0001338929false--12-31Q320230.0010.0010.001100000400000100000400000100000400000100000040000000.0012500000000155739766218756851270.0011978087926600000015573976620.0010.00110000004000000.000810,00000013389292023-01-012023-09-300001338929us-gaap:OptionMember2022-01-012022-12-310001338929ahro:WarrantsMember2022-01-012022-12-310001338929ahro:WarrantsMember2023-01-012023-09-300001338929us-gaap:OptionMember2023-01-012023-09-300001338929us-gaap:ConvertibleNotesPayableMember2023-01-012023-09-300001338929us-gaap:ConvertibleNotesPayableMember2022-01-012022-12-310001338929ahro:PendingLitigation3Member2023-01-012023-09-300001338929ahro:PendingLitigation2Member2023-01-012023-09-300001338929us-gaap:PendingLitigationMember2023-01-012023-09-300001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2015-08-012015-08-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2023-09-300001338929srt:ChiefExecutiveOfficerMember2017-12-310001338929srt:ChiefExecutiveOfficerMember2017-01-012017-12-310001338929srt:ChiefExecutiveOfficerMember2016-01-012016-12-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2015-08-310001338929ahro:AHOriginalsIncMemberahro:PromissoryNotesPayableMember2019-06-180001338929ahro:AHOriginalsIncMemberahro:PromissoryNotesPayableMember2019-06-012019-06-180001338929ahro:TotalRelatedPartiesLoansMember2023-09-300001338929ahro:RelatedPartyLoansMember2023-09-300001338929ahro:ConvertibleNotesMember2023-09-300001338929ahro:PromissoryNotesPayableMember2023-09-300001338929ahro:UnsecuredDebtOneMember2023-09-300001338929ahro:NovemberTwoFiveTwoZeroOneFourMemberahro:UnsecuredDebtsMember2019-01-012019-12-310001338929ahro:NovemberTwoFiveTwoZeroOneFourMemberahro:UnsecuredDebtsMember2022-12-310001338929ahro:AprilOneTwoZeroOneSixMemberahro:UnsecuredDebtsMemberahro:ForbearanceAgreementMember2023-09-300001338929ahro:NovemberTwoFiveTwoZeroOneFourMemberahro:UnsecuredDebtsMember2023-09-300001338929ahro:ConvertiblePromissoryNotesMember2022-12-310001338929ahro:ConvertiblePromissoryNotesMember2023-09-300001338929ahro:PreferredStocksMember2014-09-012014-09-300001338929us-gaap:SeriesDPreferredStockMember2023-01-012023-09-300001338929us-gaap:SeriesDPreferredStockMember2023-06-012023-06-200001338929us-gaap:SeriesCPreferredStockMember2023-04-012023-04-260001338929us-gaap:SeriesBPreferredStockMember2023-06-200001338929us-gaap:SeriesCPreferredStockMember2023-01-012023-09-300001338929ahro:PreferredStocksMember2023-06-200001338929us-gaap:SeriesBPreferredStockMember2014-09-012014-09-300001338929us-gaap:SeriesBPreferredStockMember2014-09-300001338929ahro:PreferredStocksMember2014-09-300001338929ahro:ConversionOfNotesMember2023-01-012023-09-300001338929ahro:CapitalStockCommonStockMember2023-01-012023-09-300001338929ahro:CapitalStockCommonStockMember2023-09-300001338929ahro:CapitalStockCommonStockMember2022-12-310001338929ahro:AhiMember2023-09-300001338929ahro:ECOCHAINMember2023-09-300001338929us-gaap:FairValueInputsLevel3Member2023-09-300001338929us-gaap:FairValueInputsLevel2Member2023-09-300001338929us-gaap:FairValueInputsLevel1Member2023-09-300001338929us-gaap:FairValueInputsLevel3Member2022-12-310001338929us-gaap:FairValueInputsLevel2Member2022-12-310001338929us-gaap:FairValueInputsLevel1Member2022-12-310001338929ahro:RoyaltiesMember2022-01-012022-12-310001338929ahro:RoyaltiesMember2023-01-012023-09-300001338929ahro:RightOfUseAssetsMember2022-01-012022-12-310001338929ahro:WebsitesMember2022-01-012022-12-310001338929ahro:RightOfUseAssetsMember2023-01-012023-09-300001338929ahro:WebsitesMember2023-01-012023-09-3000013389292022-01-012022-12-310001338929ahro:PatentMember2022-01-012022-12-310001338929ahro:PatentMember2023-01-012023-09-300001338929ahro:TridentMember2022-12-310001338929ahro:TridentMember2023-09-300001338929ahro:CameraMember2022-12-310001338929ahro:CameraMember2023-09-300001338929ahro:ForkliftMember2022-12-310001338929ahro:ForkliftMember2023-09-300001338929us-gaap:FurnitureAndFixturesMember2022-12-310001338929us-gaap:FurnitureAndFixturesMember2023-09-300001338929ahro:ForkliftMember2023-01-012023-09-300001338929us-gaap:FurnitureAndFixturesMember2023-01-012023-09-300001338929ahro:EquipmentsMember2023-01-012023-09-3000013389292017-01-110001338929us-gaap:SeriesDPreferredStockMember2023-06-200001338929us-gaap:SeriesCPreferredStockMember2023-04-260001338929ahro:AhOriginalsIncMember2023-01-012023-09-300001338929ahro:AhOriginalsIncMember2019-06-012019-06-180001338929ahro:AhiriginalsIncMember2019-06-180001338929ahro:AhOriginalsIncMember2019-06-180001338929ahro:AccumulatedDeficitMember2023-09-300001338929us-gaap:AdditionalPaidInCapitalMember2023-09-300001338929ahro:SeriesDPreferredStocksMember2023-09-300001338929ahro:SeriesCPreferredStocksMember2023-09-300001338929us-gaap:CommonStockMember2023-09-300001338929ahro:SeriesBPreferredStocksMember2023-09-300001338929ahro:AccumulatedDeficitMember2023-07-012023-09-300001338929us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001338929ahro:SeriesDPreferredStocksMember2023-07-012023-09-300001338929ahro:SeriesCPreferredStocksMember2023-07-012023-09-300001338929us-gaap:CommonStockMember2023-07-012023-09-3000013389292023-06-300001338929ahro:AccumulatedDeficitMember2023-06-300001338929us-gaap:AdditionalPaidInCapitalMember2023-06-300001338929ahro:SeriesDPreferredStocksMember2023-06-300001338929ahro:SeriesCPreferredStocksMember2023-06-300001338929us-gaap:CommonStockMember2023-06-300001338929ahro:SeriesBPreferredStocksMember2023-06-300001338929ahro:AccumulatedDeficitMember2023-04-012023-06-300001338929us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000013389292023-04-012023-06-300001338929us-gaap:CommonStockMember2023-04-012023-06-3000013389292023-03-310001338929ahro:AccumulatedDeficitMember2023-03-310001338929us-gaap:AdditionalPaidInCapitalMember2023-03-310001338929ahro:SeriesDPreferredStocksMember2023-03-310001338929ahro:SeriesCPreferredStocksMember2023-03-310001338929us-gaap:CommonStockMember2023-03-310001338929ahro:SeriesBPreferredStocksMember2023-03-310001338929ahro:AccumulatedDeficitMember2023-01-012023-03-310001338929us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001338929us-gaap:CommonStockMember2023-01-012023-03-3100013389292023-01-012023-03-310001338929ahro:AccumulatedDeficitMember2022-12-310001338929us-gaap:AdditionalPaidInCapitalMember2022-12-310001338929us-gaap:CommonStockMember2022-12-310001338929ahro:SeriesBPreferredStocksMember2022-12-3100013389292022-09-300001338929ahro:AccumulatedDeficitMember2022-09-300001338929us-gaap:AdditionalPaidInCapitalMember2022-09-300001338929us-gaap:CommonStockMember2022-09-300001338929ahro:SeriesBPreferredStocksMember2022-09-300001338929ahro:AccumulatedDeficitMember2022-07-012022-09-300001338929us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001338929us-gaap:CommonStockMember2022-07-012022-09-3000013389292022-06-300001338929ahro:AccumulatedDeficitMember2022-06-300001338929us-gaap:AdditionalPaidInCapitalMember2022-06-300001338929us-gaap:CommonStockMember2022-06-300001338929ahro:SeriesBPreferredStocksMember2022-06-3000013389292022-04-012022-06-300001338929ahro:AccumulatedDeficitMember2022-04-012022-06-300001338929us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001338929us-gaap:CommonStockMember2022-04-012022-06-3000013389292022-03-310001338929ahro:AccumulatedDeficitMember2022-03-310001338929us-gaap:AdditionalPaidInCapitalMember2022-03-310001338929ahro:SeriesDPreferredStocksMember2022-03-310001338929ahro:SeriesCPreferredStocksMember2022-03-310001338929us-gaap:CommonStockMember2022-03-310001338929ahro:SeriesBPreferredStocksMember2022-03-3100013389292022-01-012022-03-310001338929ahro:AccumulatedDeficitMember2022-01-012022-03-310001338929us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001338929us-gaap:CommonStockMember2022-01-012022-03-3100013389292021-12-310001338929ahro:AccumulatedDeficitMember2021-12-310001338929us-gaap:AdditionalPaidInCapitalMember2021-12-310001338929us-gaap:CommonStockMember2021-12-310001338929ahro:SeriesBPreferredStocksMember2021-12-3100013389292022-01-012022-09-3000013389292022-07-012022-09-3000013389292023-07-012023-09-300001338929us-gaap:SeriesDPreferredStockMember2022-12-310001338929us-gaap:SeriesDPreferredStockMember2023-09-300001338929us-gaap:SeriesCPreferredStockMember2022-12-310001338929us-gaap:SeriesCPreferredStockMember2023-09-300001338929us-gaap:SeriesBPreferredStockMember2023-09-300001338929us-gaap:SeriesBPreferredStockMember2022-12-3100013389292022-12-3100013389292023-09-3000013389292023-11-15iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 000-52047

