital to implement our business plan, potentially resulting in greater operating losses unless we are able to raise the required capital

from alternative sources. There is no assurance that alternative capital, if needed, would be available on terms acceptable to us, or

at all.

Future

sales of our common stock may depress our share price.

As

of December 31, 2023, we had 5,320,672 shares of our common stock outstanding. Sales of a number of shares of common stock

in the public market or issuances of additional shares pursuant to the exercise of our outstanding warrants, or the expectation of such

sales or exercises, could cause the market price of our common stock to decline. We may also sell additional shares of common stock or

securities convertible into or exercisable or exchangeable for common stock in subsequent public or private offerings or other transactions,

which may adversely affect the market price of our common stock.

Our

stockholders may experience substantial dilution in the value of their investment if we issue additional shares of our capital stock.

Our

charter allows us to issue up to 250,000,000 shares of our common stock and up to 130,000,000 shares of preferred stock. To raise additional

capital, we may in the future sell additional shares of our common stock or other securities convertible into or exchangeable for our

common stock at prices that are lower than the prices paid by existing stockholders, and investors purchasing shares or other securities

in the future could have rights superior to existing stockholders, which could result in substantial dilution to the interests of existing

stockholders.

Certain

of our outstanding shares of convertible preferred stock and warrants contain full-ratchet anti-dilution protection, which may cause

significant dilution to our stockholders.

We currently have outstanding 26 shares of Series

B convertible preferred stock convertible into an aggregate of 80,473 shares of common stock, and warrants issued in October 2022

that are exercisable for an aggregate of 616,641 shares of common stock. The Series B convertible preferred stock and October 2022 warrants

contain full-ratchet anti-dilution provisions which, subject to limited exceptions, would reduce the conversion price of the Series B

preferred stock (and increase the number of shares issuable under the Series B preferred stock) and reduce the exercise price of the

October 2022 warrants in the event that we in the future issue common stock, or securities convertible into or exercisable to purchase

common stock, at a price per share lower than the conversion price or exercise price then in effect. Depending upon how such provisions

are interpreted, the alternative cashless exercise provision contained in the Class C Warrants and Class D Warrants could potentially

result in a significant reduction in the conversion or exercise price of the Series B convertible preferred stock and October 2022 warrants.

Our outstanding 26 shares of Series B preferred stock are, prior to this offering, convertible into 80,473 shares of common stock

at a conversion price of $0.3554 per share. The October 2022 warrants are exercisable at an exercise price of $0.3554 per

share. These full ratchet anti-dilution provisions will likely be triggered by the issuance of the Units in this offering.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds

and the proceeds may not be invested successfully.

Other

than amounts required to be paid to certain lenders, our management will have broad discretion as to the use of the net proceeds from

this offering and could use them for purposes other than those contemplated at the time of commencement of this offering. Accordingly,

you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their

use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our management to

use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flows.

Your

interest in our Company may be diluted as a result of this offering.

The shares issuable upon the exercise of the Warrants to be issued pursuant

to the offering will dilute the ownership interest of stockholders not participating in this offering and holders of Warrants who have

not exercised their Warrants.

This

offering may cause the trading price of our common stock to decrease.

The

number of shares of common stock underlying the securities we propose to issue and ultimately will issue if this offering is completed,

may result in an immediate decrease in the market price of our common stock. This decrease may continue after the completion of this

offering. We cannot predict the effect, if any, that the availability of shares for future sale represented by the Warrants issued

in connection with the offering will have on the market price of our common stock from time to time.

Holders

of pre-funded warrants and Warrants will have no rights as a common stockholder until such holders exercise their pre-funded warrants

and Warrants, respectively, and acquire our common stock.

