Complete Solaria, Inc. (“Complete Solaria” or the “Company”)

(NASDAQ: CSLR) today announced that T.J. Rodgers will become the

company’s Chief Executive Officer (CEO). Rodgers said, “First, I

would like to thank Chris Lundell, our current CEO, who came in at

the board’s request to stabilize the company during a stressful

period of rapid headcount reduction. Chris will remain on the

Company’s board. Moving forward, I believe in the Company’s mission

and I will step up to the CEO job to use my experience at fund

raising and M&A to help it succeed. That said, I will resign as

CEO when one of two endpoints occurs: success, when we are on a

solid economic footing and growing rapidly – or failure, when I

believe that the chokehold our private equity debt holders have on

us will prevent the company from ever being successful.”

Will Anderson, Complete Solaria founder and

board member said, “I founded Complete Solaria in 2010, and am

proud of the great progress we made in the last year. Our quarterly

operating expense has dropped from $12 million in 2023 to a

forecasted $3.6 million this quarter. We have fixed many field

quality problems by changing the way we work with our new VP of

Quality, Linda DeJulio. Our ex-Cypress executives Minh Pham and

Perry Cruz, have cut our installation cycle time to half of what it

used to be. In medical terms, our financial condition is ‘critical

but stable,’ but we will be able to get through this quarter

without more funding, although the undeclared default Carlyle’s

Andew Kapp resolutely holds over us has convinced many of our

vendors to cut off our credit, severely limiting our revenue

because we cannot afford to buy and install the systems for which

we already have orders.”

Rodgers observed, “I have never worked with

investors that deliberately harm their companies. I am a Silicon

Valley entrepreneur whose first company, Cypress Semiconductor, was

funded by iconic Sand Hill Road firms: Kleiner Perkins, Sequoia,

and Mayfield – all storied and ethical venture funds that exist to

build companies not only with funding but also with their direct

involvement – just as I am now doing at Complete Solaria. I believe

the stark contrast between Silicon Valley’s incubator methods and

Carlyle’s classic private equity hardball tactics is why Silicon

Valley companies, along with Microsoft, occupy the top nine

positions on the prestigious S&P 500 – while N.Y. private

equity, despite having trillions of dollars, is a no-show on the

S&P 500 down to the No. 11 slot, now filled by the 153-year old

J.P. Morgan. As a counter example, the little Silicon Valley firm I

helped out in 2017, Enphase Energy, is now worth $15 billion. In

2020, it was invited to join the S&P 500, replacing Tiffany –

and then became the S&P’s fastest growing company for a record

three consecutive years. I helped that ailing startup with no

compensation other than the return I earned on the investment I

made, in order to help out John Doerr, Chairman of Kleiner Perkins,

to repay him for the 10 years he spent on Cypress’s board helping

me. Silicon Valley believes in and builds companies; we don’t

threaten to put people out of business or confiscate their assets –

that’s what thugs do.”

Complete Solaria also announced the promotion of

Brian Wuebbels, its current Chief Financial Officer, who also has

an MBA and a degree in mechanical engineering, to the position of

Chief Operating Officer reporting to Rodgers. Wuebbels said, “Last

year, I made the decision to move on from Complete Solaria in order

to take the next step in my career, but I agreed with T.J. Rodgers

to stay behind for a quarter to make sure that CSLR’s first full

physical audit and SEC 10K report filing were on time and

error-free. I now look forward to taking our solar operations to

the next level in yield, quality and cycle time.”

T.J. Rodgers continued, “We now have senior

leadership in place at Complete Solaria with strong retention

packages under our new employee option program. This will allow me

to focus on strategy and shareholder value – and since we have less

than $1 million in cash, that must start with converting

our debt to equity, as I have just done personally. I am

now convinced that Andrew Kapp’s plan from the Carlyle playbook is

to keep kneeling on our neck while allowing us to build value, and

then to strip the newly created assets from the company. You can

read more about Carlyle’s destructive tactics in a new book by

Pulitzer Prize-winning journalist Gretchen Morgenson, entitled

These Are The Plunderers: How Private Equity Runs – and Wrecks

– America. Carlyle’s website piously and hypocritically claims

‘As a global firm we work together to create long-term value for

our investors, companies, shareholders, people and communities.’

The Carlyle chapter in the new book tells a completely different

story of how Carlyle acquired the Toledo-based health care company,

HCR ManorCare – an operator and owner of over five hundred nursing

homes – then stripped out and sold the company’s facilities to a

real estate broker for $6.6 billion, eventually bankrupting the

company with high rent payments on the properties it once owned.

The playbook comes from Carlyle founder, David Rubinstein, who is

quoted in Plunderers as having rationalized his

destructive takeover with: ‘While we’re not perhaps guardian

angels, we are providing a social service…making companies more

efficient.’ Based on this and our experience, it seems a more

accurate Carlyle mission statement would read like this: ‘We buy or

take over companies using high-interest loans with complex

covenants and high penalties, and then strip and sell their assets

for a profit.’