AUTHENTIC HOLDINGS, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 11-3746201 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

50 Division Street Somerset NJ 08873

(Address of principal executive offices)

(732) 695-4389

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller Reporting Company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act: None

As of November 15, 2023, there were 1,978,087,926 shares outstanding of the registrant’s common stock.

AUTHENTIC HOLDINGS, INC.

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

AUTHENTIC HOLDINGS INC.

Condensed Consolidated Balance Sheets

As of September 30, 2023 and December 31, 2022

| | September 30, 2023 | | | December 31, 2022 | |

| | (Unaudited) | | | (Audited) | |

ASSETS | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 563 | | | $ | - | |

Prepaid interest and deposits | | | - | | | | - | |

Advances | | | 450,000 | | | $ | 625,000 | |

Total Current Assets | | | 450,563 | | | | 625,000 | |

| | | | | | | | |

Property and equipment, net of depreciation | | | 34,850 | | | | 68,206 | |

Intangible assets | | | 15,591 | | | | 18,473 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 501,004 | | | $ | 711,679 | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

Current Liabilities | | | | | | | | |

Bank overdraft | | | - | | | | 306 | |

Accounts payable and accrued liabilities | | | 224,259 | | | | 234,641 | |

Accrued compensation | | | 501,250 | | | | 501,250 | |

Unsecured notes and accrued interest payable | | | 309,834 | | | | 250,464 | |

Convertible notes and accrued interest - net of debt discount of $97,000 and $155,641 respectively. | | | 1,185,693 | | | | 1,243,243 | |

Convertible notes and accrued interest - related party | | | 85,568 | | | | 82,568 | |

Promissory Notes and Accrued Interest | | | 40,500 | | | | | |

Promissory note and accrued interest - related party | | | 505,526 | | | | 495,308 | |

Derivative liabilities | | | 1,873,114 | | | | 1,608,485 | |

Advances from related parties | | | 411,599 | | | | 383,686 | |

Related party loans and accrued interest | | | 266,433 | | | | 263,529 | |

Self Liquidating Promissory Notes | | | 186,875 | | | | 165,000 | |

Total Current Liabilities | | | 5,590,651 | | | | 5,228,480 | |

Stockholders’ Deficit | | | | | | | | |

Preferred stock, Series B, $0.001 par value, 400,000 shares authorized, 400,000 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. | | | 200 | | | | 200 | |

Preferred stock, Series C, $0.001 par value, 100,000 shares authorized, and 100,000 and 0 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. | | | 100 | | | | - | |

Preferred stock, Series D, $0.001 par value, 100,000 shares authorized, and 100,000 and 0 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. | | | 100 | | | | - | |

Common stock $0.001 par value, 2,500,000,000 shares authorized, 1,875,685,127 and 1,557,397,662 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. | | | 1,875,684 | | | | 1,557,397 | |

Additional paid-in capital | | | 30,362,015 | | | | 30,305,914 | |

Accumulated deficit | | | (37,327,746 | ) | | | (36,380,313 | ) |

Stockholders' deficit | | | (5,089,647 | ) | | | (4,516,802 | ) |

| | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | | $ | 501,004 | | | $ | 711,679 | |

The accompanying notes are an integral part of these consolidated financial statements.

AUTHENTIC HOLDINGS INC.

Condensed Consolidated Statement of Operations

For the Three and Nine Months Ended September 30, 2023 and 2022

| | Three months ended September 30, | | | Nine months ended September 30, | |

| | (Unaudited) | | | (Unaudited) | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

REVENUE | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

COST OF REVENUES | | | - | | | | - | | | | - | | | | - | |

GROSS PROFIT (LOSS) | | | - | | | | - | | | | - | | | | - | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

General and administrative | | | 51,708 | | | | 116,978 | | | | 160,423 | | | | 169,259 | |

Depreciation and Amortization | | | 13,283 | | | | 20,806 | | | | 36,237 | | | | 79,776 | |

Professional and Legal Fees | | | 14,200 | | | | 36,475 | | | | 97,298 | | | | 87,824 | |

Officer salaries and compensation | | | - | | | | - | | | | - | | | | - | |

Stock based compensation | | | - | | | | - | | | | - | | | | - | |

Research and Development | | | 5,463 | | | | - | | | | 54,858 | | | | - | |

Total Operating Expenses | | $ | 84,654 | | | $ | 174,259 | | | | 348,816 | | | | 336,859 | |

| | | | | | | | | | | | | | | | |

LOSS FROM OPERATIONS | | | (84,654 | ) | | | (174,259 | ) | | | (348,816 | ) | | | (336,859 | ) |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSE) | | | | | | | | | | | | | | | | |

Income/(Loss) on change in fair value of derivative liabilities | | | (563,106 | ) | | | - | | | | (348,623 | ) | | | 478,754 | |

Gain/(Loss) on conversion of notes | | | - | | | | - | | | | (46,153 | ) | | | 15,856 | |

Income/(Loss) on Joint Venture | | | | | | | | | | | (50,000 | ) | | | | |

Interest expense and financing costs | | | (65,324 | ) | | | (64,267 | ) | | | (141,087 | ) | | | (99,369 | ) |

Interest expense - related parties | | | (6,817 | ) | | | (7,433 | ) | | | (12,690 | ) | | | (110,267 | ) |

Other expense | | | - | | | | (3,000 | ) | | | - | | | | (6,750 | ) |

| | | | | | | | | | | | | | | | |

Total Other Expense | | | (635,247 | ) | | | (74,700 | ) | | | (598,553 | ) | | | 278,224 | |

| | | | | | | | | | | | | | | | |

Net Income (Loss) | | | (719,901 | ) | | | (248,959 | ) | | | (947,369 | ) | | | (58,635 | ) |

| | | | | | | | | | | | | | | | |

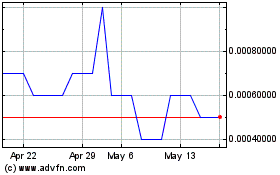

Net loss per share | | $ | (0.0004 | ) | | $ | (0.0002 | ) | | $ | (0.0005 | ) | | $ | (0.0000 | ) |

| | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | 1,970,198,993 | | | | 1,511,910,607 | | | | 1,978,087,926 | | | | 1,534,320,739 | |

The accompanying notes are an integral part of these consolidated financial statements.