Until holders of pre-funded warrants and Warrants acquire shares of our

common stock upon exercise of the pre-funded warrants and Warrants, as the case may be, holders of pre-funded warrants and Warrants will

have no rights with respect to the shares of our common stock underlying such pre-funded warrants and Warrants. Upon exercise of the pre-funded

warrants and Warrants, the holders thereof will be entitled to exercise the rights of a common stockholder only as to matters for which

the record date occurs after the exercise date.

There

is no public market for the pre-funded warrants or Warrants in this offering.

There

is no established public trading market for the pre-funded warrants or Warrants, and we do not expect a market to develop. In addition,

we do not intend to apply for listing of the pre-funded warrants or Warrants on any securities exchange or recognized trading system.

Without an active trading market, the liquidity of the pre-funded warrants and Warrants will be

limited.

Absence

of a public trading market for the pre-funded warrants or Warrants may limit your ability to resell the pre-funded warrants or Warrants.

There is no established trading market for the pre-funded warrants or Warrants

to be issued pursuant to this offering, and they will not be listed for trading on Nasdaq or any other securities exchange or market,

and the pre-funded warrants or Warrants may not be widely distributed. Purchasers of the pre-funded warrants or Warrants may be unable

to resell the pre-funded warrants or Warrants or sell them only at an unfavorable price for an extended period of time, if at all.

The

market price of our common stock may never exceed the exercise price of the Warrants issued in connection with this offering.

The Warrants being issued in connection with this offering become exercisable

upon issuance and will expire five years from the date of issuance. The market price of our common stock may never exceed the exercise

price of the Warrants prior to their date of expiration. Any Warrants not exercised by their date of expiration will expire worthless

and we will be under no further obligation to the Warrant holder.

Since

the Warrants are executory contracts, they may have no value in a bankruptcy or reorganization proceeding.

In

the event a bankruptcy or reorganization proceeding is commenced by or against us, a bankruptcy court may hold that any unexercised Warrants are executory contracts that are subject to rejection by us with the approval of the bankruptcy court. As a result, holders

of the Warrants may, even if we have sufficient funds, not be entitled to receive any consideration for their Warrants

or may receive an amount less than they would be entitled to if they had exercised their Warrants prior to the commencement of

any such bankruptcy or reorganization proceeding.

The

exclusive jurisdiction, waiver of trial by jury, and choice of law clauses set forth in the form of securities purchase agreement to

be used in this offering may have the effect of limiting a purchaser’s rights to bring legal action against us and could limit

a purchaser’s ability to obtain a favorable judicial forum for disputes with us.

The

form of securities purchase agreement used in this offering requires investors to consent to exclusive jurisdiction to courts located

in New York, New York and provides for a waiver of the right to a trial by jury. Disputes arising under the form of securities purchase

agreement are governed by Delaware and New York law, respectively. These provisions may have the effect of limiting the ability of investors

to bring a legal claim against us due to geographic limitations and/or preference for a trial by jury and may limit an investor’s

ability to bring a claim in a judicial forum that it finds favorable for disputes with us. Alternatively, if a court were to find this

exclusive forum provision inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings,

we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business

and financial condition.

We

could be delisted from Nasdaq, which could seriously harm the liquidity of our stock and our ability to raise capital.

On

October 20, 2023, we received a notice from the

Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) stating that

the bid price of our common stock for the last 30 consecutive trading days had closed below the minimum $1.00 per share required

for continued listing under Listing Rule 5550(a)(2). We initially have a period of 180 calendar days, or until April

17, 2024, to regain compliance with such rule. If we do not regain compliance with Rule 5550(a)(2) by April 17, 2024, we may be

afforded a second 180 calendar day period to regain compliance. To qualify, we would be required to meet the continued listing requirement

for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, except for the minimum

bid price requirement. In addition, we would be required to notify Nasdaq of our intent to cure the deficiency during the second compliance

period, which may include, if necessary, implementing a reverse stock split. There can be no assurance that we will be able to regain

compliance with Nasdaq requirements or will otherwise be in compliance with other Nasdaq listing criteria.

