false

FY

false

0001345865

P3Y

P3Y

0001345865

2011-12-01

2012-11-30

0001345865

2012-05-31

0001345865

2012-11-30

0001345865

2011-11-30

0001345865

2010-12-01

2011-11-30

0001345865

2012-05-01

2012-11-30

0001345865

us-gaap:PreferredStockMember

2009-11-30

0001345865

us-gaap:CommonStockMember

2009-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2009-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2009-11-30

0001345865

BABL:SubscriptionReceivablelMember

2009-11-30

0001345865

us-gaap:RetainedEarningsMember

2009-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2009-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2009-11-30

0001345865

2009-11-30

0001345865

us-gaap:PreferredStockMember

2010-11-30

0001345865

us-gaap:CommonStockMember

2010-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2010-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2010-11-30

0001345865

BABL:SubscriptionReceivablelMember

2010-11-30

0001345865

us-gaap:RetainedEarningsMember

2010-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2010-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2010-11-30

0001345865

2010-11-30

0001345865

us-gaap:PreferredStockMember

2011-11-30

0001345865

us-gaap:CommonStockMember

2011-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2011-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2011-11-30

0001345865

BABL:SubscriptionReceivablelMember

2011-11-30

0001345865

us-gaap:RetainedEarningsMember

2011-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2011-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2011-11-30

0001345865

us-gaap:PreferredStockMember

2012-04-30

0001345865

us-gaap:CommonStockMember

2012-04-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2012-04-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2012-04-30

0001345865

BABL:SubscriptionReceivablelMember

2012-04-30

0001345865

us-gaap:RetainedEarningsMember

2012-04-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2012-04-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2012-04-30