AUTHENTIC HOLDINGS INC.

Condensed Consolidated Statement of Stockholders' Deficit

For the Three and Nine Months Ended September 30, 2023 and 2022

| | Series B Preferred Stock | | | Series C Preferred Stock | | | Series D Preferred Stock | | | Common Stock | | | Additional Paid in | | | Accumulated | | | | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

Balance December 31, 2021 | | | 200,000 | | | $ | 200 | | | | | | | | | | | | | | | | 1,450,210,322 | | | $ | 1,450,210 | | | $ | 30,092,729 | | | $ | (35,222,530 | ) | | $ | (3,679,391 | ) |

Conversion of Notes Payable | | | | | | | | | | | | | | | | | | | | | | | 15,638,695 | | | | 15,638 | | | | 46,769 | | | | - | | | | 62,407 | |

Stock warrants issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 60,000 | | | | | | | | 60,000 | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 391,027.00 | | | | 391,027 | |

Balance March 31, 2022 | | | 200,000 | | | $ | 200 | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,465,849,017 | | | $ | 1,465,848 | | | $ | 30,199,498 | | | $ | (34,831,503 | ) | | $ | (3,165,957 | ) |

Issuance of shares for conversion of notes | | | | | | | | | | | | | | | | | | | | | | | | | | | 39,582,832 | | | | 39,583 | | | | 60,417 | | | | - | | | | 100,000 | |

Stock warrants issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | - | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (200,703.00 | ) | | | (200,703 | ) |

Balance June 30, 2022 | | | 200,000 | | | $ | 200 | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,505,431,849 | | | $ | 1,505,431 | | | $ | 30,259,915 | | | $ | (35,032,206 | ) | | $ | (3,266,660 | ) |

Issuance of common stock | | | | | | | | | | | | | | | | | | | | | | | | | | | 28,888,890 | | | | 28,889 | | | | 31,111 | | | | - | | | | 60,000 | |

Stock warrants issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | - | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (248,959.00 | ) | | | (248,959 | ) |

Balance September 30, 2022 | | | 200,000 | | | $ | 200 | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,534,320,739 | | | $ | 1,534,320 | | | $ | 30,291,026 | | | $ | (35,281,165 | ) | | $ | (3,455,619 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2022 | | | 200,000 | | | $ | 200 | | | | | | | | | | | | | | | | | | | | 1,557,397,662 | | | $ | 1,557,397 | | | $ | 30,305,914 | | | $ | (36,380,313 | ) | | $ | (4,516,802 | ) |

Issuance of shares for conversion of notes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | - | |

Stock issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | 15,555,556 | | | | 15,556 | | | | 19,445 | | | | | | | | 35,001 | |

Adjustment shares issued | | | | | | | | | | | | | | | | | | | | | | | | | | | 139,630,947 | | | | | | | | | | | | | | | | - | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,209,261 | ) | | | (1,209,261 | ) |

Balance March 31, 2023 | | | 200,000 | | | $ | 200 | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,712,584,165 | | | $ | 1,572,953 | | | $ | 30,325,359 | | | $ | (37,589,574 | ) | | $ | (5,691,062 | ) |

Adjustment shares issued | | | | | | | | | | | | | | | | | | | | | | | | | | | (139,630,947 | ) | | | | | | | | | | | | | | | - | |

Issuance of shares for conversion of notes | | | | | | | | | | | | | | | | | | | | | | | | | | | 302,731,907 | | | | 302,731 | | | | 71,963 | | | | | | | | 374,694 | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 981,792 | | | | 981,792 | |

Balance June 30, 2023 | | | 200,000 | | | $ | 200 | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,875,685,125 | | | $ | 1,875,684 | | | $ | 30,397,322 | | | $ | (36,607,845 | ) | | $ | (4,334,639 | ) |

Adjustment shares issued | | | | | | | | | | | 100,000 | | | | 100 | | | | 100,000 | | | | 100 | | | | 102,402,801 | | | | | | | | (35,307 | ) | | | - | | | | (35,107 | ) |

Stock warrants issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | - | |

Net Income (loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (719,901 | ) | | | (719,901 | ) |

Balance September 30, 2023 | | | 200,000 | | | $ | 200 | | | | 100,000 | | | $ | 100 | | | | 100,000 | | | $ | 100 | | | | 1,978,087,926 | | | $ | 1,875,684 | | | $ | 30,362,015 | | | $ | (37,327,746 | ) | | $ | (5,089,647 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

AUTHENTIC HOLDINGS INC.

Condensed Consolidated Statement of Cash Flows

For the Nine Months Ended September 30, 2023 and 2022

| | 2023 | | | 2022 | |

| | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

Net loss (income) | | $ | (947,369 | ) | | $ | (58,635 | ) |

Adjustments to reconcile net income (loss) to net cash from operating activities: | | | | | | | | |

Change in fair value of derivative liabilities | | | 348,623 | | | | (478,754 | ) |

Extinguishment of derivative liabilities | | | - | | | | | |

Conversion of notes payable to equity | | | 46,153 | | | | 60,180 | |

Depreciation – Property and equipment | | | 33,355 | | | | 37,115 | |

Amortization – Intangible assets | | | 2,882 | | | | 42,661 | |

Changes in operating assets and liabilities: | | | | | | | | |

Bank Indebtedness | | | (306 | ) | | | (125 | ) |

Expense paid for subsidiary | | | | | | | | |

Inventory | | | | | | | | |

Advances to joint venture | | | 175,000 | | | | (675,000 | ) |

Prepaid interest and deposits | | | | | | | | |

Expenses paid for subsidiary | | | | | | | | |

Accounts payable and accrued expenses | | | (10,447 | ) | | | (37,711 | ) |

Accrued interest | | | 80,317 | | | | 126,486 | |

Net cash used in operating activities | | $ | (271,792 | ) | | $ | (933,783 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Advances to related party | | | - | | | | - | |

Acquisition of equipment | | | - | | | | (4,022 | ) |

Net cash used in investing activities | | | - | | | | (4,022 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Advances from related parties | | $ | 27,913 | | | $ | 22,939 | |

Proceeds from stock warrants | | | - | | | | - | |

Proceeds from promissory notes | | | 116,785 | | | | - | |

Proceeds from unsecured loans | | | - | | | | - | |

Proceeds from issuance of common stock and warrants | | | 127,657 | | | | 55,221 | |

Net proceeds from convertible notes | | | - | | | | 855,866 | |

Net cash provided by financing activities | | $ | 272,355 | | | $ | 938,805 | |

| | | | | | | | |

Net change in cash and cash equivalents | | | 563 | | | | 1,000 | |

Cash and cash equivalents – beginning of period | | | - | | | | - | |

Cash and cash equivalents – end of period | | $ | 563 | | | $ | 1,000 | |

| | | | | | | | |

Supplemental Cash Flow Disclosures | | | | | | | | |

Cash paid for interest | | $ | - | | | $ | - | |

Cash paid for income taxes | | $ | - | | | $ | - | |

| | | | | | | | |

Non-Cash Investing and Financing Activity: | | | | | | | | |

Shares issued for convertible notes settlement | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these consolidated financial statements.

AUTHENTIC HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023

NOTE 1 – DESCRIPTION OF BUSINESS AND GOING CONCERN

Authentic Holdings Inc. (formerly Global Fiber Technologies, Inc.) was incorporated in Nevada on March 25, 2005 as “Premier Publishing Group, Inc.” Originally formed as a publishing company, the Company ceased its publishing operations in or around 2007.