If

we cease to be eligible to trade on the Nasdaq Capital Market:

| ● |

We

may have to pursue trading on a less recognized or accepted market, such as the OTC Bulletin Board or the “pink sheets.” |

| |

|

| ● |

The

trading price of our common stock could suffer, including an increased spread between the “bid” and “asked”

prices quoted by market makers. |

| |

|

| ● |

Shares

of our common stock could be less liquid and marketable, thereby reducing the ability of stockholders to purchase or sell our shares

as quickly and as inexpensively as they have done historically. If our stock is traded as a “penny stock,” transactions

in our stock would be more difficult and cumbersome. |

| ● |

We

may be unable to access capital on favorable terms or at all, as companies trading on alternative markets may be viewed as less attractive

investments with higher associated risks, such that existing or prospective institutional investors may be less interested in, or

prohibited from, investing in our common stock. This may also cause the market price of our common stock to decline. |

The

price of our common stock is volatile and is likely to continue to fluctuate due to reasons beyond our control.

The

volatility of publicly traded company stocks, including shares of our common stock, often do not correlate to the operating performance

of the companies represented by such stocks or our operating performance. Some of the factors that may cause the market price of our

common stock to fluctuate include:

| ● |

the

sentiment of retail investors (including as may be expressed on financial trading and other social media sites and online forums); |

| |

|

| ● |

the

direct access by retail investors to broadly available trading platforms; |

| |

|

| ● |

the

amount and status of short interest in our securities; |

| |

|

| ● |

access

to margin debt; |

| |

|

| ● |

trading

in options and other derivatives on our common stock and any related hedging; |

| |

|

| ● |

CTL’s

ability to sell silicon nitride based spinal fusion products and our cost of manufacturing such products for CTL; |

| |

|

| ● |

our

ability to develop, obtain regulatory clearances or approvals for, and market new and enhanced product candidates on a timely basis; |

| |

|

| ● |

our

ability to enter into OEM and private label partnership agreements and the terms of those agreements; |

| |

|

| ● |

our

ability to develop products that are effective in inactivating the SARS-CoV-2 virus; |

| |

|

| ● |

changes

in governmental regulations or in the status of our regulatory approvals, clearances or future applications; |

| |

|

| ● |

our

announcements or our competitors’ announcements regarding new products, product enhancements, significant contracts, number

and productivity of distributors, number of hospitals and surgeons using products, acquisitions or strategic investments; |

| |

|

| ● |

announcements

of technological or medical innovations for the treatment of orthopedic pathology; |

| |

|

| ● |

delays

or other problems with the manufacturing of our products, product candidates and related instrumentation; |

| |

|

| ● |

volume

and timing of orders for our products and our product candidates, if and when commercialized; |

| |

|

| ● |

changes

in the availability of third-party reimbursement in the United States and other countries; |

| |

|

| ● |

quarterly

variations in our or our competitors’ results of operations; |

| |

|

| ● |

changes

in earnings estimates or recommendations by securities analysts, if any, who cover our common stock; |

| |

|

| ● |

failure

to meet estimates or recommendations by securities analysts, if any, who cover our stock; |

| ● |

changes

in the fair value of our derivative liabilities resulting from changes in the market price of our common stock, which may result

in significant fluctuations in our quarterly and annual operating results; |

| |

|

| ● |

changes

in healthcare policy in the United States and internationally; |

| |

|

| ● |

product

liability claims or other litigation involving us; |

| |

|

| ● |

sales

of a substantial aggregate number of shares of our common stock; |

| |

|

| ● |

sales

of large blocks of our common stock, including sales by our executive officers, directors and significant stockholders; |

| |

|

| ● |

disputes

or other developments with respect to intellectual property rights; |

| |

|

| ● |

changes

in accounting principles; |

| |

|

| ● |

changes

to tax policy; and |

| |

|

| ● |

general

market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our

competitors. |

These

and other external factors may cause the market price and demand for our common stock to fluctuate substantially, which may limit or

prevent our stockholders from readily selling their shares of our common stock and may otherwise negatively affect the liquidity of our

common stock. In addition, in the past, when the market price of a stock has been volatile, holders of that stock have sometimes instituted

securities class action litigation against the company that issued the stock. If our stockholders brought a lawsuit against us, we could

incur substantial costs defending the lawsuit regardless of the merits of the case or the eventual outcome. Such a lawsuit also would

divert the time and attention of our management from running our company.