0001345865

2012-04-30

0001345865

us-gaap:PreferredStockMember

2009-12-01

2010-11-30

0001345865

us-gaap:CommonStockMember

2009-12-01

2010-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2009-12-01

2010-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2009-12-01

2010-11-30

0001345865

BABL:SubscriptionReceivablelMember

2009-12-01

2010-11-30

0001345865

us-gaap:RetainedEarningsMember

2009-12-01

2010-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2009-12-01

2010-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2009-12-01

2010-11-30

0001345865

2009-12-01

2010-11-30

0001345865

us-gaap:PreferredStockMember

2010-12-01

2011-11-30

0001345865

us-gaap:CommonStockMember

2010-12-01

2011-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2010-12-01

2011-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2010-12-01

2011-11-30

0001345865

BABL:SubscriptionReceivablelMember

2010-12-01

2011-11-30

0001345865

us-gaap:RetainedEarningsMember

2010-12-01

2011-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2010-12-01

2011-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2010-12-01

2011-11-30

0001345865

us-gaap:PreferredStockMember

2011-12-01

2012-04-30

0001345865

us-gaap:CommonStockMember

2011-12-01

2012-04-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2011-12-01

2012-04-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2011-12-01

2012-04-30

0001345865

BABL:SubscriptionReceivablelMember

2011-12-01

2012-04-30

0001345865

us-gaap:RetainedEarningsMember

2011-12-01

2012-04-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2011-12-01

2012-04-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2011-12-01

2012-04-30

0001345865

2011-12-01

2012-04-30

0001345865

us-gaap:PreferredStockMember

2012-05-01

2012-11-30

0001345865

us-gaap:CommonStockMember

2012-05-01

2012-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2012-05-01

2012-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2012-05-01

2012-11-30

0001345865

BABL:SubscriptionReceivablelMember

2012-05-01

2012-11-30

0001345865

us-gaap:RetainedEarningsMember

2012-05-01

2012-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2012-05-01

2012-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2012-05-01

2012-11-30

0001345865

us-gaap:PreferredStockMember

2012-11-30

0001345865

us-gaap:CommonStockMember

2012-11-30

0001345865

us-gaap:AdditionalPaidInCapitalMember

2012-11-30

0001345865

BABL:AdditionalPaidInCapitalWarrantslMember

2012-11-30

0001345865

BABL:SubscriptionReceivablelMember

2012-11-30

0001345865

us-gaap:RetainedEarningsMember

2012-11-30

0001345865

BABL:DeficitAccumulatedDuringTheDevelopmentStageMember

2012-11-30

0001345865

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2012-11-30

0001345865

2012-03-07

0001345865

2012-03-07

2012-03-07

0001345865

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2012-03-07

2012-03-07

0001345865

us-gaap:OfficeEquipmentMember

2012-11-30

0001345865

us-gaap:RelatedPartyMember

2012-04-30

0001345865

2012-04-01

2012-04-30

0001345865

srt:MinimumMember

us-gaap:RelatedPartyMember

2012-04-01

2012-04-30

0001345865

us-gaap:RelatedPartyMember

2011-12-01

2012-11-30

0001345865

us-gaap:RelatedPartyMember

2010-12-01

2011-11-30

0001345865

us-gaap:RelatedPartyMember

2012-03-31

0001345865

us-gaap:RelatedPartyMember

2012-11-30

0001345865

2008-02-01

2008-02-01

0001345865

BABL:EngagementAgreementMember

2010-06-15

0001345865

BABL:DutchesCapitalMember

2010-08-18

0001345865

BABL:DutchesCapitalMember

2010-08-18

2010-08-18

0001345865

BABL:DutchesCapitalMember

2012-12-01

2013-11-30

0001345865

BABL:NotreDameCapitalIncMember

2010-10-12

0001345865

2013-05-31

0001345865

BABL:CompleteAdvisoryPartnersMember

2011-12-01

2012-11-30

0001345865

BABL:CompleteAdvisoryPartnersMember

2011-04-12

2011-04-12

0001345865

BABL:InvestorRelationsMember

2012-07-01

2012-07-01

0001345865

BABL:GaryCoMember

2011-11-29

2011-11-30

0001345865

BABL:BulzakCoMember

2011-11-29

2011-11-30

0001345865

BABL:BuildablockAssetsMember

2011-12-01

2012-11-30

0001345865

us-gaap:PrivatePlacementMember

2011-12-01

2012-11-30

0001345865

us-gaap:CommonStockMember

2011-12-01

2012-11-30

0001345865

srt:MinimumMember

us-gaap:CommonStockMember

2012-11-30

0001345865

srt:MaximumMember

us-gaap:CommonStockMember

2012-11-30

0001345865

BABL:CommonStockOneMember

2011-12-01

2012-11-30

0001345865

BABL:CommonStockTwoMember

2011-12-01

2012-11-30

0001345865

2010-12-01

2011-02-28

0001345865

BABL:TwoThousandTwelveEquityIncentivePlanMember

2012-07-06

0001345865

BABL:TwoThousandTwelveEquityIncentivePlanMember

us-gaap:EmployeeStockOptionMember

2012-06-01

2012-08-31

0001345865

us-gaap:EmployeeStockOptionMember

2011-12-01

2012-11-30

0001345865

us-gaap:EmployeeStockOptionMember

2010-12-01

2011-11-30

0001345865

BABL:OptionAgreementMember

2010-02-01

2010-02-28

0001345865

BABL:OptionAgreementMember

2023-02-01

2023-02-28

0001345865

BABL:OptionAgreementOneMember

2010-02-01

2010-02-28

0001345865

BABL:OptionAgreementOneMember

2010-08-31

2010-08-31

0001345865

BABL:ConsultantOneMember

2008-08-25

2008-08-25

0001345865

BABL:ConsultantTwoMember

2008-10-30

2008-10-30

0001345865

BABL:ConsultantOneMember

2008-08-25

0001345865

BABL:ConsultantTwoMember

2008-10-30

0001345865

2008-08-25

0001345865

2008-08-25

2008-08-25

0001345865

2008-10-30

0001345865

2008-10-30

2008-10-30

0001345865

2012-12-01

2013-05-31

0001345865

us-gaap:CommonStockMember

BABL:PrivatePlacementAgreementMember

2010-11-01

2010-11-30

0001345865

us-gaap:WarrantMember

BABL:PrivatePlacementAgreementMember

2010-11-01

2010-11-30

0001345865

BABL:PrivatePlacementAgreementMember

us-gaap:WarrantMember

2010-11-30

0001345865

us-gaap:CommonStockMember

BABL:PrivatePlacementAgreementMember

2012-05-01

2012-05-31

0001345865

us-gaap:WarrantMember

BABL:PrivatePlacementAgreementMember

2012-05-01

2012-05-31

0001345865

us-gaap:WarrantMember

BABL:PrivatePlacementAgreementMember

2012-05-31

0001345865

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BABL:ThreeCustomersMember

2011-08-31

0001345865

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BABL:ThreeCustomersMember

2010-12-01

2011-08-31

0001345865

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BABL:ThreeCustomersMember

2010-12-01

2011-08-31

0001345865

BABL:SharesCommonStockMember

2012-03-06

2012-03-07

0001345865

BABL:ValtechMember

2012-04-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

iso4217:CAD

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended November 30, 2012

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

file number 333-131599

BUILDABLOCK

CORP.

(Exact

Name Of Registrant As Specified In Its Charter)

| Florida |

|

22-3914075 |

| (State

of Incorporation) |

|

(I.R.S.

Employer Identification No.) |

| 382

NE 191st Street, #83251, Miami, Florida |

|

33179 |

| (Address

of Principal Executive Offices) |

|

(ZIP

Code) |

Registrant’s

Telephone Number, Including Area Code: (855) 946-5255

Securities

Registered Pursuant to Section 12(g) of The Act: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of the registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part

III of this Form 10-K or any amendment to this Form 10-K. ☐

The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day of the registrant’s

most recently completed second fiscal quarter was $3,643,799.

On

November 30, 2012, the Registrant had 23,937,979 shares of common stock issued and outstanding. Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-Accelerated

filer ☐ |

Smaller

reporting company ☒ |

EXPLANATORY

NOTE:

The

current management submitting the following unaudited financial statements were not employed by the Company nor Board members for the

financial periods presented below. The current Board of Directors in the best interests of the Shareholders chooses to file the necessary

reporting obligations as a Voluntary Reporting Company. These unaudited financial reports are for a period prior to the filing of the

FORM 15 dated October 4, 2013 with the SEC. The information is to the best of managements knowledge at the time of the filing.

TABLE

OF CONTENTS

Forward-Looking

Statements and Associated Risks

This

Annual Report on Form 10-K of Buildablock Corp. (hereinafter the “Company” or the “Registrant”) includes forward-looking

statements. The Registrant has based these forward-looking statements on its current expectations and projections about future events.

These forward- looking statements are subject to known and unknown risks, uncertainties and assumptions about the Registrant that may

cause its actual results, levels of activity, performance or achievements to be materially different from any future results, levels

of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “should,” “could,” “would,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,”

or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a discrepancy include, but

are not limited to, those described in this Annual Report on Form 10-K and in the Registrant’s other Securities and Exchange Commission

filings. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results

may vary in material respects from those projected in the forward-looking statements. For a more detailed discussion of the foregoing

risks and uncertainties, see “Risk Factors”.

PART

I

ITEM

1. DESCRIPTION OF BUSINESS Back to Table of Contents

The

Company, f/k/a HIPSO Multimedia, Inc., a Florida corporation, was incorporated in April 2005. The Company entered into an Asset Purchase

Agreement on November 30, 2011, providing for the acquisition of intellectual property rights comprised of an Internet and mobile service

platform whose purpose is to empower or capitalize on the growth of the neighborhood, local economy (the “Buildablock Assets”).

Effective

March 7, 2012, the Company completed the acquisition of the Buildablock Assets. In connection with the completion of the acquisition,

the Company effected a reverse st ck split oft e Company’s outstanding shares of common stock, par value $0.00001, on a one-for-eight

(1:8) basis (which occurred on March 7, 2012) and issued an aggregate of 8,755,484 shares of common s to ck effective March 7, 2012,

representing 50% of the Company’s then-outstandmg shares, after givmg effect to the one-for-eight reverse stock split and issuance

of the shares.

Upon

the closing of the transaction, Gary Oberman and Bartek Bulzak were elected to the Company’s Board of Directors, Mr. Oberman was

appointed President and Chief Executive Officer and Mr. Bulzak was appointed Chief Technology Officer.

Effective

February 24, 2012, the name of the Company was changed to Buildablock Corp.

Business

Summary.

Buildablock.com is an Internet service platform whose mission is to act as a transactional catalyst between buyers and sellers while

leveraging a growing collection of patented, sophisticated user friendly tools. Growing beyond the scope of aggregation sites or group

buying catalogs, Buildablock.com offers consumers maximum value for their purchasing dollar by combining group buying leverage, social

media interactivity and automated negotiating tools. Buildablock.com’s dashboard of buying tools and follow-on services represent

a new paradigm in supply chain interaction for both retailers and consumers alike. The Company expects that ease of customer acquisition

and diverse, recurring revenue streams will combine to return exceptional value to the Company’s shareholders.

Recent

Activities. In January 2013, the Company launched its e-commerce website, Buildablock.com and the site is now live and fully integrated.

In

the Company’s press release announcing the launch, the Company’s CEO, Gary Oberman, stated, “we are excited by the

live launch of our e-commerce website. We believe that group buying using the Buildablock platform is the wave of the future since it

provides for negotiated discounting and user empowerment since it is the customer that chooses products for discounting by just uploading

them onto our site. As just one example of how our economies of scale work, by consolidating large blocks of fuel buyers that number

in the thousands, the Buildablock platform can approach large fuel providers to negotiate fleet pricing for its members. This is a very

compelling application of our business model that can provide the opportunity for Buildablock users to save money on gas.”