After ceasing the publishing operations, the Company's operations consisted solely of utilizing the expertise of its board Members and outside agents to further the efforts of its advisory services business plan through a wholly owned subsidiary known as Trident Merchant Group, Inc. On April 20, 2011 the Company filed an amendment with the Nevada Secretary of State for a name change to Premiere Opportunities Group, Inc. which became official on June 29, 2011.

During the fourth quarter of 2013, the Company became involved in the manufacturing and global distribution of ladies’ apparel. However, in 2014 the Company stopped developing a footprint in the apparel business due to cash restraints and logistics and ceased agreements with all third parties. On August 4, 2014, the Company filed an amendment to the articles of incorporation to change the name of the Company to Global Fashion Technologies, Inc.

On January 11, 2017 the Company filed an amendment to change the name of the Company to Eco Tek 360, Inc. In November 2018, the Company created a new subsidiary, Fiber Chain, Inc., for the purpose of operating as an intermediary providing an expedited trading platform for buyers and sellers to efficiently consummate fiber transactions. The Company owns 51% of ECO CHAIN 360, Inc. ECO CHAIN 360, Inc. has had no operations to date nor did it have assets or liabilities as of September 30, 2023 or 2022.

On April 18, 2019, the Company filed an amendment to change the name of the Company to Global Fiber Technologies, Inc.

On June 18, 2019, the Company completed its acquisition of assets from AH Originals, Inc. (“AHO”), a corporation controlled by the same owner group of Global Fiber Technologies, Inc., for the consideration of 6,400,000 shares of common stock of the Company to be issued and the issuance of a promissory note of $447,150 that bears 3% interest per annum and has a one-year term with eight options to extend the maturity date for three-month periods. In addition, the Company issued to AHO 200,000 common shares of Authentic Heroes, Inc. (“AHI”), a subsidiary created by the Company, to hold the purchased assets. AHI has commenced minimal operations.

The Company’s business plan is to operate through its wholly owned and majority owned subsidiaries. Authentic Heroes is a company with proprietary know how and patented technology that is currently operating in the memorabilia industry. It has licenses with Universal Music Group artists RUN DMC, YUNGBLUD and is in discussions with several other music artists. Ecotek360 is a fiber rejuvenation technology company. It has no current operations, but plans on offering branded fabrics, apparel and uniforms to the corporate, hotel, hospital and military markets and is still in the development stage but running testing in the joint venture with Fiber Conversion Inc a joint development partner in Broadalbin NY. Fiber Chain, Inc. is still in the development stage and its business plan is to operate as an intermediary providing an expedited trading platform for buyers and sellers to efficiently consummate fiber transactions.

On April 26, 2023, the Company entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Maybacks Global Entertainment LLC, an Arizona limited liability company (“Maybacks”), and the members of Maybacks. As a result of the transaction, Maybacks became a wholly-owned subsidiary of the Company. In accordance with the terms of the Purchase Agreement, at the closing an aggregate of 100,000 shares of the Company’s newly created Series C Preferred Stock were issued to the holders of Maybacks in exchange for their membership interests of Maybacks.

The Purchase Agreement includes a funding obligation, which requires the Company to provide capital to fund the monthly expenses of Maybacks.

On June 20, 2023, the Company closed an Asset Purchase Agreement (the “Asset Agreement”) with Goliath Motion Picture Promotions owned by Priscella Cooper (the “Seller”). On the Closing Date, pursuant to the Asset Agreement, the Company acquired various full-length motion pictures and serial television shows (the “Assets”). In exchange for the Assets, the Company issued to the Seller 100,000 shares of the Company’s Series D Preferred Stock, par value $0.001 with state value of $50 per share.

Management plans to raise additional debt or equity and continue to settle obligations by issuing stock, as well as grow other debt and equity until the Company generates positive cash flow from an operating company. However, the Company’s financial statements show an accumulated deficit of $37,327,746 as of September 30, 2023, with a net working capital deficit of $5,140,024 and limited cash resources. These factors raise doubts about the Company’s ability to continue as a going concern within the next year.

The Company's ability to continue as a going concern depends on its ability to repay or settle its current indebtedness, generate positive cash flow, and raise capital through equity and debt financing or other means on favorable terms. If the Company cannot obtain additional funds when required or on favorable terms, management may be necessary to restructure the Company or cease operations.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The Company’s consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in U.S. dollars. The Company uses the accrual basis of accounting and has adopted a December 31 fiscal year-end.

Principles of Consolidation

The accompanying consolidated financial statements include all the accounts of the Company and its wholly owned subsidiaries, Maybacks Global Entertainment LLC, Trident Merchant Group, Inc. and Progressive Fashions Inc., and its majority-owned subsidiaries, Leading Edge Fashion, LLC, Pure361, LLC and ECO CHAIN 360, Inc., which are 51% owned. All significant intercompany accounts and transactions have been eliminated. As noted in Note 1, our 51% owned subsidiaries, Pure361, Leading Edge Fashions, LLC, and ECO CHAIN 360, Inc., had no operations, assets, or liabilities as of September 30, 2023, and 2022. Because of this, a non-controlling interest is not reflected in these financial statements. In addition, the Company has consolidated Authentic Heroes, Inc., of which the Company owns 80%.

The Company filed articles of Merger with the Secretary of State of Nevada to effectuate a merger with its wholly-owned subsidiary, Authentic Holdings, Inc. Shareholder approval was optional under Section 92A.180 of the Nevada Revised Statutes. As part of the merger, the Company’s board of directors authorized a change in our name to “Authentic Holdings, Inc.” The Company’s Articles of Incorporation have been amended to reflect this name change.

Reclassifications

Specific amounts in the prior period’s financial statements have been reclassified to conform to the current presentation. These reclassifications did not affect the reported consolidated net loss.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and investments in money market funds. The Company considers all highly liquid instruments with an original maturity of 90 days or less at the time of purchase to be cash equivalents.

Inventories

Inventories are stated at the lower cost (first-in, first-out method) or net realizable value.

On September 30, 2023, and December 31, 2022, the Company had no acquired inventories.

Equipment

Property and equipment are stated at cost. Costs of replacements and significant improvements are capitalized, and maintenance and repairs are charged to operations as incurred. Depreciation expense is provided primarily by the straight-line method over the estimated useful lives of the assets as follows:

Equipment | | 5 Years | |

Furniture and Fixtures | | 7 Years | |

Forklift | | 3 Years | |

| | September 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Furniture and Equipment | | $ | 215,665 | | | $ | 215,665 | |

Forklift | | | 20,433 | | | | 20,433 | |

Camera | | | 4,022 | | | | 4,022 | |

Trident | | | 733 | | | | 733 | |

Total Equipment | | | 240,853 | | | | 240,853 | |

Less accumulated depreciation | | | (206,003 | ) | | | (172,648 | ) |

| | $ | 34,850 | | | $ | 68,206 | |

Depreciation expenses amounted to $33,355 and $37,155 for the nine months ended September 30, 2023 and 2022, respectively.

The long-lived assets of the Company are reviewed for impairment under ASC 360, “Property, Plant and Equipment” (“ASC 360”), whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The recoverability of assets to be held and used is measured by comparing the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the assets. If such assets are impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. During the nine months ended September 30, 2023, and 2022, no impairment losses have been identified.

Intangible Assets

The Company accounts for intangible assets (including trademarks and website) under ASC 350 “Intangibles-Goodwill and Other” (“ASC 350”). ASC 350 requires that goodwill and other intangibles with indefinite lives be tested for impairment annually or on an interim basis if events or circumstances indicate that the fair value of an asset has decreased below its carrying value. In addition, ASC 350 requires that goodwill be tested for impairment at the reporting unit level (operating segment or one level below an operating segment) on an annual basis and between annual tests when circumstances indicate the recoverability of the carrying amount of goodwill may be in doubt. Application of the goodwill impairment test requires judgment, including identifying reporting units, assigning assets and liabilities to reporting units, assigning goodwill to reporting units, and determining the fair value. Significant judgments required to estimate the fair value of reporting units include assessing future cash flows and determining appropriate discount rates and other assumptions. Changes in these estimates and assumptions or the occurrence of one or more confirming events in future periods could cause the actual results or outcomes to differ from such estimates materially and affect the determination of fair value and goodwill impairment at future reporting dates.