Securities

analysts may not continue to provide coverage of our common stock or may issue negative reports, which may have a negative impact on

the market price of our common stock.

Since

completing our initial public offering of shares of our common stock in February 2014, a limited number of securities analysts have been

providing research coverage of our common stock. If securities analysts do not continue to cover our common stock, the lack of research

coverage may cause the market price of our common stock to decline. The trading market for our common stock may be affected in part by

the research and reports that industry or financial analysts publish about our business. If one or more of the analysts who elect to

cover us downgrade our stock, our stock price would likely decline rapidly. If one or more of these analysts cease coverage of us, we

could lose visibility in the market, which in turn could cause our stock price to decline. In addition, under the Sarbanes-Oxley Act

of 2002, and a global settlement among the SEC, other regulatory agencies and a number of investment banks, which was reached in 2003,

many investment banking firms are required to contract with independent financial analysts for their stock research. It may be difficult

for a company such as ours, with a smaller market capitalization, to attract independent financial analysts that will cover our common

stock. This could have a negative effect on the market price of our stock.

Anti-takeover

provisions in our organizational documents and Delaware law may discourage or prevent a change in control, even if an acquisition would

be beneficial to our stockholders, which could affect our stock price adversely and prevent attempts by our stockholders to replace or

remove our current management.

Our

restated certificate of incorporation, as amended, (the “Restated Certificate of Incorporation”) and amended and restated

bylaws (the “Restated Bylaws”) contain provisions that could discourage, delay or prevent a merger, acquisition or other

change in control of our company or changes in our board of directors that our stockholders might consider favorable, including transactions

in which you might receive a premium for your shares. These provisions also could limit the price that investors might be willing to

pay in the future for shares of our common stock, thereby depressing the market price of our common stock. Stockholders who wish to participate

in these transactions may not have the opportunity to do so. Furthermore, these provisions could prevent or frustrate attempts by our

stockholders to replace or remove management. These provisions:

| ● |

allow

the authorized number of directors to be changed only by resolution of our board of directors; |

| |

|

| ● |

provide

for a classified board of directors, such that not all members of our board will be elected at one time; |

| |

|

| ● |

prohibit

our stockholders from filling board vacancies, limit who may call stockholder meetings, and prohibit the taking of stockholder action

by written consent; |

| |

|

| ● |

prohibit

our stockholders from making certain changes to our restated certificate of incorporation or restated bylaws except with the approval

of holders of 75% of the outstanding shares of our capital stock entitled to vote; |

| |

|

| ● |

require

advance written notice of stockholder proposals that can be acted upon at stockholders’ meetings and of director nominations

to our board of directors; and |

| |

|

| ● |

authorize

our board of directors to create and issue, without prior stockholder approval, preferred stock that may have rights senior to those

of our common stock and that, if issued, could operate as a “poison pill” to dilute the stock ownership of a potential

hostile acquirer to prevent an acquisition that is not approved by our board of directors. |

In

addition, we are subject to the provisions of Section 203 of the Delaware General Corporation Law, which may prohibit certain business

combinations with stockholders owning 15% or more of our outstanding voting stock. Any delay or prevention of a change in control transaction

or changes in our board of directors could cause the market price of our common stock to decline.

We

do not intend to pay cash dividends.

We

have never declared or paid cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable

future. We currently intend to retain all available funds and any future earnings for debt service and use in the operation and expansion

of our business. In addition, the terms of any future debt or credit facility may preclude us from paying any dividends.