This

press release further stated that the Company had progressed into the marketing phase where initiatives will include merchant awareness

programs and buyer incentive campaigns. One such program is its joint venture relationship with Linen Chest, Canada’s leading retailer

in home fashion, with over 28 stores. Linen Chest is a very strong Canadian brand with an emerging digital presence that had been looking

for an online solution to help drive traffic to its physical stores and increase online sales without the need for deep discounting.

Sheldon

Liebner, President of the Linen Chest, was quoted in the Company’s press release, stating, “Buildablock’s unique group

bidding methodology ensures maximum traffic through negotiated price management. We had entertained doing business with fixed discounters

like Groupon, but found very little user engagement during the sales process, which limits customer loyalty. With Buildablock, our view

is that the user experience will be very engaging, which will maintain maximum value to both the buyer and the seller alike. Buildablock

users completed several transactions with Linen Chest in the early phase of its live launch, which was easily facilitated and which Linen

Chest reports drove new traffic to both its website and physical stores. Buildablock is the only platform we found that delivers high

quality, free advertising without degrading our brand. This is very encouraging news for our firm as we transition our way across the

digital landscape”.

From

this alliance with Linen Chest, the Company was able to obtain essential user feedback through its soft launch in order to finalize systems

and procedures and prepare for its live launch. Buildablock is now focused upon increasing its shopper population through various programs

and initiatives. Since Buildablock’s social login requirement is similar to that of other leading social networking sites, the

Company expects to gain exposure to the friends networks of new subscribers it gained via marketing efforts already undertaken, which

could lead to over 400,000 potential new subscribers by way of referral.

The

Company views the social networking element as a key to enhancing the shopper experience and expects to go live with its mobile application

in the near future. The Company is intent on increasing the consumer and merchant adoption of the Buildablock platform and remains confident

in its ultimate success of its vibrant and exciting e-commerce platform.

A

Unique Shopping Platform. Buildablock.com is an online shopping platform that revolutionizes conventional online shopping. The site

brings together great ideas, such as group discounts, wish lists, online negotiations, and more, into a unique venue that empowers consumers

to save on the items they want from the merchants they choose.

When

a Buildablock.com user finds an item he or she likes, whether online or in a retail store, the Buildablock.com user simply posts basic

details about it on Buildablock.com and shares the information on social media. The Company calls that action a “Wink”. Then,

others with the same interest can join the Wink to form a buyer group. Once a certain number of buyers have joined the Wink, Buildablock.com

automatically opens a negotiation with the merchant to win a substantial discount for everyone in the buyer group.

The

Buildablock Advantage. Buildablock.com is capable of saving users money when it comes to buying the things users really want to purchase.

While arranging terrific deals for users will always be Buildablock.com’s primary objective, Buildablock.com is not one-dimensional.

Rather, Buildablock.com empowers both shoppers and merchants, by acting as a mediator between shoppers and merchants.

Employees

We

currently have approximately 4 full employees, including our president, and two part-time per diem installers for our Telecommunication

Services and equipment.

Patents,

Trademarks, Service Marks And Licenses and Other Intellectual Property

On

November 30, 2011, the Company, entered into an Asset Purchase Agreement (the “Agreement”) with 3324109 Canada Inc., a Canadian

corporation owned by Gary Oberman (“GaryCo”) and 8040397 Canada Inc., a Canadian corporation, owned by Bartek Bulzak (“BulzakCo”),

collectively, the “Sellers”, providing for the acquisition by the Company of the Buildablock Assets. The Sellers have conducted

no other business other than the development of this platform. The intellectual property was funded l 00% by the respective owners of

the Sellers personally. The Agreement provides for the issuance of 4,377,742 shares of the Company’s common stock to each of GaryCo

and BulzakCo, for an aggregate of 8,755,484 shares, representing 50% of the Company’s outstanding shares after giving effect to

a one-for-eight reverse stock split. On March 7, 2012, the Company completed the acquisition of the Buildablock Assets and the common

shares were issued at that time

Major

Customers

As

of November 30, 2012, the Company had one customer who generated 75% of our revenues.

Government

Regulation

The

Company’s business is not subject to any governmental regulation.

Recent

Developments

Effective

March 7, 2012, the Company completed the acquisition of the Buildablock Assets. In connection with the completion of the acquisition,

the Company effected a reverse stock split of the Company’s outstanding shares of common stock, par value $0.00001, on a one-for-

eight (1:8) basis (which occurred on March 7, 2012) and issued an aggregate of 8,755,484 shares of common stock effective March 7, 2012,

representing 50% of the Company’s outstanding shares after giving effect to the one-for-eight reverse stock split and issuance

of the shares. The Buildablock Assets were valued at $10,000. Upon the closing of the transaction, Messrs. Gary Oberman and Bartek Bulzak

were elected to the Company’s Board of Directors, Mr. Oberman was appointed President and Chief Executive Officer and Mr. Bulzak

was appointed Chief Technology Officer. Effective upon the closing of the transaction, Mr. Rene Arbic resigned as President and Chief

Executive Officer of the Company. In addition, Mr. Arbic has agreed to resign from the Board within one year of the closing of the transaction.

In

addition on April 13, 2012, the Board of Directors approved the sale ofValtech back to some or all of the original shareholders ofValtech

for $1.00. This sale occurred on April 30, 2012.

As

a result of this sale, the Company on April 13, 2012, became a development stage company, as it continues the development of its social

networking platform under the “Buildablock” name.

ITEM

1A. RISK FACTORS RELATED TO OUR BUSINESS Back to Table of Contents

Investing

in our common stock will provide an investor with an equity ownership interest. Shareholders will be subject to risks inherent in our

business. The performance of our shares will reflect the performance of our business relative to, among other things, general economic

and industry conditions, market conditions and competition. The value of the investment may increase or decrease and could result in

a loss. An investor should carefully consider the following factors as well as other information contained in this annual report on Form

10-K for the year ended November 30, 2012.

This

annual report on Form 10-K also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in the forward-looking statements as a result of many factors, including the risk factors described

below and the other factors described elsewhere in this Form 10-K.

Risk

factors related to our business

With

the disposition of Valtech, the Company commenced operating in the development stage as it develops its purchased intellectual property.

The Company has no revenues and nominal assets other than cash which was raised during May 2012 as part of a private placement. New management

has had some preliminary discussions regarding further capitalization of the Company. These plans include the raising of capital through

the equity markets to fund future operations and generating adequate revenues for the new business of the Company. Even if the Company

raises sufficient capital to support its operating expenses and generates revenues, there can be no assurance that the revenues will

be sufficient to enable it to develop business to a level where it will generate profits and cash flows from operations. These matters

raise substantial doubt about the Company’s ability to continue as a going concern. However, the accompanying consolidated financial

statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities

in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded

assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

new and retain existing customers, generate and sustain a revenue base sufficient to meet operating expenses, and achieve profitability,

if ever.