The cost of intangible assets with determinable useful lives is amortized to reflect the pattern of economic benefits consumed on a straight-line or accelerated basis over the estimated periods benefited. Patents, technology, and other intangibles with contractual terms are generally amortized over their respective legal or contractual lives. When certain events or changes in operating conditions occur, an impairment assessment is performed, and lives of intangible assets with determinable lives may be adjusted.

We amortize the cost of our intangible assets over the 15-year estimated useful life on a straight-line basis.

The following table sets forth the amortization for the intangible assets on September 30, 2023 and December 31, 2022:

| | September 30, 2023 | | | December 31, 2022 | |

| | | | | | |

Patent | | $ | 12,406 | | | $ | 12,406 | |

Websites | | | 10,690 | | | | 10,690 | |

Right of use assets | | | 62,356 | | | | 62,356 | |

Royalties | | | 125,000 | | | | 125,000 | |

| | | 210,452 | | | | 210,452 | |

Less accumulated amortization | | | (194,861 | ) | | | (191,980 | ) |

| | $ | 15,591 | | | $ | 18,472 | |

Amortization expenses amounted to $919 and $664 for the nine months ended September 30, 2023 and 2022, respectively.

Prepaid interest and deposits

Interest and deposits include prepaid consulting fees, OTC market annual fees, and license agreements. Prepaid interest is amortized over the life of the related liability.

Revenue Recognition

The Company recognizes revenue from its customer contracts following ASC 606 – Revenue from Contracts with Customers. The Company recognizes revenues when satisfying the performance obligation of the associated contract that reflects the consideration expected to be received based on the terms of the contract.

Revenue related to contracts with customers is evaluated utilizing the following steps:

| 1. | Identify the contract, or contracts, with a customer. |

| 2. | Identify the performance obligations in the contract. |

| 3. | Determine the transaction price. |

| 4. | Allocate the transaction price to the performance obligations in the contract. |

| 5. | Recognize revenue when the Company satisfies a performance obligation. |

Accounts Receivable

Accounts receivables are recorded following ASC 310,” Receivables.” Accounts receivables are recorded at the invoiced amount and do not bear interest. The Company has no amount recorded as an allowance for doubtful accounts. The allowance for doubtful accounts is the Company’s best estimate of probable credit losses in its existing accounts receivable. Based on management’s estimate and all charges being current, the Company has not deemed it necessary to reserve for doubtful accounts at this time.

Leases

Effective October 1, 2019, the Company adopted the Financial Accounting Standards Board’s (the “FASB”) Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842) (“ASU 2016-02”), and additional ASUs issued to clarify and update the guidance in ASU 2016-02 (collectively, the “new leases standard”), which modifies lease accounting for lessees to increase transparency and comparability by recording lease assets and liabilities for operating leases and disclosing essential information about leasing arrangements. The Company adopted the new lease standard utilizing the modified retrospective transition method, under which amounts in prior periods presented were not restated for contracts existing at the time of adoption. The Company currently does not have any operating lease over one year term to require accessing (i) whether any are or contain leases, (ii) lease classification, and (iii) initial direct costs.

Income Taxes

Income taxes are accounted for under the asset and liability method stipulated by ASC 740 “Income Taxes.” Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities, their respective tax bases and operating loss, and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years those temporary differences are expected to be recovered or settled. Under ASC 740, the effect on deferred tax assets and liabilities or a change in tax rate is recognized in income in the period that includes the enactment date. Deferred tax assets are reduced to estimated amounts to be realized using a valuation allowance. A valuation allowance is applied when in management's view, it is more likely than not that such deferred tax asset will be unable to be utilized.

The Company adopted specific provisions under ASC Topic 740, which provide interpretative guidance for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. Effective with the Company’s adoption of these provisions, interest related to the unrecognized tax benefits is recognized in the financial statements as a component of income taxes.

The Company’s tax returns are subject to examination by the federal and state tax authorities for the years ended 2017 through 2021. In the unlikely event that an uncertain tax position exists in which the Company could incur income taxes, the Company would evaluate whether there is a probability that the uncertain tax position taken would be sustained upon examination by the taxing authorities. Reserves for uncertain tax positions would be recorded if the Company determined it is probable that a position would not be sustained upon examination or if payment would have to be made to a taxing authority and the amount is reasonably estimated. As of September 30, 2023, and December 31, 2022, the Company does not believe it has any uncertain tax positions that would result in the Company having a liability to the taxing authorities.

Stock-based Compensation

We account for stock-based awards at fair value on the grant date and recognize compensation over the service period they are expected to vest. Using the Black-Scholes option pricing model, we estimate the fair value of stock options and stock purchase warrants. The estimated value of the portion of a stock-based award that is ultimately expected to vest, considering estimated forfeitures, is recognized as expense over the requisite service periods. The model includes subjective input assumptions that can materially affect the fair value estimates. The expected volatility is estimated based on the most recent historical period of other comparative securities, equal to the weighted average life of the options. The estimate of stock awards that will ultimately vest requires judgment. To the extent that actual forfeitures differ from estimated forfeitures, such differences are accounted for as a cumulative adjustment to compensation expenses and recorded in the period that estimates are revised.

For the nine months ended September 30, 2023, and 2022, the Company incurred no stock-based compensation.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records any “beneficial conversion feature” (“BCF”) intrinsic value as additional paid-in capital and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument. The discount is amortized over the life of the debt. If the underlying debt is converted, a proportionate share of the unamortized amounts is immediately expensed.

Debt Issue Costs

The Company may pay debt issue costs in connection with raising funds through the issuance of debt, whether convertible or not, or with other considerations. These costs are recorded as debt discounts and are amortized over the life of the obligation to the statement of operations as amortization of debt discount.

Original Issue Discount

Suppose a debt is issued with an original issue discount. In that case, the original issue discount is recorded as a debt discount, reducing the face amount of the note. It is amortized over the life of the debt to the statement of operations as amortization of debt discount. If the underlying debt is converted, a proportionate share of the unamortized amounts is immediately expensed.

Use of Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant items subject to such estimates and assumptions include the valuation of stock-based awards issued and derivatives embedded in financial instruments. Assessments are used to determine depreciation, the valuation of non-cash issuances of common stock, stock options, and warrants, and valuing convertible notes for beneficial conversion features, among others.

Fair Value

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) establishes a framework for all fair value measurements and expands disclosures related to fair value measurement and developments. ASC 820 defines fair value as the price received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

ASC 820 requires that assets and liabilities measured at fair value are classified and disclosed in one of the following Six categories:

Level 1—Quoted market prices for identical assets or liabilities in active markets or observable inputs.

Level 2—Significant other observable inputs that observable market data can corroborate; and

Level 3—Significant unobservable inputs that observable market data cannot corroborate.

The following table summarizes fair value measurements by level on September 30, 2023 and December 31, 2022, measured at fair value on a recurring basis:

December 31, 2022 | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Liabilities | | | | | | | | | | | | |

Derivative Liabilities | | $ | - | | | $ | - | | | $ | 1,608,485 | | | $ | 1,608,485 | |

| | | | | | | | | | | | | | | | |

September 30, 2023 | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Liabilities | | | | | | | | | | | | | | | | |

Derivative Liabilities | | $ | - | | | $ | - | | | $ | 1,873,114 | | | $ | 1,873,114 | |

The concentration of Credit Risk

The carrying value of short-term financial instruments, including cash, restricted cash, trade accounts receivable, accounts payable, accrued expenses, and short-term debt, approximates the fair value of these instruments. These financial instruments generally expose the Company to limited credit risk and have no stated maturities or have short-term maturities and carry interest rates that approximate the market. The Company maintains cash balances at financial institutions insured by the FDIC. On September 30, 2023 and December 31, 2022, the Company had no amounts above the FDIC limit.