Our

outstanding shares of Series B Convertible Preferred Stock, Series C Convertible Preferred Stock, Series D Convertible Preferred Stock

and our outstanding common stock warrants are convertible and exercisable into shares of our common stock and when converted or exercised,

the issuance of additional shares of common stock may result in downward pressure on the trading price of our common stock.

We

have outstanding shares of Series B Convertible Preferred Stock, Series C Convertible Preferred Stock and Series D Convertible Preferred

Stock that are each convertible into shares of common stock. We believe that as such holders convert their preferred shares into common

stock, they will immediately sell their shares of common stock. The sale of such shares of common stock may result in downward pressure

on the trading price of our common stock resulting in a lower stock price. Additionally, we have outstanding warrants to purchase shares

of common stock. Many of these warrants have a cashless exercise provision that if exercised may also result in downward pressure on

the trading price of our common stock and cause such price to decline.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are based on our management’s current beliefs, expectations and assumptions about

future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements

may be found, among other places, in the Sections titled “Business,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus and in any of our filings with the

SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act

All

statements, other than statements of historical fact, included or incorporated herein regarding our strategy, future operations, financial

position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

“think,” “may,” “could,” “will,” “would,” “should,” “continue,”

“potential,” “likely,” “opportunity” and similar expressions or variations of such words are intended

to identify forward-looking statements but are not the exclusive means of identifying forward-looking statements. Examples of our forward-looking

statements include:

| ● |

our

ability to achieve sufficient market acceptance of any of our products or product candidates; |

| |

|

| ● |

our

ability to enter into and maintain successful OEM arrangements with third parties; |

| |

|

| ● |

our

perception of the growth in the size of the potential market for our products and product candidates; |

| |

|

| ● |

our

estimate of the advantages of our silicon nitride technology platform; |

| |

|

| ● |

our

ability to become a profitable biomaterial technology company; |

| |

|

| ● |

our

ability to design, manufacture and commercialize armor plates for military, police and civilian use; |

| |

|

| ● |

Our

ability to successfully integrate the recently acquired Technology Assessment & Transfer and develop and commercialize products

arising from this acquisition; |

| |

|

| ● |

our

estimates regarding our needs for additional financing and our ability to obtain such additional financing on suitable terms; |

| |

|

| ● |

our

ability to succeed in obtaining FDA clearance or approvals for our product candidates; |

| |

|

| ● |

our

ability to receive CE Marks for our product candidates; |

| |

|

| ● |

the

timing, costs and other limitations involved in obtaining regulatory clearance or approval for any of our product candidates and

product candidates and, thereafter, continued compliance with governmental regulation of our existing products and activities; |

| |

|

| ● |

our

ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of

others; |

| |

|

| ● |

our

ability to obtain sufficient quantities and satisfactory quality of raw materials to meet our manufacturing needs; |

| |

|

| ● |

the

availability of adequate coverage reimbursement from third-party payers in the United States; |

| |

|

| ● |

our

estimates regarding anticipated operating losses, future product revenue, expenses, capital requirements and liquidity; |

| |

|

| ● |

our

ability to maintain and continue to develop our sales and marketing infrastructure; |

| ● |

our

ability to enter into and maintain suitable arrangements with an adequate number of distributors; |

| |

|

| ● |

our

manufacturing capacity to meet future demand; |

| |

|

| ● |

our

ability to develop effective and cost-efficient manufacturing processes for our products; |

| |

|

| ● |

our

reliance on third parties to supply us with raw materials and our non-silicon nitride products and instruments; |

| |

|

| ● |

the

safety and efficacy of products and product candidates; |

| |

|

| ● |

potential

changes to the healthcare delivery systems and payment methods in the United States or internationally; |

| |

|

| ● |

our

ability to attract and retain a qualified management team, engineering team, sales and marketing team, distribution team, and other

qualified personnel and advisors. |

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some