Our

auditor has raised doubts about the Company’s ability to continue as a going concern.

The

Company has lost money in every quarter since the inception of its business. As of November 30, 2012, our accumulated loss was $1,884,979.

In April 2012, the related party loans with the four principal shareholders of the Company were assumed by Valtech, upon the sale back

to Valtech along with the accrued interest on those loans. Currently there is a $0 balance due those shareholders. The amount outstanding

prior to the sale was $1,928,319. The loans did bear interest at an annual rate of 10% for individual amounts exceeding $150,000 (CDN$).

Interest expense for the years ended November 30, 2012 and 2011 were $35,361 and $97,401, respectively, and are reflected in operations

from discontinued operations. Accrued interest on these loans prior to the sale was $329,395. The accrued interest along with the notes

were sold in April 2012, and the balance is $0 as of November 30, 2012.

The

Company may not be successful in implementing its business plan.

While

the Company’s business model and strategy of offering “triple play” Telecommunications Services is similar to those

being utilized by many existing providers of telecommunication services, the Company may not be successful, for many reasons, including

but not limited to insufficient resources to compete in its present market or in expanded markets in Canada or elsewhere. If the assumptions

underlying the business model are not valid or if the Company is unable to implement the business plan, achieve predicted levels of market

penetration or obtain the desired level of pricing of services for sustained periods, the Company may not be successful. The Company

focuses on selling directly to consumers and through hotels and apartment buildings. It may never be able to achieve significant market

acceptance, favorable operating results or profitability.

The

Company has a concentration of credit risk.

On

August 31, 2011, $6,372, or 76% of the Company’s accounts receivable was with three customers. In addition, there was one customer

who represented approximately 66% of the revenue for the nine months ended August 31, 2011. This customer is considered a major customer

of the Company.

The

Company expects that its losses will continue for the foreseeable future.

The

Company has incurred losses and experienced negative cash flow from operations since it commenced its Telecommunications Services business.

It expects to continue to incur significant losses and negative cash flow from operations for the foreseeable future. If revenue does

not grow as it expects or if its ability to raise capital is insufficient or operating expenditures exceed its expectations, then the

Company’s business, prospects, financial condition and results of operations will face materially adverse effects.

Competitive

forces may result in the decrease of the price for the Company’s Telecommunication Services.

Prices

for communications services have historically decreased over time. The Company expects that prices for its Telecommunications Services

may decrease after the market for such services becomes saturated. While the Company believes that the market for Telecommunication Services

shall continue to grow, the Company cannot predict with any certainty the number of years before which saturation occurs. At such time

that market saturation occurs, the Company may have to reduce prices in order to remain competitive. The inability to sell its Telecommunication

Services at desired pricing levels would significantly impair its ability to achieve profitability.

The

actual amount and timing of future capital requirements will depend upon a number of factors, including, but not limited to:

| - |

the

number of new markets it enters and the timing of entry; |

| - |

the

rate and price at which customers purchase services; |

| - |

the

level of marketing required to attract and retain customers; and |

| - |

opportunities

to invest in or acquire complementary businesses. |

Failure

to manage growth could have a detrimental effect on the Company’s business.

The

Company anticipates that the number and rate of installations for new customers will continue to increase provided that the Company is

able to raise sufficient capital. However, rapid growth would place a significant strain on the Company’s management, financial

controls, operations, personnel and other resources. If the Company fails to manage its anticipated rapid growth, its business could

be materially adversely affected. If the Company is unable to provide its existing customers with adequate service and if it does not

institute adequate financial and reporting systems, managerial controls and procedures, its financial condition will be adversely affected.

It is currently implementing operational support systems to bill customers, process customer orders and coordinate with vendors and contractors.

To manage growth effectively, it must successfully implement these systems on a timely basis and continually expand and upgrade these

systems as our operations expand.

The

Company’s success depends in large part on its retention of executive officers.

The

Company is managed by a small number of executive officers. Competition for qualified executives in the telecommunications industry is

intense, and there are a limited number of persons with comparable experience. The Company depends upon its executive officers, and,

in particular, Rene Arbic, President and Chief Executive Officer, to execute its business strategy and manage employees. While Company

does not have employment agreements with nor does it have “key person” life insurance policies on any of its executive officers,

Rene Arbic has an employment agreement with Valtech, the Company’s operating subsidiary. The loss of these key individuals would

have a material adverse effect on the Company’s business.

If

the Company fails to recruit and hire qualified personnel in a timely manner or to retain its employees, it will not be able to execute

its business strategy.

The

Company’s strategy is to continue expanding its presence in Montreal and in Quebec Province. It also plans to expand its service

areas to other provinces in Canada. In order to execute this strategy, it must identify, hire, train and retain highly qualified technical,

sales, marketing and customer service personnel. If it cannot hire and retain a sufficient number of qualified employees, it will not

be able to expand as planned. The Company may be unable to identify, hire or retain employees with experience in the telecommunications

industry. Any failure to attract suitable employees would adversely affect its business.

The

Company may make acquisitions of complementary businesses in the future which may disrupt its business and be dilutive to existing shareholders.

The

Company intends to consider acquisitions of businesses in the future. Acquisitions of businesses and technologies involve numerous risks,

including the diversion of the attention of management, difficulties in assimilating the acquired operations, loss of key employees from

the acquired company and difficulties in transitioning key customer relationships. In addition, acquisitions may result in dilutive issuances

of equity securities, the incurrence of additional debt, large one-time expenses and the creation of goodwill or other intangible assets

that result in significant amortization expense. Any of these factors could materially harm the Company’s business or operating

results.

The

Company’s quarterly operating results are likely to fluctuate significantly, causing its stock price to be volatile.

The

Company cannot accurately forecast quarterly revenue and operating results, which may fluctuate significantly from quarter to quarter.

If quarterly revenue or operating results fall below the expectations of investors or securities analysts, the price of its common stock

could fall substantially. Its quarterly revenue and operating results may fluctuate as a result of a variety of factors, many of which

are outside our control, including:

| - |

the

amount and timing of expenditures relating to the rollout of services; |

| - |

the

rate at which it is able to attract and retain customers; |

| - |

the

availability of future financing to continue expansion; |

| - |

technical

difficulties; |

| - |

the

introduction of new services or technologies by our competitors and |

| - |

pressures

on the pricing of services. |

The

Company’s principal shareholders and management own a significant percentage of its capital stock and are able to exercise significant

influence over the Company.

The

Company’s executive officers and directors and principal shareholders together beneficially own a majority of the total common

stock of the Company. Accordingly, these stockholders, as a group, will be able to determine the composition of the board of directors

and will retain the power to approve all matters requiring shareholder approval and will continue to have significant influence over

the Company’s affairs. This concentration of ownership could have the effect of delaying or preventing a change in control of the

Company or otherwise discouraging a potential acquirer from attempting to obtain control of our company, which in turn could have a material

and adverse effect on the market price of our common stock or prevent our stockholders from realizing a premium over the market prices

for their shares of common stock.