New Accounting Pronouncements

In August 2020, the FASB issued ASU 2020-06, ASC Subtopic 470-20 "Debt—Debt with Conversion and Other Options." The standard reduced the number of accounting models for convertible debt instruments and convertible preferred stock. Convertible instruments that continue to be subject to separation models are (1) those with embedded conversion features that are not clearly and closely related to the host contract, that meet the definition of a derivative, and that do not qualify for a scope exception from derivative accounting; and, (2) convertible debt instruments issued with substantial premiums for which the premiums are recorded as paid-in capital. The amendments in this update are effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Company has adopted this standard and determined no material impact on its financial statements.

NOTE 3 – CAPITAL STOCK

Preferred Stock

As of September 30, 2023, and December 31, 2022, the Company had 600,000 and 0 shares of its $0.001 par value preferred stock issued and outstanding, respectively.

During the nine months ended September 30, 2023, the Company issued preferred shares as follows:

The Company issued a total of 100,000 shares of Series C Preferred Stock in connection with the Maybacks acquisition.

The Company issued a total of 100,000 shares of Series D Preferred Stock in connection with the Asset Agreement.

During the nine months ended September 30, 2022, the Company had no issuance of preferred shares.

Series B Preferred Stock

In September 2014, the Company designated a "Series B Convertible Preferred Stock" (the "Series B Preferred"). The Company had originally allocated 1,000,000 shares to the series, par value $0.001 per share, and features included super voting rights of 10,000 votes per share, non-cumulative dividends at 8% per annum, accrued daily, and a liquidation preference over the common stock, along with other features contained in the Certificate of Designation for the Series B Preferred Stock filed with the State of Nevada.

On June 20, 2023, the Board of Director and the outstanding shareholders of the Series B Preferred Stock consented to amend and restate the Certificate of Designation for the Series B Preferred Stock, to (i) reduce the number of authorized preferred stock designated to the Series B Preferred Stock to 400,000 shares, (ii) revise the liquidation preference of the Series B Preferred Stock from a preferred payout to a parity payout in any liquidation with the common stock and Series C Preferred Stock of the Company, and (iii) to change the language with respect to dividends, such that the Series B Preferred Stock shall have no dividend rights except as may be declared by the Board in its sole and absolute discretion, out of funds legally available for that purpose.

Series C Preferred Stock

On April 26, 2023, the Board of Directors created, out of the available shares of preferred stock, par value $0.001 per share, a series of preferred stock known as “Series C Preferred Stock” consisting of 100,000 shares.

Under the terms of the Certificate of Designation for the Series C Preferred Stock, the shares shall not accrue nor pay dividends except as declared by the board of directors in its sole discretion. The Series C Preferred Stock shall rank pari passu with the Series B Preferred Stock and common stock in respect of the preferences as to dividends, distributions and payments upon the liquidation, dissolution and winding up of the Company.

The outstanding shares of Series C Preferred Stock shall automatically convert into shares of our common stock upon the following to occur:

| • | Upon the two-year anniversary of the filing of the Certificate of Designation with the State of Nevada, 25% of the shares of Series C Preferred Stock held by any Holder of record of Series C Preferred Stock shall be automatically converted into Common Stock at a ratio of one hundred shares of Common Stock for each share of Series C Preferred Stock. |

| | |

| • | Upon achievement by Maybacks of reaching 40 channels, 50% of the shares of Series C Preferred Stock held by any Holder of record of Series C Preferred Stock shall be automatically converted into Common Stock at a ratio of one hundred shares of Common Stock for each share of Series C Preferred Stock. |

| | |

| • | Upon the achievement by Maybacks of reaching the first $250,000 in “net ad revenue” (post ad agency payout), 2.5% of the shares of Series C Preferred Stock held by any Holder of record of Series C Preferred Stock shall be automatically converted into Common Stock at a ratio of one hundred shares of Common Stock for each share of Series C Preferred Stock. |

| | |

| • | After the achievement by Maybacks of reaching the first $250,000 in “net ad revenue” (post ad agency payout), for each successive nine (9) times that Maybacks achieves $250,000 in “net ad revenue” (post ad agency payout), 2.5% of the shares of Series C Preferred Stock held by any Holder of record of Series C Preferred Stock shall be automatically converted into Common Stock at a ratio of one hundred shares of Common Stock for each share of Series C Preferred Stock. |

In the event that the Company goes through a “Change of Control” event, the foregoing milestone achievements above shall be deemed accomplished and all rights to the shares of Common Stock shall immediately vest prior to the close of such Change of Control event.

Series D Preferred Stock

On June 20, 2023, the Board of Directors created, out of the available shares of preferred stock, par value $0.001 per share, a series of preferred stock known as “Series D Preferred Stock” consisting of 100,000 shares.

Under the terms of the Certificate of Designation for the Series D Preferred Stock, the shares shall not accrue nor pay dividends except as declared by the board of directors in its sole discretion. The Series D Preferred Stock shall not have voting rights except as it pertains to altering the rights associated with the Series D Preferred Stock. The Series D Preferred Stock shall have a stated value of $50 per share (the “Stated Value”) and each share shall be entitled to a preference over the common stock, the Series B Preferred Stock, and the Series C Preferred Stock of the Stated Value upon the liquidation, dissolution and winding up of the Company. Each share of Series D Preferred Stock shall be convertible, at any time after three years of issuance or immediately in the event of a change in control at the option of the Holder thereof, into that number of shares of common stock (subject to a beneficial ownership limitation of up to 9.99%) determined by dividing the Stated Value by the Conversion Price, which is closing price of the common stock of the Company on the OTC, on the day immediately prior to the conversion. The Company has the right to redeem the Series D Preferred Stock after five years by making a payment of cash equal to 106% of the sum of an amount equal to the total number of Series D Preferred Stock held by the Holder multiplied by the Stated Value. In the event of a change in control, the company shall redeem the outstanding shares of Series D Preferred Stock by making a payment in cash using the same formula.

Common Stock

As of September 30, 2023, and December 31, 2022, the Company had 1,978,087,926 and 1,557,397,662 shares of its $0.001 par value common stock issued and outstanding, respectively.

During the nine months ended September 30, 2023, the Company issued common shares as follows:

| · | Issued 15,555,556 shares for cash amounting to $35,000; and |

| | |

| · | Issued 302,731,909 shares for conversion of notes valued at $175,187. |

During the nine months ended September 30, 2022, the Company had no issuance of shares.

Stock Options

No stock options were issued during the nine months ended September 30, 2023, and 2022. All stock options issued previous to 2021 were either exercised or expired.

NOTE 4 – NOTES PAYABLE

Unsecured Notes Payable

On November 25, 2014, the Company issued an unsecured promissory note to an individual in the amount of $100,000 at 10% interest and due on April 1, 2015. On April 1, 2016, the Company entered into a forbearance agreement. The Company was granted an extension of the note through September 30, 2016, in consideration of 150,000 shares of common stock valued at $150,000 with interest accruing after March 29, 2016, at 12%. The lender was issued an additional 50,000 shares valued at $50,000 to extend the note to August 31, 2017. During the year ended December 31, 2019, the Company made a $15,000 repayment. The initial extension fee was amortized ratably over the extension period of 180 days.

The unsecured note and accrued interest were $309,834 as of September 30, 2023 and $250,464 as of December 31, 2022. The note is currently in default.

Convertible Notes Payable

As of September 30, 2023, and December 31, 2022, convertible notes outstanding are $1,185,693 and $1,243,243 respectively.

The following table summarizes the convertible notes included in the balance sheet on September 30, 2023 and December 31, 2022:

| | September 30, 2023 | | | December 31, 2022 | |

Principal balances | | $ | 1,053,638 | | | $ | 1,180,001 | |

Discount | | | (94,451 | ) | | | (92,000 | ) |

Accrued Interest | | | 226,506 | | | | 155,243 | |

| | $ | 1,185,693 | | | $ | 1,243,243 | |

NOTE 5 – DERIVATIVE LIABILITIES

The Company analyzed the conversion option for derivative accounting consideration under ASC 815, "Derivatives and Hedging," and determined that the convertible notes should be classified as a liability since the conversion option becomes effective at issuance resulting in there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The Company accounts for convertible notes and warrants as a derivative liability due to there being no explicit limit to the number of shares to be delivered upon settlement of all conversion options.