Rodgers continued, “David Rubenstein has hurt

more than just the companies he invests in. He collects trophy

board memberships, including his trusteeship on the Harvard

Corporation Board, which he will leave this year after only one

term. During his tenure, Harvard slipped to No. 248 – last – on the

list of 248 colleges ranked for free speech on campus by the highly

respected Foundation for Individual Rights and Expression. FIRE

co-founder, Harvey Silverglate, author of “The Shadow

University”, a definitive work on free speech on campus, said,

‘I spent the first half of my career defending students from

conservative college administrative crack-downs, and the second

half of my career defending student free speech against attacks by

the left-wing orthodoxies now in power.’ Harvard’s last-place free

speech ranking by FIRE is based on quantitative metrics which

include a complete legal review of the university’s speech code,

direct interviews with over 55,000 students, the number of scholars

sanctioned for unaligned views, and the number of invited speakers

deplatformed. What I find amazing is that Mr. Rubenstein is a

graduate of the University of Chicago, whose Chicago

Statement is the speech code widely considered to be

the best in the nation. Princeton and 107 other universities have

adopted it. How could Mr. Rubenstein possibly fail to convince his

fellow Harvard Corporation Board members to adopt an exemplary

speech code from his alma mater when they were struggling in last

place?

T.J. Rodgers closed, “Messrs. Kapp and

Rubenstein, I built and ran a real, operating semiconductor company

for an industry-record 34 years. I don’t need or want your help. I

want your knee off of my neck, so I can breathe. If you don’t free

us by converting your debt to equity, as I have, I will resign

shortly thereafter and allow investors to observe and cringe at

Carlyle’s organ-harvesting methods in action.”

Rodgers added an epilogue, “While I was spending

Sunday night writing this press release, I received an email from

Carlyle at 10:06 EDT from Sanket Patel, another Carlyle employee

I’ve never heard of. Patel warned me that my recent threatened

press release (i.e. the above) might “necessitate legal action by

Carlyle.” Make my day. I would relish telling my Carlyle stories in

detail – under oath – to a jury of my peers in a public trial.”

About Complete Solaria

Complete Solaria is a solar company with unique technology and

end-to-end customer offering, which includes financing, project

fulfilment and customer service. Complete Solaria’s digital

platform together with premium solar products enable one-stop

service for clean energy needs for customers wishing to make the

transition to a more energy-efficient lifestyle. For more

information visit www.CompleteSolaria.com and follow us on

LinkedIn.

Forward Looking

Statements

This press release may contain certain forward-looking statements

within the meaning of the federal securities laws with respect to

the referenced transactions. These forward-looking statements

generally are identified by the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would,” and similar expressions, but the absence of

these words does not mean that a statement is not a forward-looking

statement. Forward-looking statements are forecasts, predictions,

projections and other statements about future events that are based

on current expectations, hopes, beliefs, intentions, strategies and

assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to: (i) risks that the sale of

certain assets and other business items will not be completed on

the terms set forth in the Asset Purchase Agreement or the

ancillary agreements referenced in the Asset Purchase Agreement, if

at all; (ii) the sale of assets disrupts current plans and

operations of the companies or diverts managements’ attention from

Complete Solaria’s business operations; (iii) the outcome of any

legal proceedings that may be instituted in connection with the

assets sale; (iv) the price of Complete Solaria’s securities may be

volatile due to a variety of factors, including changes in the

applicable competitive or regulatory landscapes, variations in

operating performance across competitors, changes in laws and

regulations affecting Complete Solaria’s business, and changes in

the combined capital structure; (v) the ability to implement

business plans, forecasts, and other expectations after the

completion of the business combination, and identify and realize

additional opportunities; (vi) the evolution of the markets in

which Complete Solaria will compete.

The foregoing list of factors is not exhaustive.

Readers should carefully consider the foregoing factors and the

other risks and uncertainties described in the “Risk Factors”

section of the registration statement on Form S-4 filed, which was

declared effective by the Securities and Exchange Commission (the

“SEC”) on June 30, 2023. Such filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Complete Solaria

assumes no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

For investor inquiries, please contact:

Complete Solaria, Inc.

Phone: +1 (510) 270-2537

CompleteSolariaIR@icrinc.com

Source: Complete Solaria, Inc.

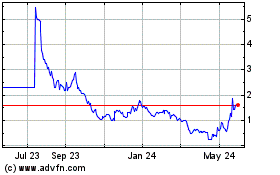

Complete Solaria (NASDAQ:CSLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

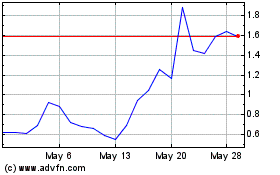

Complete Solaria (NASDAQ:CSLR)

Historical Stock Chart

From Apr 2023 to Apr 2024