Risk

factors related to the market for our common stock

There

is no assurance that an active trading market will be sustained for our common stock.

Our

common stock became eligible for quotation on the FINRA OTCBB under the symbol “HPSO” on August 8, 2008. Further, there can

be no assurance regarding the market price of our shares. In addition, the liquidity of any trading market in our common stock, and the

market price quoted for the shares of common stock, may be adversely affected by changes in the overall market for securities generally

and by changes in our financial performance or prospects for companies in our industry generally. As a result, you cannot be sure that

an active trading market will develop or be sustained for our shares.

State

blue sky registration; potential limitations on resale of our securities.

It

is the intention of the management to seek coverage and publication of information regarding the Company in an accepted publication which

permits a manual exemption. This manual exemption permits a security to be distributed in a particular state without being registered

if the Company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not

enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors,

(2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for

the most recent fiscal year of operations. Furthermore, the manual exemption is a nonissuer exemption restricted to secondary trading

transactions, making it unavailable for issuers selling newly issued securities.

Most

of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service,

and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize

securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do

not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont

and Wisconsin.

Dividends

unlikely.

We

do not expect to pay dividends for the foreseeable future. The payment of dividends, if any, will be contingent upon our future revenues

and earnings, capital requirements and general financial condition. The payment of any dividends will be within the discretion of our

board of directors. It is our intention to retain all earnings for use in the business operations and accordingly, we do not anticipate

that the Company will declare any dividends in the foreseeable future.

Possible

Issuance of Additional Securities.

Our

Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock, par value $0.00001. As of November 30, 2012,

we had 23,937,979 shares of common stock issued and outstanding. We may issue additional shares of common stock in connection with any

financing activities, as compensation for services or in connection with any future acquisitions. To the extent that additional shares

of common stock are issued, our shareholders would experience dilution of their respective ownership interests in the Company. The issuance

of additional shares of common stock may adversely affect the market price of our common stock and could impair our ability to raise

additional capital through the sale of our equity securities.

Compliance

with Penny Stock Rules.

Our

securities are considered a “penny stock” as defined in the Exchange Act and the rules thereunder, since the price of our

shares of common stock is less than $5. Unless our common stock will otherwise be excluded from the definition of “penny stock,”

the penny stock rules apply with respect to our common stock. The penny stock rules require a broker-dealer prior to a transaction in

penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the SEC that provides

information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer

with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its sales person in the transaction,

and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny

stock rules require that the broker-dealer, not otherwise exempt from such rules, must make a special written determination that the

penny stock is suitable for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure rules

have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock

rules. So long as the common stock is subject to the penny stock rules, it may become more difficult to sell such securities. Such requirements,

if applicable, could additionally limit the level of trading activity for our common stock and could make it more difficult for investors

to sell our common stock.

ITEM

1B. UNRESOLVED STAFF COMMENTS Back to Table of Contents

None.

ITEM

2. DESCRIPTION OF PROPERTIES Back to Table of Contents

The

Company’s corporate offices are located at 550 Chemin du Golf, Suite 202, Ile des Soeurs, Quebec H3E 1A8. The office building is

owned by Canvar Group, which is owned by Peter Varadi, a principal shareholder. The office space is made available to us on a month-to-month

basis on a rent-free basis. The Company believes that the office facilities of approximately 2,500 square feet are sufficient for the

foreseeable future and that this arrangement will remain in effect.

ITEM

3. LEGAL PROCEEDING Back to Table of Contents

On

April 7, 2008, the Company entered into a consulting agreement with Thomas Klein and Arshad Shaw (the “Consultants”), pursuant

to which each Consultant was issued 300,000 restricted shares of the Company’s common stock, granted options to purchase 500,000

shares and options to purchase additional shares during the period commencing May 1, 2008 through October 1, 2008. As a result of the

failure of Consultants to provide the services required under the consulting agreement, the Company terminated the consulting agreement

on August 28, 2008.

The

Company commenced a lawsuit against the Consultants and the former transfer agent for its common stock and filed an amended complaint

on February 3, 2009, alleging, among other things, non-performance by the Consultants of their obligations under the consulting agreement

and their failure to pay for the initial 500,000 options that each exercised.

On

August 30, 2009, the Court entered a default judgment against the defendants which provide for an injunction against the transfer agent

ordering it not to lift restrictions on the certificates evidencing the 300,000 restricted shares of common stock issued to and the 500,000

shares underlying the options granted to each Consultant. On January 26, 2011, the successor transfer agent cancelled the restricted

shares in the Consultants’ names. On March 1, 2011, attorneys for the Consultants filed a motion seeking legal fess from the Company

not to exceed

$1,762.50.

The

Company is not a party to any other litigation and does not believe that any litigation is pending or threatened.

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS Back to Table of Contents

None.

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON STOCK AND RELATED STOCKHOLDER MATTER Back to Table of Contents

| (a) | Market

Price Information |

The

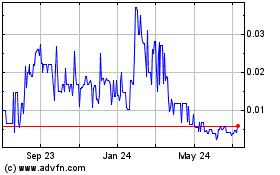

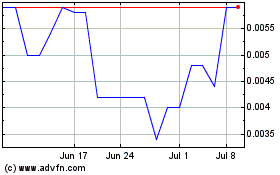

Registrant’s common stock is subject to quotation on the FINRA OTCBB under the symbol BABL. To the best knowledge of the Registrant,

there has been no liquid trading market for the Registrant’s common stock since its registration statement was declared effective.

The following table shows the high and low bid prices for the Registrant’s common stock during the last three fiscal years as reported

by the National Quotation Bureau Incorporated. These prices reflect inter-dealer quotations without adjustments for retail markup, markdown

or commission, and do not necessarily represent actual transactions.

| | |

Fiscal 2011 | | |

Fiscal 2010 | | |

Fiscal 2009 | |

| | |

High | | |

Low | | |

High | | |

Low | | |

High | | |

Low | |

| First Quarter ended February 28, | |

$ | 0.18 | | |

$ | 0.06 | | |

$ | 0.12 | | |

$ | 0.04 | | |

$ | 1.29 | | |

$ | 0.09 | |

| Second Quarter ended May 31, | |

$ | 0.10 | | |

$ | 0.05 | | |

$ | 0.18 | | |

$ | 0.09 | | |

$ | 0.25 | | |

$ | 0.06 | |

| Third Quarter ended August 31, | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.15 | | |

$ | 0.10 | | |

$ | 0.16 | | |

$ | 0.06 | |

| Fourth Quarter ended November 30, | |

$ | 0.08 | | |

$ | 0.03 | | |

$ | 0.16 | | |

$ | 0.09 | | |

$ | 0.13 | | |

$ | 0.04 | |

Approximate

Number of Holders of Common Stock: On November 30, 2012, there were approximately 25 shareholders of record of our common stock.