The following table summarizes the derivative liabilities included in the balance sheet at September 30, 2023:

Fair Value Measurements Using Significant Observable Inputs (Level 3)

Balance - December 31, 2022 | | $ | 1,608,485 | |

Net Loss (gain) on change in fair value of the derivative | | | 348,623 | |

Adjustment due to conversion of notes | | | (83,994 | ) |

Balance – September 30, 2023 | | $ | 1,873,114 | |

NOTE 6 – RELATED PARTY TRANSACTIONS

During the nine months that ended September 30, 2023, and 2022, net cash proceeds of $27,913 and $22,939, respectively, were received from related parties for operating expenses. Advances from related parties accumulated balances as of September 30, 2023, and December 31, 2022, were $411,599 and $383,686, respectively.

Promissory Notes Payable – related party

On June 18, 2019, the Company issued a promissory note at a principal amount of $447,150 as part of the consideration for the acquisition of assets from AH Originals, Inc., a corporation controlled by the same owner group of Authentic Holdings Inc., formerly Global Fiber Technologies, Inc. The promissory note bears 3% interest per annum and has a one-year term with eight options to extend the maturity date for six-month periods.

Convertible Notes Payable – related party

In August 2015, the Company issued an unsecured promissory note to an investor in the amount of $50,000, convertible to common stock at $1.00 per share. The note bears an interest rate of 8% per annum and matured on August 8, 2016. The note is currently unpaid and in default. The note does not contain a beneficial conversion feature. As of September 30, 2023, the note has an accumulated interest of $35,568.

Related Party Loans

During 2016, the Company received loans from the CEO and board of directors totaling $284,900. In the year ended December 31, 2017, the Company received additional loans from these individuals of $160,650. The loans bear interest at 5% per annum and matured on June 30, 2017, and September 30, 2017. During the year ended December 31, 2017, $241,059 of the notes and interest was converted at approximately $0.19 for 580,000 common shares. The conversion of debt resulted in a gain on extinguishment of debt in the amount of $130,859 in the year ended December 31, 2017.

Balances of all loans due to related parties as of September 30, 2023:

| | Principal | | | Accrued Interest | | | Total | |

Promissory note – related party (net of $17,594 discount) | | $ | 429,556 | | | $ | 75,970 | | | $ | 505,526 | |

Convertible notes – Related party | | | 50,000 | | | | 35,568 | | | | 85,568 | |

Related Party Loans | | | 208,150 | | | | 58,283 | | | | 266,433 | |

Total Related Parties Loans | | | 687,706 | | | | 169,821 | | | $ | 857,527 | |

NOTE 7 – LEASES

The Company’s right-of-use assets under the operating lease for an office premise had expired on October 1 and the lease was not renewed. There are no lease liabilities balances as of September 30, 2023.

The company currently does not have any long-term operating lease. Our operating lease expenses were $0 for the nine months ended September 30, 2023 and $1,601 for the year ended December 31, 2022.

NOTE 8 – COMMITMENTS AND CONTINGENCIES

The Company is a party to pending litigation matters. The Company does not believe it has any liability, nor has it accrued any liability as of September 30, 2023 and December 31, 2022, for the following:

One matter is entitled Randazzo LLC v. Avani Holdings LLC & Global Fashion Technologies, Inc. The plaintiff initiated this litigation to evict Avani Holdings LLC from its rented premises in California and to recover unpaid rent. The Company does not operate outside the premises and has never signed any leases or other documents with the plaintiff. A judgment of eviction was entered, but the Company does not operate out of the premises in question and therefore did not appear in the matter to oppose the judgment of eviction. The plaintiff is also seeking unpaid rent in the amount of $26,595

The second matter is entitled Patricia Witthuhn v. Global Fashion Technologies, Inc. The plaintiff initiated this litigation to collect wages allegedly due pursuant to her employment with Avani Holdings LLC. The Company never hired Ms. Witthuhn and never acquired Avani Holdings, LLC. Consequently, there is no legitimate cause of action against the Company. However, the Company cannot hire outside counsel for this litigation due to cash flow constraints. The amount being sought by the plaintiff is approximately $15,000.

The third matter is entitled William Corso v. Global Fashion Technologies, Inc. The plaintiff initiated this litigation to collect wages allegedly due pursuant to his employment with Avani Holdings LLC. The Company never hired Mr. Corso and never acquired Avani Holdings, LLC. Consequently, there is no legitimate cause of action against the Company. However, the Company cannot hire outside counsel for this litigation due to cash flow constraints. The amount being sought by the plaintiff is approximately $40,000.

NOTE 9 – NET LOSS PER SHARE

Potentially dilutive securities are excluded from the calculation of net loss per share when their effect would be anti-dilutive. For all periods presented in the consolidated financial statements, all potentially dilutive securities have been excluded from the diluted share calculations as they were anti-dilutive as a result of the net losses incurred for the respective periods. Accordingly, basic shares equal diluted shares for all periods presented.

Potentially dilutive securities were comprised of the following:

| | September 30, 2023 | | | December 31, 2022 | |

Warrants | | | 11,000,000 | | | | 11,000,000 | |

Options | | | 2,700,000 | | | | 2,700,000 | |

Convertible notes payable, including accrued interest | | | 936,887,548 | | | | 936,887,548 | |

| | | 950,587,548 | | | | 950,587,548 | |

NOTE 10 – SUBSEQUENT EVENTS

Subsequent to the reporting period, the Company issued 102,402,799 shares for conversion of notes.

In accordance with ASC 855-10, the Company has analyzed events and transactions that occurred subsequent to September 30, 2023 through the date these financial statements were issued and has determined that the Company does not have any other material subsequent events to disclose or recognize in these financial statements, aside from the foregoing.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain.

Other factors, which could have a material adverse effect on our operations and future prospects on a consolidated basis, include but are not limited to our ability to implement and achieve success with our business plan, changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC, including the risks and uncertainties identified under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K.

Overview

Authentic Holdings Inc. formerly Global Fiber Technologies, Inc. was incorporated in Nevada on March 25, 2005, as “Premier Publishing Group, Inc.” Originally formed as a publishing company, we ceased our publishing operations in or around 2007.

We created a subsidiary, ECO CHAIN 360, Inc., in November 2018 for the purpose of operating as an intermediary providing an expedited trading platform for buyers and sellers to efficiently consummate fiber transactions. We own 51% of ECO CHAIN 360, Inc. ECO CHAIN 360, Inc. has had no operations to date, nor did it have assets or liabilities as of September 30, 2023 or 2022.

On June 18, 2019, we completed the acquisition of assets from AH Originals, Inc. (“AHO”), a corporation controlled by the same owner group of our company for the consideration of 6,400,000 shares of our common stock to be issued and the issuance of a promissory note of $447,150 that bears 3% interest per annum and has a one-year term with eight options to extend the maturity date for six-month periods. In addition, we issued to AHO 200,000 common shares of Authentic Heroes, Inc. (“AHI”), a subsidiary created by us to hold the purchased assets.

The Authentic Heroes, Inc. subsidiary has patented technology that takes the original event worn apparel from an iconic individual and creates “Fan-wear” collectibles containing fibers from that original. All of the Fan-Wear items have an embedded QR Code that registers the items on our Blockchain for their provenance and immutability.

The Authentic Heroes subsidiary is also in the business of creating vinyl records for distribution into retail department stores and online sales and has pressed 100,000 vinyls to date under the heading of “Old is Gold” Christmas.

The Authentic Heroes subsidiary also has completed an NFT Platform on the Etherium Blockchain capable of housing millions of NFTs. The NFT platform has minted 500,000 NFTs as part of free music NFT given away with its “Old is Gold” Christmas album.

