Faraday Future Announces Reverse Stock Split and Authorized Share Reduction

February 25 2024 - 9:00PM

Business Wire

Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE)

(“Faraday Future”, “FF” or “Company”), a California-based global

shared intelligent electric mobility ecosystem company, today

announced that the Company intends to implement a reverse stock

split of the issued and outstanding shares of the Company’s common

stock, par value $0.0001 per share (the “common stock”), at a ratio

of 1-for-3 (the “reverse stock split”), that is expected to become

effective at 5:00 p.m. ET on February 29, 2024. The Company’s

common stock is expected to begin trading on a split-adjusted basis

commencing upon market open on March 1, 2024.

As previously disclosed, at the Company’s Special Meeting of

Stockholders held on February 5, 2024, the Company’s stockholders

voted to approve a proposal authorizing the Board of Directors of

the Company to amend the Company’s Third Amended and Restated

Certificate of Incorporation (as amended, the “Charter”) to effect

a reverse stock split of the Company’s issued and outstanding

common stock and a corresponding reduction in the total number of

shares of common stock the Company is authorized to issue. As a

result of the reverse stock split, every three shares of the

Company’s issued and outstanding common stock will be automatically

combined and converted into one issued and outstanding share of

common stock. The Company’s Class A common stock will trade under a

new CUSIP number, 307359 703, effective March 1, 2024, and remain

listed on the Nasdaq Capital Market under the symbol “FFIE.” The

Company’s Class B common stock will have a new CUSIP number, 307359

802, effective March 1, 2024. The Company’s publicly traded

warrants will continue to be traded on the Nasdaq Capital Market

under the symbol “FFIEW” and the CUSIP number for the warrants will

remain unchanged. However, under the terms of the applicable

warrant agreement, the number of shares of Class A Common Stock

issuable on exercise of each warrant will be proportionately

decreased. Specifically, following effectiveness of the Reverse

Stock Split, every three shares of Class A Common Stock that may be

purchased pursuant to the exercise of public warrants now

represents one share of Class A Common Stock that may be purchased

pursuant to such warrants. Accordingly, for the Company’s warrants

trading under the symbol “FFIEW”, every three warrants will be

exercisable for one share of Class A Common Stock at an exercise

price of $2,760 per share of Class A Common Stock. The reverse

stock split reduces the number of shares of common stock issuable

upon the conversion of the Company’s outstanding convertible

securities, and the exercise or vesting of its outstanding stock

options, restricted stock units and private warrants in proportion

to the ratio of the reverse stock split and causes a proportionate

increase in the conversion and exercise prices of such convertible

securities, stock options, restricted stock units and private

warrants. In addition, the authorized shares of Common Stock will

be reduced from 1,389,937,500 to 463,312,500.

No fractional shares of common stock will be issued as a result

of the reverse stock split. Stockholders of record who would

otherwise be entitled to receive a fractional share will be

entitled to receive from the Company one full share of the

post-reverse stock split common stock. The reverse stock split

impacts all holders of the Company’s common stock proportionally

and will not impact any stockholder’s percentage ownership of the

Company common stock.

Faraday Future has chosen its transfer agent, Continental Stock

Transfer & Trust Company, to act as exchange agent for the

reverse stock split. Stockholders owning shares via a bank, broker

or other nominee will have their positions automatically adjusted

to reflect the reverse stock split and will not be required to take

further action in connection with the reverse stock split, subject

to brokers’ particular processes.

Additional information about the Reverse Stock Split and the

related Charter amendment can be found in the Company’s definitive

proxy statement filed with the Securities and Exchange Commission

on January 10, 2024, as supplemented on January 24, 2024.

ABOUT FARADAY FUTURE

Faraday Future is the pioneer of the Ultimate AI TechLuxury

ultra spire market in the intelligent EV era, and the disruptor of

the traditional ultra-luxury car civilization epitomized by Ferrari

and Maybach. FF is not just an EV company, but also a

software-driven intelligent internet company. Ultimately FF aims to

become a User Company by offering a shared intelligent mobility

ecosystem. FF remains dedicated to advancing electric vehicle

technology to meet the evolving needs and preferences of users

worldwide, driven by a pursuit of intelligent and AI-driven

mobility.

FOLLOW FARADAY FUTURE:

https://www.ff.com/

https://www.ff.com/us/mobile-app/

https://twitter.com/FaradayFuture

https://www.facebook.com/faradayfuture/

https://www.instagram.com/faradayfuture/

www.linkedin.com/company/faradayfuture/

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. When used in this

press release the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements, which

include statements regarding the expected timing and implementation

of the reverse split and the commencement of trading of the

Company’s post-split common stock, involve a number of known and

unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes

include, among others: the Company’s ability to continue as a going

concern and improve its liquidity and financial position; the

Company’s ability to remediate its material weaknesses in internal

control over financial reporting; risks related to the restatement

of the Company’s previously issued consolidated financial

statements; the Company’s limited operating history and the

significant barriers to growth it faces; the Company’s history of

losses and expectation of continued losses; increased operating

expenses; incorrect assumptions and analyses developed by

management; the market performance of the Company’s common stock;

the Company ability to regain compliance with Nasdaq listing

requirements; the Company’s ability to execute on its plans to

develop and market its vehicles and the timing of these development

programs; the Company’s estimates of the size of the markets for

its vehicles and cost to bring those vehicles to market; the rate

and degree of market acceptance of the Company’s vehicles; the

success of other competing manufacturers; the performance and

security of the Company’s vehicles; the Company’s ability to

receive funds from, satisfy the conditions precedent of, and close

on the various financings described elsewhere by the Company; the

result of current and future financing efforts, the failure of any

of which could result in the Company seeking protection under the

Bankruptcy Code; the Company’s indebtedness; the Company’s ability

to cover future warranty claims; insurance coverage; the outcome of

the Securities and Exchange Commission (“SEC”) investigation

relating to the matters that were the subject of the Special

Committee investigation; the success of the Company’s remedial

measures taken in response to the Special Committee findings; the

Company’s dependence on its suppliers and contract manufacturers;

the Company’s ability to develop and protect its technologies; the

Company’s ability to protect against cybersecurity risks; general

economic and market conditions impacting demand for the Company’s

products; risks related to the Company’s operations in China; risks

related to the Company’s stockholders who own a significant amount

of the Company’s common stock; potential cost, headcount and salary

reduction actions may not be sufficient or may not achieve their

expected results; the ability of the Company to attract and retain

directors and employees; any adverse developments in existing legal

proceedings or the initiation of new legal proceedings; and

volatility of the Company’s stock price. The foregoing list of

factors is not exhaustive. You should carefully consider the

foregoing factors and the other risks and uncertainties described

in the “Risk Factors” section of the Company’s Annual Report on

Form 10-K/A for the year ended December 31, 2022 and Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023, as

well as the risk factors incorporated by reference in Item 8.01 of

the Current Report on Form 8-K/A filed with the SEC on December 28,

2023, and other documents filed by the Company from time to time

with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and the Company does not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240225961414/en/

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

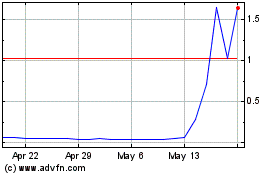

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

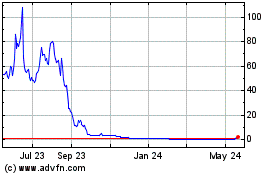

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Apr 2023 to Apr 2024