Securities

Authorized for Issuance Under Equity Compensation Plans

The

Registrant’s board of director approved an equity compensation plan under which 3,000,000 shares of our common stock is authorized

for issuance. No shares have been issued under such plan as of the filing of this mended annual report for the year ended November 30,

2012.

Dividend

Policy

Holders

of our common stock are entitled to dividends when, as, and if declared by the Board of Directors, out of funds legally available therefore.

There are no restrictions in our articles of incorporation or by-laws that restrict us from declaring dividends.

Recent

Sales of Unregistered Securities

Date

of

Issuance |

|

Name |

|

No.

of

Shares |

|

Consideration |

|

Exemption |

| 02/13/2009 |

|

Dan

Ryan |

|

50,000 |

|

Exercise

of options in exchange for $7,000 |

|

Section

4(2) |

| 06/15/2009 |

|

Claude

Gendron |

|

300,000 |

|

For

services valued at $48,000 |

|

Section

4(2) |

| 09/05/2009 |

|

Marc

Chabot |

|

250,000 |

|

Private

placement valued at $25,000 |

|

Section

4(2) |

| 09/21/2009 |

|

MLCIA

Publication |

|

180,000 |

|

For

services valued at $18,900 |

|

Section

4(2) |

| 02/10/2010 |

|

Harold

Gervais |

|

125,000 |

|

For

services valued at $7,500 |

|

Section

4(2) |

| 02/10/2010 |

|

Daniel

Ringuet |

|

90,000 |

|

Exercise

of options in exchange for $5,400 |

|

Section

4(2) |

| 02/10/2010 |

|

Daniel

Ringuet |

|

10,000 |

|

For

services valued at $600 |

|

Section

4(2) |

| 02/10/2010 |

|

Solnex

Inc. |

|

25,000 |

|

For

services valued at $1,500 |

|

Section

4(2) |

| 02/23/2010 |

|

Joel

Pensley |

|

500,000 |

|

Exercise

of options in exchange for $25,000 |

|

Section

4(2) |

| 04/01/2010 |

|

Claude

Gendron |

|

500,000 |

|

Private

placement valued at $24,000 |

|

Section

4(2) |

| 04/08/2010 |

|

Daniel

Ringuet |

|

90,000 |

|

Exercise

of options in exchange for $12,600 |

|

Section

4(2) |

| 04/08/2010 |

|

Solnex

Inc. |

|

25,000 |

|

For

services valued at $3,500 |

|

Section

4(2) |

| 04/08/2010 |

|

Harold

Gervais |

|

75,000 |

|

For

services valued at $10,500 |

|

Section

4(2) |

| 05/21/2010 |

|

Guylain

Pelletier |

|

400,000 |

|

Conversion

of $50,000 of debt into equity |

|

Section

4(2) |

| 05/28/2010 |

|

Gaetan

Giguere |

|

80,000 |

|

Conversion

of $10,000 of debt into equity |

|

Section

4(2) |

| 06/01/2010 |

|

Michael

Price |

|

200,000 |

|

Conversion

of $25,000 of debt into equity |

|

Section

4(2) |

| 06/09/2010 |

|

David

Cleale |

|

160,000 |

|

Conversion

of $20,000 of debt into equity |

|

Section

4(2) |

| 06/18/2010 |

|

David

Oliver-Trottier |

|

64,000 |

|

Conversion

of $8,000 of debt into equity |

|

Section

4(2) |

| 06/25/2010 |

|

Rene

Mathieu |

|

270,256 |

|

Conversion

of $33,800 of debt into equity |

|

Section

4(2) |

| 06/25/2010 |

|

Leandre

Vachon |

|

160,000 |

|

Conversion

of $20,000 of debt into equity |

|

Section

4(2) |

| 06/25/2010 |

|

Julee

Pare |

|

80,000 |

|

Conversion

of $10,000 of debt into equity |

|

Section

4(2) |

| 07/02/2010 |

|

Charles

Rancourt |

|

200,000 |

|

Conversion

of $25,000 of debt into equity |

|

Section

4(2) |

| 07/02/2010 |

|

Jean

Boissonneault |

|

120,000 |

|

Conversion

of $15,000 of debt into equity |

|

Section

4(2) |

| 07/22/2010 |

|

Richard

Chevenal |

|

200,000 |

|

Conversion

of $25,000 of debt into equity |

|

Section

4(2) |

| 07/15/2010 |

|

Sylvie

Vachon |

|

80,000 |

|

Conversion

of $10,000 of debt into equity |

|

Section

4(2) |

| 07/16/2010 |

|

Hugues

Pomerleau |

|

200,000 |

|

Conversion

of $25,000 of debt into equity |

|

Section

4(2) |

| 07/16/2010 |

|

Dave

Jacques |

|

80,000 |

|

Conversion

of $10,000 of debt into equity |

|

Section

4(2) |

| 08/06/2010 |

|

Eric

Lessard |

|

120,000 |

|

Conversion

of $15,000 of debt into equity |

|

Section

4(2) |

| 09/01/2010 |

|

Peter

John Burningham |

|

100,000 |

|

Conversion

of $12,500 of debt into equity |

|

Section

4(2) |

| 09/01/2010 |

|

Gilles

Lamarche |

|

150,000 |

|

For

services valued at $9,000 |

|

Section

4(2) |

| 09/01/2010 |

|

Benoit

Desmeules |

|

100,000 |

|

For

services valued at $6,000 |

|

Section

4(2) |

| 09/01/2010 |

|

Jean-Rene

Lemieux |

|

50,000 |

|

For

services valued at $3,000 |

|

Section

4(2) |

| 11/15/2010 |

|

Constellation

Asset Management |

|

570,000 |

|

For

services valued at $68,400 |

|

Section

4(2) |

| 11/15/2010 |

|

Jens

Dalsgaard |

|

570,000 |

|

For

services valued at $68,400 |

|

Section

4(2) |

The

Company believes that the above issuances of restricted shares were exempt from registration pursuant to Section 4(2) of the Act as privately

negotiated, isolated, non-recurring transactions not involving any public solicitation. The recipients in each case represented their

intention to acquire the securities for investment only and not with a view to the distribution thereof. Appropriate restrictive legends

are affixed to the stock certificates issued in such transactions.

Equity

Compensation Plans

Securities

Authorized for Issuance Under Equity Compensation Plans.