On April 26, 2023, we entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Maybacks Global Entertainment LLC, an Arizona limited liability company (“Maybacks”), and the members of Maybacks. As a result of the transaction, Maybacks became our wholly-owned subsidiary.

Maybacks is looking to capitalize on the “cutting the cord” phenomenon and take advantage of its low operating costs and ability to offer free TV and channel access for established organizations at a fraction of what cable and satellite dish companies charge.

Maybacks is an Over the Air and platform driven television network with 25 channels of various programs that include movies, sports, talk shows and live events. Many of those programs being proprietary content. Maybacks generates revenue through the placement of insert advertisements, revenue share programs, channel access fees and barter.

Maybacks has agreements with “Local Now” Byron Allen’s National Network and several other networks are looking to carry Maybacks’ programing.

Maybacks has expanded its agreement with Didja Local BTV into all of Local BTV's 65 markets. Under the original agreement, Mayback's programming was limited to a single local platform in just a small number of major cities. The modified agreement has now increased Mayback's programming to over 40 local channels and 25 national channels in cities such as NYC, Los Angeles, San Diego, Miami, and Las Vegas to name a few. Maybacks’ content, which is currently featured on platforms such as Streaming Pulse, Direct TV, ROKU, and Fire TV will now be featured in the most major and local markets on Local BTV.

There are many Over the Air and platform driven television networks with greater financial resources and experience in running, such as Sling TV, which is owned by DISH Network as well as many other independent networks. We plan to compete with many firms, including corporations with large divisions, many of these companies have greater financial, technical or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and are able to respond more effectively to changing business and economic conditions than we can.

There are no assurances that we will be able to compete against these larger rivals and gain market share. We have realized revenues during the quarter ended September 30, 2023, and we are hopeful more advertising agreements are signed and more ad pressions sold to generate future revenue for our company. While these are signs that progress in our company has been made, we are not profitable and still face several challenges, including those presented as ‘Risk Factors” in our most recent Annual Report on Form 10-K.

On June 20, 2023, the Company closed an Asset Purchase Agreement (the “Asset Agreement”) with Goliath Motion Picture Promotions owned by Priscella Cooper (the “Seller”). On the Closing Date, pursuant to the Asset Agreement, the Company acquired various full-length motion pictures and serial television shows (the “Assets”).

As a result of the Asset Agreement and the acquisition of the Assets, the Company plans to “tokenize” all the titles, namely 14,000 plus full-length motion pictures and serial television shows. The Company is currently using the non-tokenized library for content distribution on its own TV Network known as Maybacks. It is the Company’s intention to start the tokenization process within thirty (30) days of this filing and have the “Alpha” version completed within 90 days from its start date. Once the first 1000 movies are tokenized it is the Company’s intention to market those movies on its own Video on Demand and Linear Television platforms. In addition, the Company plans to aggressively market its tokenized platform to other TV networks as well as major film production and distribution companies.

The Company intends to fund operations through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements, until the Company generates positive cash flow from operations. However, the Company’s financial statements show an accumulated deficit of $37,327,746 as of September 30, 2023, with a net working capital deficit of $5,140,088 and limited cash resources. These factors raise doubts about the Company’s ability to continue as a going concern within the next year.

The Company's ability to continue as a going concern depends on its ability to repay or settle its current indebtedness, generate positive cash flow, and raise capital through equity and debt financing or other means on favorable terms. If the Company cannot obtain additional funds when required or on favorable terms, management may be necessary to restructure the Company or cease operations.

Our address is 50 Division Street Suite 500, Somerset NJ 08873. Our corporate website is http://globalfibertechnologies.com/.

The Company has never declared bankruptcy or been in receivership. The Company has earned minimal revenues and has limited cash on hand. The Company has sustained losses since inception and has primarily relied upon the sale of its securities and loans from related parties and outside parties for funding.

COVID-19

The COVID-19 pandemic did not have a material net impact on our financial statements during the nine months ended September 30, 2023. However, there still remains uncertainty around the COVID-19 pandemic. We cannot reasonably predict the ultimate impact of the COVID-19 pandemic, including the extent of any impact on our business, results of operations and financial condition, which will depend on, among other things, the duration and spread of the pandemic (including the emergence and spread of new COVID-19 variants and resurgences), actions taken by governmental authorities and others in response to the pandemic, the acceptance, safety and efficacy of vaccines, and global economic conditions.

Results of Operations for the Three and Nine Months Ended September 30, 2023 and 2022.

Revenue

We expect that revenue will increase in future quarters as Maybacks continues to enter into agreements to expand the markets for its movie and TV programming and agreements for advertising spots.

We also expect that revenue will increase in future quarters as we are currently re-building a more fortified, secure, and user-friendly platform for storing and claiming our future NFTs. We are also building a landing platform on top of our current NFT platform, which will be industry-first. This platform’s purpose is to help NFT investors recapture the losses incurred on certain types of projects. In the process, it should create substantial opportunities for us and give us tremendous credibility in the Blockchain and NFT community. We expect to announce the completion of that project in late June and potentially launch it in late Augus.

We will also start work shortly on a project which will have its roots in the music industry that will include many artists and will be a game-driven project with prizes awarded at the end of each contest period, which could include free concert tickets, backstage passes, airfare to and from the concert. The future looks bright for our NFT platform, and we fully expect it to become an integral part of our company.

Operating Expenses

Operating expenses decreased from $84,654 for the three months ended September 30, 2023, to $174,259 for the same period in 2022. Operating expenses increased from $348,816 for the nine months ended September 30, 2023, to $336,859 for the same period in 2022. Overall, this increase results from our efforts to acquire Maybacks and the assets of Goliath, and to build out our organization to establish a strong base for current and future growth. The detail of expenditures by major category is reflected in the table below.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

General and Administrative | | $ | 51,708 | | | $ | 116,978 | | | $ | 160,423 | | | $ | 169,259 | |

Depreciation and Amortization | | | 13,283 | | | | 20,806 | | | | 36,236 | | | | 79,776 | |

Professional and Legal Fees | | | 14,200 | | | | 36,475 | | | | 97,298 | | | | 87,824 | |

Research and Development | | | 5,463 | | | | | | | | 54,858 | | | | | |

Total Operating Expense | | $ | 84,654 | | | $ | 174,259 | | | $ | 348,816 | | | $ | 336,859 | |

Operating expenses increased by 4% in the amount of $11,957 for the nine months ended September 30, 2023, compared to the same period in 2022. Listed below are the major changes to operating expenses:

General and administrative expenses decreased by $8,836 for the nine months ended September 30, 2023, compared to the same period in 2022.

Depreciation and amortization decreased by $43,540 for the nine months ended September 30, 2023, compared to the same period in 2022, primarily due to $33,334 amortization of right of use asset as a result of the expiration of long-term lease.

Professional and legal fees increased by $9,475 for the nine months ended September 30, 2023, compared to the same period in 2022, primarily due to $19,700 in other consulting fees.

Research and development increased by $54,858, for the nine months that ended September 30, 2023, compared to the same period in 2022, primarily due to the development of blockchain built put and NFT platform service product lines during the first quarter of 2023.

Other Income (Expenses)

Other expenses were $635,247 for the three months ended September 30, 2023, compared to other expense of $74,700 for the same period in 2022, primarily as a result of the loss in the valuation of derivative liabilities amounted to $563,106.

Other expenses were $598,553 for the three months ended September 30, 2023, compared to other income of $278,224 for the same period in 2022, primarily as a result of the loss in the valuation of derivative liabilities amounted to $348,623, interest expense and financing costs of $153,777 and loss in a joint venture of $50,000.

Net Loss

We recorded a net loss of $719,901 for the three months ending September 30, 2023, compared with net loss of $248,959 for the same period in 2022. We recorded a net loss of $947,369 for the nine months ending September 30, 2023, compared with net loss of $58,635 for the same period in 2022.