Bitcoin Halving: Anticipating Price Impact, Miner Challenges, And Long-Term Outlook

April 19 2024 - 6:00PM

NEWSBTC

The highly anticipated Bitcoin Halving event is close, bringing

with it heightened expectations regarding the long-term impact on

the Bitcoin price. There are concerns, however, that this

quadrennial event may already be priced in, as Bitcoin recently

reached an unprecedented all-time high of $73,700 on March 14. This

surge broke the pattern of previous Halvings, where Bitcoin had

never surpassed its previous ATH before the event. However,

historical data reveals significant price increases in the year

following previous Halvings. Experts Predict Delayed Bitcoin

Halving Price Impact Analysts argue that the compounding impact of

reduced issuance takes several months to materialize, suggesting

that the Halving itself may not prompt a significant rally before

or immediately after the event. Deutsche Bank analysts share

this sentiment, highlighting that substantial price increases have

typically occurred in the run-up to previous Halvings rather than

immediately after them. Related Reading: Analyst Forecast: Litecoin

Poised For $250-$300, But Can It Hold? Another factor to consider

is the increased production costs for Bitcoin miners resulting from

the Halving. As the mining reward decreases, participating in the

mining process becomes less profitable. This has historically

led to a decline in the hashrate, the total computational power

used for Bitcoin mining. JPMorgan analysts predict that production

costs could rise to an average of $42,000 after the Halving. One

JPMorgan analyst wrote, “This estimate is also the level we

envisage Bitcoin prices drifting towards once

Bitcoin-Halving-induced euphoria subsides after April.” While these

factors may influence short-term price movement, historical data

reveals that the price of Bitcoin has experienced significant

increases in the year following previous Halvings. The

respective price gains for the three previous halvings were 8,760%,

2,570%, and 594%. However, it’s important to note that each

successive halving has a diminishing impact on the new supply of

Bitcoin. Mining Industry Shake-Up In the mining sector, Halving

could lead to significant revenue losses, estimated to be around

$10 billion annually. According to Fortune, publicly traded

miners have taken measures to increase their resilience, diversify

their offerings, and optimize their operations. However, mining

stocks have faced challenges, with some experiencing significant

declines. While larger miners may undergo a period of adjustment,

smaller miners and pools may be pushed offline. This could result

in a wider market share for the surviving miners. Experts at

private asset management firm Bernstein expect the mining industry

to consolidate, with “smaller and less efficient players”

potentially selling assets to raise capital and shore up their

balance sheets. The increased market dominance of the

surviving miners is expected to be profitable over the long term,

especially with the continued structural demand for Bitcoin from

ETFs. Timing The Bitcoin Bull Market Peak Cryptocurrency analyst

Rekt Capital has provided insights into the potential timing of

Bitcoin’s bull market peak based on historical Halving cycles and

the current acceleration seen in the market. According to

Rekt Capital, Bitcoin has traditionally reached its peak in the

bull market approximately 518-546 days after the Halving event.

However, the current cycle has shown signs of unprecedented

acceleration, with Bitcoin surpassing previous all-time highs

roughly 260 days ahead of historical norms. Nonetheless, the recent

“pre-Halving retrace” has slowed down the cycle by around 30 days

and counting. Related Reading: The Next Dogecoin? Top Trader Points

To This Memecoin Taking into account this accelerated perspective,

if Bitcoin’s bull market peak is measured from the moment it breaks

its old all-time high, it may occur 266-315 days later. As Bitcoin

achieved new all-time highs in March, this suggests a potential

bull market peak in December 2024 or February 2025, according to

Rekt’s analysis. Both perspectives carry significance throughout

the cycle, especially if the acceleration trend persists. However,

prolonged retracements or consolidation periods can slow down the

cycle, potentially pushing the anticipated bull market peak further

into the future. At the time of writing, BTC was trading at

$64,300, up from the $59,000 mark reached in the early hours of

Friday. Featured image from Shutterstock, chart from

TradingView.com

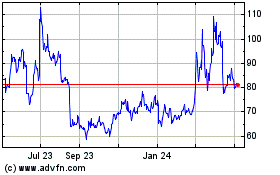

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

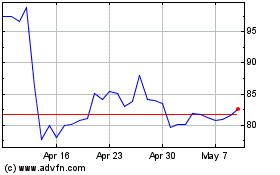

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024