Equity

Compensation Plan Information

| Plan category | |

Number of securities to be issued upon exercise of outstanding options,

warrants and

rights (a) | | |

Weighted-average exercise price of outstanding options,

warrants and

rights (b) | | |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities

reflected in

column (a) (c) | |

| Equity compensation plans approved by security holders | |

| -0- | | |

| -0- | | |

| 3,000,000 | |

| Equity compensation plans not approved by security holders | |

| -0- | | |

| -0- | | |

| -0- | |

| Total | |

| -0- | | |

| -0- | | |

| 3,000,000 | |

ITEM

6. SELECTED FINANCIAL DATA Back to Table of Contents

| Operating Results Data: | |

2012 | | |

2011 | |

| Revenues | |

$ | 0 | | |

$ | 134,422 | |

| Net loss | |

| (1,379,032 | ) | |

| (860,465 | ) |

| Net loss per basic common shareholder | |

| (0.01 | ) | |

| (0.01 | ) |

| Basic weighted average common shares | |

| 17,790,270 | | |

| 67,167,107 | |

| | |

| | | |

| | |

| Financial Position Data: | |

| | |

| |

| Total assets | |

| 372,007 | | |

| 35,181 | |

| Total liabilities | |

| 131,963 | | |

| 2,611,047 | |

| Stockholders’ deficit | |

| 240,044 | | |

| (2,575,866 | ) |

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS AND RESULTS OF OPERATIONS AND FINANCIAL CONDITIONS Back to Table of Contents

Forward-Looking

Statements

The

following discussion contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future

events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use of words

such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial

performance. From time to time, we also may provide forward-looking statements in other materials we release to the public.

The

following discussion should be read in conjunction with our financial statements and the related notes appearing elsewhere in this report.

The following discussion contains forward-looking statements reflecting our plans, estimates and beliefs. Our actual results could differ

materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include,

but are not limited to those discussed below and elsewhere in this report, particularly in the section entitled “Risk Factors”.

To

the extent that statements in the report are not strictly historical, including statements as to revenue projections, business strategy,

outlook, objectives, future milestones, plans, intentions, goals, future financial conditions, future collaboration agreements, the success

of the Company’s development, events conditioned on stockholder or other approval, or otherwise as to future events, such statements

are forward-looking. The forward-looking statements contained in this annual report are subject to certain risks and uncertainties that

could cause actual results to differ materially from the statements made. Other important factors that could cause actual results to

differ materially include the following: business conditions and the amount of growth in the Company’s industry and general economy;

competitive factors; ability to attract and retain personnel; the price of the Company’s stock; and the risk factors set forth

from time to time in the Company’s SEC reports, including but not limited to its annual report on Form 10-K; its quarterly reports

on Forms 10-Q; and any reports on Form 8-K.

Overview

In

June 2008, we acquired our wholly-owned subsidiary, Valtech Communications Inc. (“Valtech”) in a reverse merger transaction,

issuing 40 million restricted shares to the Valtech shareholders.

Valtech

offers low-cost, highly reliable triple-play service of Digital Phone, Digital Voice, High-Speed Internet and Digital TV backed by fast,

friendly and live customer service (“Telecommunication Services”). Our present plan is to expand our bundled services by

providing an end-to- end IPTV solution consisting of IPTV middleware, video on demand, network based PVR, IPTV head ends, content protection,

IPTV infrastructure, system integration and IPTV applications such as games. In order to expand our services to include end-to-end IPTV

service, the Company is dependent upon its ability to raise sufficient capital to fund its agreement with Ericsson. To date, the Company

has been unable to meet its obligations under the Ericsson agreement and at present no agreement with Ericsson has been negotiated and

no negotiations with Ericsson are on-going.

We

intend to use our limited resources to market our services to new residential and commercial building complexes and existing hotel chains.

Further, we intend to market our bundled Telecommunication Services in industry publications and intend to develop our website and promote

its presence in order to increase web traffic and possible sales to new clients (www.valtech.ca).

Our

management believes that the trend in our business is toward greater convergence to high speed Internet and high definition television.

We believe that our bundled Telecommunication Services are competitive in terms of reliability and pricing as compared to the services

offered by incumbent operators. Since we have no patent protection, it is possible that a well-funded company could enter the field and

diminish our prospective business growth. We face uncertainties regarding our future growth because we must compete on price and quality

of service with traditional communications companies with far longer operating histories, more established customer relationships, greater

financial, technical and marketing resources, larger customer bases and greater brand or name recognition. Furthermore, companies that

may seek to enter our markets may expose us to severe price competition and future technological developments could make us less competitive.

Cash

and Cash Equivalents. The Company considers all highly liquid fixed income investments with maturities of three months or less, to

be cash equivalents. On November 30, 2012, the Company had $362,007 in cash and cash equivalents. At November 30, 2011, the company had

$0 in cash.

Accounts

Receivable. Management periodically reviews the current status of existing receivables and management’s evaluation of periodic

aging of accounts. The Company accounts receivable for the years ended November 30, 2012 and 2011 were $0 and $26,147 an respectively.

Deferred

Costs. Deferred costs as of November 30, 2012 and 2011, are reflected in assets held under discontinued operations. There was $0

and $71,100 charged to operations for amortization expense for the year ended November 30, 2012 and 2011, respectively, which are

reflected in discontinued operations.

Revenue

Recognition. Through April 30, 2012, the Company through Valtech received revenue from subscribers to its triple play network in

which it provided digital TV, voice over internet protocol (VoIP), and high speed internet access, all via fiber optic cable. The Company

billed its subscribers on a monthly basis and recognized the monthly revenue based upon the specific plan selected by the subscriber.

The Company additionally provided contracted services to wire commercial buildings with fiber optic cable in order to provide for similar

services. Valtech was sold on April 30, 2012. For reporting periods ended after April 30, 2012, revenues for Valtech are reported net

of operating expenses as gain or loss from discontinued operations.

Buildablock

is a development stage company and has not yet recorded any revenues. Buildablock plans to recognize revenue from sales when the following

criteria are met: persuasive evidence of an arrangement exists; delivery has occurred; the selling price is fixed or determinable; and

collectability is reasonably assured.

Fixed

Assets: Fixed assets as of November 30, 2012 and 2011, are reflected in assets held under discontinued operations. There was $0

and $4,997 charged to operations for depreciation expense for the years ended November 30, 2012 and 2011, respectively, which are

reflected in discontinued operations.

Results

of Operations.

Comparison

of the years ended November 30, 2012 and 2011

Revenues:

Our revenues for the year ended November 30, 2012 were $0 compared to $134,422for year ended November 30, 2011. The Company’s

revenues decreased by $143,422, which represents a 100% decrease from the prior year. The Company’s decrease in revenues is mainly

attributable to the sale of Valtech.

Cost

of Sales: Cost of Sales for the year ended November 30, 2012 was $0 compared to $301,379 for year ended November 30, 2011. The Company’s

cost of sales decrease was $301,379, which represents a 100% decrease from prior year. Thus, the decrease in the cost of sales was directly

related to the decrease in wirings and installations as well as equipment.

Depreciation

and Amortization: For the year ended November 30, 2012 we recorded $0 in depreciation and amortization expenses compared to

$132,490 during the year ended November 30, 2011.

General

and Administrative Expenses: General and Administrative Expenses for the year ended November 30, 2012 was $1,121,464 compared to

$429,616 for year ended November 30, 2011. The Company’s general and administrative expenses increase was 691,848, which

represents a 161% increase from the prior year mainly due to increased non-cash compensation expenses.

Interest

Expense: The Company’s interest expense for the year ended November 30, 2012 was $0 compared to $131,402 for year ended November

30, 2010. The decrease of 131,402 were due to the fact that the related party loans with the four principal shareholders of the Company

were assumed by Valtech, upon the sale back to Valtech along with the accrued interest on those loans. Currently there is a $0 balance

due those shareholders.

Liquidity

and Capital Resources

During

the year ended November 30, 2012, our net cash increased by 362,007. During the year ended November 30, 2012 and 2011, net cash used

in operating activities was $1,083,641and $388,545, respectively. This cash was used to fund our operations for the periods, adjusted

for non-cash expenses and changes in operating assets and liabilities.

We

had no investing activities in the years ended November 30, 2012 and 2011.

Net

cash provided by financing activities was $(1,486,449) during the year ended November 30, 2012 compared to $355,851 net cash provided

by financing activities during the year ended November 30, 2011. The net cash provided by financing activities for the year ended November

30, 2012 resulted from proceeds of $1,486,730 related to the issuance of stoc. The net cash provided by financing activities for the

year ended November 30, 2011 resulted from proceeds of $355,851 related to the issuance of stock.

The

Company has only limited capital. Additional financing is necessary for the Company to continue as a going concern.

Our

continued operations will depend on whether we are able to raise additional funds through third parties, such as equity and debt financing,

as well as additional loans from our affiliated shareholders. However, there can be no assurance that such additional funds will be available

on acceptable terms and there can be no assurance that any additional funding that we do obtain will be sufficient to meet our needs

in the long term. We will continue to fund operations from cash on hand and through the similar sources of capital previously described.

We can give no assurances that any additional capital that we are able to obtain will be sufficient to fully fund our growth plan.

Current

and Future Financing Needs

We

have incurred an accumulated deficit of $1,884,979 through November 30, 2012. We have incurred negative cash flow from operations since

we started our Telecommunication Services business. We may need to obtain additional funds sooner or in greater amounts than we currently

anticipate. Potential sources of financing include strategic relationships, public or private sales of our shares or debt and other sources.

We may seek to access the public or private equity markets when conditions are favorable due to our long-term capital requirements. We

do not have any committed sources of financing at this time, and it is uncertain whether additional funding will be available when we

need it on terms that will be acceptable to us, or at all. If we raise funds by selling additional shares of common stock or other securities

convertible into common stock, the ownership interest of our existing stockholders will be diluted. If we are not able to obtain financing

when needed, we may be unable to carry out our business plan. As a result, we may have to significantly limit our operations and our

business, financial condition and results of operations would be materially harmed.

Effect

of Exchange Rate on Cash.

During

2012, the Company reported a loss of $59 due to changes in the exchange rate compared to a gain of $19,689 in 2011. A loss reflects an

increase in the value of the Canadian dollar as compared to the United States dollar.

Cash

end of Year. The Company’s cash increased by $362,007 to $362,007 at the end of November 30, 2012 compared to an decrease of

$13,005 at the end of November 30, 2011.

Off-Balance

Sheet Arrangements

As

of November 30, 2012 we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K promulgated

under the Securities Act of 1934.

Contractual

Obligations and Commitments

The

Company leases its office space from a related party. See also footnote 7 in the consolidated financial statements.

Critical

Accounting Policies

Our

financial statements are prepared in accordance with accounting principles generally accepted in the United States, which require management

to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements,

the disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates. The critical accounting policies that affect our more significant estimates and assumptions

used in the preparation of our financial statements are reviewed and any required adjustments are recorded on a monthly basis.

Recent

Accounting Pronouncements

In

May 2011, FASB issued Accounting Standards Update (ASU) No. 2011-04, Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements in U.S. GAAP and IFRSs . FASB ASU 2011-04 amends and clarifies the measurement and disclosure requirements of FASB ASC

820 resulting in common requirements for measuring fair value and for disclosing information about fair value measurements, clarification

of how to apply existing fair value measurement and disclosure requirements, and changes to certain principles and requirements for measuring

fair value and disclosing information about fair value measurements. The new requirements are effective for fiscal years beginning after

December 15, 2011. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will

have a material impact on the Company’s results of operations, cash flows or financial position.

In

June 2011, FASB issued ASU No. 2011-05, Presentation of Comprehensive Income , which amends the disclosure and presentation requirements

of Comprehensive Income. Specifically, FASB ASU No. 2011-05 requires that all nonowner changes in stockholders’ equity be presented

either in 1) a single continuous statement of comprehensive income or 2) two separate but consecutive statements, in which the first

statement presents total net income and its components, and the second statement presents total other comprehensive income and its components.

These new presentation requirements, as currently set forth, are effective for the Company beginning October 1, 2012, with early adoption

permitted. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will have

a material impact on the Company’s results of operations, cash flows or financial position.

In

September 2011, FASB issued ASU 2011-08, Testing Goodwill for Impairment , which amended goodwill impairment guidance to provide

an option for entities to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination

that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. After assessing the totality

of events and circumstances, if an entity determines that it is not more likely than not that the fair value of a reporting unit is less

than its carrying amount, performance of the two-step impairment test is no longer required. This guidance is effective for annual and

interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. Adoption

of this guidance is not expected to have any impact on the Company’s results of operations, cash flows or financial position.

There

were other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific

industries and are not expected to have a material impact on the Company’s financial position, results of operations or cash flows.

ITEM

7A. QUANTITATIVEAND QUALITATIVE DISCLOSURE ABOUT MARKET RISK Back to Table of Contents

We

have not entered into, and do not expect to enter into, financial instruments for trading or hedging purposes.

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Back to Table of Contents

BUILDABLOCK

CORP.

(formerly

Hipso Multimedia, Inc.

(a development stage company)

CONSOLIDATED

BALANCE SHEETS

November

30, 2012 and 2011

(unaudited)

| | |

11/30/12 | | |

11/30/11 | |

| | |

(unaudited) | | |

(unaudited) | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 362,007 | | |

$ | - | |

| Current assets held under discontinued operations | |

| - | | |

| 35,181 | |

| Total Current Assets | |

| 362,007 | | |

| 35,181 | |

| | |

| | | |

| | |

| OTHER ASSETS | |

| | | |

| | |

| Intellectual property | |

| 10,000 | | |

| | |

| Total other assets | |

| 10,000 | | |

| | |

| Total Assets | |

| 372,007 | | |

| 35,181 | |

| | |

| | | |

| | |

| LIABILITY AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Cash overdraft | |

$ | - | | |

$ | 301 | |

| Accounts payable | |

| 69,083 | | |

| 38 | |

| Accrued expenses | |

| 60,380 | | |

| 60,380 | |